Decoding December 23': Analysis of EUR/USD GBP/USD

From Eurozone Manufacturing PMIs to US Job Reports: How Key Economic Factors Are Shaping the EUR/USD and GBP/USD Markets | That's TradingNEWS

Comprehensive Analysis of EUR/USD and GBP/USD Market Dynamics

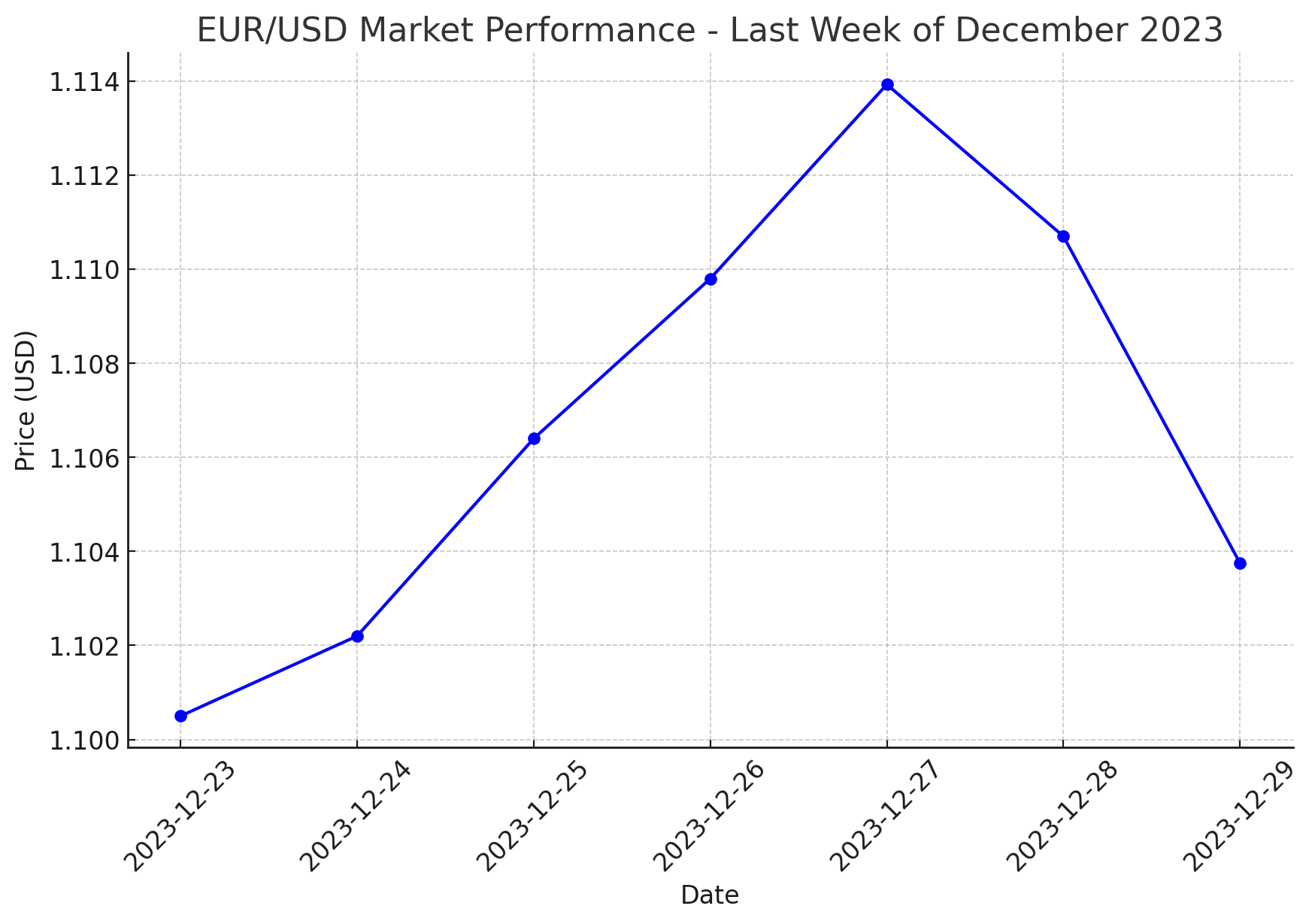

EUR/USD Market Performance: A Closer Look

In the concluding week of December 2023, the EUR/USD pair showed a modest gain of 0.21%, closing at $1.10375. The fluctuation ranged from a low of $1.10050 to a high of $1.11393, reflecting a week of mixed sentiments in the currency market.

Key Economic Indicators Influencing EUR/USD

- Manufacturing PMI Impact: The upcoming manufacturing PMI data for the Eurozone is crucial. A dip in these figures could hint at a looming recession, affecting the EUR/USD pair.

- German Unemployment and Consumer Spending: The German unemployment data will be a significant indicator of consumer spending trends and inflationary pressures, influencing the European Central Bank's (ECB) monetary policy.

- Inflation and Services PMI Data: French and German inflation figures, coupled with Eurozone services PMIs, will be pivotal. High inflation coupled with robust service sector data could signal a sustained high-interest rate environment in the Eurozone.

US Dollar Dynamics and Federal Reserve Policies

- Manufacturing Sector Outlook: The US manufacturing PMIs will offer insights into the sector's health, potentially swaying the Federal Reserve's rate cut decisions in early 2024.

- US Job Market and FOMC Minutes: The JOLTs Job Openings Report and FOMC Meeting Minutes will provide a glimpse into the US job market's strength and the Fed’s stance on rate cuts.

- Service Sector and Labor Market: The ISM Non-Manufacturing PMI and the US Jobs Report will be critical. A weakening in these areas could bolster expectations of an early 2024 rate cut by the Fed.

EUR/USD Short-Term Forecast

The near-term trajectory for EUR/USD will hinge on upcoming PMI data, inflation figures, and labor market insights. Notably, the US Jobs Report could significantly impact market expectations regarding the Fed's monetary policy.

EUR/USD Technical Analysis

- Daily and 4-Hour Charts: Both indicate a bullish trend, with the currency pair staying above the 50-day and 200-day EMAs.

- Resistance and Support Levels: The EUR/USD faces resistance at $1.10720, with a potential to reach the $1.12 mark. Conversely, a drop below $1.10 could lead to testing the $1.09294 support level.

- Relative Strength Index (RSI) Indications: The current RSI levels suggest a potential rise to the $1.11 handle before entering overbought territory.

GBP/USD Market Insights

The GBP/USD pair is experiencing near-term fluctuations, primarily influenced by the latest UK Nationwide Housing Prices and US economic data. A contraction in the US Chicago PMI has unexpectedly boosted risk appetite, impacting the GBP/USD pair.

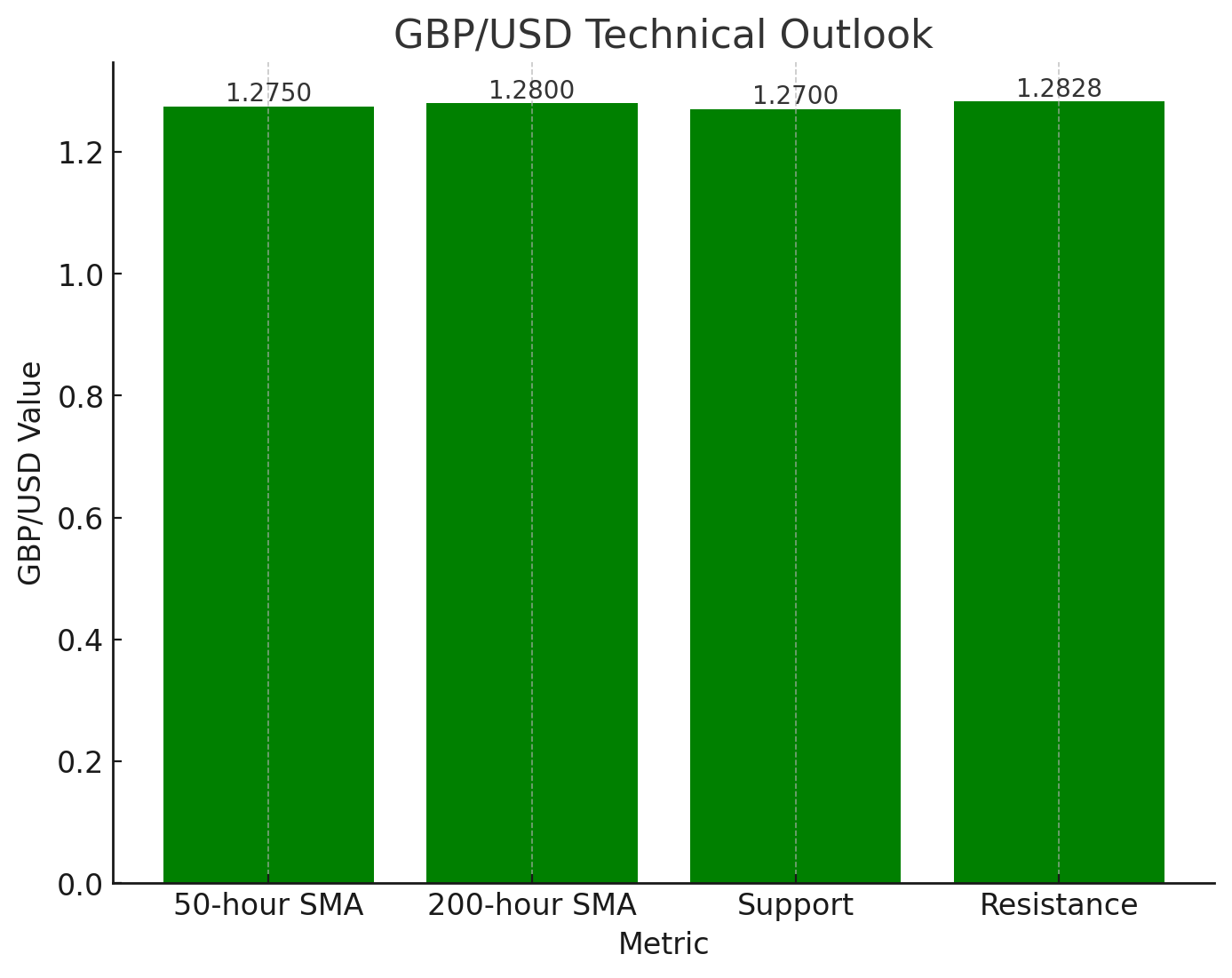

Technical Outlook for GBP/USD

- SMA Analysis: The pair is oscillating between the 50-hour and 200-hour SMAs, indicating a state of short-term congestion.

- Technical Indicators: Daily candlestick patterns and the Relative Strength Index (RSI) suggest a possibility of pullback from overbought conditions.

- GBP/USD Support and Resistance: The pair finds immediate support around the 1.2700 level, with resistance near the 1.2828 high.

Longer-Term Prospects

- EUR/USD: The medium-term trend seems upward, with the potential for the pair to oscillate between 1.1100 and 1.0656 in the first quarter of 2024, depending on incoming data.

- GBP/USD: A broader view suggests a cautious approach, as the pair's direction is largely influenced by broader USD dynamics and UK economic indicators.

Bank of Japan’s Policy Impact on EUR/JPY

EUR/JPY might face pressure due to anticipated changes in the Bank of Japan’s policy. The Yen's strength could lead to a test of the 154.00 support level, with a potential to extend to lower levels.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex