DocuSign’s (NASDAQ:DOCU) 59% Stock Surge Signals $88 Fair Value Target

Massive $134.9B market opportunity, 86% upside potential, and AI leadership fuel growth | That's TradingNEWS

NASDAQ:DOCU: A Strategic Overview of Momentum, Challenges, and the Hidden Upside

Investment Thesis: Why DocuSign Is Positioned for Long-Term Growth

DocuSign, Inc. (NASDAQ:DOCU) has rebounded strongly in 2024, with its shares up over 59% since mid-year, signaling growing confidence in its strategic shift beyond electronic signatures. The company is evolving into a comprehensive Intelligent Agreement Management (IAM) platform, tapping into a global Total Addressable Market (TAM) estimated at $134.9 billion by 2033. Despite heightened competition and tempered expectations, the stock still offers upside potential, driven by strong fundamentals, expansion into high-growth markets, and valuation metrics that reveal room for improvement.

Exploring the Key Drivers Behind NASDAQ:DOCU's Recent Rally

The third quarter of fiscal 2024 was pivotal for DocuSign. The company reported an 8% year-over-year revenue growth to $754.8 million, surpassing Wall Street expectations of $745.3 million. This marked a re-acceleration of growth compared to 7% in the prior quarter. More notably, billings—a forward-looking indicator of future revenues—rose 9%, showcasing robust demand for the company’s new products and services, particularly its IAM platform.

The IAM launch has positioned DocuSign to attract enterprise customers by automating and managing complex contractual processes, effectively broadening its appeal beyond small-to-medium businesses. By enabling contract creation, negotiation, and analytics, IAM integrates advanced features that are proving popular among high-value customers. This is evident from the 12% growth in direct sales bookings and the addition of 1,066 customers spending over $300,000 annually, a 15% increase year-over-year.

Hidden Upside: Valuation and Market Expansion Potential

Despite recent price gains, DocuSign's valuation remains below the sector median, signaling a hidden upside. With a forward P/E of 16.6, DOCU trades at a steep 46% discount to the sector's median P/E of 30.93. This discount feels unwarranted given the company's robust revenue growth, which is projected to accelerate beyond the current 7% CAGR as its new IAM platform gains traction globally.

If DOCU's forward P/E aligns with the sector median, its share price could rise significantly. At the current price of $107, a re-rating to the sector median implies an upside of approximately 86%, pushing the fair value toward $200 per share. Moreover, as international revenue—which accounts for 28% of total sales—continues to grow at over 15% annually, DocuSign has the potential to become a dominant global player in contract management solutions.

Why DocuSign’s AI Integration is Underappreciated

While competitors like Adobe are often highlighted for their AI advancements, DocuSign has quietly built a competitive edge by integrating AI-driven features into its IAM platform. Its AI tools, such as automatic contract review and summarization, not only reduce costs for clients but also enhance efficiency in complex negotiations. These features resonate particularly well with enterprise clients, a segment that DocuSign has successfully penetrated. Yet, Wall Street has been slow to price in the growth potential from these innovations.

Real Estate and Notarization Markets: Untapped Growth Opportunities

In addition to its enterprise focus, DocuSign has entered new verticals, such as real estate and online notarization. The launch of DocuSign Transactions targets the $132 trillion global real estate market by streamlining processes for agents and brokers. Similarly, its partnership with Legitify, Europe’s leading online notarization platform, positions the company to capitalize on a burgeoning $4 billion market in the EU. These ventures not only diversify revenue streams but also align with broader digital transformation trends, creating additional long-term growth opportunities.

Risks and Competitive Challenges

The primary risks for DocuSign are competition and its reliance on expanding beyond electronic signatures. While Adobe's Document Cloud has shown faster growth at 18% year-over-year, DocuSign’s ability to maintain market leadership with 53.5% share provides a cushion. However, competition from large, well-capitalized players could compress margins in the near term.

Another concern is the company’s high reliance on stock-based compensation (SBC), which accounted for 21% of revenue in fiscal 2024. This expense, combined with exposure to the real estate sector—a segment currently under pressure from high-interest rates—could temper profitability growth.

Strategic Outlook and Valuation Re-Rating Potential

DocuSign’s leadership in electronic signatures and its ongoing transition to a broader IAM provider position it well for long-term success. With a TAM projected to grow to $134.9 billion by 2033 and its current valuation implying significant room for multiple expansion, the stock remains attractive. If the company continues to deliver 8-10% revenue growth and maintains its 30% operating margin trajectory, shares could surpass $130 by mid-2025, offering a 22% upside from current levels.

Additionally, as the IAM platform scales internationally, contributing an estimated 4% to top-line growth annually, the stock could justify a forward P/E closer to 30. This would unlock an upside of over 50%, making DocuSign a compelling investment for those with a long-term horizon.

Where the Numbers Point

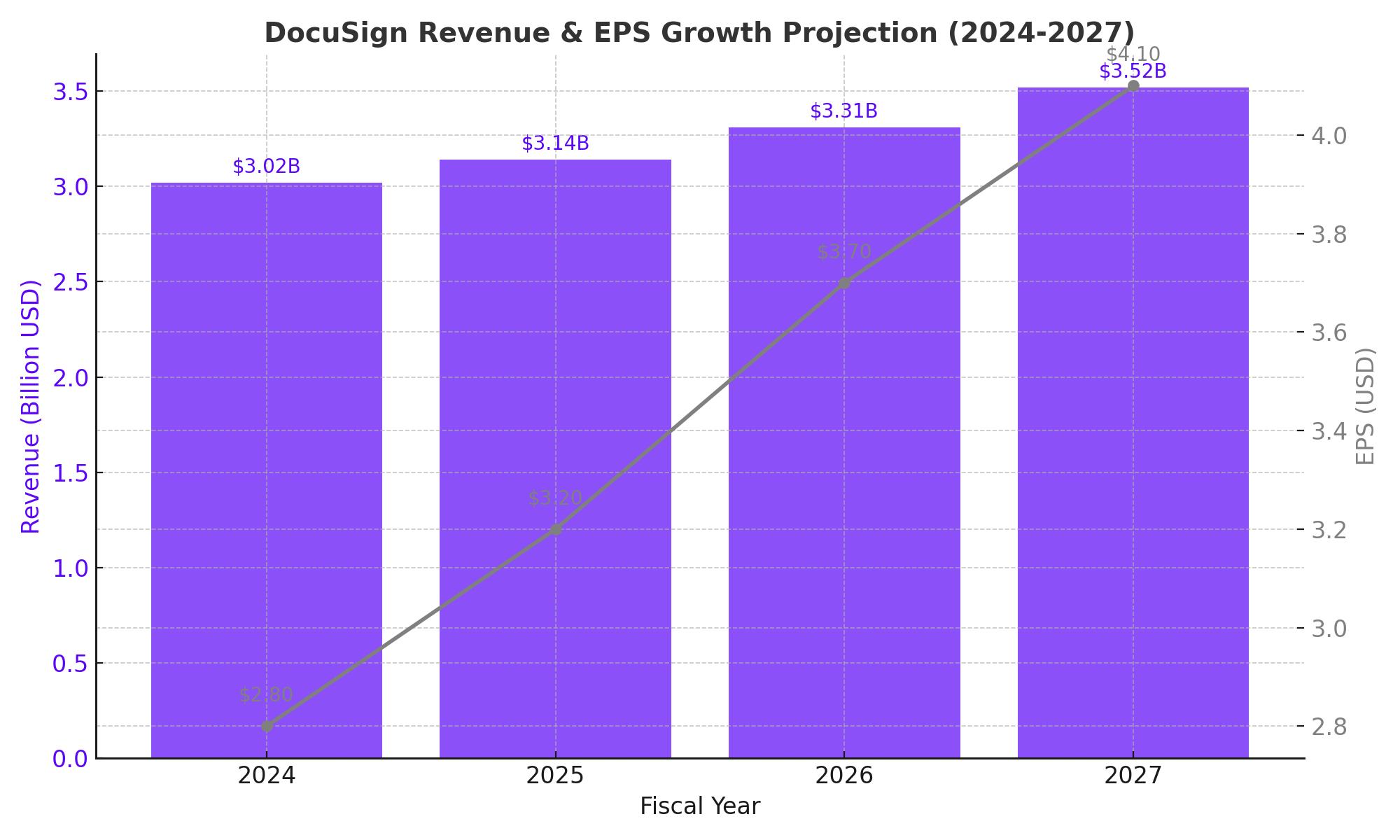

Looking at forward estimates, DocuSign's revenue is expected to reach $3.14 billion in fiscal 2026, a 6% increase from 2025. Pro forma EPS for the same period is projected at $3.70, translating to a forward P/E of 29x at the current share price. This suggests that if management can accelerate growth to even 8%, the market will likely re-rate the stock, potentially driving it to a valuation above $150 within two years.

Conclusion: Is NASDAQ:DOCU a Buy, Sell, or Hold?

While recent price movements reflect improving sentiment, DocuSign's current valuation leaves room for growth. Its diversification into IAM, partnerships in real estate and notarization, and robust financial performance position it as a long-term winner in the contract management space. However, investors should remain cautious of competitive pressures and near-term volatility tied to macroeconomic factors.

For long-term investors, the current price of $107 represents an attractive entry point with a potential upside of 40-60% over the next 12-18 months. For those already holding, DOCU remains a solid buy, with catalysts such as international expansion, AI-driven features, and broader IAM adoption likely to unlock further value.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex