Comparative Performance and Competitor Analysis of SPUU vs. SSO ETFs

Detailed Comparison of Expense Ratios, Asset Base, Trading Volume, and Performance Metrics for SPUU and SSO | That's TradingNEWS

Comparative Performance and Competitor Analysis

Comparison with ProShares Ultra S&P500 ETF (SSO)

The Direxion Daily S&P 500 Bull 2X Shares (NYSEARCA: SPUU) is frequently compared with the ProShares Ultra S&P500 ETF (NYSEARCA: SSO) due to their similar investment objectives. Both ETFs aim to deliver twice the daily performance of the S&P 500 index, but they differ in several key aspects that can influence investor decisions.

Expense Ratios

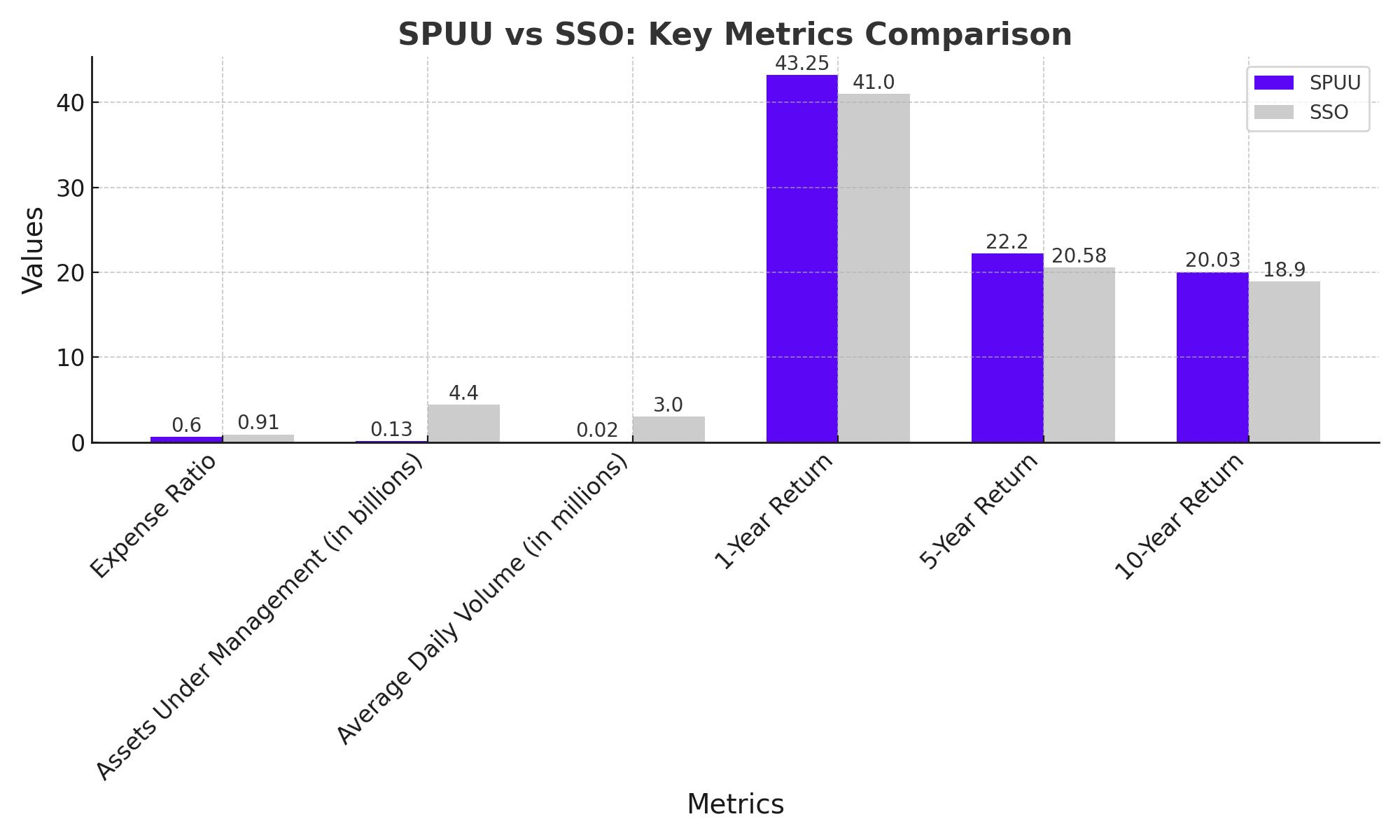

One of the primary differences between SPUU and SSO is the expense ratio. SPUU offers a lower expense ratio of 0.60%, making it a more cost-effective option for investors looking to minimize fees. In contrast, SSO has a higher expense ratio of 0.91%. Over the long term, lower expense ratios can significantly impact net returns, especially in a leveraged product where fees can compound.

Asset Base and Trading Volume

While SPUU has a cost advantage, it has a smaller asset base compared to SSO. SPUU manages net assets worth $129.16 million, whereas SSO boasts a more substantial asset base with assets under management (AUM) of approximately $4.4 billion. This larger asset base often translates to better liquidity and tighter bid-ask spreads, making SSO more efficient for larger trades.

The average daily trading volume also reflects this difference. SPUU's average volume is around 16,045 shares, while SSO sees a significantly higher volume, averaging about 3 million shares per day. Higher trading volume in SSO can provide better execution and lower transaction costs, an essential factor for active traders.

Performance Metrics

When comparing performance, both ETFs show impressive returns, albeit with slight variations. Over the past year, SPUU has delivered a return of 43.25%, while SSO has posted a slightly lower return of approximately 41%. This difference, although marginal, highlights SPUU’s potential to slightly outperform its counterpart under certain market conditions.

Historical Returns

Analyzing the longer-term performance provides additional insights. Over the past five years, SPUU has achieved an annualized return of 22.20%, compared to SSO’s 20.58%. Similarly, the ten-year annualized return for SPUU is 20.03%, while SSO stands at 18.90%. These figures demonstrate SPUU’s consistent ability to deliver higher returns over extended periods, albeit with higher risk due to its leveraged nature.

Volatility and Risk

Leveraged ETFs are inherently more volatile than their non-leveraged counterparts. Both SPUU and SSO amplify the daily movements of the S&P 500, but this also means they can suffer more significant losses during market downturns. Investors must be mindful of the increased risk associated with these products. SPUU’s beta, a measure of its volatility relative to the market, is approximately 2.00, indicating it is twice as volatile as the S&P 500.

Practical Considerations

For investors considering SPUU or SSO, several practical factors should be considered. SPUU’s lower expense ratio makes it attractive for cost-conscious investors, while SSO’s higher liquidity and larger asset base can be advantageous for those prioritizing trading efficiency. Additionally, the slight performance edge of SPUU may appeal to those seeking higher returns, albeit with the acceptance of increased risk and potential volatility.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex