CrowdStrike's 3Q24 Triumph: Breaking Industry's Records

A Comprehensive Look at CrowdStrike's Financial Strength, Innovative Growth, and Strategic Market Positioning in 3Q24 | That's TradingNEWS

Executive Overview: CrowdStrike's Impressive 3Q24 Performance and Growth Trajectory

Robust Financial Performance in 3Q24

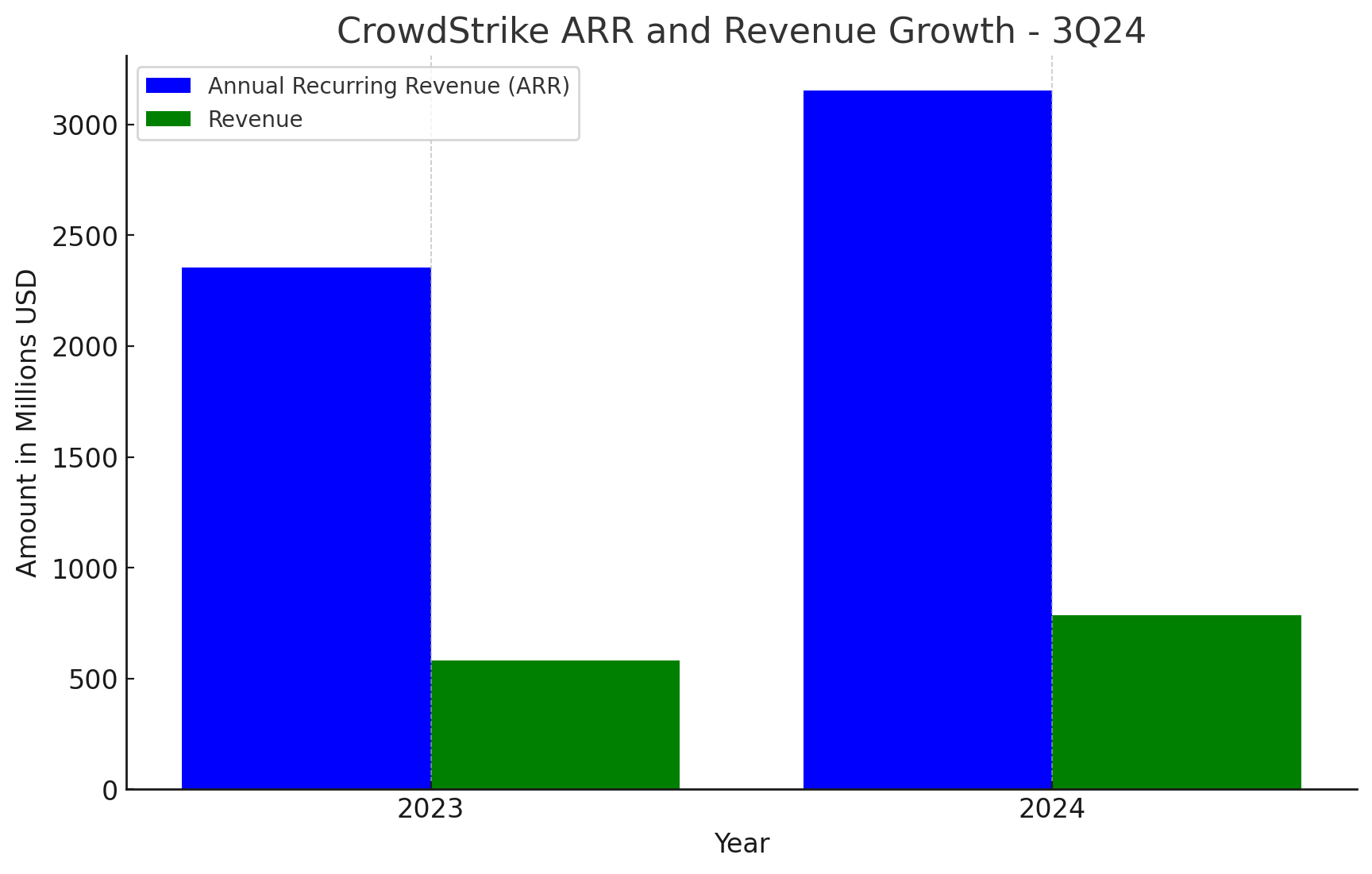

CrowdStrike Holdings, Inc. (NASDAQ: CRWD) has delivered a striking performance in its third quarter of 2024, surpassing the $3 billion Annual Recurring Revenue (ARR) milestone, a first for a pure-play cybersecurity vendor. The company recorded a 34.9% growth in ARR to $3,153 million, highlighting its robust market position. Remarkably, this growth trajectory has been achieved amidst a challenging macroeconomic environment, underscoring the company's resilience and strategic execution.

Subscription ARR: A Key Growth Indicator

The subscription-based model continues to be a cornerstone of CrowdStrike's success. The company reported a 35% year-over-year increase in revenues, amounting to $786 million. This growth is further evidenced by their record non-GAAP subscription gross margin, surpassing 80% for the quarter. These figures are indicative of CrowdStrike's effective cost management and operational efficiency.

Operational Efficiency and Profitability

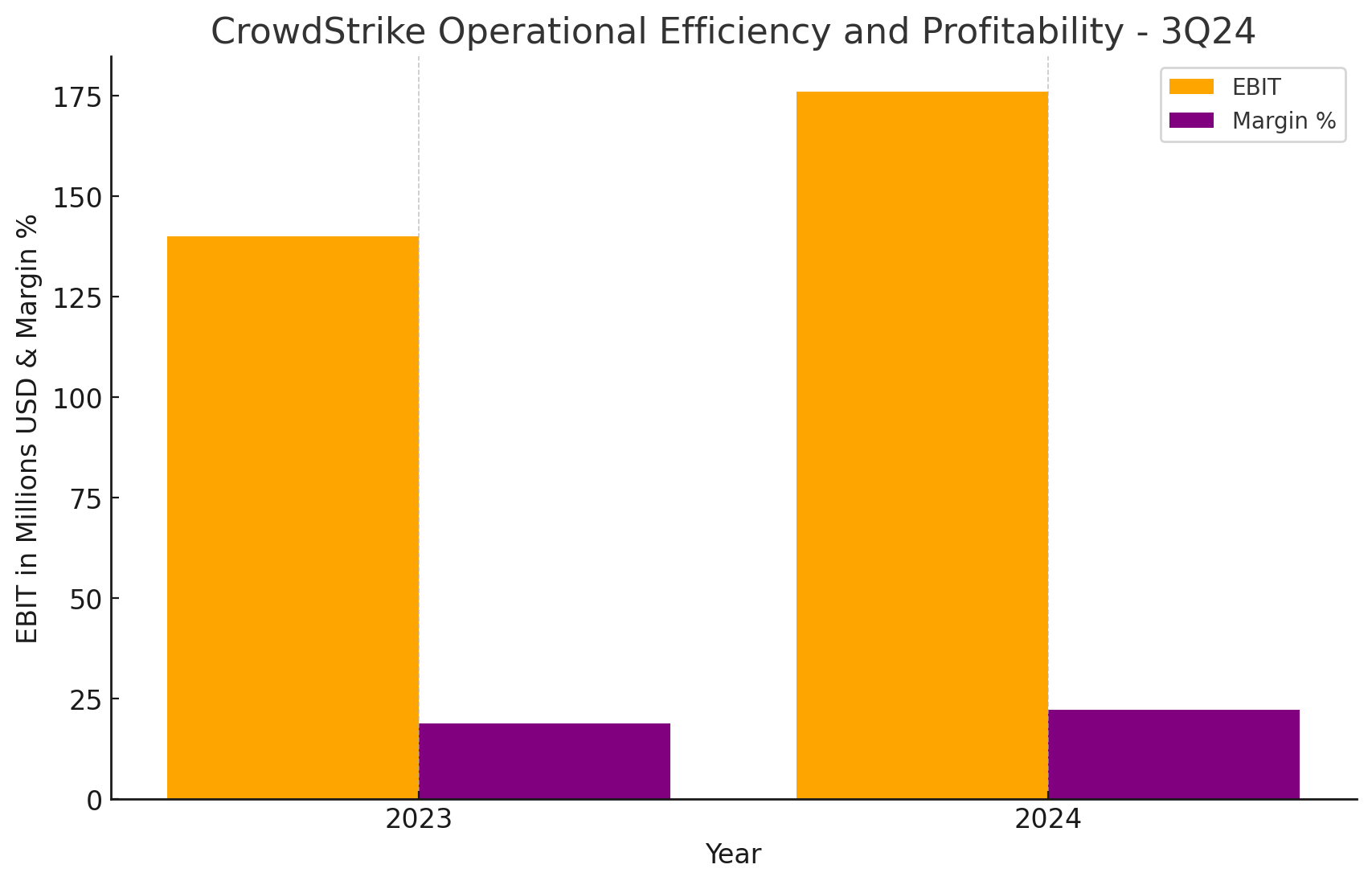

CrowdStrike demonstrated commendable cost discipline alongside its revenue growth. The company's EBIT stood at $176 million, with a margin of 22.3%, surpassing consensus expectations. This was complemented by a disciplined approach to operating expenses, which grew by 25% - a rate slower than revenue growth, thus leading to margin expansion.

Strong Cash Flow and Balance Sheet

The company's financial health is further bolstered by a strong balance sheet, with $3.2 billion in cash reserves. CrowdStrike's free cash flow (FCF) Rule of 66, up from 63 in the last quarter, is a testament to its efficient capital utilization and robust operational model.

Forward-Looking Perspective: Growth and Innovation

Looking ahead, CrowdStrike is well-positioned to achieve its target of $10 billion ARR in the medium term, backed by a record pipeline and widening competitive gap. The company's continuous investment in innovation, especially in R&D, positions it favorably for sustained growth.

Market Position and Competitive Edge

CrowdStrike's competitive edge is evident in its high customer retention and expansion rates. The company's Falcon platform has shown increasing adoption, with significant portions of its customer base utilizing multiple cloud modules, demonstrating its comprehensive value proposition in the cybersecurity space.

Strategic Partnerships and Market Diversification

The company's growth strategy is further reinforced by strategic partnerships with leading companies like Dell, Pax8, and AWS. These collaborations have enhanced CrowdStrike's market reach, particularly in the SMB segment, diversifying its customer base and reinforcing its market position.

Valuation and Investment Perspective

Despite its strong performance and growth prospects, CrowdStrike's valuation appears rich at the current levels. While the company remains a high-conviction stock, its current market valuation calls for a neutral stance. However, any valuation correction could present an attractive entry point for long-term investors.

Sector Performance and Comparison

In the broader context, CrowdStrike has outshined its peers in the Zacks Computer & Technology sector and Internet Software category. The company's stock performance reflects its strong fundamentals, bolstered by a diversified portfolio and a robust partner network.

Cybersecurity Industry Outlook

The cybersecurity industry is poised for significant growth, driven by increased spending on security and risk management. This trend is expected to benefit CrowdStrike, given its strong portfolio and innovative solutions.

Conclusion: A Balanced View on CrowdStrike's Future

CrowdStrike's impressive 3Q24 performance, combined with its strategic investments and market positioning, makes it a standout in the cybersecurity landscape. While the current valuation calls for caution, the company's long-term prospects remain bright, positioning it as a potential market leader in the evolving cybersecurity domain.

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex