Comprehensive Analysis of Gold Market Trends and Price Movements

Examining Geopolitical Impacts, Economic Indicators, and Technical Patterns Driving Gold Prices | That's TradingNEWS

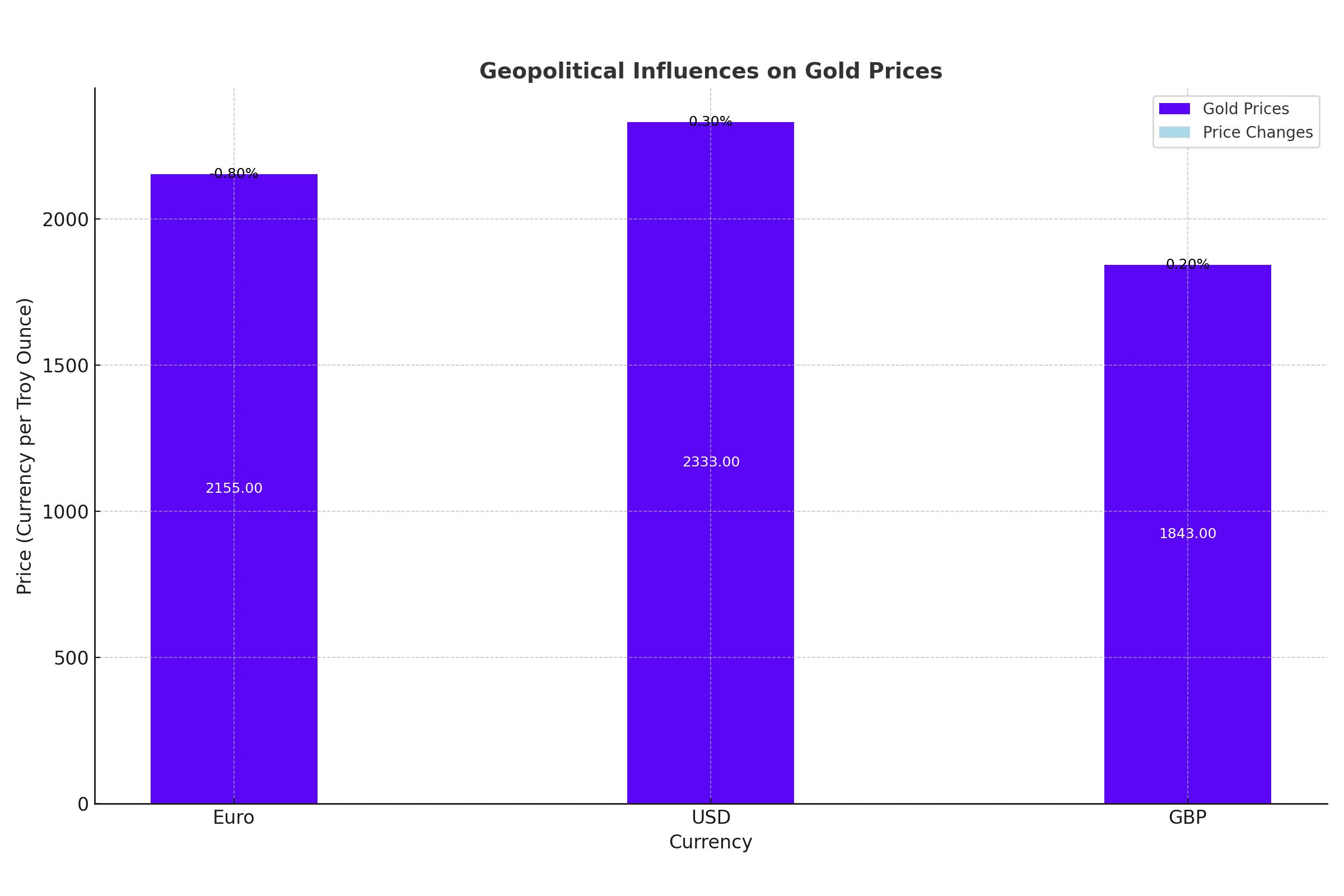

Geopolitical Influences on Gold Prices

Gold prices dipped against a stronger Euro on Monday as European markets reacted to political developments in France. The Paris stock market rose sharply, driven by relief that Marine Le Pen's National Rally didn't secure a decisive victory in the parliamentary elections. Although Le Pen's party won a significant portion of the vote, it was less than expected, leading to a rally in France's CAC40 index, which surged 2.8% at the opening.

The spread between French and German bond yields narrowed, indicating improved market confidence in France's fiscal policies. This political landscape impacts gold prices, as investors adjust their portfolios based on perceived stability and risk.

Gold's Performance in Various Currencies

For European investors, gold prices fell as much as 0.8%, dropping to €2155 per Troy ounce. Despite geopolitical risks, the Euro strengthened, impacting gold's appeal. Year-to-date, Euro gold prices have risen 15.3%, while the Euro has fallen 2.5% against the US Dollar. This highlights gold's role as a safe-haven asset amid currency fluctuations and political uncertainties.

US Political and Economic Factors

US President Joe Biden's political performance and the upcoming elections add another layer of complexity. A CBS News/YouGov poll indicates that 72% of registered voters believe Biden should not run for re-election. Such political uncertainty affects market sentiment and can drive demand for safe-haven assets like gold.

Spot gold prices in the US rose 0.3% to $2333 per Troy ounce on Monday, despite a 0.7% decline in June. For the second quarter of 2024, gold in USD increased by 5.3%, and 12.4% for the year to date. The UK gold price in Pounds per Troy ounce edged higher by 0.2% to £1843, amid expectations of a shift in political power following the upcoming General Election.

Technical Analysis and Key Levels

From a technical perspective, gold showed a strong recovery last week, rebounding from below $2300 to break above the $2320 resistance level. This movement suggests potential for further gains. Key resistance levels to watch are $2334, $2350, and $2358. On the downside, support levels include $2320, $2310, and $2300.

Economic Indicators and Market Sentiment

Gold prices are influenced by various economic indicators and market sentiment. The upcoming US labor market data, including the NFP and unemployment report, are crucial. These reports will impact expectations for Federal Reserve rate cuts, which in turn affect gold prices. Lower interest rates generally benefit gold, as they reduce the opportunity cost of holding non-yielding assets.

The ISM manufacturing data and other economic reports will provide insights into the health of the US economy, influencing the Dollar and gold. A robust economic performance could strengthen the Dollar and weigh on gold, while weaker data would likely support gold prices.

Global Market Movements

Global market movements also play a significant role. For instance, Asian and European stock indexes were mostly firmer overnight, and US indexes pointed towards higher openings. The benchmark 10-year US Treasury note yield stood at 4.40%, impacting the relative attractiveness of gold.

Oil prices, trading around $81.85 per barrel, also influence gold through their impact on inflation and economic growth. Higher oil prices can lead to higher inflation, boosting gold's appeal as an inflation hedge.

Silver Market Performance

Silver prices, closely linked to gold, rose 0.4% to $29.26 per ounce, marking a 23.5% gain year-to-date. Silver's industrial demand, accounting for nearly 60% of its annual use, adds another dimension to its price movements. Economic indicators affecting industrial activity can significantly impact silver prices.

Future Market Outlook

Looking ahead, the gold market is poised for continued volatility. The geopolitical landscape, economic data releases, and Federal Reserve policy decisions will be key drivers. Analysts from JPMorgan and Barclays suggest that gold prices could see further gains if geopolitical tensions persist and economic data support a dovish Fed stance.

Investors should stay vigilant, closely monitoring these factors to navigate the complex and dynamic gold market. With significant events and data releases on the horizon, gold's role as a safe-haven asset will continue to be tested.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex