Economic and Technical Influences on Forex Rates

From U.S. Jobs Data to Fed Policies: Unpacking How Key Economic Indicators and Central Bank Actions Drive EUR/USD Exchange Rate Trends | That's TradingNEWS

Analyzing the Economic and Technical Factors Affecting the EUR/USD Exchange Rate

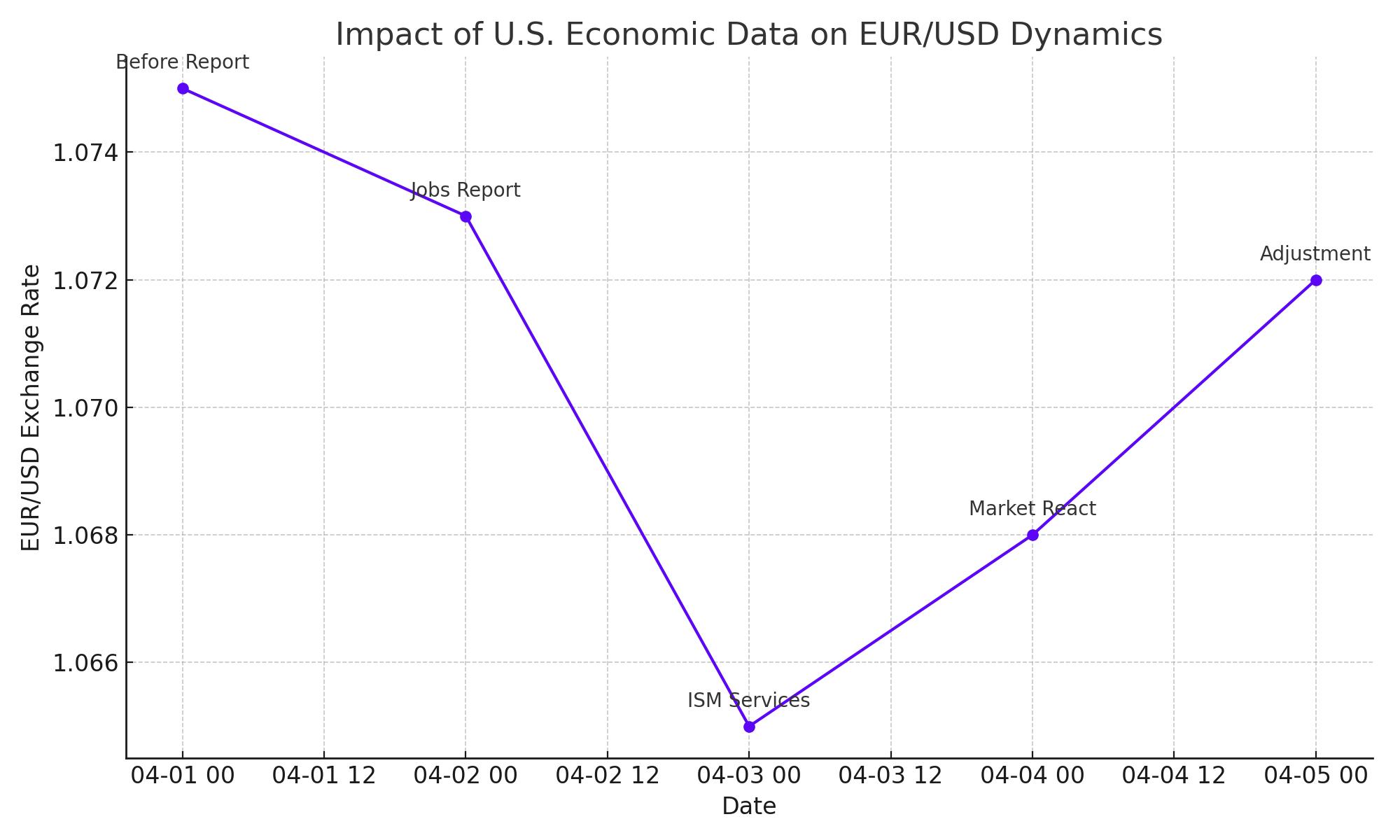

Impact of U.S. Economic Data on EUR/USD Dynamics

The EUR/USD pair has been highly responsive to recent U.S. economic data. A weaker-than-expected U.S. Jobs Report catalyzed a notable dip in the U.S. dollar, highlighting its sensitivity to domestic economic signals. Compounding this volatility, the U.S. ISM Services Index revealed a slowdown in service sector growth, with the PMI index falling to its lowest level in two years at 49.1. Concurrently, the index's prices paid component escalated to 58.3, marking a significant three-month peak. These figures point to rising inflationary pressures, which could prompt the Federal Reserve to adjust monetary policy more aggressively than currently anticipated.

European and British Economic Landscape

In contrast to the U.S., Europe faces a week devoid of major economic announcements, potentially leaving the Euro vulnerable to external market shifts. In the UK, the Bank of England is anticipated to maintain its current policy settings during its upcoming announcement. However, a shift in the Monetary Policy Committee's sentiment, possibly leaning towards a rate cut, could undermine the strength of the British Pound, reflecting the intricate relationship between policy expectations and currency strength.

Technical Analysis of EUR/GBP

The EUR/GBP pair has demonstrated resilience, bouncing back from recent troughs and surpassing significant moving averages. The pair faces immediate technical resistance at 0.8600, closely followed by the 200-day simple moving average at 0.8603. A breach of these levels could push the pair towards higher resistance at 0.8620 and 0.8645. On the downside, support is positioned at 0.8550, which could stabilize declines.

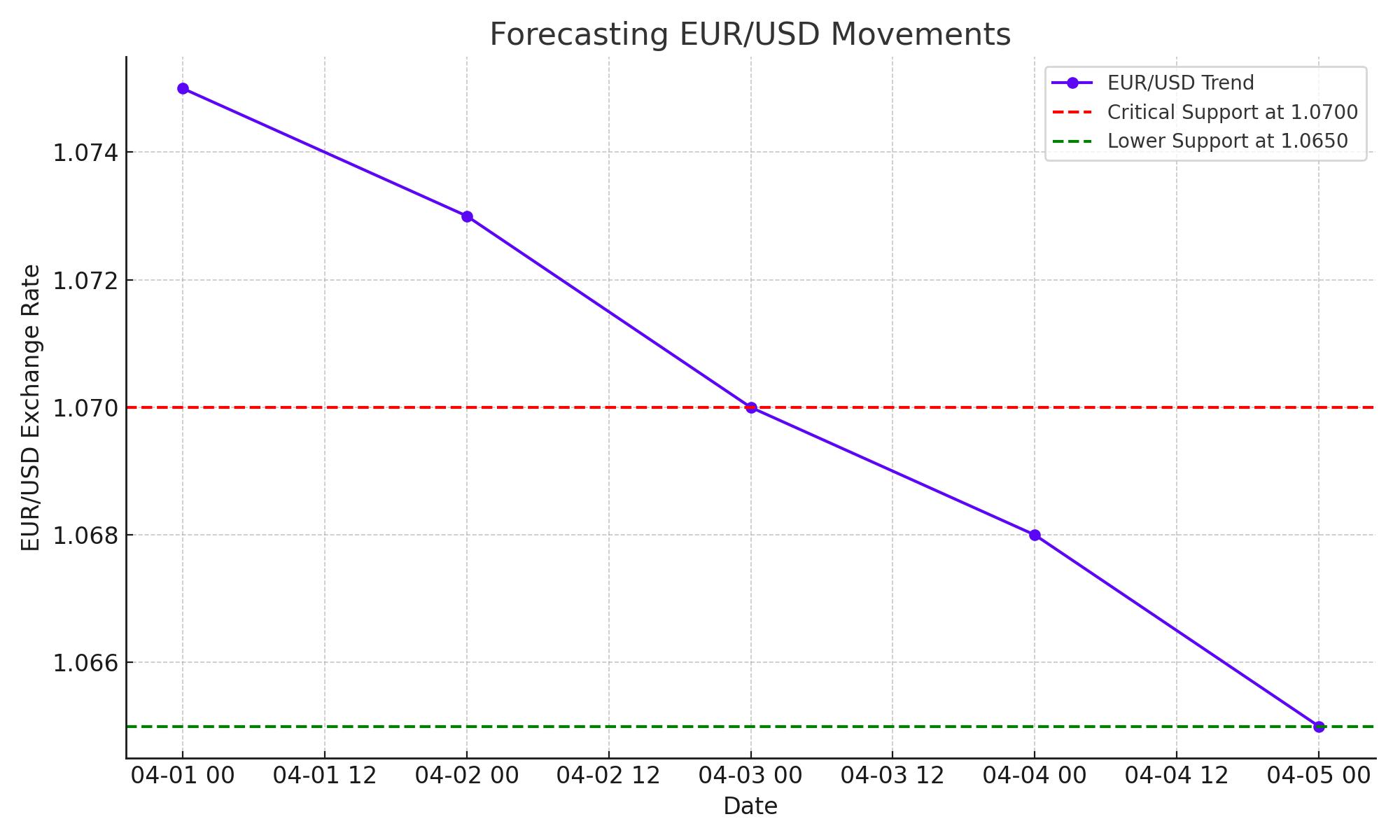

Forecasting EUR/USD Movements

The EUR/USD is currently navigating within an upward trend channel, though the formation risks devolving into a bearish flag should the pair fall through critical support levels. The currency pair's long-term pattern displays consistent lower highs and lower lows, with a potential drop below 1.0600 signaling further bearish potential. Immediate support around 1.0700 needs to hold to prevent losses and possibly catalyze a push towards resistance levels between 1.0780 and 1.0795.

Federal Reserve's Influence on Market Sentiment

Recent communications from the Federal Reserve and the ongoing dialogue from Fed officials are set to heavily sway short-term EUR/USD fluctuations. After the Fed's latest deliberations, market anticipation of rate cuts has moderated, though a 25 basis point reduction remains priced in. These developments necessitate a careful reevaluation of future EUR/USD price movements, considering both technical positions and macroeconomic fundamentals.

Navigating EUR/USD Exchange Rate Trends

The current trajectory of the EUR/USD pair is a delicate balance between diverging economic indicators and fluctuating market sentiment. Although technical analysis suggests potential downward pressure, fundamental economic conditions and policy directions offer opportunities for bullish corrections, contingent on maintaining critical support thresholds. Investors are advised to closely monitor upcoming economic data and policy updates, which will be crucial in shaping the currency pair's direction in the near term.

That's TradingNEWS

Read More

-

SPYD ETF Price at $43.57: Is This High-Dividend S&P 500 Fund Still Cheap for 2026?

30.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Ignite: XRPI at $10.79 and XRPR at $15.43 While XRP-USD Holds the $1.80 Floor

30.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast $4: Storage Slides, UNG Climbs and NG=F Targets $5.50

30.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 158 Ceiling and 154.50 Support Define the 2026 Battle

30.12.2025 · TradingNEWS ArchiveForex