Comprehensive Analysis: The EUR/USD Forex Pair's Journey

Decoding Market Movements: Insights into EUR/USD's Response to Global Economic Trends and Central Bank Policies | That's TradingNEWS

1/12/2024 12:00:00 AM

Analyzing the Dynamics of the EUR/USD Forex Pair

Contextual Overview

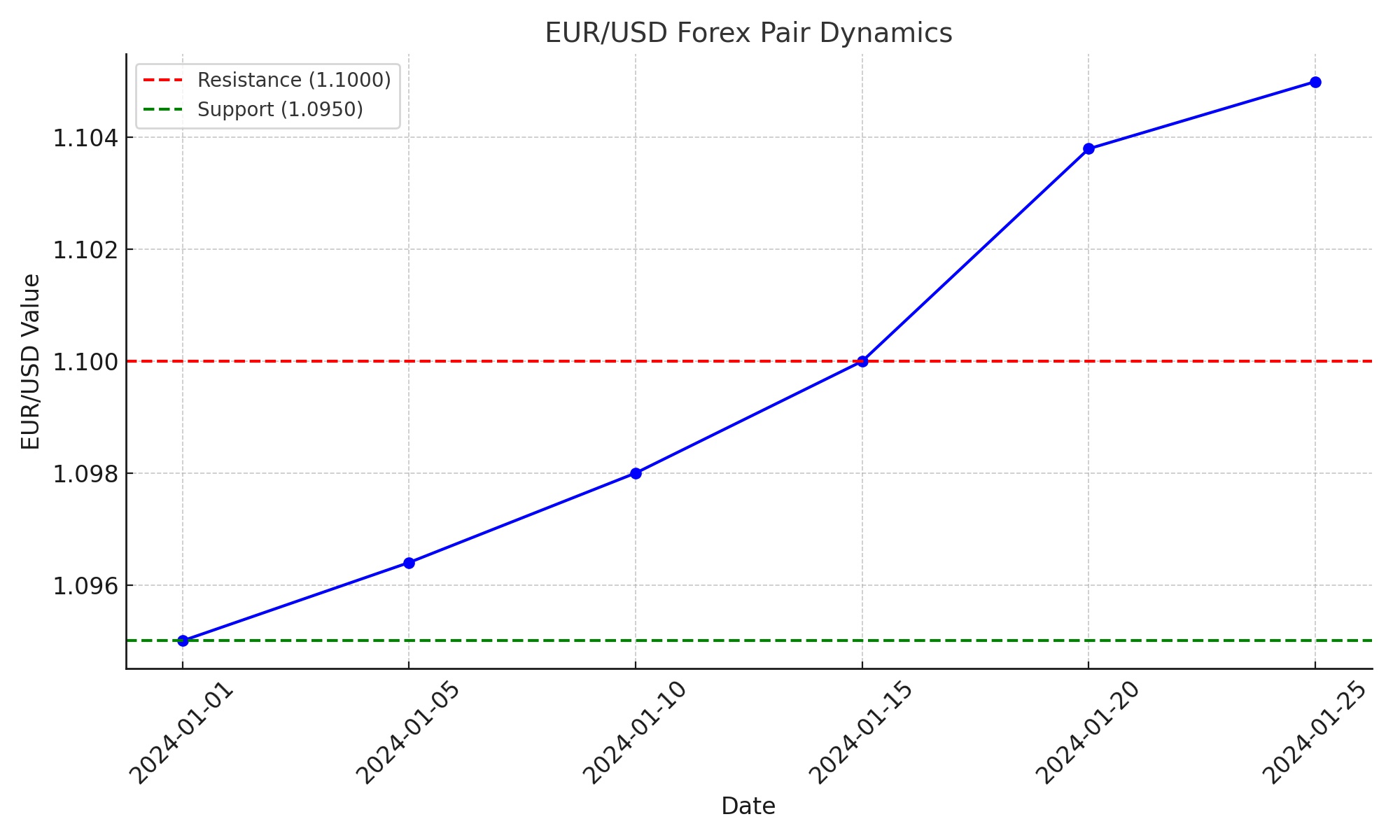

The EUR/USD pair, a key barometer in the forex markets, has been experiencing a notable uptrend, primarily influenced by the subdued U.S. Dollar (USD). This trend reflects market anticipation of several rate cuts by the Federal Reserve by the end of 2024. Currently, the pair is hovering around the 1.0980 mark, bolstered by these expectations.

Technical Indicators and Market Sentiment

- Resistance and Support Levels: The EUR/USD pair is approaching a critical psychological resistance at 1.1000. Surpassing this could potentially drive the pair towards 1.1038, aligning with last week's high. On the flip side, the pair faces immediate support at the 23.6% Fibonacci retracement level (1.0964), followed by a key level at 1.0950. A breach below these could exert downward pressure, directing the pair towards 1.0850.

- Relative Strength Index (RSI): The RSI, hovering above the 50 mark, signals a bullish market sentiment, indicating a positive momentum for the pair.

- Moving Average Convergence Divergence (MACD): Despite its position above the centerline, the MACD line shows a convergence below the signal line, hinting at a potential upward trend shift. Traders are advised to seek further confirmation before making significant moves.

Impact of Economic Indicators

- Eurozone and UK Data: The release of the ECB Economic Bulletin and the Italian Industrial Production data, revealing a contraction of -1.5%, provides a mixed picture of the Eurozone's economic health. The UK data, showing a modest GDP growth and housing equity trends, suggests a mixed economic scenario.

- US Economic Data: The US data, featuring a stable inflation rate and a robust labor market, plays a pivotal role in shaping the USD's strength. The upcoming Core PPI and PPI data releases are critical for understanding inflation trends, which may influence the dollar’s movement.

- Market’s Reaction to Data Releases: The market's response to these data releases will be crucial in determining the near-term trajectory of the EUR/USD pair.

Broader Economic Considerations

- Global Economic Climate: The overall global economic situation, including factors like the state of the Chinese economy and its impact on Europe, cannot be overlooked. Investor sentiment in the Eurozone, while showing some improvement, is juxtaposed with concerns about a potential recession in Germany.

- US Inflation Expectations: The recent US inflation expectations report, showing a decline to the lowest levels in three years, adds another layer to the complex economic narrative influencing the EUR/USD pair.

Technical Forecast and Future Outlook

- Near-Term Predictions: The technical forecast suggests a bullish outlook for the EUR/USD pair, especially if it maintains its stance above the 1.0950 mark. However, a decisive break below key support levels could alter this outlook significantly.

- Long-Term Projections: Analysts have mixed forecasts for the EUR/USD pair, with some anticipating a rise to 1.14 by the end of 2024, while others foresee potential declines. The Federal Reserve's rate decisions and upcoming US economic data (especially inflation figures) will be crucial in shaping these long-term trajectories.

Conclusion

The EUR/USD pair's movement is at a critical juncture, influenced by a confluence of economic indicators, central bank policies, and global economic conditions. Investors and traders must closely monitor these factors to navigate the potential volatility and opportunities in the forex market. The coming weeks and months will be pivotal in determining the course of this major currency pair.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex