EUR/USD Falls as Inflation Fears Loom and ECB Rate Cuts Draw Near

With US inflation rising and ECB rate cuts expected, EUR/USD battles key support levels amidst economic uncertainty | That's TradingNEWS

EUR/USD Remains Pressured After US Inflation Data Pushes Dollar Higher

Euro Struggles Amid US Inflation Surge

The EUR/USD currency pair has been under pressure following the release of higher-than-expected US inflation data. The recent Consumer Price Index (CPI) report showed a 2.4% year-over-year increase for September, slightly above the anticipated 2.3%, intensifying the sell-off in the euro and pushing the pair to a two-month low. The euro is currently trading at $1.0940, having briefly dipped below $1.09 during the previous session.

While the dollar initially gained strength after the inflation data was released, that momentum faded quickly. Investors are now focusing on the next key indicator—US Producer Price Index (PPI) data, expected to increase by 0.1% month-over-month for September, with a 1.6% annual gain. The PPI measures inflation at the wholesale level, a critical figure that helps guide Federal Reserve decisions. The market will closely watch the outcome as it could further influence EUR/USD price movements.

European Central Bank Rate Cuts Expected

A Reuters poll shows that most economists anticipate the European Central Bank (ECB) will cut rates twice—once in October and again in December—with both cuts expected to be 25 basis points. This expectation comes on the heels of Eurozone inflation falling below 2% in September, giving the ECB more confidence in easing monetary policy.

The decline in Eurozone inflation, along with ECB President Christine Lagarde’s indication of more rate cuts, has weighed on the euro. Meanwhile, the US dollar remains resilient due to stronger economic data, including the latest nonfarm payroll report showing robust job growth. This divergence in monetary policy between the ECB and the Federal Reserve is a significant factor in the euro's recent weakness against the dollar.

Technical Analysis: EUR/USD Tests Key Support

On the technical side, EUR/USD is testing the critical support level of 1.0950, which it had previously failed to break. The pair is trading below its 30-day simple moving average (SMA), with the Relative Strength Index (RSI) nearing oversold territory. This indicates a bearish bias in the short term, though the pair may see some relief if PPI data comes in lower than expected.

The US dollar also faces resistance at key Fibonacci levels around 102.55 on the DXY index. Traders are closely watching this level, with potential pullback scenarios in GBP/USD and AUD/USD presenting opportunities for those looking to capitalize on USD strength. A breach of the 1.0950 support in EUR/USD could lead to further downside, with the next major support level near 1.0900.

Recent Trends and Euro Recovery Potential

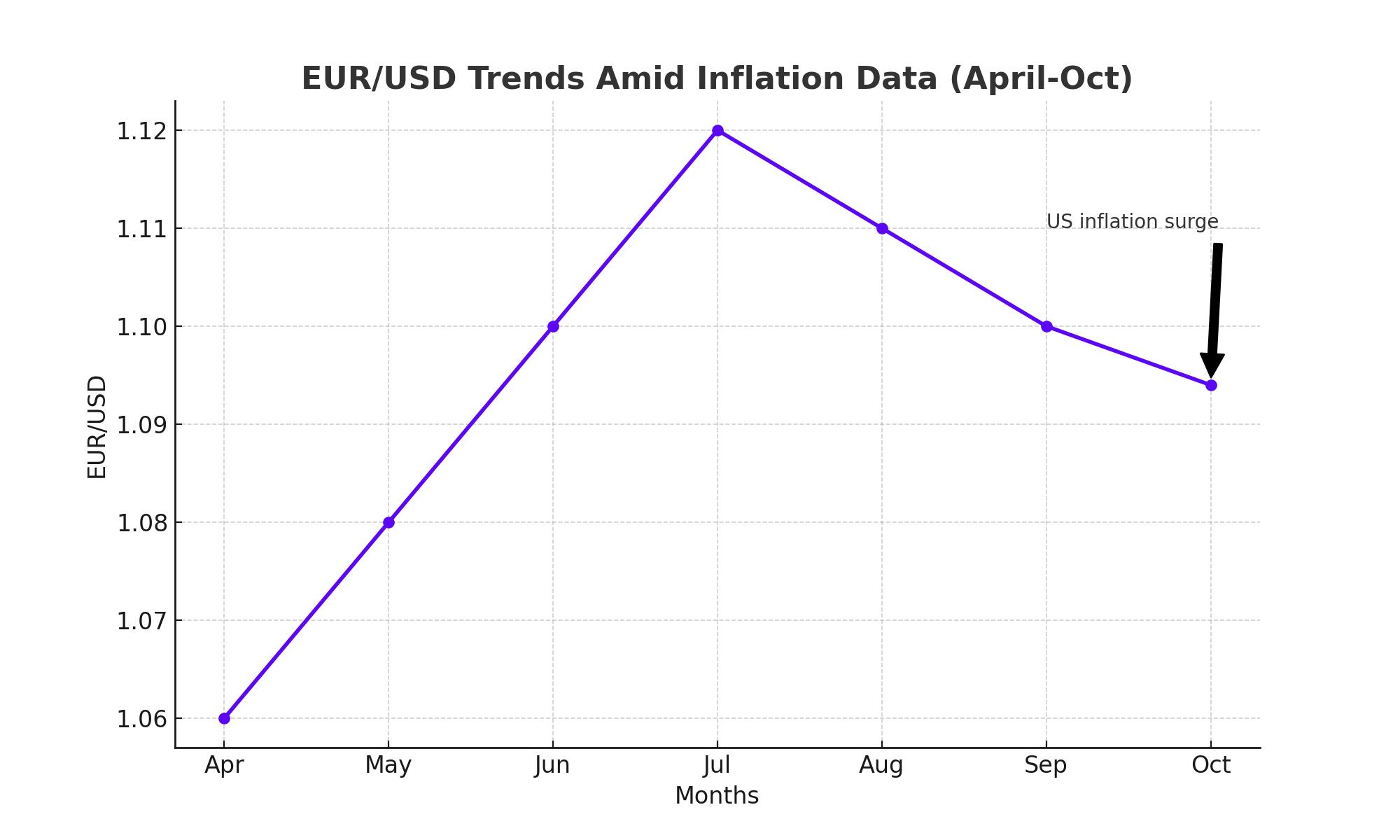

Between April and September, the euro saw a significant rally against the US dollar, rising from 1.06 to 1.12. Analysts attribute this strength to weaker US economic data, particularly in the labor market, and lower oil prices. However, as the US economy shows signs of resilience, particularly in jobs growth, the momentum has shifted back in favor of the dollar.

Analysts remain divided on the euro's potential for further gains. Some, like Tomasz Wieladek, Chief European Economist at T. Rowe Price, argue that a weaker US dollar, rather than a stronger euro, has been the primary driver of recent euro gains. As US inflation begins to cool, and with recession fears lingering, some believe the euro could continue to rise in the fourth quarter. However, others, like Claudio Wewel, FX Strategist at J. Safra Sarasin, caution that the euro may not benefit from further rate differentials, suggesting that EUR/USD could drift lower in the coming months.

EUR/USD Overvalued?

Some analysts, including James Stanley, Senior Strategist at Forex.com, believe that EUR/USD is overvalued at its current levels. He points to the pair's failure to break above 1.12 despite favorable conditions earlier in the year. A stronger US dollar, driven by unwinding trades in USD/JPY, has limited the euro’s upside.

Commerzbank analysts forecast EUR/USD to end the year at $1.11, while Bank of America has a slightly higher projection of $1.12. ING’s FX strategist Francesco Pesole expects EUR/USD to revert to 1.100, or lower, as the rate differential continues to favor the dollar.

US Presidential Election and Its Impact on EUR/USD

Looking ahead, one of the most significant factors influencing EUR/USD will be the 2024 US presidential election. Tomasz Wieladek notes that the policies of candidates like Donald Trump or Kamala Harris could have profound effects on the dollar. Trump’s policies, which include raising tariffs and cutting taxes, could drive up inflation and result in a stronger dollar as the Federal Reserve keeps interest rates high. A Trump win could see EUR/USD fall to 1.05, while a Harris victory could push it to 1.15.

The Impact of A Strong Euro

A stronger euro poses challenges for the European economy, particularly for export-driven industries like automotive manufacturing. A stronger currency makes European goods more expensive in foreign markets, potentially dampening demand. On the other hand, a stronger euro also boosts the purchasing power of European consumers, providing a tailwind to domestic demand.

For investors, currency movements can have a significant impact on portfolios, particularly for those holding foreign-denominated assets. Hedging strategies, such as investing in mutual funds or ETFs with a currency hedge, can mitigate some of these risks. However, these strategies come with higher fees, making them less attractive for long-term investors.

Conclusion: What Lies Ahead for EUR/USD?

As we move deeper into Q4, EUR/USD is facing significant headwinds. The European Central Bank’s expected rate cuts, coupled with resilient US economic data, are likely to keep the euro under pressure. Traders will continue to monitor inflation data, labor market reports, and the US presidential election as key drivers for the currency pair’s future trajectory. While the euro may find some short-term relief, the broader outlook remains uncertain as the US dollar continues to dominate the forex landscape.

That's TradingNEWS

Read More

-

GPIX ETF Climbs to $52.54 as 8% Yield Turns S&P 500 Volatility Into Income

02.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI $11.54, XRPR $16.35 And XRP-USD At $1.99 Aim For A $5–$8 Cycle

02.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Tests $3.50–$3.60 Floor Before LNG Wave

02.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds Near 157 as BoJ Caution and Fed Cut Bets Drive the Move

02.01.2026 · TradingNEWS ArchiveForex