Expedia NASDAQ:EXPE Capitalizing on the Global Travel Boom

From Strategic Expansions to Overcoming Market Challenges, Explore How Expedia Group, Inc. (NASDAQ:EXPE) is Shaping the Future of Travel | That's TradingNEWS

Exploring the Ascendant Trajectory of Expedia Group, Inc. (NASDAQ:EXPE)

The Resurgence of Travel: A Catalyst for Growth

In an era where the travel industry is witnessing unprecedented growth, Expedia Group, Inc. (NASDAQ:EXPE) emerges as a formidable player capitalizing on this upward trajectory. The easing of pandemic restrictions has sparked a resurgence in travel demand, with the International Air Transport Association (IATA) projecting a record-breaking 4.7 billion global travelers by 2024. This rejuvenation is further supported by the online travel market's expected expansion to $1.56 trillion by 2030, marking a compound annual growth rate (CAGR) of nearly 13%.

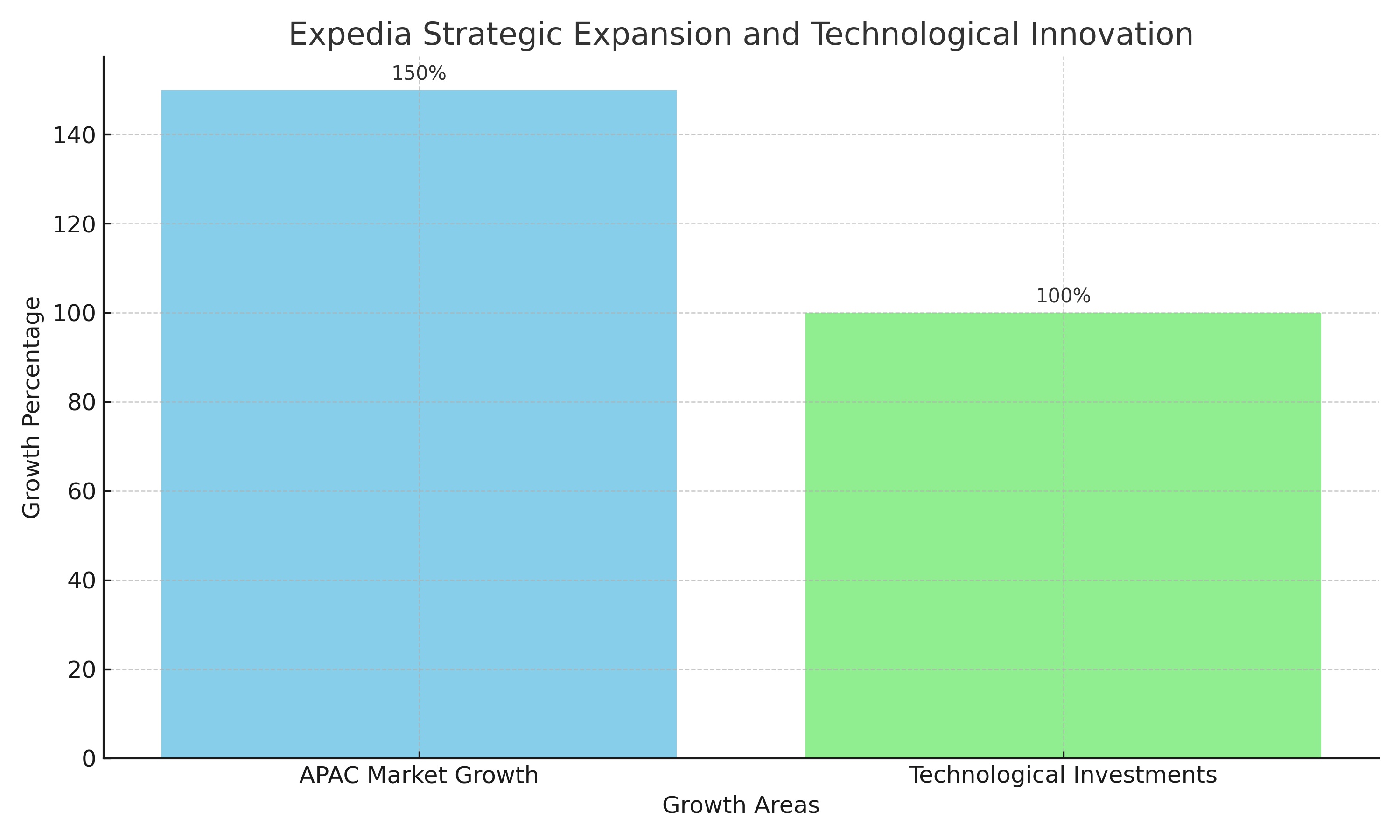

Strategic Expansion and Technological Innovation

Expedia's strategic forays into the Asia-Pacific market, particularly its B2B segment in China, which witnessed a staggering 150% year-over-year growth in Q3, underscore its commitment to global expansion. This growth is not just geographical; it's technological. The company's investment in unifying its core brand technologies—Expedia, Hotels.com, and VRBO—onto a single platform has streamlined operations and enhanced customer experiences, showcasing a forward-thinking approach to innovation.

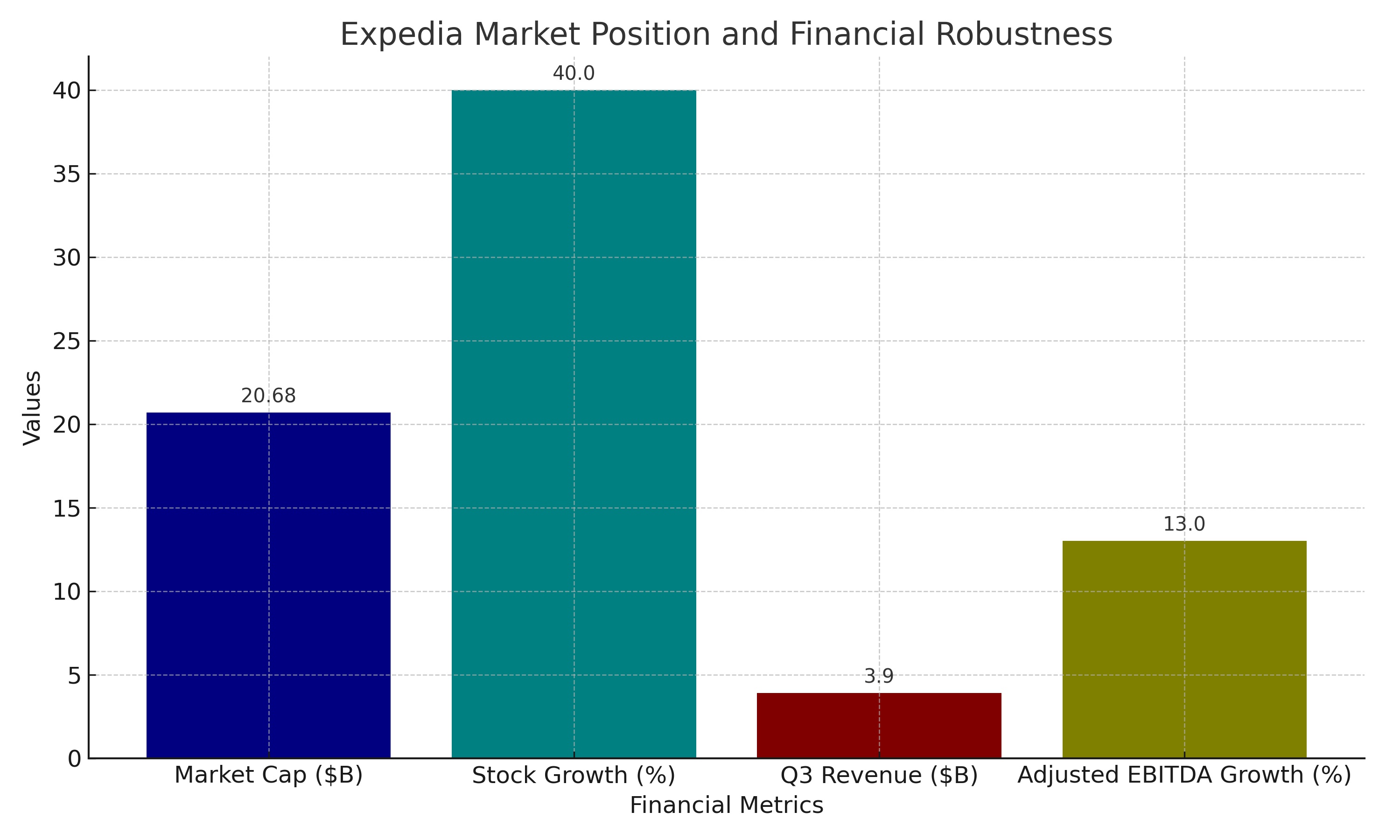

Market Position and Financial Robustness

With a market capitalization of $20.68 billion and a strong buy quant rating from Seeking Alpha, Expedia stands out in the Hotels, Resorts, and Cruise Lines industry. Its stock performance, outpacing the S&P 500 with over 40% growth despite occasional setbacks, reflects robust investor confidence. This confidence is buoyed by solid financial results, including a record-high Q3 revenue of $3.9 billion and an adjusted EBITDA growth of 13%.

Investment Viability: A Closer Look at Valuation Metrics

Diving deeper into Expedia Group, Inc.'s (NASDAQ:EXPE) financial health reveals an intriguing valuation narrative. The company's PEG Forward ratio, standing at a notable deviation of 60% below the sector's median, suggests a significant undervaluation, hinting at an overlooked investment opportunity. Moreover, the anticipated EPS growth trajectory of 60% through to 2025 accentuates Expedia's robust potential for profitability and market leadership.

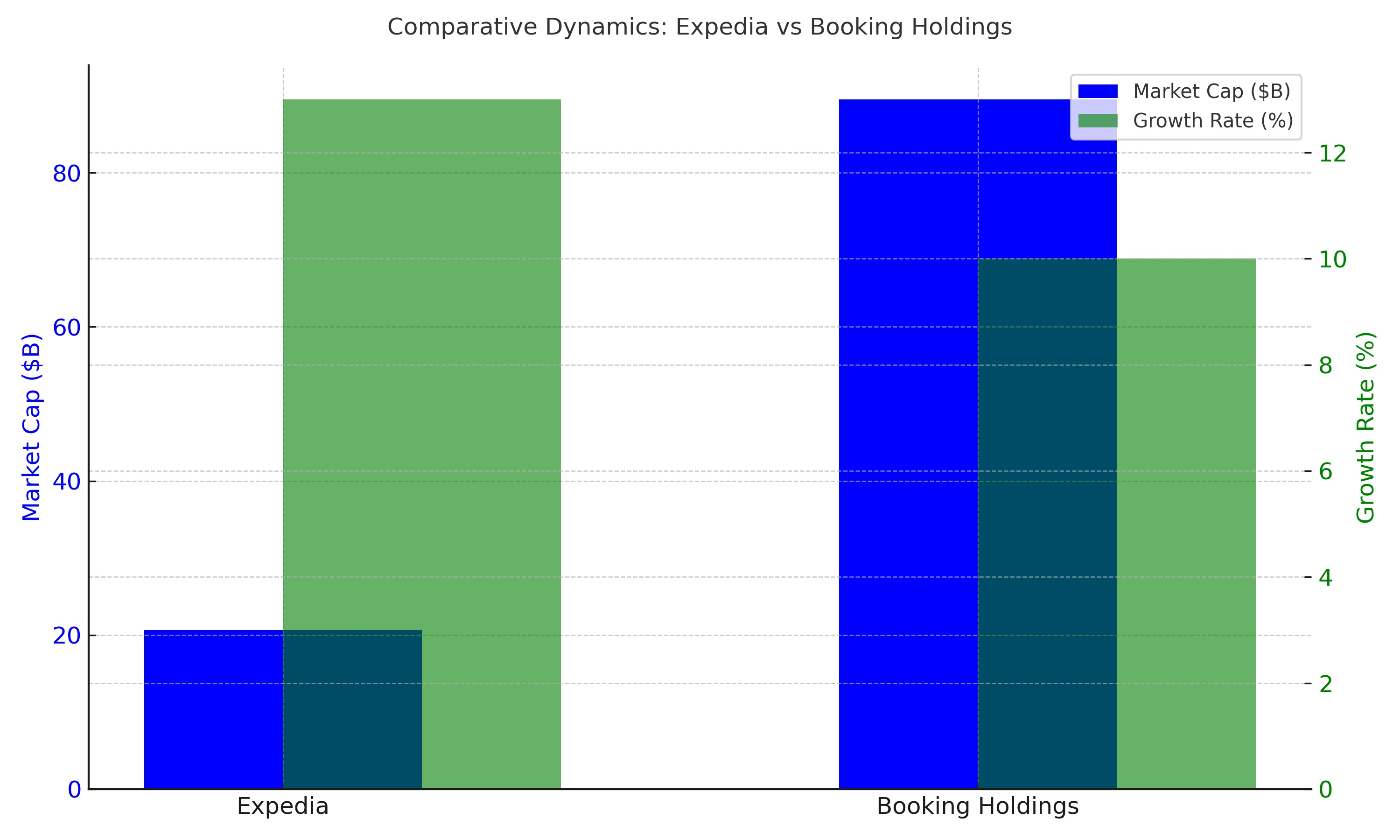

Comparative Dynamics: Expedia and Booking Holdings

Within the competitive orbit of online travel agencies, Expedia's strategic maneuvers vis-à-vis Booking Holdings showcase a fierce rivalry. Despite Booking's expansive global footprint, Expedia's concentrated efforts in B2B engagement and technological enhancements delineate a path of aggressive growth. This strategic differentiation is crucial in understanding Expedia's positioning and potential for market capture in the online travel domain.

Strategic Resilience Amidst Market Volatility

The journey of Expedia through the tumultuous waters of the online travel industry is a testament to its resilience. Faced with challenges ranging from cutthroat competition to the uncertainties of global crises and cybersecurity threats, Expedia's strategic foresight and technological adaptability have fortified its market stance. This resilience is a critical component of Expedia's ability to sustain growth and navigate future market disruptions.

Insider and Institutional Engagement: A Financial Perspective

The financial landscape of Expedia is further illuminated by recent insider transactions and institutional investments. Significant stock sales by insiders, coupled with robust institutional holdings, reflect a vibrant financial ecosystem surrounding Expedia. These transactions, as chronicled on platforms like Tradingnews.com, offer a granular view of the company's financial dynamics and investor sentiment.

Prospective Outlook: Navigating Future Pathways

Expedia's trajectory in the global travel industry is marked by a relentless pursuit of growth, innovation, and financial solidity. Positioned at the cusp of an industry revival, Expedia's strategic expansions and technological advancements herald a new era of opportunities. This forward-looking perspective underscores Expedia's readiness to leverage the anticipated upswing in travel dynamics, cementing its role as a leading entity in the online travel market.

Conclusion: Expedia's Strategic Imperative for Growth

In summary, Expedia Group, Inc. (NASDAQ:EXPE) embodies a strategic confluence of innovation, market acumen, and financial rigor. As the travel industry embarks on a trajectory of resurgence, Expedia's comprehensive growth strategies and operational efficiencies prime it for a leading role in the evolving market landscape. With a keen focus on technological integration and market expansion, Expedia is poised to navigate the complexities of the global travel industry, presenting a compelling investment proposition for those looking to capitalize on the sector's growth dynamics. This strategic orientation, underscored by Expedia's financial and operational metrics, renders it a pivotal player in the travel industry's future narrative.

Echoing the insights of TradingNEWS, Expedia's journey ahead is illuminated by its adaptive strategies, market foresight, and unwavering commitment to innovation, setting the stage for sustained growth and market leadership in the dynamic realm of online travel.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex