Disney's Strong Q1 2024 Surpassing Earnings Expectations

Analyzing Disney’s (NYSE:DIS) revenue growth, segment performance, and strategic investments in AI and digital finance for the first quarter of 2024 | That's TradingNEWS

Overview of Disney's Strategic Financial Performance

NYSE:DIS Market Adaptation and Earnings Insights

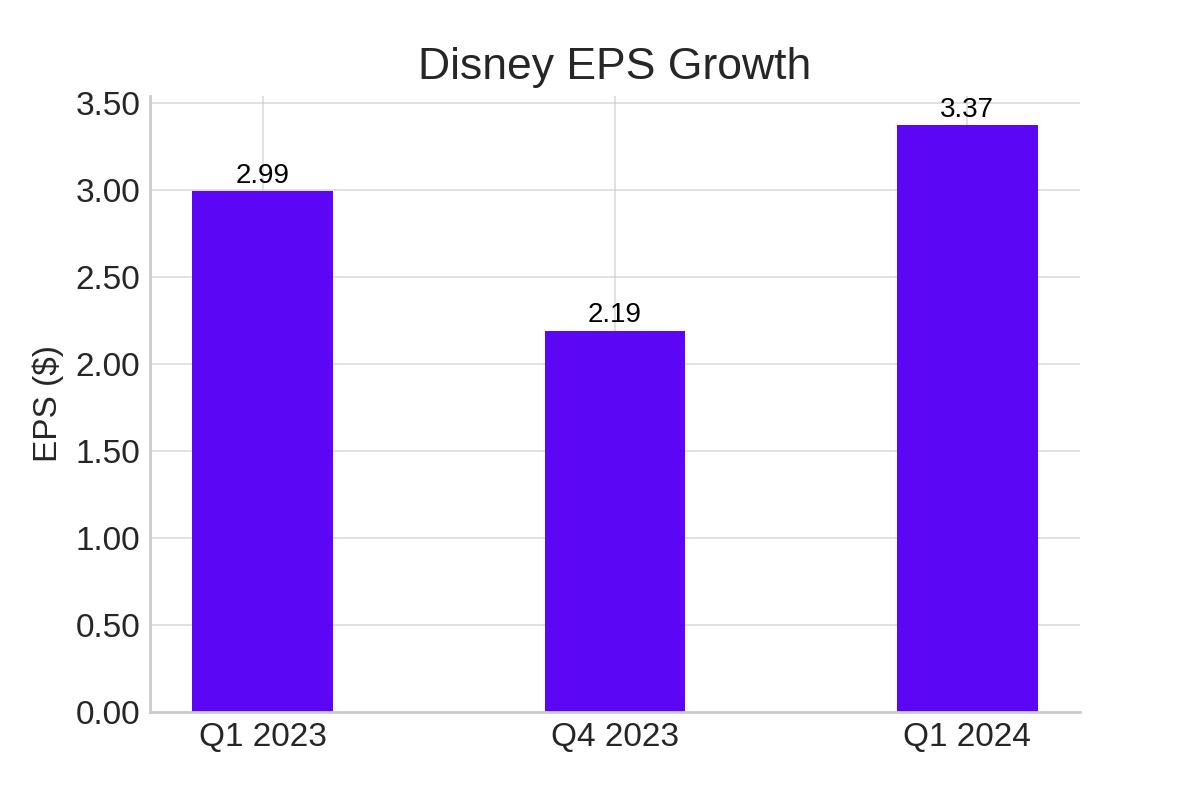

In the first quarter of 2024, Disney (NYSE:DIS) demonstrated a strong financial performance, signaling robust operational efficiency and the ability to thrive amid evolving market dynamics. The company reported an earnings per share (EPS) of $3.37, notably surpassing the analysts' expectation of $3.04. This figure not only represents an improvement from the $2.99 EPS reported in the first quarter of the previous year but also shows a significant jump from $2.19 in the last quarter of 2023.

Revenue Growth and Segment Analysis

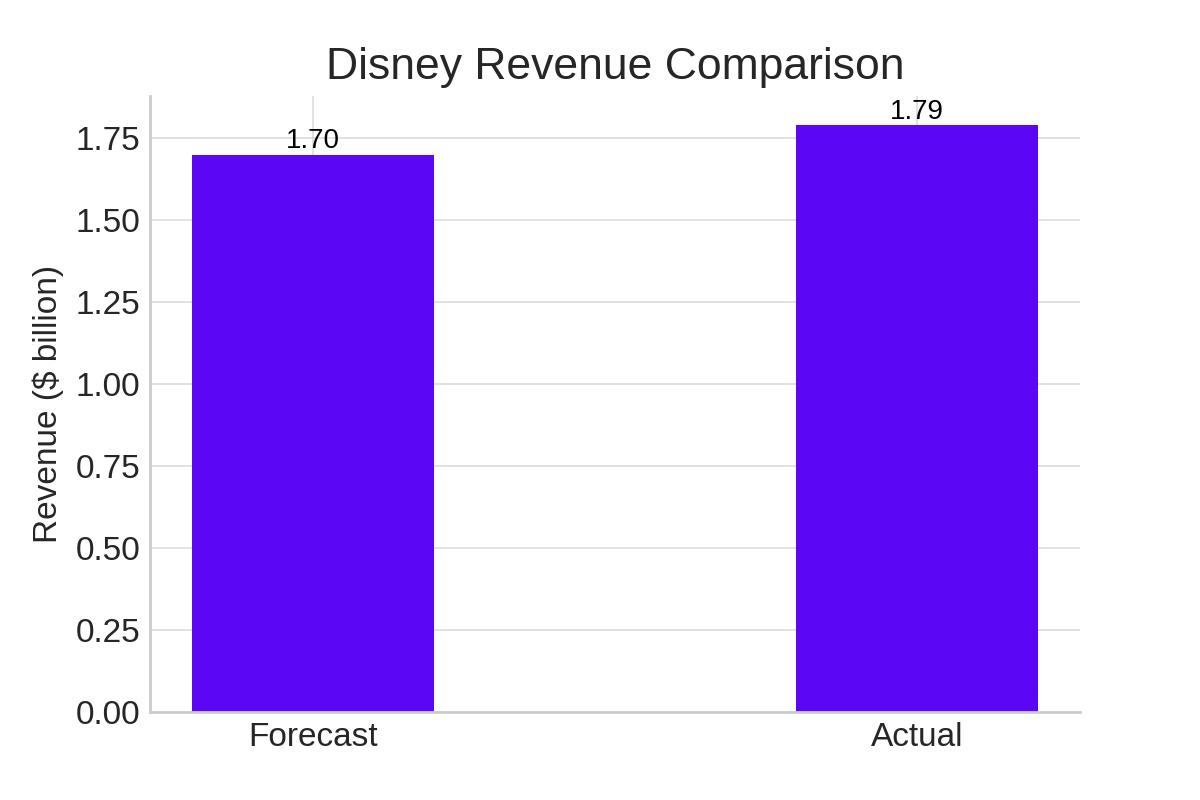

Disney's revenue for the quarter was reported at $1.79 billion, exceeding the forecasts by 5.06%, which had anticipated $1.70 billion. This increase underscores the strong demand for Disney’s diverse portfolio, including its critical financial analytics and credit rating services.

Detailed Segment Performance Analysis

Moody's Analytics and Investors Service Breakdown

Disney operates through two primary business segments: Moody's Analytics (MA) and Moody's Investors Service (MIS). This quarter, MA reported a revenue of $799 million, up 8% from the previous year, driven by a surge in annual recurring revenue by 10%. This boost is attributed to heightened demand for sophisticated know-your-customer solutions and extensive data services.

Conversely, MIS saw a more dramatic increase, with revenues rising 35% year-over-year to $987 million. This growth is largely fueled by favorable market conditions and strategic positioning that capitalized on vibrant asset classes.

Operational Costs and Profit Margins

Despite a minor increase in operating expenses to $985 million for the quarter, up from the previous year, Disney managed to enhance its adjusted operating margin to 50.7%, a significant rise from 44.6% in the first quarter of 2023. This improvement reflects Disney's effective cost management and operational optimization strategies.

Market Response and Forward-Looking Statements

Despite the impressive earnings report, Disney’s stock saw a 2.5% dip in early trading, likely due to its updated EPS guidance for 2024. The new forecast ranges from $10.40 to $11.00, narrowly missing the analysts' consensus of $10.74. Nevertheless, the company reaffirmed its strong cash flow projection, expecting between $1.9 billion and $2.1 billion for the year.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex