EUR/USD Price Forecast: 1.18 Range Trade Now, 1.10–1.20 Battle Next

The pair holds around 1.1767–1.1800 as investors weigh 2026 Fed cuts, a steady ECB, Trump tariff risk and DXY stuck near 98 to judge whether EUR/USD breaks 1.20 or slips back toward 1.13–1.10 | That's TradingNEWS

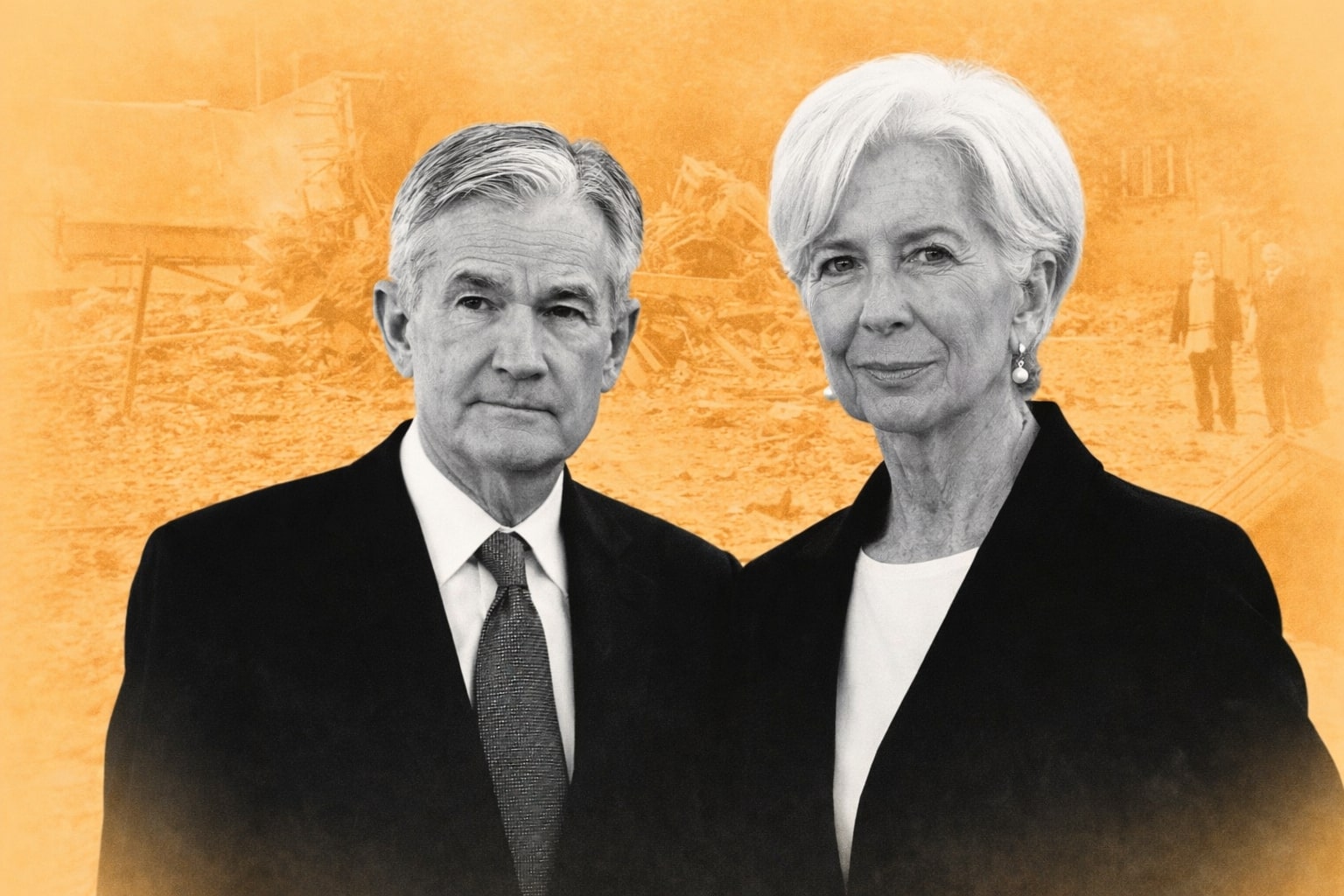

EUR/USD Price Outlook 2026 – Narrowing Fed–ECB Gap Turns the Tide for the Euro

EUR/USD Technical Positioning Around 1.18 and Key Ranges

EUR/USD trades around 1.176–1.179, sitting just under the 1.1800 cap after a persistent grind higher, while the DXY holds near 97.9–98.1 with upside blocked below roughly 98.70. The pair is riding a rising channel on the medium-term charts: the 50-EMA near 1.1745 acts as first dynamic support and the 100-EMA around 1.1705 is the deeper structural line. As long as 1.1740–1.1705 holds, the tape remains constructive, not exhausted. A clean daily close above 1.1850 flips the narrative and opens a run toward 1.1950–1.2000, while a break and close below 1.1705 unlocks a test of 1.1650–1.1600 and, on a macro shock, the 1.13 area that sits at the bottom of 2026 institutional scenarios.

Fed Easing Path 2025–2026: How the Dollar’s Yield Advantage Shrinks

The Fed has already crossed from peak-hawkish to an active easing cycle. Three cuts in 2025 took the federal funds target range down from 4.50% in March to 3.50–3.75% by December. Futures markets now price at least two additional cuts in 2026, pointing toward a 3.00–3.25% zone if incoming data cooperate. The Fed’s own projections still imply only one cut, but the market is trading realized inflation cooling, softer labor momentum, and a political backdrop openly pushing for looser policy once Powell’s term ends in May 2026. A new chair chosen in that environment is a structural headwind for the dollar: every 25-bp cut narrows the rate gap with the euro and erodes the premium that supported the greenback in 2022–2023.

ECB’s “Good Place” Stance: Why Policy Stasis Supports the Euro

On the euro side, the ECB is parked in deliberate stasis. Eurozone inflation printed 2.2% y/y in November, up from 2.1%, with services inflation at 3.5% and energy slightly negative. That mix keeps headline above the 2% target while the sticky services component limits the ECB’s room to ease. Policy rates are frozen: the deposit rate at 2.00%, main refi at 2.15%, and marginal lending at 2.40%. Updated projections show inflation drifting gradually toward target over three years, and the message from Frankfurt is simple: policy is in a “good place,” with no rush to cut and no strong need to hike. Street surveys echo that view, with most economists expecting unchanged ECB rates through 2026, and only a wide, low-conviction range for 2027. In rate-spread terms, that means the gap is being closed by the Fed moving down, not the ECB moving up, which systematically undermines the dollar’s carry advantage against EUR/USD.

Eurozone Growth: Slow but Resilient, Not a Collapse Story

Macro growth in the Eurozone is weak but not broken. The bloc expanded 0.2% q/q in Q3, with Spain at 0.6% and France at 0.5%, while Germany and Italy were flat. The European Commission projects 1.3% growth in 2025, 1.2% in 2026, and 1.4% in 2027. That profile is uninspiring but far from recessionary. The upward revision for 2025 and the mild trim for 2026 effectively admit a bumpier near-term trajectory, but they confirm there is enough baseline demand to prevent a systemic euro breakdown. This “muddle-through” path is exactly what stops EUR/USD from trading like a crisis currency even when headlines focus on manufacturing strain and energy uncertainty.

Trade Friction and Tariff Risk: The Bearish EUR/USD Scenario

The real macro threat for EUR/USD is not domestic demand but trade conflict. A 10–20% US tariff package on EU exports directly hits the euro area’s most exposed sectors: autos, chemicals, and parts of capital goods. Eurozone exports to the US are already flagged as falling roughly 3%, and a tariff escalation would likely push growth below the 1.3% baseline. In that world, the ECB’s “patient” stance becomes harder to maintain; a combination of weaker activity and political pressure for support would pull the Governing Council toward a more dovish bias. That is the path back toward 1.13, with a deeper risk tail into the 1.10 zone if tariffs are aggressive and long-lasting. That downside scenario exists, but it requires the trade shock plus a clear signal the ECB is abandoning its current “on hold” posture.

Dollar Index (DXY) Structure: Corrective, Not in a Fresh Uptrend

The DXY bounce from about 97.74 back toward 98.0–98.1 looks corrective, not impulsive. The index is capped by the 100-EMA near 98.70, and buying interest fades quickly around the 38.2% retracement cluster at 98.12–98.24. The latest upswing reclaimed the 23.6% Fib at 97.98, but momentum has already stalled. Unless the DXY can reclaim and hold above roughly 98.35–98.70, the base case remains sideways-to-lower, with risk of another push down to 97.74 and potentially 97.55 if sellers re-engage. For EUR/USD, that backdrop favours a grind higher rather than a fresh dollar bull leg; the pair is effectively trading an index that is struggling under its own moving-average ceiling.

Short-Term Tape: Holiday Liquidity Masks a Constructive Euro Bias

Current price action is distorted by thin year-end liquidity. The 1.1800 handle is acting as a clear near-term “headache level” where rallies keep stalling, but the more important signal is what is not happening: EUR/USD is not being aggressively sold back below the 50-EMA at 1.1745 or the 100-EMA at 1.1705. The pair is consolidating near the top of its recent range rather than bleeding back into the mid-1.16s. A daily close above 1.1850 would confirm a breakout from this holiday range and put 1.1950–1.2000 into focus. A daily close below 1.1705 would confirm that the Fed–ECB spread story is fully priced for now and that new macro or political drivers are taking control of the narrative.

Institutional Targets: 1.10 Versus 1.20 and Where Spot Sits Now

Street projections for EUR/USD into 2026 are split into two clean camps. One group expects renewed dollar strength and projects 1.10 on the assumption that US growth re-accelerates and the Fed ultimately cuts less than the market currently prices. The other group leans into the narrowing yield gap and sees 1.20 by mid-2026, assuming the ECB stays on hold while the Fed continues easing. Spot near 1.17–1.18 is the market’s live compromise between those two end-points. It prices some narrowing of the spread, some Eurozone resilience, and some tariff risk, but not the full upside of a smooth “Fed cuts + Europe muddles through” scenario.

Read More

-

SCHD ETF at $31.62: Dividend Rotation Turns a 2025 Laggard into a 2026 Leader

11.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR Lag Price While Fresh XRPZ Inflows and $152M Bank Bets Test the Dip

11.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Defend the $3.00 Floor After Collapse From Above $7.50

11.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Drops Below Key Averages as Yen Rally Targets 152–150 Zone

11.02.2026 · TradingNEWS ArchiveForex

Risk–Reward Assessment: Why EUR/USD Is a Buy on Dips, Not a Neutral Hold

At current levels, the risk–reward profile favours a bullish stance on EUR/USD. The pair is trading below the upper consensus band (1.20) and comfortably above the lower band (1.10–1.13), with the technical structure confirming that bias: higher lows building above 1.17, upward-sloping key moving averages, and a DXY capped by its own EMA resistance. The catalyst set for early 2026 is clear: confirmation of the next Fed chair, the first Fed meeting of the year, and the next Eurozone inflation and growth prints. Each of these events has more potential to reinforce the rate-gap compression theme than to reverse it, unless the data or appointments are dramatically hawkish for the dollar or brutally weak for Europe.

Final View: EUR/USD Rating, Targets, and Invalidation Levels

On a 6–12 month horizon, EUR/USD is a BUY with a bullish bias, not a neutral hold. The strategic map is straightforward: treat pullbacks into the 1.1740–1.1700 band as accumulation zones, tolerate noise down toward 1.1650 if tariffs or political headlines trigger temporary risk-off moves, and target a base-case zone around 1.19–1.21 in 2026 as Fed cuts continue and the ECB stays put. This thesis is invalidated only if Eurozone growth drops clearly below the 1.3% baseline and the ECB signals a genuine easing cycle, or if the US avoids further cuts and reasserts growth and rate leadership. Until that combination appears on the tape, the balance of hard data and rate mechanics supports being long EUR/USD on dips, not fading the euro at current levels.