Comprehensive Analysis of Bitcoin's Current Market Dynamics

Unraveling the complexities of recent market movements, liquidation impacts, and ETF flows to forecast Bitcoin's potential trajectory and investment opportunities | That's TradingNEWS

In-Depth Market Analysis of Bitcoin's Current Landscape

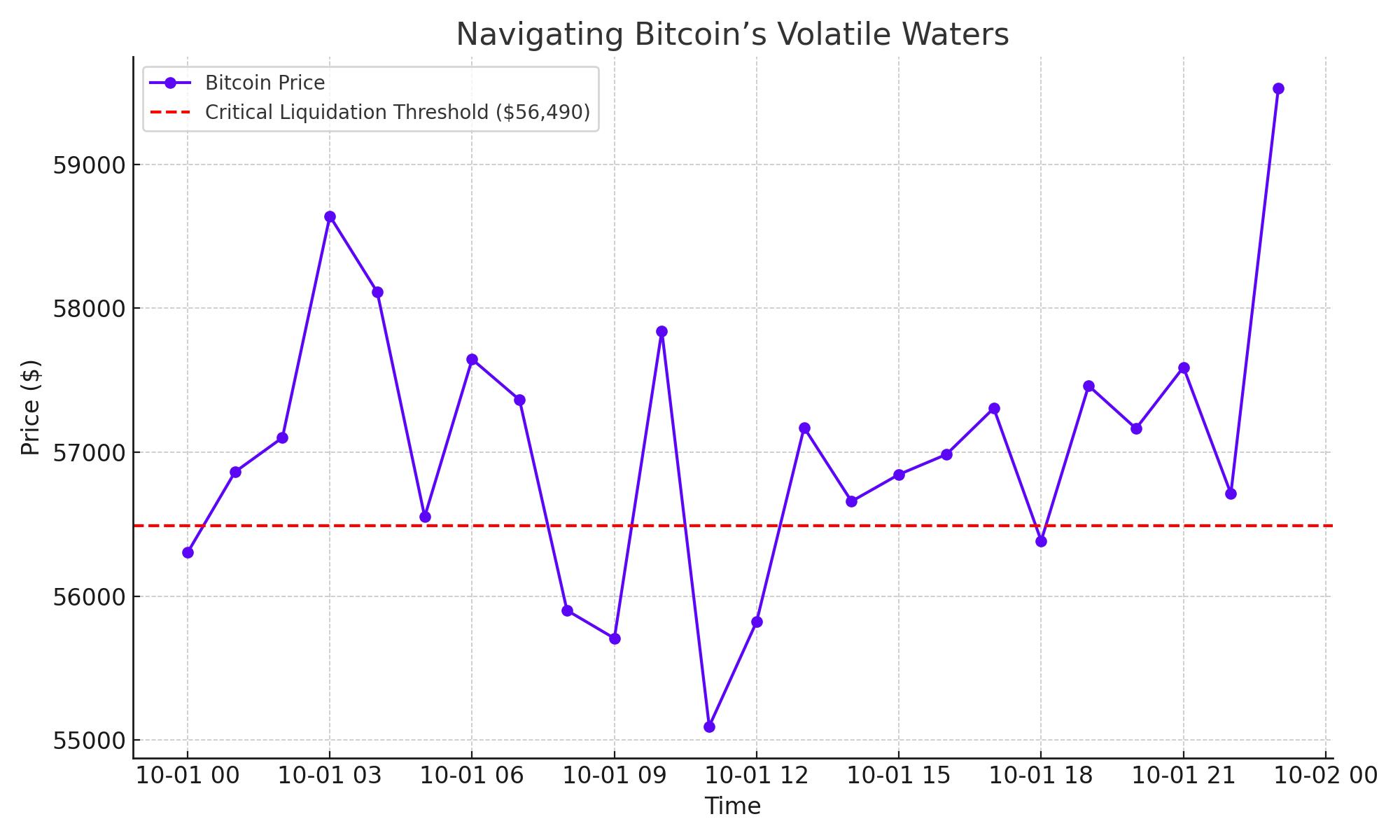

Navigating Bitcoin’s Volatile Waters: A Look at Recent Market Dynamics

Bitcoin’s journey around the $57,000 price point represents a significant node of volatility and opportunity within the cryptocurrency market. In just the last 24 hours, approximately $381 million worth of positions were liquidated, signaling a high-stakes environment for traders. This tumultuous activity underscores a broader narrative of unpredictability where even small fluctuations can lead to substantial financial outcomes. A critical threshold looms at $56,490, where an additional $34 million in potential liquidations could further sway market directions.

The Ripple Effect of Liquidation Events in Cryptocurrency Markets

The cryptocurrency market, notorious for its swift shifts, witnessed a substantial $33 million in Bitcoin positions unwound over the past day, with the collective digital currency sphere seeing over $112 million in liquidations. The bulk of these, about $70 million, comprised short positions. These numbers not only reflect the fragile equilibrium within which Bitcoin operates but also illustrate the broader implications of liquidation events that can dramatically alter market sentiments and pricing structures overnight.

Market Sentiments and Predictive Movements

Amid these fluctuations, Bitcoin's resilience is tested as it currently steadies above the $59,000 mark, reflecting a modest 3% rise in its value within a day. The observed market recovery, albeit slight, aligns with expert forecasts suggesting a bullish outlook despite short-term pressures. Analysts like Sergei Gorev from YouHodler propose a potential surge beyond $80,000, although caution remains due to possible corrections dipping as low as the $52,000 Fibonacci level.

Understanding ETF Dynamics and Bitcoin’s Market Position

The nuanced dynamics of Bitcoin exchange-traded funds (ETFs) also play a crucial role in the cryptocurrency’s market performance. Notably, there was a net outflow of $34.4 million from spot Bitcoin ETFs, indicating a cooling interest following a period of intense activity. This trend was punctuated by a significant outflow from Grayscale’s GBTC, contrasting with modest inflows into other ETFs like Ark Invest’s ARKB. These movements are pivotal in gauging investor sentiment and future market trends.

Strategic Implications for Investors and the Broader Crypto Market

The current landscape presents a mixed bag of challenges and opportunities for investors. With Bitcoin’s dominance slightly decreasing to 50%, and Ether’s dominance inching up to 15.4%, the market cap for cryptocurrencies has expanded by 3.7% to $2.34 trillion. These metrics not only reflect the ongoing shifts within the market but also suggest strategic entry points for investors aiming to capitalize on the volatility.

Conclusion: Bullish Outlook on Bitcoin’s Investment Viability

Despite the recent market turbulence with around $381 million in liquidations in just one day, Bitcoin has shown remarkable resilience, maintaining stability above $59,000. This resilience, especially in the face of significant potential liquidations at critical price points, highlights Bitcoin’s robustness and ability to recover swiftly.

Bullish sentiment is further supported by expert projections suggesting a potential surge beyond $80,000. While acknowledging possible corrections to as low as $52,000, the prevailing expert opinion remains positive on Bitcoin's long-term growth prospects.

The dynamics observed in Bitcoin ETFs, particularly the mix of outflows and inflows, illustrate ongoing investor engagement and confidence. Despite a net outflow of $34.4 million from spot Bitcoin ETFs, targeted inflows into certain funds like Ark Invest’s ARKB indicate selective investor optimism.

Bitcoin’s dominance at 50%, coupled with a market cap increase to $2.34 trillion, underscores a vibrant market environment. These indicators, together with expert analysis and market recovery post-liquidations, provide a strong buy signal for strategic investors looking to capitalize on expected upward trends in Bitcoin’s trajectory.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex