EUR/USD Struggles Amid Fed Rate Cuts and Eurozone Economic Weakness

Fed's Dovish Stance Drives EUR/USD Higher, But Resistance Looms

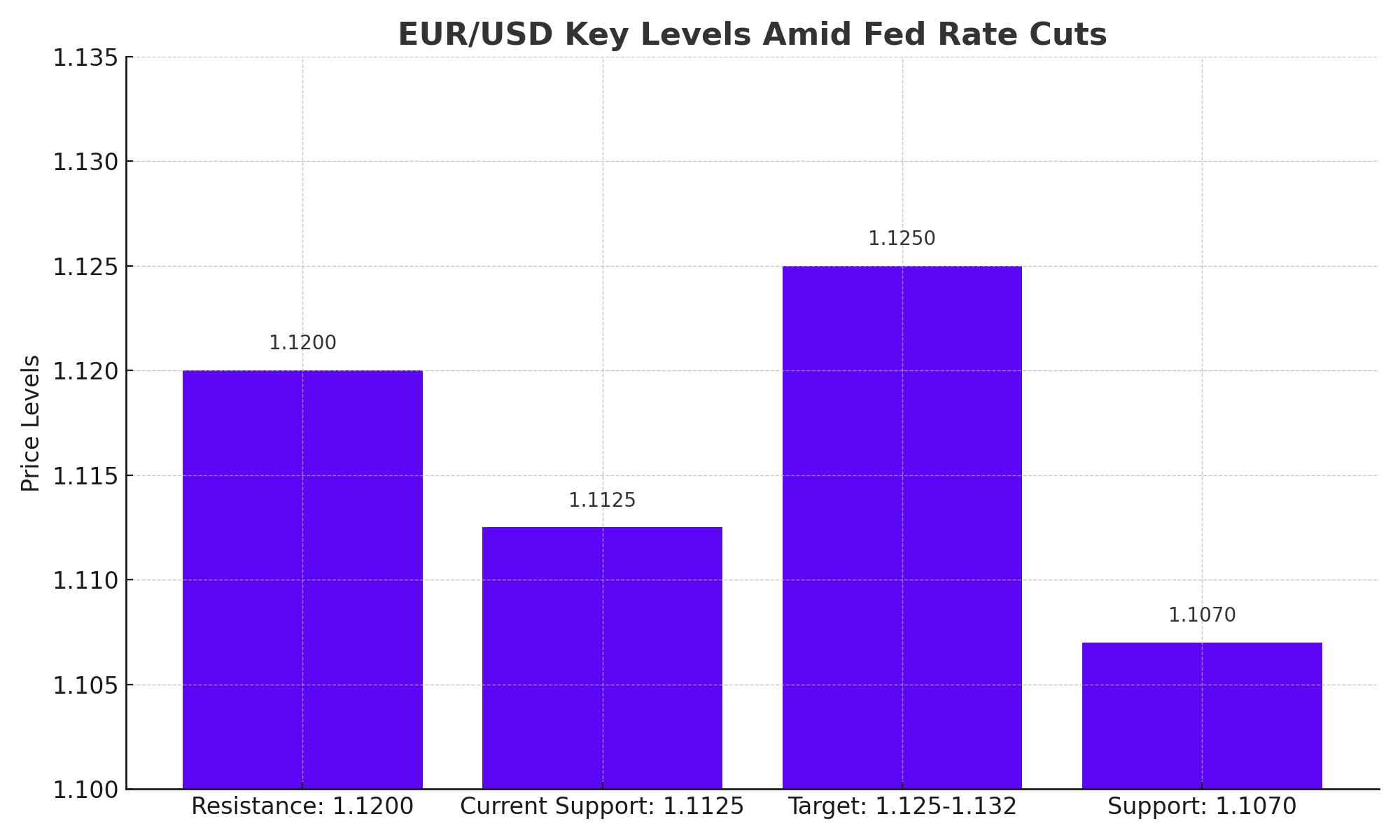

The EUR/USD pair has been navigating a complex market landscape, with its recent upward momentum largely driven by expectations of further monetary easing from the U.S. Federal Reserve. As of now, the pair is testing critical resistance levels near 1.1200, propelled by a combination of lower-than-expected U.S. inflation data and a potential 50-basis-point rate cut by the Fed.

The most recent U.S. Personal Consumption Expenditure (PCE) inflation data came in at 2.2% year-over-year in August, down from 2.5% in July. This lower reading not only undershot market expectations but also bolstered the case for further rate cuts, as inflation continues to ease toward the Fed’s 2% target. The core PCE, excluding food and energy, also grew by a modest 0.1% month-over-month, reinforcing the dovish sentiment. This decline in inflation has triggered optimism for more aggressive monetary easing, with the markets already pricing in another rate cut before the year ends.

The dovish stance from the Fed has resulted in a weaker dollar, creating a favorable environment for EUR/USD. The pair surged past 1.1125—a critical support level—during the last trading session. Analysts from Goldman Sachs now predict the pair could rally by another 2.67%, setting a potential target around the 1.15 mark, driven by Fed actions and increasing market risk appetite.

However, while this trend is positive for the Euro, it's important to recognize that the gains could be capped. The current resistance around 1.1200 is proving tough to break, and the pair has tested this level multiple times in recent weeks without success. Market participants are closely watching Fed Chairman Jerome Powell’s upcoming remarks, which will provide further clues on the Fed’s policy direction. A failure to break through this resistance could send EUR/USD back toward the 1.1070 zone in the short term.

Eurozone Faces Economic Slowdown, Pressuring ECB to Act

On the other side of the Atlantic, the Eurozone's economic outlook remains fragile. Recent data out of the region suggests that the economy is losing momentum, putting pressure on the European Central Bank (ECB) to consider further easing. The Eurozone's Purchasing Managers Index (PMI) fell to 48.7 in September, the lowest level since 2020, indicating contraction in the manufacturing sector. Meanwhile, inflationary pressures in the Eurozone have also eased, with key economies like France and Spain reporting significant declines in Consumer Price Index (CPI) readings. France’s CPI fell to 1.2% in September from 1.8% in August, while Spain’s CPI dropped from 2.3% to 1.5% over the same period.

This softer inflation data, coupled with weak PMI numbers, is pushing analysts to anticipate further rate cuts from the ECB. Barclays has already forecasted a 25-basis-point cut in October, and additional cuts are expected well into 2024. Markets have priced in the ECB’s dovish outlook, which would bring the refinancing rate down from the current 3.75% to around 2% by mid-2024. Despite these economic challenges, the Euro has remained resilient, largely thanks to the broader weakness in the USD, as the Fed’s aggressive rate cuts overshadow the Eurozone’s slowdown.

China’s Stimulus and Global Economic Impact

Adding to the complex dynamic is China’s role in shaping global risk sentiment. The People’s Bank of China (PBoC) has been actively introducing fiscal stimulus measures to counteract the slowdown in its economy. Recent liquidity injections by China have contributed to global risk-on sentiment, which has benefited pro-cyclical currencies like the Euro. As China ramps up its efforts to stabilize its economy, these measures are expected to provide additional support to the EUR/USD in the short to medium term.

Analysts believe that further Chinese stimulus could lead to an uptick in global money supply (M2), a factor that has historically shown a positive correlation with Bitcoin and other risk assets. This influx of liquidity, combined with falling U.S. bond yields, has made the Euro more attractive for investors seeking returns outside the dollar.

Technical Analysis: EUR/USD Faces Critical Levels

From a technical standpoint, EUR/USD is at a pivotal juncture. The pair is trading above the 50-day moving average, and key support is holding strong at 1.1125. This level has been tested multiple times in recent sessions, and as long as the pair remains above it, the technical outlook remains bullish. A sustained break above the 1.1200 resistance zone could pave the way for further gains, with the next target around the 1.125-1.132 range.

However, traders are cautious. If the pair fails to close the week above 1.1200, it could trigger a pullback toward the 1.1070 level, which has been acting as a support floor. Should this level break, the next downside target would be around 1.1050, a key Fibonacci retracement level. Technical indicators like the Relative Strength Index (RSI) are showing signs of overbought conditions, suggesting that a short-term correction may be on the horizon before further upside is seen.

What Lies Ahead: Balancing Fed and ECB Policies

Looking ahead, the future of the EUR/USD pair will largely be determined by the policy moves of the Fed and ECB. On one hand, the Fed’s dovish stance and anticipated rate cuts are likely to keep the dollar under pressure, which should benefit the Euro. On the other hand, the Eurozone’s sluggish economy and the ECB’s looming rate cuts could limit the upside for EUR/USD.

Powell’s upcoming speech will be crucial for the markets, as investors seek clarity on whether the Fed will continue with its rate-cutting cycle or adopt a more cautious approach. Similarly, the ECB’s October meeting could offer further insight into how the central bank plans to navigate the Eurozone’s economic slowdown.

For now, the EUR/USD is navigating a delicate balance between a weakening USD and a fragile Eurozone economy. Traders should pay close attention to the 1.1125 support and the 1.1200 resistance levels for short-term direction, while keeping a longer-term eye on global central bank policies.

Conclusion: A Cautious but Bullish Outlook for EUR/USD

While the EUR/USD pair has shown impressive resilience in recent weeks, the path forward remains uncertain. The pair’s ability to break through the 1.1200 resistance will be a key indicator of further upside potential, with a retest of the 1.125-1.132 range possible if conditions remain favorable. However, traders should remain cautious, as the Eurozone’s economic weakness and the ECB’s dovish outlook could limit gains. For now, the outlook remains cautiously bullish, but key levels must be monitored closely for any signs of a reversal.