Dell Technologies (NASDAQ: DELL) Positioned for Growth Amid AI Revolution and Market Recovery

Introduction to Dell’s Market Position

Dell Technologies Inc. (NASDAQ: DELL) has seen significant volatility over the past few months, with its stock experiencing a 52% decline from its mid-year peak. However, the company has staged a robust recovery, rebounding by approximately 35% from its lows, positioning itself as a leader in the AI-driven hardware enterprise market. Despite facing challenges, Dell’s strategic investments in artificial intelligence (AI) and enterprise solutions have set the stage for long-term growth and profitability.

Earnings Performance and Market Outlook

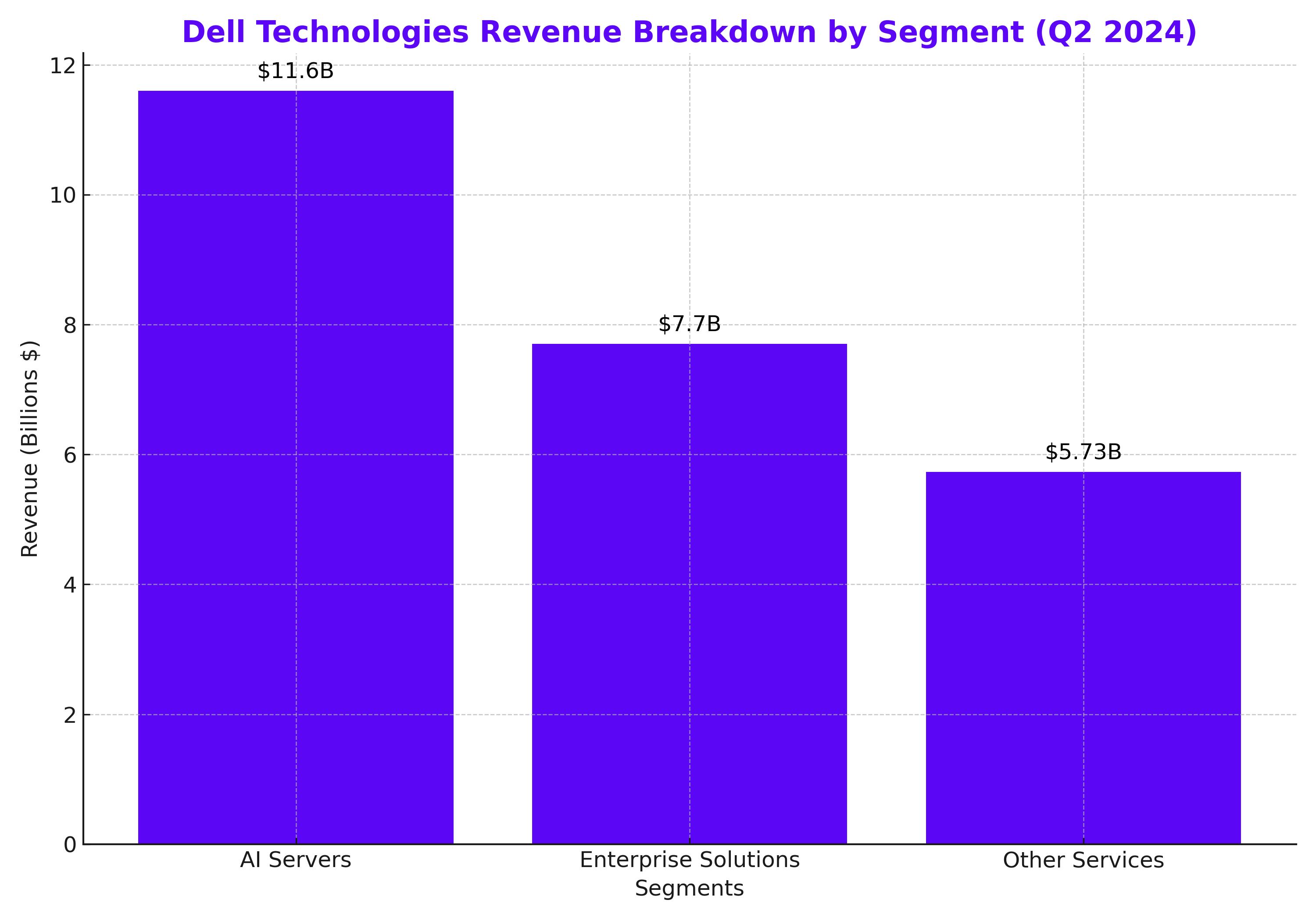

Dell's recent earnings report paints a promising picture. For the most recent quarter, the company posted earnings per share (EPS) of $1.89, beating analyst estimates by $0.18, or roughly 11%. Revenue came in at $25.03 billion, surpassing forecasts by $910 million, marking a 4% increase. Particularly noteworthy was Dell's Infrastructure Solutions Group (ISG), which recorded a 38% year-over-year growth in revenue, reaching $11.6 billion. This includes record server and networking revenue of $7.7 billion, driven by an 80% year-over-year increase in enterprise AI-related sales.

Dell has consistently outperformed earnings expectations. The company’s trailing twelve-month (TTM) EPS estimate was $6.18, yet Dell managed to earn $7.24, a 17.5% outperformance. This trend suggests the potential for further earnings surprises in the near future. Based on this track record, Dell is expected to generate between $10.40 and $10.80 per share next year, translating to a forward price-to-earnings (P/E) ratio well below 12, an attractive valuation for a company with Dell's growth trajectory.

Impact of AI Growth on Dell's Business

Dell’s success in the AI hardware sector is largely driven by its ability to cater to enterprise customers. Dell’s servers and networking equipment, particularly those optimized for AI workloads, have seen robust demand. The company shipped $3.1 billion worth of AI servers in the most recent quarter, and the AI server backlog remains strong at $3.8 billion. This backlog, paired with a growing pipeline, underscores Dell's ability to capitalize on the AI boom.

While competitors like Super Micro Computer (NASDAQ: SMCI) face challenges, including short-selling reports and delayed filings, Dell's stability and market-leading position could attract more customers. With AI becoming increasingly integral to enterprise IT infrastructure, Dell is well-positioned to capture a significant share of this growing market.

S&P 500 Inclusion: A Catalyst for Dell’s Stock

Dell’s recent addition to the S&P 500 index is a significant milestone, boosting its visibility among institutional investors. Inclusion in the S&P 500 often leads to increased demand for a stock as index funds and ETFs are required to hold shares, providing a natural support level for the stock price. Historically, stocks included in the S&P 500 outperform in the months following inclusion due to the influx of new investment.

The stock is currently trading around $100, with analysts projecting a potential upside of 50-70% based on its forward P/E ratio. Dell's earnings growth could support a forward P/E multiple of 15-17, implying a price range of $150 to $170. Some analysts even suggest a bullish case where Dell's stock could reach $220 within the next 12 months.

Dell’s Competitive Position in AI and Enterprise Solutions

Dell’s Infrastructure Solutions Group (ISG) is at the core of its AI strategy, driving significant revenue growth through its AI-optimized server solutions. The company is also leveraging its long-standing relationships with enterprise customers to upsell its AI services, positioning itself as a full-service provider for AI-driven data center solutions.

Despite the competitive landscape, Dell’s strong engineering support, management capabilities, and financial services offerings give it an edge over competitors like SMCI. The company’s AI server revenue grew 23% sequentially, and its backlog and pipeline growth suggest that this momentum will continue.

Forward Guidance and Potential for Outperformance

Dell’s forward guidance is optimistic, with Q3 expected to be solid and Q4 likely to be even stronger. The company has guided for full-year revenue of $97 billion, with a strong finish to the year anticipated. Analysts expect Dell to continue raising both revenue and EPS guidance, driven by the growing demand for AI servers and related services.

Dell’s management has highlighted the increasing number of enterprise customers adopting AI solutions, signaling a long runway for growth in this area. The total addressable market (TAM) for AI infrastructure is expected to grow 22% annually, reaching $174 billion, up from $154 billion previously. As one of the leading providers of AI infrastructure, Dell is well-positioned to benefit from this expanding market.

Valuation and Free Cash Flow Growth

Dell’s current valuation appears conservative, with the stock trading at a significant discount to its peers in the information technology sector. The company’s forward P/E ratio of 13.89 is nearly 40% lower than the sector median, despite its strong growth prospects. Dell’s price-to-earnings growth (PEG) ratio of 1.12 further supports the view that the stock is undervalued relative to its earnings potential.

Using a discounted cash flow (DCF) model, Dell’s current share price represents a 44.2% discount to its intrinsic value, based on projected free cash flow growth of 12% over the next three years. The company’s focus on AI infrastructure and data center solutions, combined with operational efficiency improvements, should support continued free cash flow growth and shareholder returns.

Risks to Dell’s Growth Story

Despite the positive outlook, Dell faces several risks. Macroeconomic factors, such as rising interest rates and potential economic slowdowns, could impact demand for its legacy computer business and AI solutions. Additionally, the company faces stiff competition in the AI enterprise hardware space, with players like SMCI and others vying for market share.

Dell’s reliance on key suppliers, particularly Nvidia for its AI server GPUs, poses another risk. Supply chain disruptions or pricing pressures from Nvidia could impact margins in the short term. However, Dell has demonstrated resilience in managing these risks, and its ability to offer alternative solutions, such as servers powered by AMD chips, provides some flexibility.

Conclusion: Dell as a Strong Buy for Long-Term Investors

Dell Technologies (NASDAQ: DELL) presents a compelling investment opportunity, particularly for investors looking to gain exposure to the rapidly growing AI infrastructure market. The company’s strong earnings performance, competitive position in AI and enterprise solutions, and inclusion in the S&P 500 all support a bullish outlook for the stock.

With a forward P/E ratio below the sector average and significant upside potential, Dell is well-positioned for long-term growth. The risks associated with macroeconomic factors and supply chain disruptions are real but manageable. Given Dell’s strong financial performance and growth prospects, the stock remains a strong buy for long-term investors.

For real-time insights on Dell’s stock, including live price updates, visit Dell Technologies Stock Real-Time Chart.

Additionally, track insider transactions and get a detailed stock profile by visiting Dell Technologies Insider Transactions.