Ford Motor NASDAQ:F Future of Automotive Innovation

Operational Resilience and Strategic Initiatives: A Detailed Look into Ford's Performance and Prospects in the Competitive Automotive Landscape | That's TradingNEWS

Analyzing Ford Motor Company (NASDAQ:F): A Comprehensive Review

1. Operational Highlights and Financial Performance

NASDAQ:F has demonstrated notable operational resilience, particularly in its diversified segments: Ford Blue, Ford Model e, and Ford Pro. The company's strategic focus on these areas, especially in the context of their electric vehicle (EV) initiatives under Ford Model e, reflects an adaptive approach to the dynamic automotive market.

-

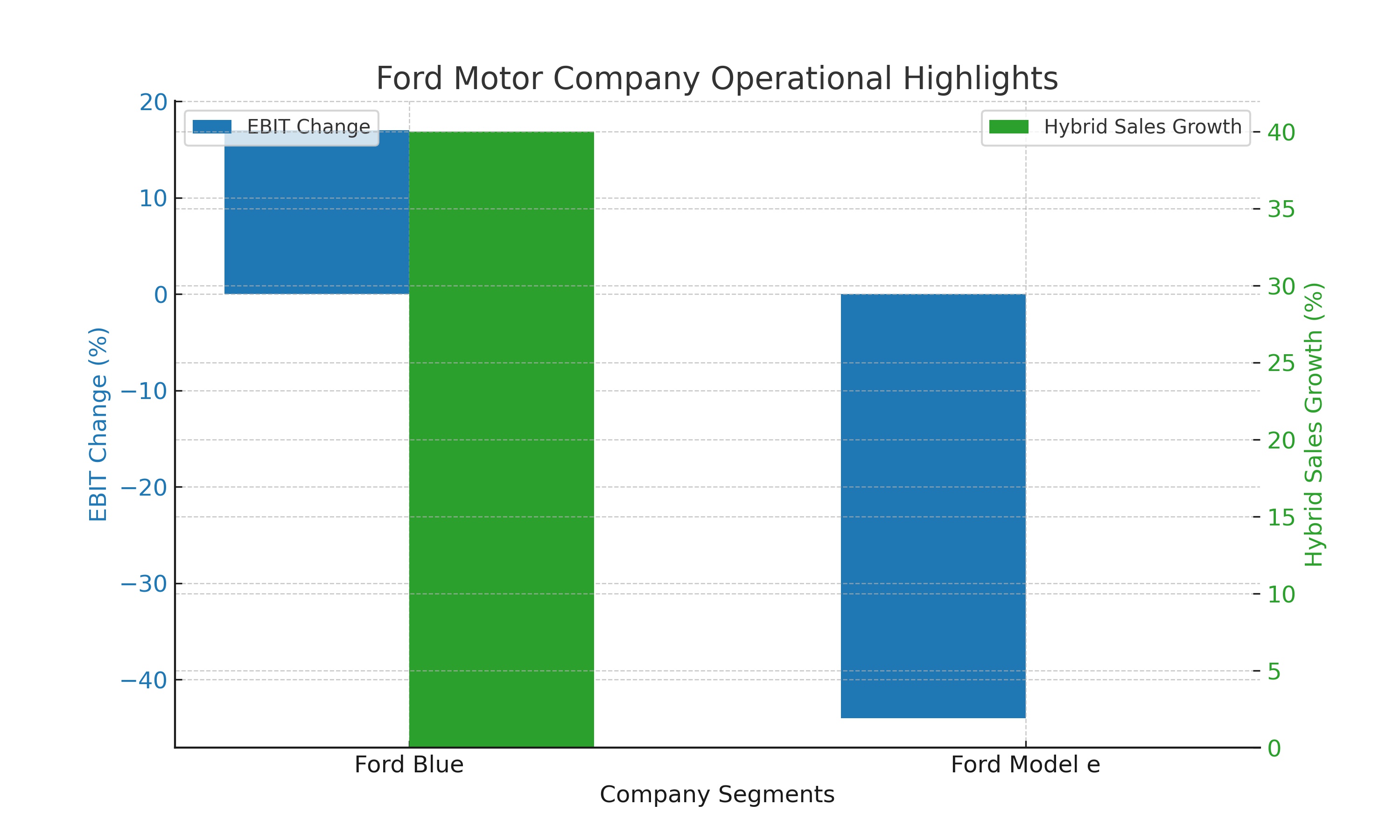

Ford Blue's Performance: Reporting a 17% year-over-year increase in Q3 EBIT, Ford Blue's introduction of gas and hybrid versions of the 2024 F-150 pickup marks a significant stride. The segment's 40% jump in hybrid sales, driven by the F-150 and Maverick trucks, underscores a strong market response.

-

Challenges in Ford Model e: Despite a 44% increase in Q3 wholesales and a 26% rise in revenue for Ford Model e's first-generation electric cars, the segment incurred a loss of $1.3 billion. This loss, attributable to significant investments in new technology, highlights the cost-intensive nature of competing in the EV space.

-

Ford Pro's Commercial Edge: The commercial arm, Ford Pro, continues to show promise, offering diversified revenue streams beyond consumer vehicles.

-

Software-Enabled Services Growth: The 50% year-over-year increase in software-enabled services, approaching 600,000 subscribers, indicates Ford's successful foray into digital and connected services.

2. Market Valuation and Stock Performance

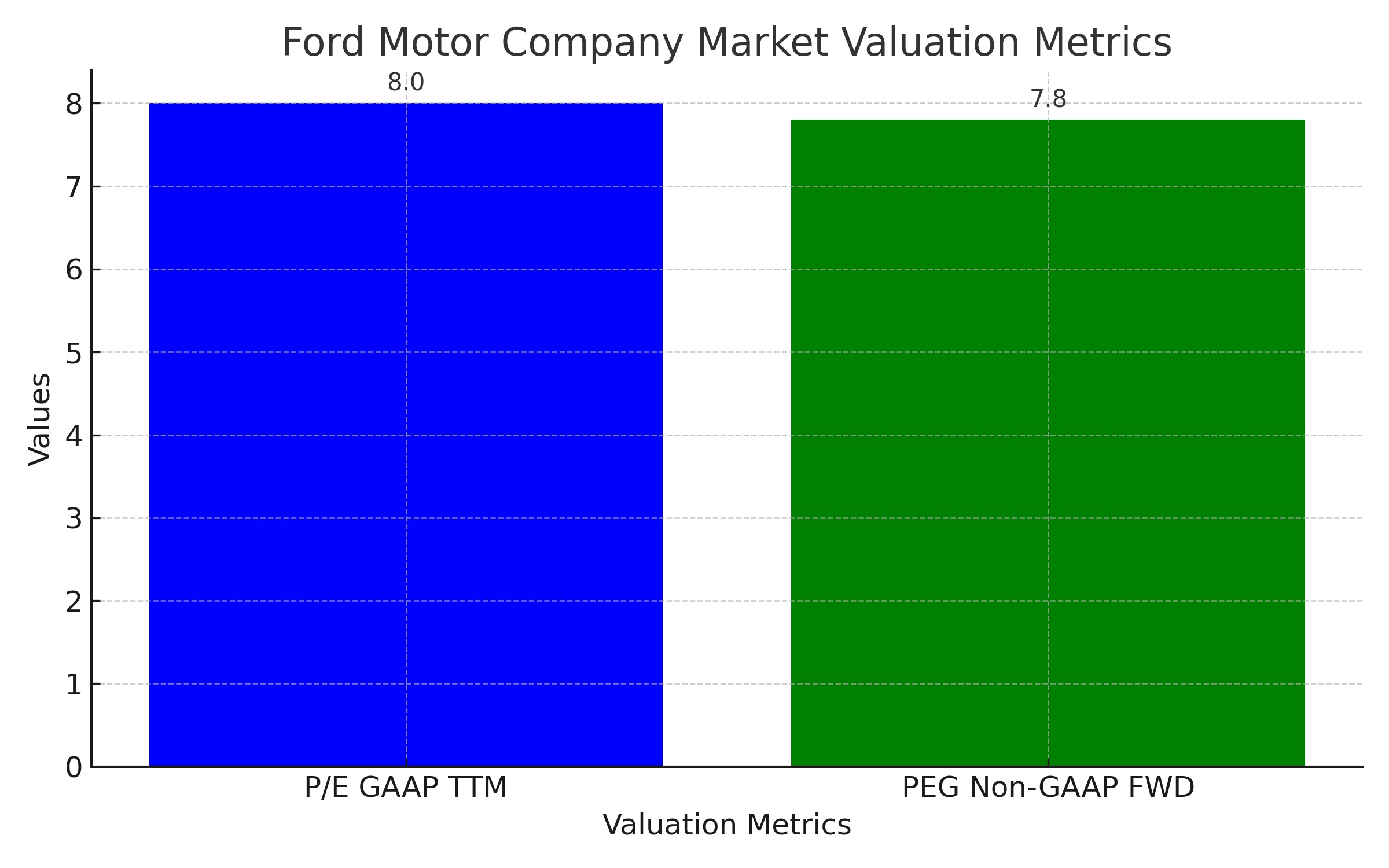

NASDAQ:F's stock valuation presents a dichotomy. While the company's P/E GAAP TTM ratio suggests an undervalued stock, the PEG Non-GAAP FWD ratio of 7.8 raises concerns about long-term earnings growth.

-

Competitive Valuation: Compared to peers, Ford's P/E GAAP TTM ratio positions it averagely, neither significantly overvalued nor undervalued.

-

Profitability Concerns: Ford's net margin comparison with peers reveals a struggle in profitability growth, which is a common trend in the industry.

-

DCF Analysis: Discounted Cash Flow (DCF) calculations suggest a potential undervaluation of around 50%. However, considering historical trends, a more realistic EPS growth rate might position the fair value around $19, indicating a 40% margin of safety.

3. Financial Health and Balance Sheet Analysis

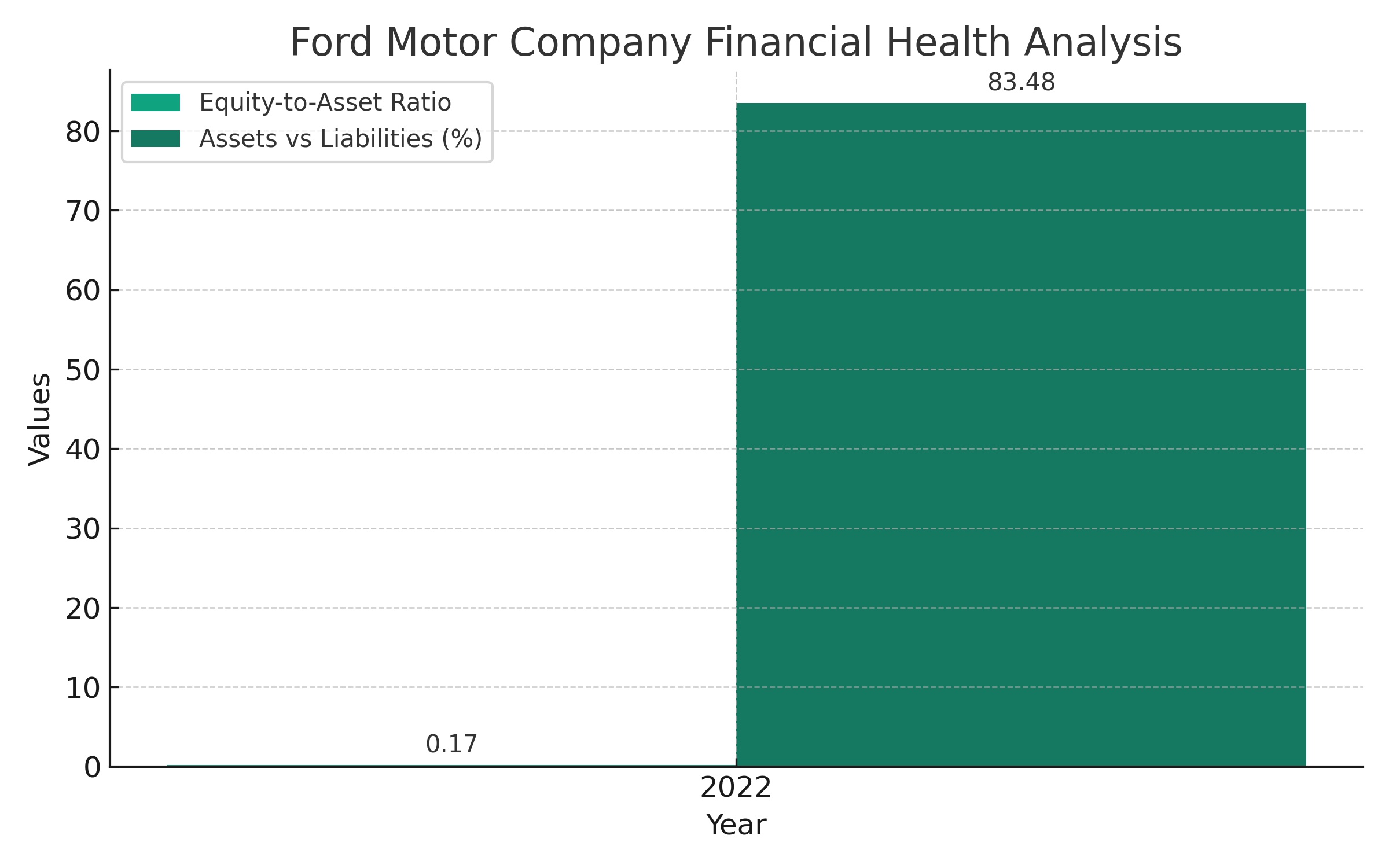

Ford's balance sheet stability is a mixed bag. An equity-to-asset ratio of 0.17, coupled with 83.48% of assets balanced by liabilities, signals financial leverage that could be both a strength in terms of investment capacity and a risk factor.

-

Asset Growth vs. Liabilities: The company's recent trend of increasing assets faster than liabilities is a positive indicator for financial readiness in competitive markets.

-

Debt Concerns: The substantial debt level, while common in capital-intensive industries, warrants caution for long-term investors.

4. Company Positives and Strategic Initiatives

Ford's collaboration with Tesla (TSLA) for EV charging and its $9.2 billion loan for battery plant investments reflect proactive steps in aligning with the EV revolution.

-

EV Market Positioning: Ford's goal of producing 2 million EVs annually by 2026, along with its early launch of the all-electric F-150 Lightning, positions it favorably in the EV transition.

-

Hybrid Market Potential: The success in the hybrid vehicle market, especially with the F-150, could be a significant revenue driver.

5. Industry Challenges and Competitive Landscape

The automotive industry's shift to electric vehicles presents both opportunities and challenges for Ford. The competition in the EV space, especially with innovative players like Tesla, places pressure on Ford to not only keep up but also differentiate itself.

-

EV Market Risks: Ford's EV segment, despite its growth, faces profitability challenges, with the Model E segment reporting significant operational losses.

-

Market Saturation Concerns: The increasing number of players in the EV market could lead to heightened competition and pressure on margins.

6. Investment Perspective and Analyst Viewpoint: A Numerical Analysis

In assessing Ford's (NASDAQ:F) investment potential, a detailed look at the numbers is crucial to understand both the short-term opportunities and the long-term challenges the company faces.

Short-term Upside

-

Valuation Metrics: Ford's P/E GAAP TTM (trailing twelve months) ratio stands at approximately 8, suggesting a lower valuation compared to the industry average. This could indicate a potential undervaluation in the market. Additionally, a forward P/E ratio of around 9 reinforces this potential undervaluation.

-

DCF Analysis: Utilizing a Discounted Cash Flow (DCF) model, with an optimistic assumption of a 4% 10-year growth stage and a 2% 10-year terminal stage, suggests Ford might be undervalued by as much as 50%. However, a more conservative DCF model, factoring in a 1% EPS growth rate aligned with historical trends, places Ford's fair value closer to $19. This implies a possible 40% upside from current levels, making it an attractive short-term investment.

Long-term Outlook

-

Revenue Growth Concerns: Ford's long-term revenue growth has been relatively slow. For example, the compound annual growth rate (CAGR) of revenues has not kept pace with the industry's more dynamic players. This slow growth trajectory could impact long-term investment viability.

-

Profitability Metrics: Ford's net margin comparison with peers indicates a struggle in maintaining high profitability levels. The company's net margins are lower than some of its key competitors, which could be a potential red flag for long-term investors seeking sustained profit growth.

-

Competitive Challenges in EV Market: The EV segment, while growing, has shown substantial operational losses (e.g., a $1.3 billion loss in the Model E segment in a recent quarter). With the intensifying competition in the EV market, these profitability challenges could be exacerbated in the long term.

Analyst Ratings and Market Consensus

-

Hold Rating: The prevailing analyst consensus on Ford leans towards a 'Hold' rating. This reflects a cautious optimism about the company's short-term prospects, tempered by uncertainties about its long-term growth trajectory in a rapidly evolving automotive industry.

-

Average Target Price: The average analyst target price for Ford's stock hovers around $12.64, which, compared to its current price, suggests a moderate upside potential. This target price reflects both the opportunities and risks inherent in Ford's current market position.

7. Linking to Stock and Insider Transactions Information

For real-time stock performance and detailed insights into insider transactions, interested readers can refer to the following links:

Conclusion

While Ford (NASDAQ:F) shows potential for short-to-medium-term gains based on current undervaluation and operational strengths, its long-term outlook is clouded by challenges in revenue growth, margin pressures, and intense competition in the evolving EV market. The stock might not be the strongest contender for a long-term focused portfolio, but it presents a moderate investment opportunity with a cautious approach.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex