Exxon Mobil (NYSE:XOM): Navigating Growth Opportunities Amid Challenges

Expanding Influence in the Permian Basin Through Strategic Acquisitions

Exxon Mobil's acquisition of Pioneer Resources significantly enhances its position in the Permian Basin, doubling its acreage and cementing its role as a dominant player in one of the most productive oil regions in the world. This acquisition increases Exxon Mobil's output to 1.3 million barrels of oil equivalent per day in the Permian, providing a robust foundation for long-term growth. By leveraging Pioneer's expertise and integrating it with Exxon Mobil's operational efficiency, the company aims to boost production while maintaining cost discipline. The integration of this acquisition highlights Exxon Mobil's strategy of expanding upstream capabilities to support sustainable growth.

Recent Stock Price Weakness Creates a Long-Term Opportunity

Shares of Exxon Mobil (NYSE:XOM) have experienced a recent decline, largely driven by the Federal Reserve's slower pace of interest rate cuts projected for 2025. Despite this short-term volatility, the fundamentals of Exxon Mobil remain intact, offering investors a compelling buying opportunity. Trading at approximately $105 per share, the stock provides an attractive entry point with a forward P/E ratio of 13.3x, slightly above its three-year average of 12.3x. This valuation, combined with the company's robust dividend yield of 4%, makes Exxon Mobil an appealing option for long-term dividend-focused investors.

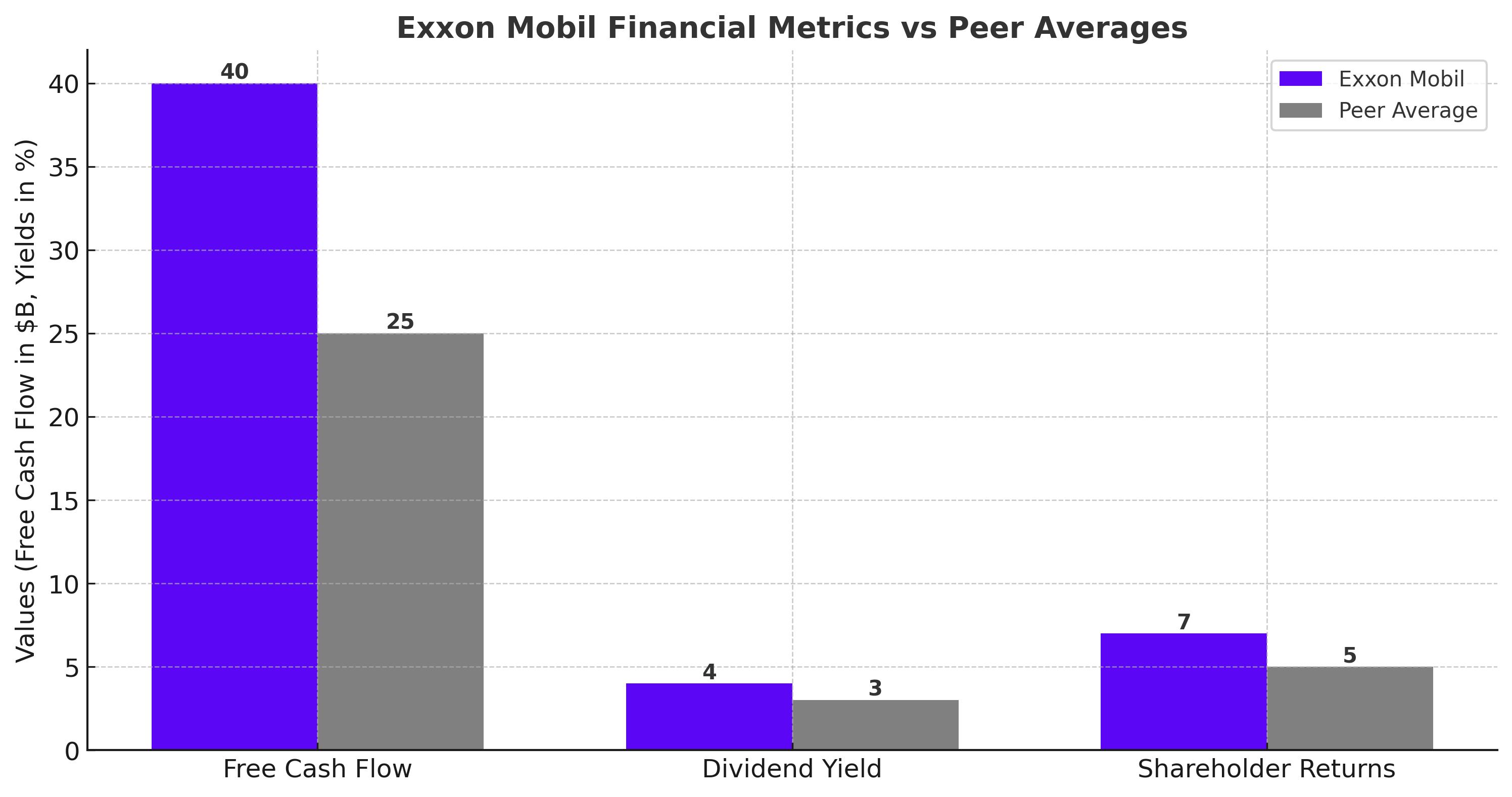

Unparalleled Free Cash Flow Among Energy Giants

Exxon Mobil continues to stand out in the energy sector with its unparalleled free cash flow generation. In Q3 2024 alone, the company reported $11.4 billion in free cash flow, significantly surpassing Chevron ($7.8 billion) and ConocoPhillips ($5.5 billion) during the same period. Over the trailing twelve months, Exxon Mobil's free cash flow of $40 billion reflects its strong operational efficiency and cost management. This financial strength underpins the company's ability to return substantial value to shareholders through dividends and stock buybacks.

Strategic Focus on Cost Efficiency and Revenue Growth

Exxon Mobil's multi-year restructuring efforts have delivered substantial results, including a reduction of structural costs by over $6 billion. These efforts have improved the company’s earnings profile and positioned it to achieve a 50% increase in total earnings by 2030. This translates into an annual growth rate of approximately 7%, a target supported by its diversified portfolio and strategic investments in high-growth areas.

Diversification Beyond Traditional Oil and Gas

Exxon Mobil is making strides to diversify its revenue streams. The company's $400 billion market opportunity in low-carbon solutions, biofuels, and lithium production reflects its commitment to future-proofing its business. By 2030, Exxon Mobil aims to generate $2 billion annually from low-carbon solutions and $6 billion from innovative products like Proxxima. These initiatives position Exxon Mobil as a leader in both traditional and alternative energy sectors, aligning with global energy transition trends.

Challenges in the Current Energy Landscape

Despite its strong financial position, Exxon Mobil faces challenges, including declining petroleum prices, which recently fell to $70 per barrel. Additionally, the company’s reliance on production efficiency in the Permian Basin introduces risks. Any disruptions in this core growth area could impact earnings and slow the company's progress toward its ambitious targets. Moreover, geopolitical factors and fluctuating demand for traditional energy products remain persistent headwinds for the sector.

Valuation Reflects Optimism and Growth Potential

Exxon Mobil's forward P/E ratio of 13.3x is higher than ConocoPhillips (11.6x) but remains competitive within the sector. This valuation is supported by strong cash flow generation and a capital return strategy that includes significant dividends and stock repurchases. The stock's fair value, based on a projected earnings growth rate of 7% and a target P/E of 14-15x, ranges from $112 to $120 per share. This upside potential further underscores the attractiveness of Exxon Mobil as a long-term investment.

Dividend Growth and Shareholder Returns

Exxon Mobil's dividend yield of 4%, combined with its extensive buyback program, provides a total shareholder yield exceeding 7%. The company has demonstrated its commitment to rewarding shareholders, with $12.3 billion paid in dividends and $14 billion in stock repurchases year-to-date. These metrics highlight Exxon Mobil’s ability to deliver consistent returns, even in a challenging macroeconomic environment.

Conclusion: Is Exxon Mobil a Buy?

Exxon Mobil (NYSE:XOM) presents a compelling case for investors seeking a combination of stability, growth, and income. Its dominant position in the Permian Basin, strong cash flow generation, and strategic diversification efforts position it for sustained success. While risks related to petroleum pricing and geopolitical factors persist, the stock's current valuation and dividend yield provide a favorable risk-reward profile. Trading at $105 per share, Exxon Mobil offers a unique opportunity for long-term investors to capitalize on its robust fundamentals and growth prospects. For real-time updates on Exxon Mobil’s stock performance, visit NYSE:XOM Real-Time Chart.