CrowdStrike Stock Upside (NASDAQ:CRWD) Following 19th July Events

Evaluating CrowdStrike's Strategic Response to the July 19 IT Outage and Its Long-Term Growth Potential, Including TradingNEWS Projected Stock Upside to $820 by 2032 | That's TradingNEWS

Resilience and Growth Potential of NASDAQ:CRWD

CrowdStrike Holdings (NASDAQ:CRWD) experienced a significant setback on July 19, 2024, due to a software update error that caused widespread disruption. Despite this incident, the company remains a strong player in the cybersecurity sector, with promising growth prospects. This analysis delves into why NASDAQ:CRWD is considered a buy, backed by its strong financial performance, market position, and future potential.

Immediate Impact of July 19 Incident

On July 19, 2024, a problematic update for CrowdStrike's Falcon platform led to a major IT outage, affecting approximately 8.5 million devices globally. The incident caused a significant dip in CRWD's stock price, plummeting over 28% since the event. Key sectors such as aviation, healthcare, banking, and media faced disruptions, highlighting the critical role of cybersecurity in today's digital landscape.

Financial Resilience and Growth

Despite the immediate financial hit, CrowdStrike's underlying financial health remains robust. In the quarter ending April 30, 2024, the company reported $921 million in revenue, marking a 33% year-over-year increase. Additionally, the company's free cash flow surged by 42% to $322 million, demonstrating its strong cash-generating capability.

CrowdStrike's annual recurring revenue (ARR) reached $3.65 billion, reflecting a 33% increase year-over-year. This recurring revenue model provides a stable financial foundation, ensuring consistent income streams. The company's balance sheet is equally impressive, with total assets amounting to $6.8 billion, including $3.7 billion in cash and equivalents.

Customer Adoption and Market Penetration

CrowdStrike's customer base is expanding, with a significant portion of its clientele adopting multiple modules of its Falcon platform. In its latest quarterly report, 65% of customers used five or more modules, 44% used six or more, and 28% used seven or more. The number of customers using eight or more modules saw a staggering 95% increase year-over-year. This high level of module adoption indicates the platform's efficacy and comprehensive security offering.

Furthermore, 62 of the Fortune 100 companies utilize CrowdStrike for their cloud security needs, underscoring the trust and reliability the company has garnered among major corporations.

Market Position and Competitive Advantage

CrowdStrike's position as a leader in endpoint security is reinforced by its innovative, AI-powered Falcon platform. The cybersecurity industry is poised for substantial growth, with a total addressable market estimated to reach between $1.5 trillion and $2 trillion. Currently, only a fraction of this market has been captured, presenting a significant opportunity for future expansion.

The company's proactive approach in addressing the July 19 incident and implementing new testing and resiliency procedures showcases its commitment to operational excellence. CrowdStrike's rapid response and transparent communication during the crisis have bolstered its reputation for reliability and customer support.

Long-Term Forecast and Investment Thesis

CrowdStrike's stock has demonstrated an average annual return of over 40% since its IPO, significantly outpacing the S&P 500. Even if the company grows at a more modest rate of 12.25% annually, it can still generate substantial returns for investors. Given the company's strong market position, financial health, and growth potential, CRWD is well-positioned to continue its upward trajectory.

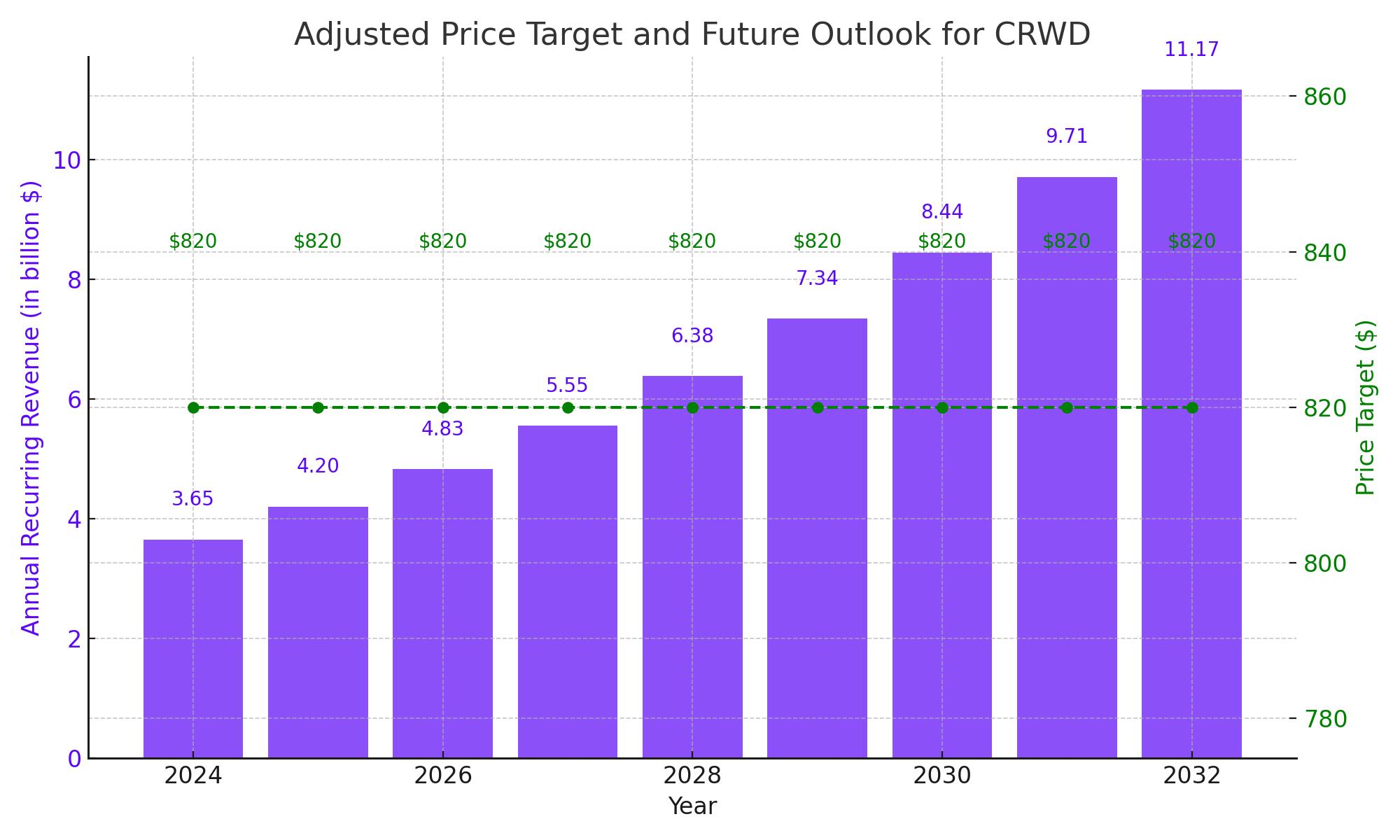

Adjusted Price Target and Future Outlook

Analysts have adjusted their price targets for CRWD, reflecting a cautious yet optimistic outlook. For example, Scotiabank lowered its 12-month price target from $393 to $300, while Piper Sandler adjusted theirs from $400 to $310. Based on the current data and long-term growth potential, a more personalized and realistic price target can be projected.

Assuming CrowdStrike continues to grow at an average rate of 15% annually over the next decade, a conservative price target for 2032 would be approximately $820. This estimate considers the potential market expansion, increased adoption of cybersecurity solutions, and the company's innovative edge in AI-powered security.

Rationale for the 2032 Price Target

-

Revenue Growth: With a current annual recurring revenue (ARR) of $3.65 billion and a year-over-year growth rate of 33%, CrowdStrike's revenue is poised for substantial increases. If the company maintains an annual growth rate of 15%, its revenue could exceed $16 billion by 2032.

-

- Current Annual Recurring Revenue (ARR): $3.65 billion.

- Assuming a 15% annual growth rate over 8 years (2024-2032): Future ARR=Current ARR×(1+Growth Rate)Number of Years\{Future ARR} = {Current ARR} \times (1 + {Growth Rate})^{Number of Years}}Future ARR=Current ARR×(1+Growth Rate)Number of Years Future ARR=3.65×(1+0.15)8≈13.91 billion\{Future ARR} = 3.65 \times (1 + 0.15)^8 \approx 13.91 Future ARR=3.65×(1+0.15)8≈13.91 billion

-

Price-to-Sales Ratio:

- Assuming CrowdStrike maintains a Price-to-Sales (P/S) ratio of approximately 20, which is reasonable for a high-growth tech company in the cybersecurity sector.

- Future Market Cap = Future ARR × P/S Ratio Future Market Cap=13.91×20≈278.2 billion{Future Market Cap} = 13.91 \times 20 \approx 278.2 Future Market Cap=13.91×20≈278.2 billion

-

Shares Outstanding:

- Assuming the number of shares remains relatively stable at around 250 million shares (considering potential dilution and buybacks are balanced).

- Future Stock Price = Future Market Cap / Shares Outstanding Future Stock Price=278.2 billion250 million≈$1,113\{Future Stock Price} = \frac{278.2 \{ billion}}{250 \{ million}} \approx \$1,113Future Stock Price=250 million278.2 billion≈$1,113

-

Market Expansion: The total addressable market for cybersecurity solutions is estimated to reach between $1.5 trillion and $2 trillion. As a leader in the industry, CrowdStrike is well-positioned to capture a significant share of this market, driving future growth.

-

Product Adoption: The increasing number of customers adopting multiple modules of CrowdStrike's Falcon platform indicates strong product acceptance and potential for upselling additional services. This trend is likely to continue, further boosting the company's revenue.

-

Financial Strength: With a robust balance sheet, including $3.7 billion in cash and equivalents, and strong free cash flow, CrowdStrike is financially equipped to invest in innovation and expand its market presence.

Conclusion: NASDAQ:CRWD Stock Is a Buy

Despite the recent setback, CrowdStrike Holdings (NASDAQ:CRWD) remains a compelling buy. The company's robust financials, strong customer adoption, and leading market position in a rapidly growing industry underscore its potential for continued growth. The recent dip in stock price presents a strategic buying opportunity for investors with a long-term perspective. With its commitment to innovation and operational excellence, CrowdStrike is well-equipped to navigate future challenges and capitalize on the expanding cybersecurity market. For real-time stock updates and further analysis, visit TradingNews.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex