Forecasting Brent Oil Prices: A Deep Dive into 2024 and Beyond

Unpacking the latest BMI and Fitch Solutions forecasts alongside economic indicators and market strategies influencing the global oil prices | That's TradingNEWS

Global Oil Market Outlook

Current Price Trends and Predictions

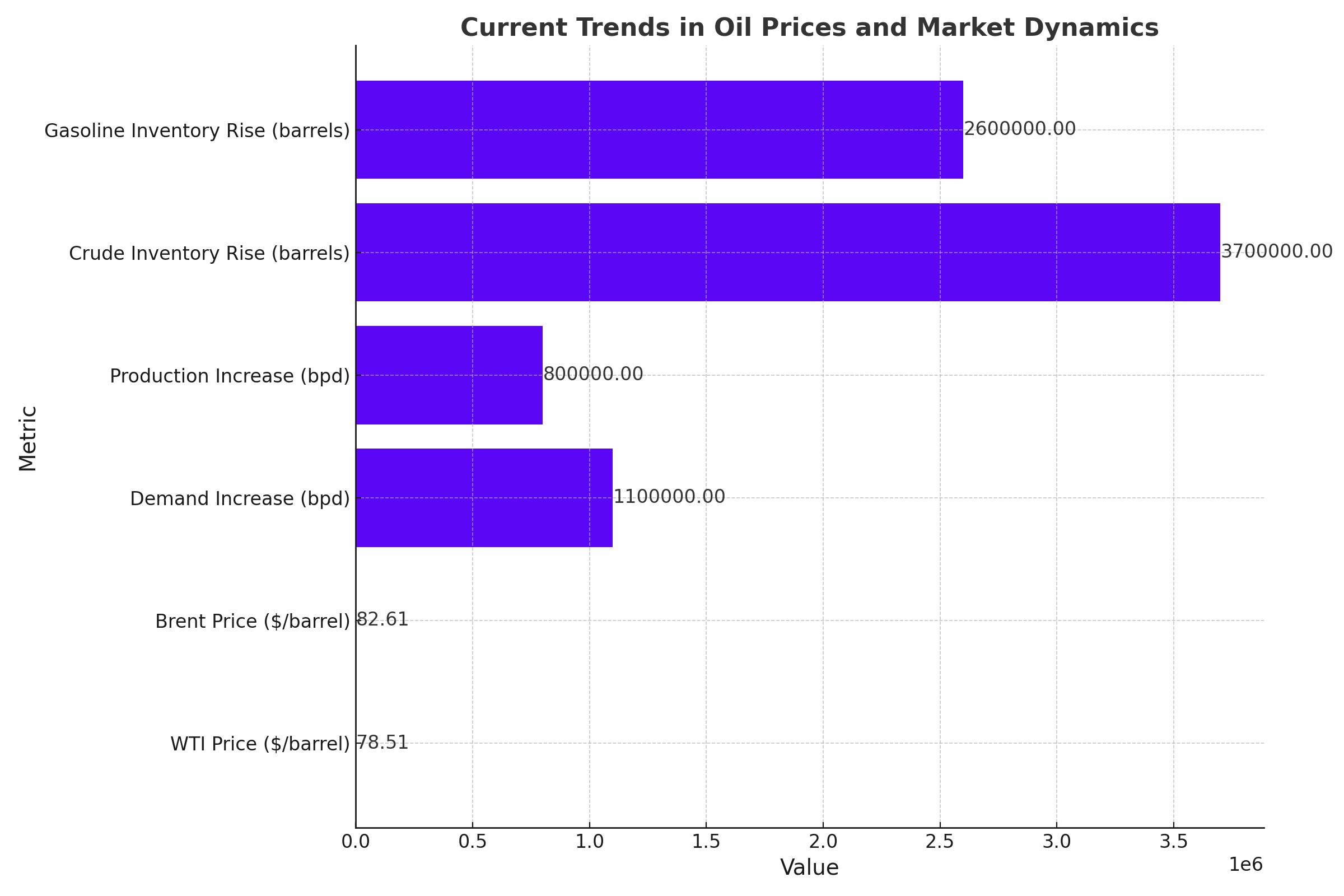

Recent reports from BMI and Fitch Solutions indicate a nuanced outlook for Brent oil prices. Analysts predict Brent crude to average around $85 per barrel in 2024, with a slight decrease to $82 per barrel in 2025, and stabilizing at $81 per barrel from 2026 to 2028. These forecasts are slightly more optimistic compared to the Bloomberg Consensus, which projects a gradual decline from $84 per barrel in 2024 to $72 by 2028.

Analytical Perspectives

BMI analysts maintain their projection for 2024 at $85 per barrel, needing an average price of $86 for the remainder of the year to meet this forecast—a slight increase from the current year-to-date average of $83.5. They have chosen to hold their forecast steady, opting to observe how market conditions develop during the peak demand season in the northern hemisphere.

Macroeconomic Factors Influencing Oil Prices

Economic Resilience and Challenges

The first half of 2024 has shown unexpected economic resilience, yet challenges such as persistent inflation, delayed interest rate cuts, and geopolitical tensions cloud the forecast for the latter half. These factors introduce significant uncertainty into the oil market, potentially impacting future price movements.

Interest Rates and Economic Growth

The anticipation around the U.S. Federal Reserve's monetary policy remains a crucial factor. BMI’s economists expect a rate cut from the current 5.50% to 4.75% by the end of the year, potentially softening the dollar and supporting oil prices. Additionally, despite various global risks, economic growth is expected to remain robust, which could sustain demand for oil.

Geopolitical Risks and Market Reactions

Elevated geopolitical risks and the questionable level of risk premia currently priced into Brent suggest potential volatility. The U.S. dollar’s performance could also influence oil prices, though this is considered the least certain of the bullish arguments presented by BMI.

Demand Dynamics and Market Supply

Demand Forecasts

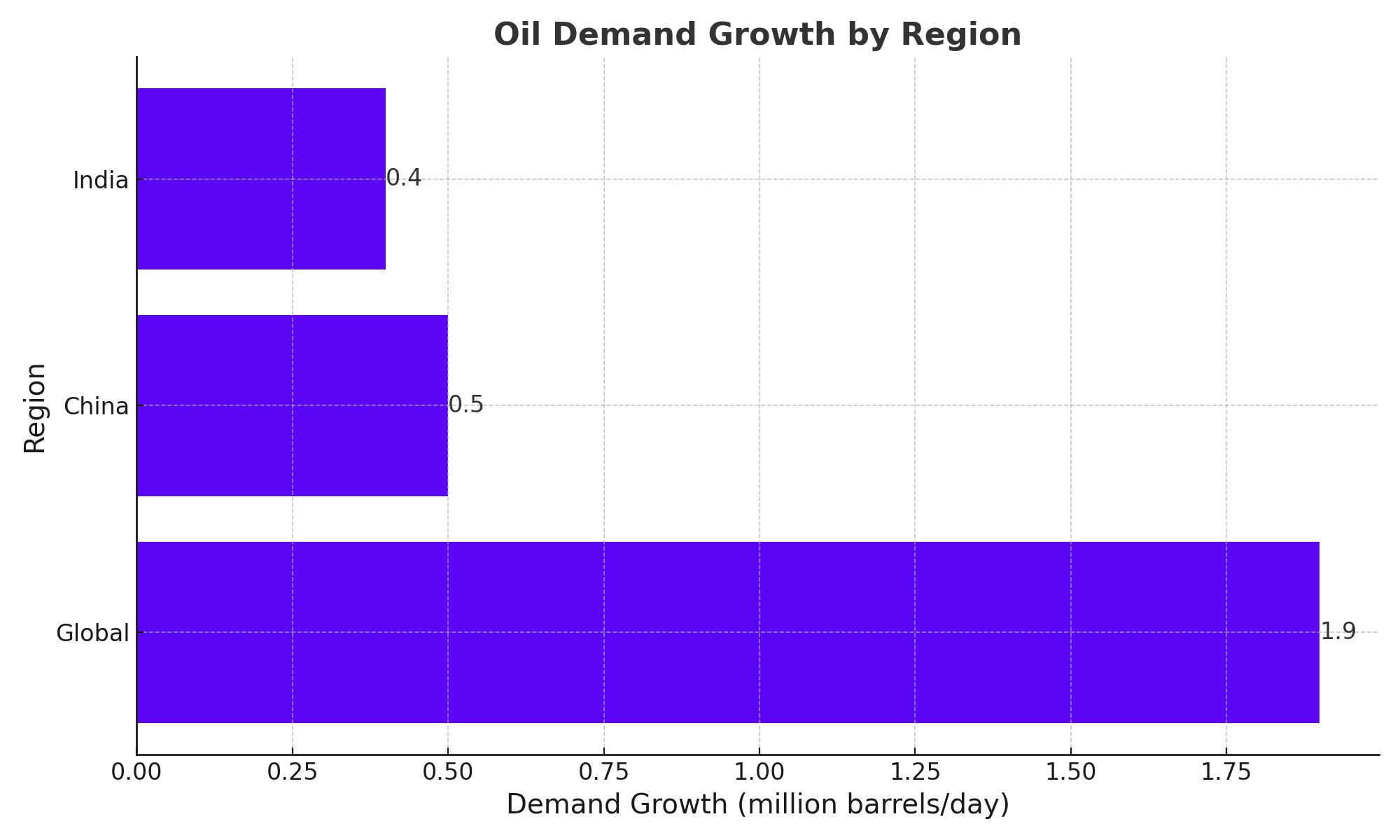

BMI forecasts a demand growth of 1.9 million barrels per day for 2024, significantly above consensus estimates, with major contributions from China and India. This robust demand, particularly in the transport and petrochemical sectors, supports a stronger price outlook.

OPEC+ Strategy

On the supply side, OPEC+ has extended its production cuts until the end of 2025, aiming to gradually reintroduce cut barrels depending on market supportiveness. This strategy should tighten the market as Middle Eastern demand surges, potentially elevating prices if effectively managed.

Other Institutional Forecasts

Contrasting views from J.P. Morgan and Standard Chartered suggest variability in market expectations. J.P. Morgan anticipates Brent could reach the high $80s-$90 range by September 2024, while Standard Chartered projects a significant increase, forecasting an average of $98 per barrel in Q3 2024 and rising to $106 by the fourth quarter.

Conclusion

The detailed data and varied forecasts highlight the complexities of predicting oil prices amid fluctuating economic conditions and market dynamics. While BMI maintains a cautiously optimistic outlook for Brent oil, the array of institutional forecasts indicates that market sentiment can vary greatly based on unfolding economic and geopolitical developments. Investors and market watchers should stay attuned to global economic indicators, central bank policies, and geopolitical events that significantly influence oil market trends.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex