Forex Market: A Comprehensive Guide to Upcoming Economic Indicators

Decoding the Impact of Core PCE Data on Investment Strategies Amidst Economic Fluctuations | That's TradingNEWS

Navigating Market Volatility: A Deep Dive into Upcoming Economic Indicators

As we edge closer to a pivotal moment on the U.S. economic calendar, the release of the core Personal Consumption Expenditures (PCE) Price Index data this Friday takes center stage, poised to stir the financial markets and potentially reshape investor sentiment. This key inflation indicator, favored by the Federal Reserve, suggests a landscape rife with anticipation and the need for strategic agility among traders.

Core PCE Data: A Critical Market Catalyst

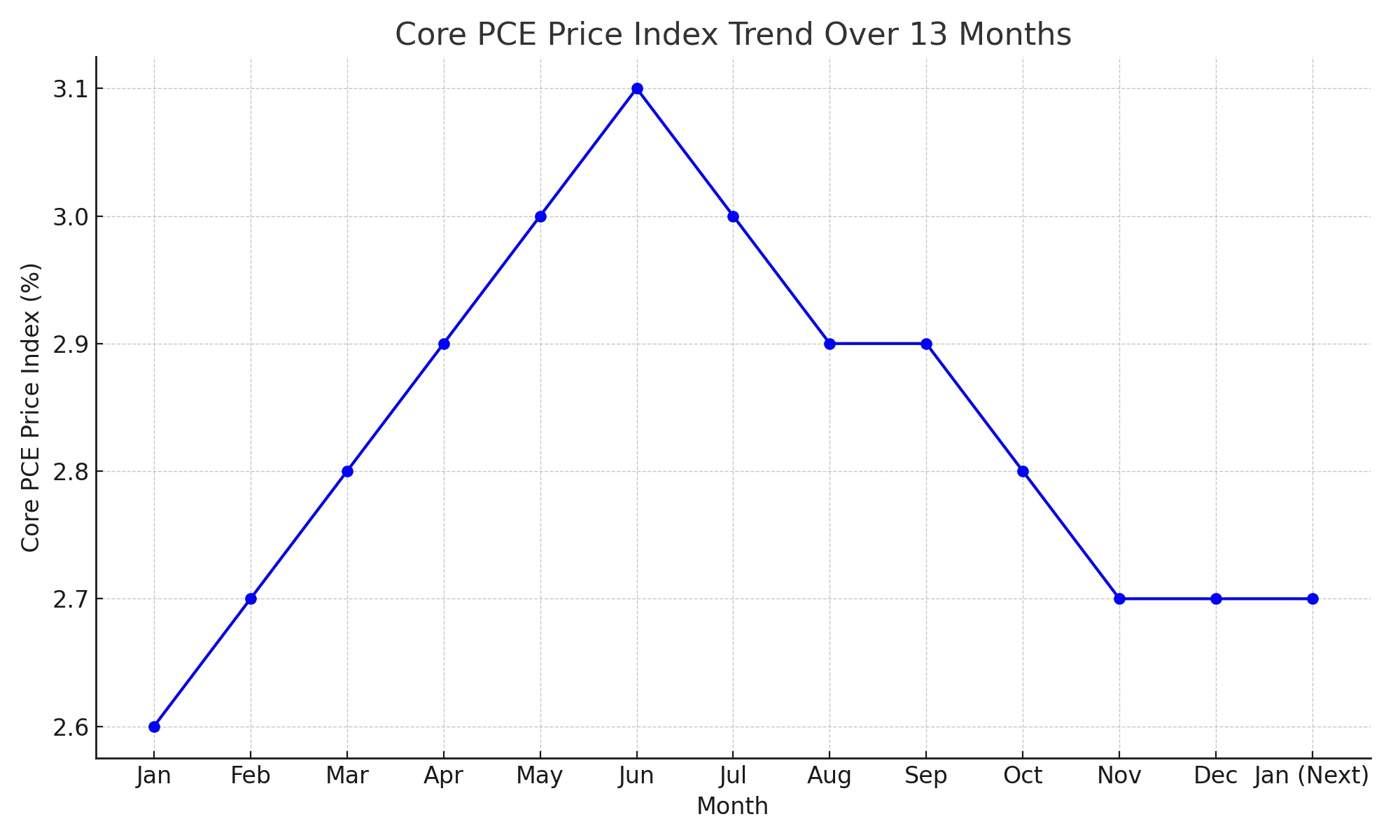

The core PCE Price Index for January is anticipated to reflect a modest month-on-month increase of 0.4%, translating into a slight deceleration in the annual inflation rate from 2.9% to 2.7%. This subtle shift signals a positive direction in inflation dynamics, albeit with a caveat for market participants to remain vigilant. The backdrop of recent Consumer Price Index (CPI) and Producer Price Index (PPI) readings hint at the potential for surprises, underscoring the importance of preparedness for any outcome.

Interest Rate Expectations: A Balancing Act

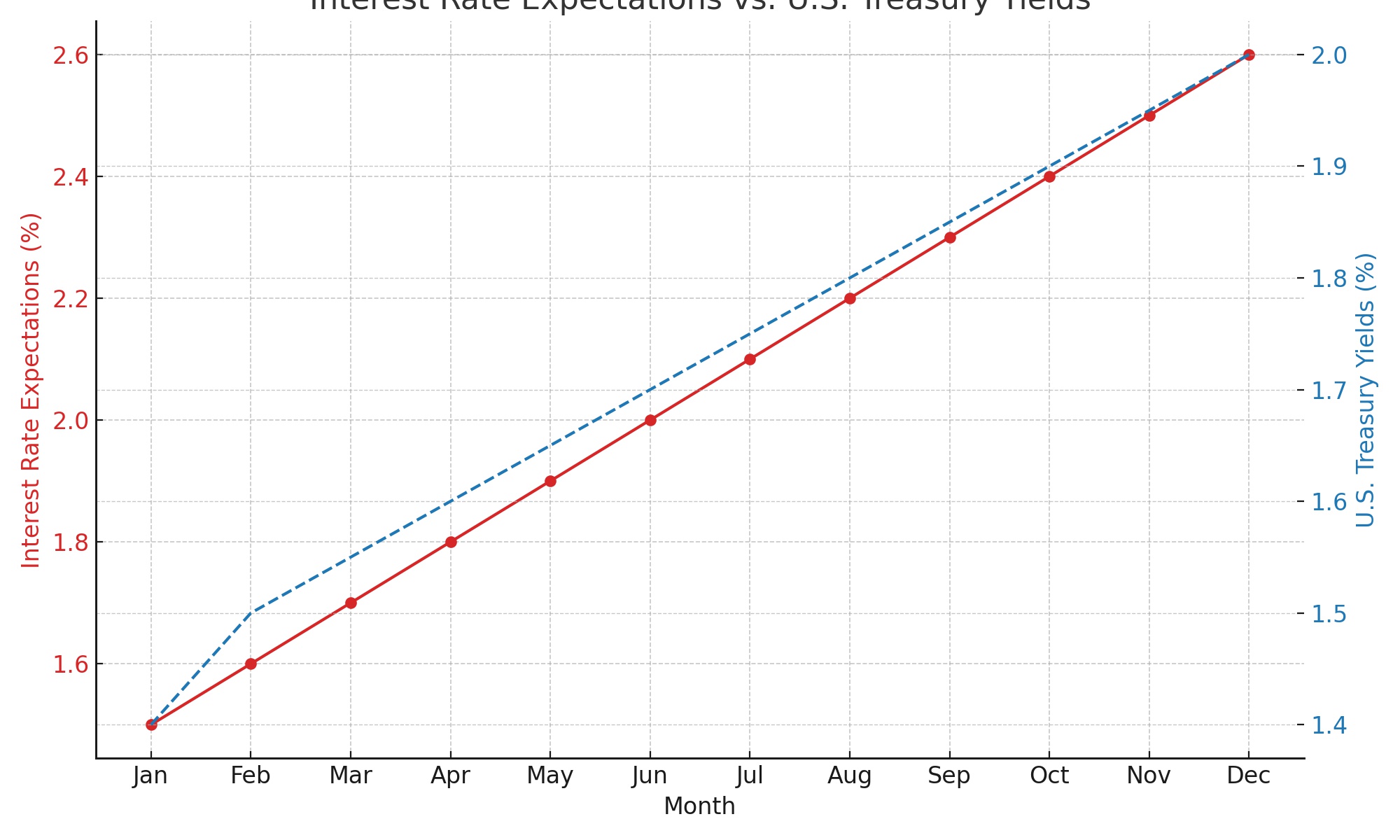

The current economic environment, characterized by persistent inflationary pressures, robust job creation, and accelerating wage growth, presents a complex puzzle for the Federal Open Market Committee (FOMC). These factors collectively suggest a postponement of monetary easing to the latter half of the year, coupled with a more conservative approach to interest rate reductions. This scenario inevitably skews the trajectory of interest rate expectations towards a more hawkish stance, influencing the dynamics of U.S. Treasury yields and the broader currency markets.

U.S. Dollar Outlook: Ascending Amid Uncertainty

In this intricate dance of economic indicators and policy expectations, the U.S. dollar emerges with a narrative of resilience and potential for further gains in 2024. The prospect of sustained higher interest rates serves as a propellant for the dollar, casting shadows over the euro, British pound, and Japanese yen as they navigate through their respective challenges.

EUR/USD Technical Perspectives: The Battle of Thresholds

The EUR/USD pairing offers a vivid illustration of the market's search for direction. Despite a recent uptick, the currency duo struggles to decisively breach the 200-day simple moving average at 1.0825, a level critical for signaling a shift in momentum. The near-term trajectory hinges on this threshold, with potential rallies eyeing the 1.0890 and 1.0950 markers. Conversely, a downturn would spotlight support levels, mapping a path of resistance and resilience in the forex landscape.

GBP/USD and USD/JPY: Technical Tug-of-War

Similar technical skirmishes unfold in the GBP/USD and USD/JPY pairings, each narrating its own story of resistance, breakout potential, and support watchpoints. The GBP/USD encounters its own set of hurdles at the 50-day moving average, while USD/JPY's upward trajectory eyes resistance with ambitions of revisiting yearly highs. These patterns not only reflect the immediate technical outlook but also encapsulate the broader sentiment and strategic positioning within the forex market.

A Week of Decisive Data and Central Bank Narratives

Looking ahead, the coming week promises a rich tapestry of economic data and central bank dialogues. From U.S. consumer confidence and GDP revisions to Eurozone inflation figures and ECB insights, each piece of data contributes to the mosaic of market expectations and strategic forecasts. The interplay between these indicators and the ensuing central bank commentary will be instrumental in shaping short-term market dynamics and the evolving narrative around monetary policy divergence.

As we navigate through this confluence of economic releases and technical thresholds, the financial landscape remains a domain of vigilance, strategy, and adaptability. With the core PCE data release on the horizon, the market stands at a crossroads, awaiting signals that will define the trajectory of currencies and the broader economic outlook in the days to come.

That's TradingNEWS

Read More

-

AMD Stock Price Forecast - AMD at $223: AI GPU Ramp, CES 2026 Catalysts and the Next Move for NASDAQ:AMD

03.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Near $2 as Whales Add $3.6B and ETF Inflows Top $1.18B

03.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: Oil Near $60 Weigh Venezuela Shock Against 3.8M bpd Glut

03.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Wall Street Opens 2026; Dow 48,382, S&P 6,858 on Chip Rally, Gold Boom and Bitcoin $90K

03.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Tests 1.35 as BoE Caution Meets Soft US Dollar

03.01.2026 · TradingNEWS ArchiveForex