Geopolitical Events and Economic Indicators Drive Oil Prices

Analyzing the Impact of Geopolitical Events and Economic Data on Oil Markets | That's TradingNEWS

Geopolitical Tensions and Economic Indicators Drive Oil Prices

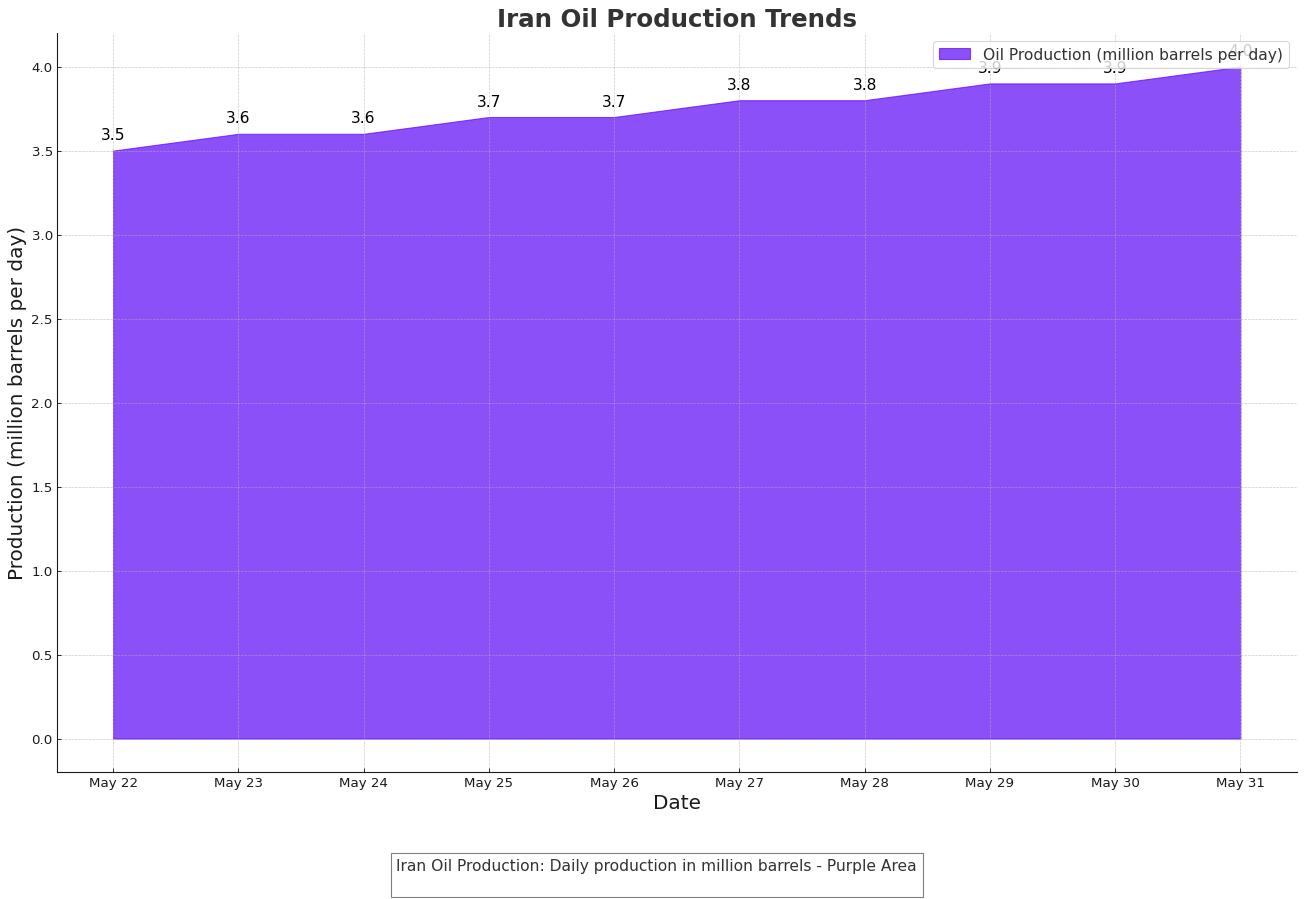

Iran's Ambitious Oil Production Plans

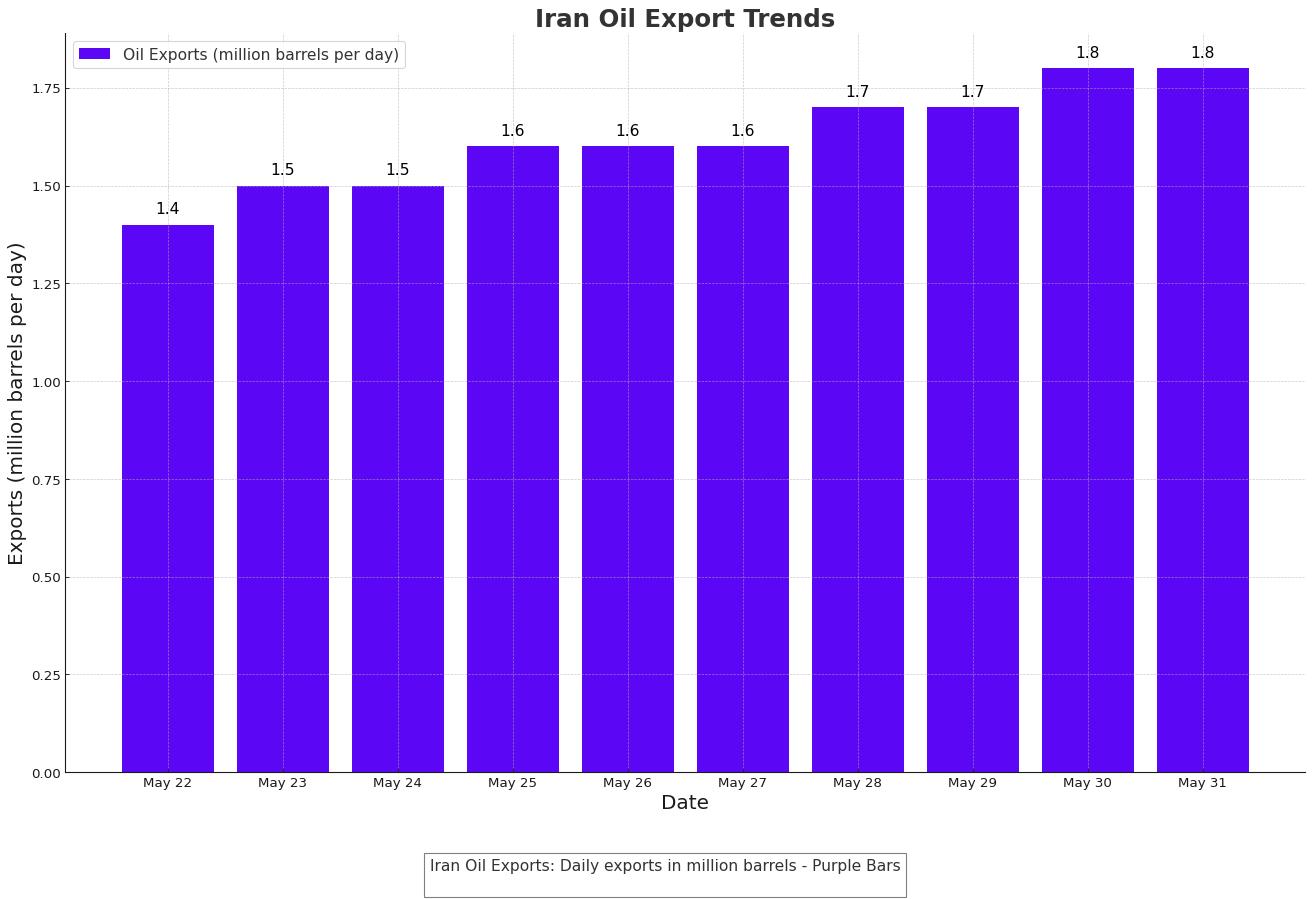

Iran has announced plans to boost its crude oil output to 4 million barrels per day, as reported by Tasnim news agency. This strategic decision, approved by an economic council led by interim president Mohammad Mokhber, aims to enhance production from the current 3.6 million barrels daily. Despite facing stringent U.S. sanctions, which have significantly curtailed its market, Iran has seen a notable increase in crude exports. The average daily export for the first quarter hit 1.56 million barrels per day, the highest in six years, according to Vortexa data. This marks a substantial rise from last year's average of 1.29 million barrels per day, which was 50% higher than the previous year.

Production Trends

Export Trends

Market Reactions and Current Oil Prices

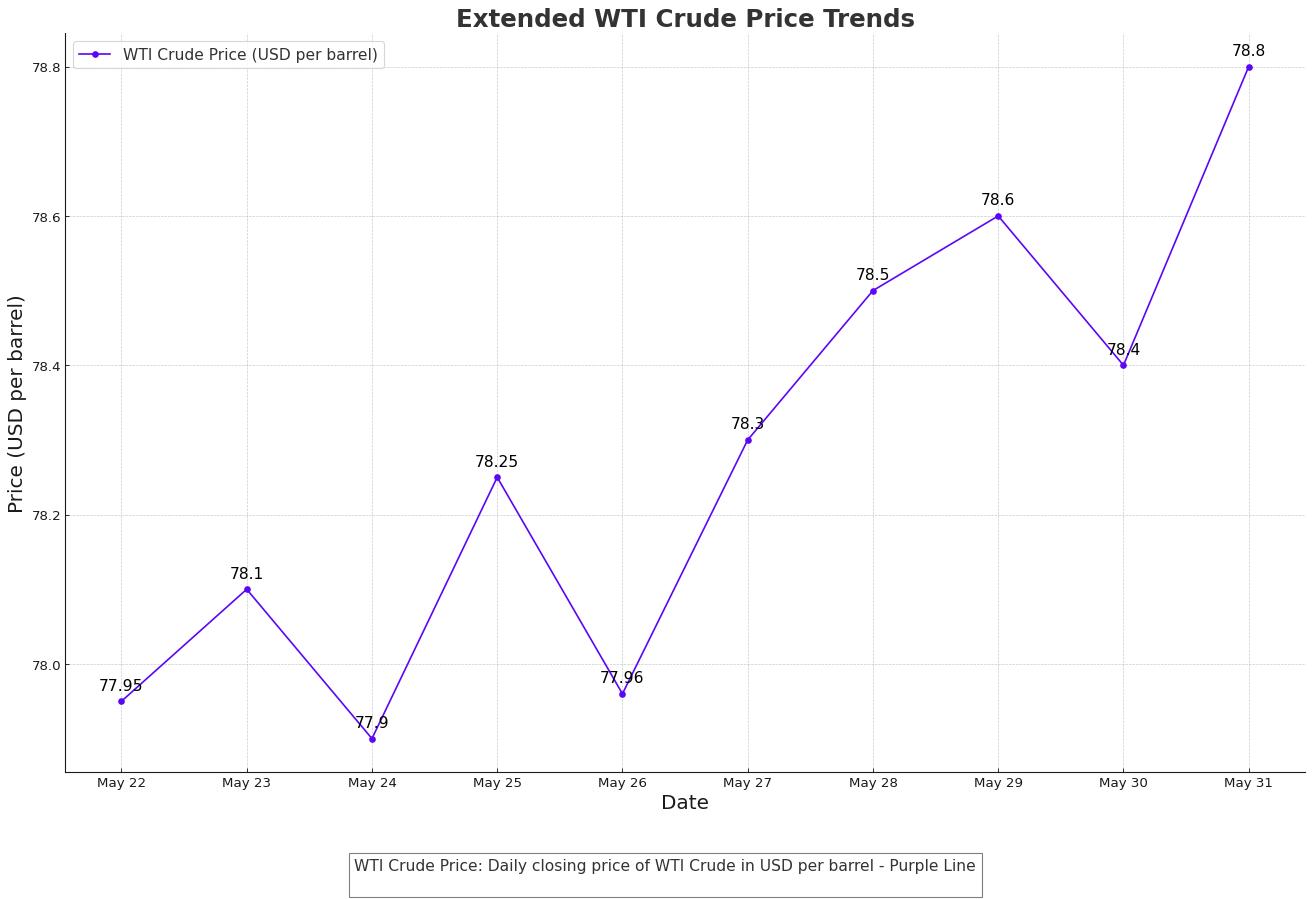

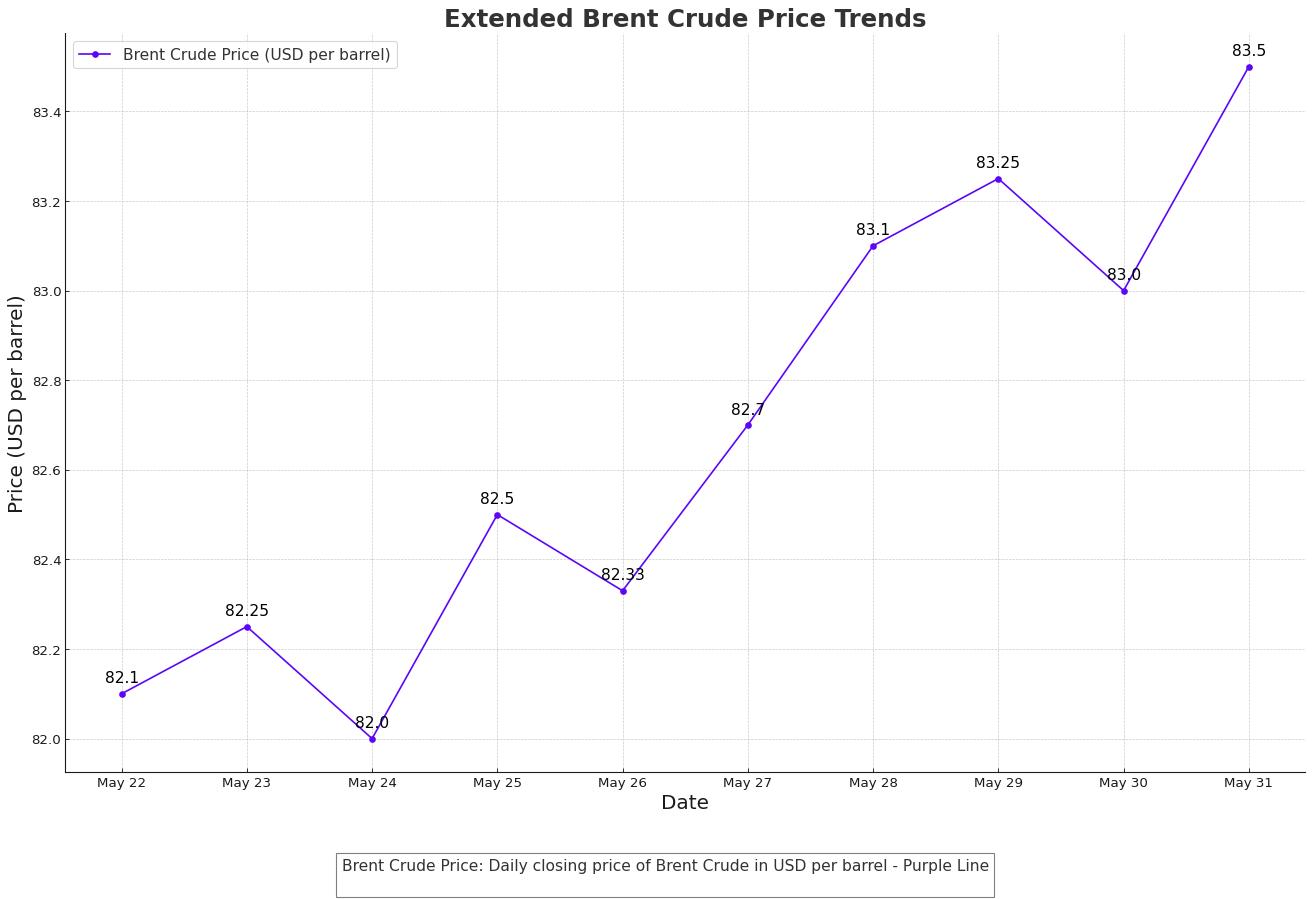

On Monday, oil prices made slight advances in a muted trading environment due to public holidays in Britain and the United States. The Brent crude July contract rose 21 cents to $82.33 per barrel by 0926 GMT, while the more active August contract increased by 26 cents to $82.10. U.S. West Texas Intermediate (WTI) crude futures saw a 23-cent uptick to $77.95. Last week, Brent lost about 2%, and WTI nearly 3%, as Federal Reserve minutes indicated some officials were open to further interest rate hikes to manage persistent inflation.

WTI Price Trends

Brent Crude Price Trends

Economic Data Impact and Federal Reserve Policies

The upcoming release of the U.S. personal consumption expenditures (PCE) index on May 31 is critical as it serves as the Federal Reserve's preferred inflation measure. Recent U.S. economic data suggest the Fed may maintain high interest rates longer than previously anticipated. Atlanta Fed President Raphael Bostic highlighted the need for patience in reaching the 2% inflation target, indicating it could take several years. This stance has reduced the likelihood of an imminent rate cut, influencing oil prices by strengthening the U.S. dollar, thereby making oil more expensive for holders of other currencies.

Anticipated OPEC+ Meeting Outcomes

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) have postponed their meeting to June 2, where they are expected to discuss extending voluntary output cuts of 2.2 million barrels per day into the second half of the year. Combined with existing cuts, these measures would total nearly 6% of global oil demand. Sources within OPEC+ suggest an extension of these cuts is likely, which supports oil prices in anticipation of peak summer demand.

Technical Analysis: WTI Crude Oil Price Forecast

WTI crude oil prices are currently trading at $77.96 per barrel. Key resistance levels are at $78.50, $79.00, and $80.00, while support levels are at $77.00, $76.50, and $75.50. The Relative Strength Index (RSI) stands at 50, indicating neutral momentum, with the 50-day Exponential Moving Average (EMA) at $77.86 providing mild support. The pivot point is set at $77.56, serving as a critical level for potential market direction. Immediate resistance levels are noted at $78.29, $79.01, and $79.92, while support levels are positioned at $76.87, $76.13, and $75.46.

Market Sentiment and Oil Demand Projections

OPEC forecasts robust growth in oil demand, expecting an increase of 2.25 million barrels per day this year, while the International Energy Agency (IEA) predicts a slower growth rate of 1.2 million barrels per day. Analysts emphasize the importance of monitoring gasoline usage as the Northern Hemisphere enters the summer driving season. Despite a post-COVID high in U.S. holiday trips, improved fuel efficiency and the rise of electric vehicles (EVs) may keep oil demand subdued. However, this could be balanced by increasing air travel.

Recent Developments and Price Movements

On Monday, gold prices gained 0.30% in early European trading, supported by a weaker USD and escalating geopolitical tensions in the Middle East. This rise follows reports of Israeli air attacks in Gaza, resulting in significant casualties. Year-to-date, gold has surged over 16%, hitting a record high of $2,400 per ounce in May. Additionally, U.S. Durable Goods Orders rose by 0.7% in April, exceeding expectations and potentially bolstering the USD.

Technical Analysis and Bullish Outlook

Despite some consolidation, gold's technical outlook remains constructive. The metal holds above the key 100-day Exponential Moving Average (EMA) on the daily chart. The 14-day Relative Strength Index (RSI) is in a bearish zone at 48.5, indicating potential further downside, but overall, the bullish trend remains intact. Immediate resistance levels are at the upper boundary of the Bollinger Band at $2,428, with extended gains possibly rallying to the all-time high of $2,450 and the psychological mark of $2,500.

Upcoming Economic Events and Federal Reserve Influence

U.S. banks will be closed for Memorial Day on Monday, but traders will watch for Fed speeches on Tuesday from officials including Michelle Bowman, Loretta Mester, and Neel Kashkari. The preliminary reading of U.S. GDP for Q1, expected to show a 1.5% growth, will be a focal point on Thursday. Stronger-than-expected GDP data could strengthen the USD, impacting USD-denominated gold prices.

Analyst Predictions and Long-term Trends

Analysts from UBS have raised their gold price forecast to $2,600 by the end of 2024, while Citi analysts predict gold could reach $3,000 per ounce within the next six to eighteen months. High gold prices are expected to reduce imports to India, the world’s second-largest gold consumer, by nearly 20% this year as consumers exchange old jewelry for new items.

Conclusion

The oil and gold markets remain influenced by a complex interplay of geopolitical tensions, economic indicators, and market sentiment. The upcoming OPEC+ meeting, U.S. PCE data, and Federal Reserve's interest rate policies will be crucial in shaping the future direction of these markets. Investors should stay vigilant and monitor these developments to navigate the volatility effectively.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex