DPZ NYSE Dominos Stock Soars as It Teams Up With Uber

DPZ:NYSE Stock Soar After Dominos and Uber seal a landmark partnership, Pizza Company Expected To Drive Sales Growth | That's TradingNEWS

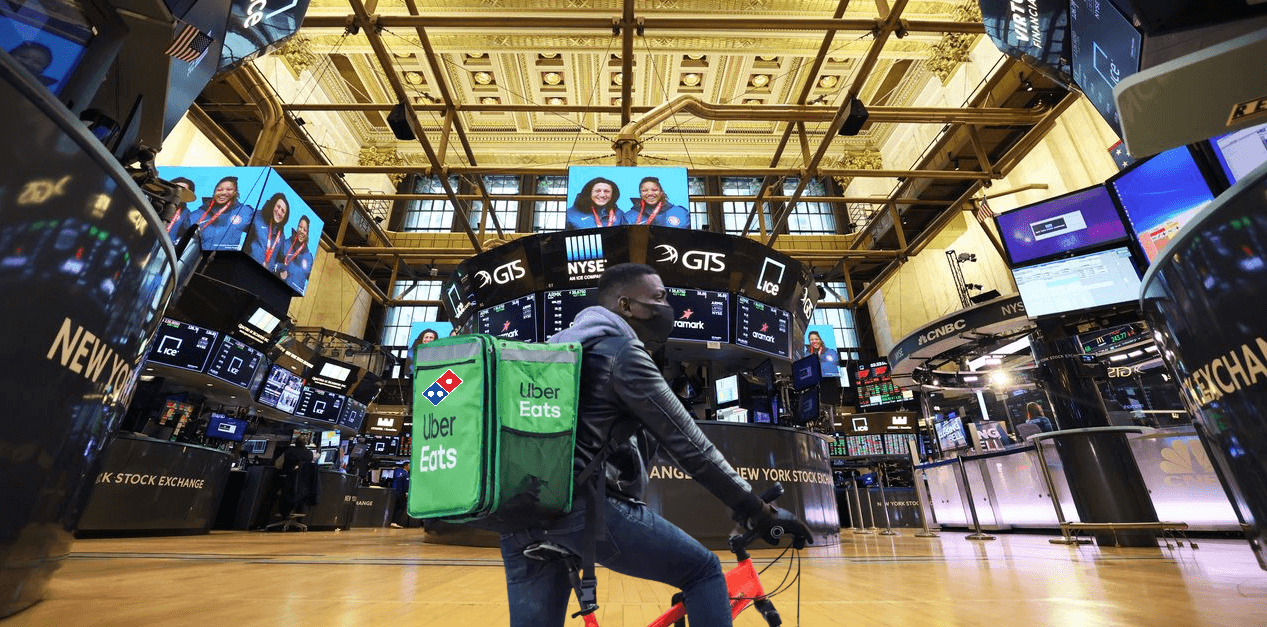

Domino’s Pizza Inc. recently secured a partnership with Uber Technologies Inc., marking a significant shift in the pizza delivery giant's approach to third-party ordering platforms. This strategic alliance will let U.S. customers order Domino's products via the Uber Eats and Postmates apps. However, the twist lies in the delivery - these orders will be handled by Domino’s own uniformed drivers, a move intended to maintain the brand experience that Domino's customers have become accustomed to over the past 60 years.

This collaboration aims to resolve the slump in Domino's delivery sales that the company has faced recently, particularly after the easing of pandemic restrictions that saw Americans gradually return to in-person dining. Although Domino's enjoyed a surge in demand during the lockdowns, it grappled with dwindling sales in recent quarters as cost-sensitive consumers started to prefer home-cooked meals over takeouts.

The alliance with Uber is anticipated to drive a significant number of additional delivery orders and is perceived to be a strategic endeavor to reach new customers, as the ordering apps of Uber are frequented by a different segment of consumers. BTIG analyst Peter Saleh affirms that this partnership could improve franchisee economics and reinvigorate Domino's faltering domestic delivery sales.

The partnership will debut this fall in four pilot markets, and it is expected to become available nationwide by the end of 2023. According to Russell Weiner, the CEO of Domino's, they are venturing into the next logical marketplace, order aggregation, as the aggregators have scaled. Weiner notes that Domino's decision to partner with Uber is informed by their experiences and research in 13 of their international markets.

The agreement with Uber is expected to bear fruit for the pizza chain on a global level. Domino's and Uber Eats are active in 27 shared international markets, which implies that up to 70% of Domino's stores worldwide could receive incremental orders from Uber Eats. Until at least 2024, Uber Eats will be the exclusive third-party platform for Domino's in the U.S.

Financially, Domino's Pizza Inc. has demonstrated consistent growth. The company recorded $1.024 billion in revenue for the quarter ending March 31, 2023, marking a 1.31% year-over-year increase. Its annual revenue for 2022 stood at $4.537 billion, showing a 4.13% rise from 2021. In terms of gross profit, the company reported $0.386 billion for the quarter ending March 31, 2023, a 4.59% year-over-year rise. Operating income for the same quarter was $0.177 billion, indicating a 7.87% increase compared to the previous year.

In regards to EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), Domino's noted a 6.55% increase year-over-year for the quarter ending March 31, 2023, reaching $0.197 billion. The company's twelve months ending March 31, 2023, reported an EBITDA of $0.866 billion, a 2.91% growth year-over-year.

Domino's stock has responded positively to the announcement, soaring by 12.1% in premarket trading, reaching an eight-month high. Meanwhile, Uber's shares made more modest gains. By incorporating third-party platforms into their business model while retaining their brand's delivery experience, Domino's stands to capture a larger customer base, thereby boosting its revenue.

In Weiner's words, "Given certain customers only order their delivery from the Uber Eats app, this deal could make Domino's available to millions of new customers around the world. Domino's will still be the face our customers see at the door, while Uber will be providing us with adequate data to understand delivery efficiency and incrementality. Meanwhile, Domino's own e-commerce platform will continue to be the place our customers can go to access our best deals and industry-leading loyalty program.

The quarter ending March 31, 2023, recorded a gross profit of $0.386 billion, up 4.59% from the same period in the previous year. Nevertheless, the company's gross profit for the year ending on the same date decreased by 0.13% year-over-year to $1.666 billion. Prior to this, the company's annual gross profit had been following a growth trajectory, with a 2.35% decline in 2022, a 5.88% increase in 2021, and a significant 13.69% increase in 2020.

In terms of operating income, Domino's reported $0.177 billion for the quarter ending March 31, 2023, a 7.87% year-over-year increase. The twelve-month period ending on the same date saw a 2.96% year-over-year increase to $0.781 billion. Notably, the company's annual operating income for 2022 marked a 1.6% decline from the previous year, ending a period of steady growth which saw a 7.55% increase in 2021 and a 15.29% increase in 2020.

Evaluating EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), the quarter ending March 31, 2023, showed an increase of 6.55% year-over-year to $0.197 billion. The twelve months ending the same day reported a 2.91% increase to $0.866 billion. However, the annual EBITDA for 2022 showed a 0.82% decline from 2021.

Amid the fluctuations in the financial metrics, the Uber partnership presents an interesting potential for Domino's. The alliance could enhance Domino's reach and efficiency, helping to bridge any fiscal downturn and further expand its market influence. As it continues its worldwide operations, the benefits of the partnership might reflect positively on its future financial figures.

Domino's has shown resilience and an ability to adapt. Its collaboration with Uber is evidence of its commitment to leverage technology and strategic partnerships to maintain its position in the pizza delivery market. By aligning with Uber, Domino's can appeal to a broader customer base, tap into Uber's vast network, and continue its trend of innovation and growth in a competitive market landscape.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex