Financial Insights and Strategic Analysis of monday.com NASDAQ:MNDY

Unveiling the Financial Strength, Revenue Growth, and AI-Driven Innovations Driving monday.com’s Market Leadership | That's TradingNEWS

Strong Financial Position

One of the notable strengths of monday.com is its robust financial health. The company boasts over $1.2 billion in cash and cash equivalents with zero debt, positioning it well to leverage growth opportunities without financial strain. As of June 26, 2024, the stock closed at $229.52 per share, with a market capitalization of $11.425 billion, indicating strong market confidence.

Revenue Growth and Profitability

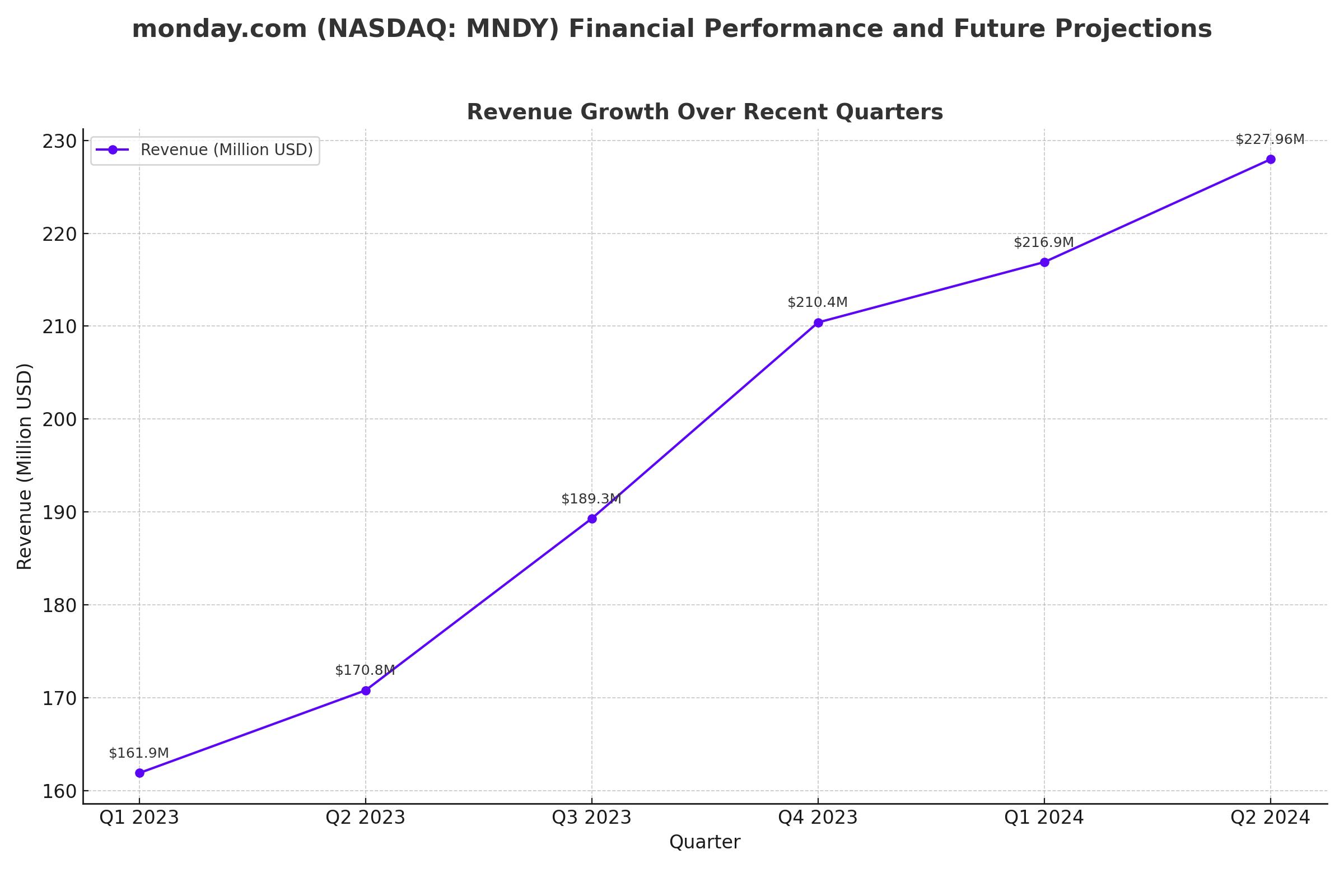

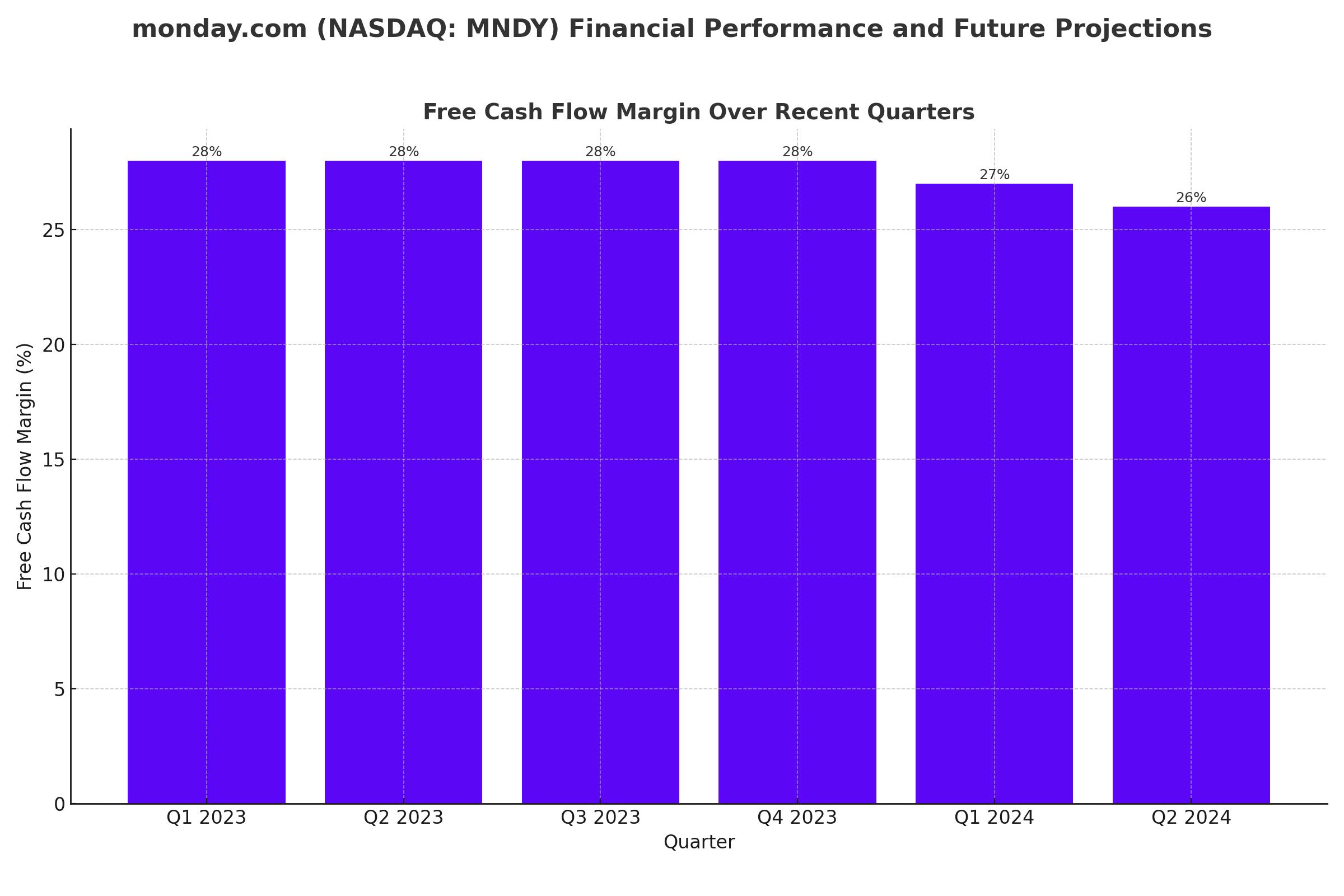

monday.com has demonstrated impressive revenue growth, with first-quarter 2024 revenues increasing by 34% to $216.9 million. This growth trajectory is expected to continue, with projected revenues of $227.96 million for the upcoming quarter, reflecting a 29.76% year-over-year increase. For the entire fiscal year, the company is forecasted to achieve $944.84 million in revenue, marking a 29.48% increase from the previous year. This robust growth is further supported by the company’s ability to maintain a high free cash flow margin, expected to compress slightly from 28% in 2023 to around 26-27% in 2024.

Valuation Metrics

Despite the premium valuation, monday.com remains an attractive investment. The stock is priced at approximately 37x forward free cash flow, which, considering its debt-free status and substantial cash reserves, presents a fair valuation. The company is on track to achieve around $250 million in free cash flow in 2024, with the potential to reach $300 million in the near future. This valuation reflects the market’s confidence in monday.com’s ability to sustain a 30% CAGR through 2025.

Product Innovation and Market Expansion

monday.com continues to innovate and expand its product offerings. The introduction of products like monday Sales CRM and monday Dev has been well-received, contributing to account growth and customer base expansion. Furthermore, the company is set to integrate advanced AI features such as AI Automations, Smart Columns, and AI-Powered Templates into its workflow solutions later in 2024. These innovations are expected to enhance user efficiency and solidify monday.com’s position in the market.

Pricing Strategy and Customer Retention

The company’s recent adjustments to its pricing model have yielded positive results, improving customer retention and reducing churn rates. This indicates a strong value proposition and customer satisfaction. However, it's important to note the declining net dollar retention rates since 2022. While this might concern some investors, it suggests a shift away from reliance on consumption-based revenue models, which can be unstable. Instead, monday.com’s strategy focuses on sustainable growth through expanding its customer base and increasing product adoption.

Market Performance and Future Projections

monday.com’s stock performance has been impressive, with a 35.72% gain over the past 52 weeks. The stock has recently reached $240.76, reflecting a +1.9% movement compared to the previous day, outpacing the S&P 500. The company’s next earnings release is highly anticipated, with an expected EPS of $0.54, a significant 31.71% increase from the previous year. For the fiscal year, the projected EPS is $2.29, a 23.78% increase from the prior year.

Analyst Sentiment and Insider Transactions

Analyst revisions and insider transactions provide additional insights into the company’s outlook. Positive estimate revisions often indicate optimism about the company’s future performance. Recent data from various analysts suggest a bullish outlook, with monday.com maintaining a Strong Buy consensus rating. For detailed insider transactions, refer to the monday.com stock profile.

Strategic Focus on AI Integration

monday.com is making a pivotal move by integrating generative AI into its platform, a step poised to drive substantial growth. This advanced technology will enable the company to create new content and streamline workflows, providing customers with sophisticated tools tailored to their evolving needs. Specifically, the introduction of AI Automations, Smart Columns, and AI-Powered Templates later in 2024 will enhance efficiency and productivity for users. This strategic focus not only aligns with current market trends but also strengthens monday.com's competitive edge in the rapidly evolving AI-driven software development landscape.

Conclusion: Investment Decision

Considering monday.com’s strong financial health, impressive growth rates, innovative product offerings, and strategic positioning, the stock presents a compelling investment opportunity. The company’s robust balance sheet, coupled with its ability to sustain high revenue growth and profitability, supports a bullish outlook. Despite the premium valuation, monday.com’s potential to deliver substantial free cash flow and maintain a 30% CAGR makes it a valuable addition to any growth-oriented portfolio.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex