Gold Eyes $2,700 as Inflation Fears and Global Risks Boost Safe-Haven Demand

Fed's Policy Shift and Middle East Uncertainty Spark Gold’s Latest Rally | That's TradingNEWS

Gold (XAU/USD) Gains Momentum Amid Market Volatility

Introduction: Strong Support Above $2,600

Gold (XAU/USD) continues to show resilience, holding above the key $2,600 level. The yellow metal has remained a safe-haven asset as it edges higher following the recent weakness in the U.S. dollar and rising global economic uncertainties. Current market sentiment, supported by an easing U.S. dollar, has catalyzed gold's ascent. Despite ongoing volatility in broader financial markets, gold remains a strong performer with potential for further gains as traders react to economic data and geopolitical concerns.

U.S. Inflation and Labor Data Impacting Gold’s Short-Term Outlook

Gold prices have been driven higher by mixed economic indicators out of the U.S. On one hand, inflation data exceeded expectations, raising concerns that the Federal Reserve may slow its pace of interest rate cuts. September’s consumer price index (CPI) rose by 2.4%, slightly above the forecasted 2.3%. Core inflation, excluding food and energy, grew by 3.3%, pushing expectations that the Fed will adopt a more cautious approach to future rate cuts. On the other hand, U.S. labor data signaled growing weaknesses, as initial jobless claims surged to 258,000 from the prior week’s 230,000, reflecting a slowing labor market.

These contrasting data points suggest that while inflation remains a concern, the labor market's fragility may prompt the Federal Reserve to continue easing monetary policy. Lower interest rates would favor non-yielding assets such as gold by reducing the opportunity cost of holding the metal, adding bullish pressure to XAU/USD.

Gold Prices Rally in Asia and Philippines Markets

In the broader Asian markets, gold experienced another day of gains. Gold futures rose 1.4%, trading at $2,662.50 per ounce, while spot gold climbed to $2,645.6. In the Philippines, the price per gram of gold increased to 4,864.80 Philippine pesos (PHP), up from the previous day’s 4,836.17 PHP, indicating broader global demand for gold. The ongoing weakness in the U.S. dollar has contributed to this momentum, as investors continue to bet on softer monetary policy from the Federal Reserve.

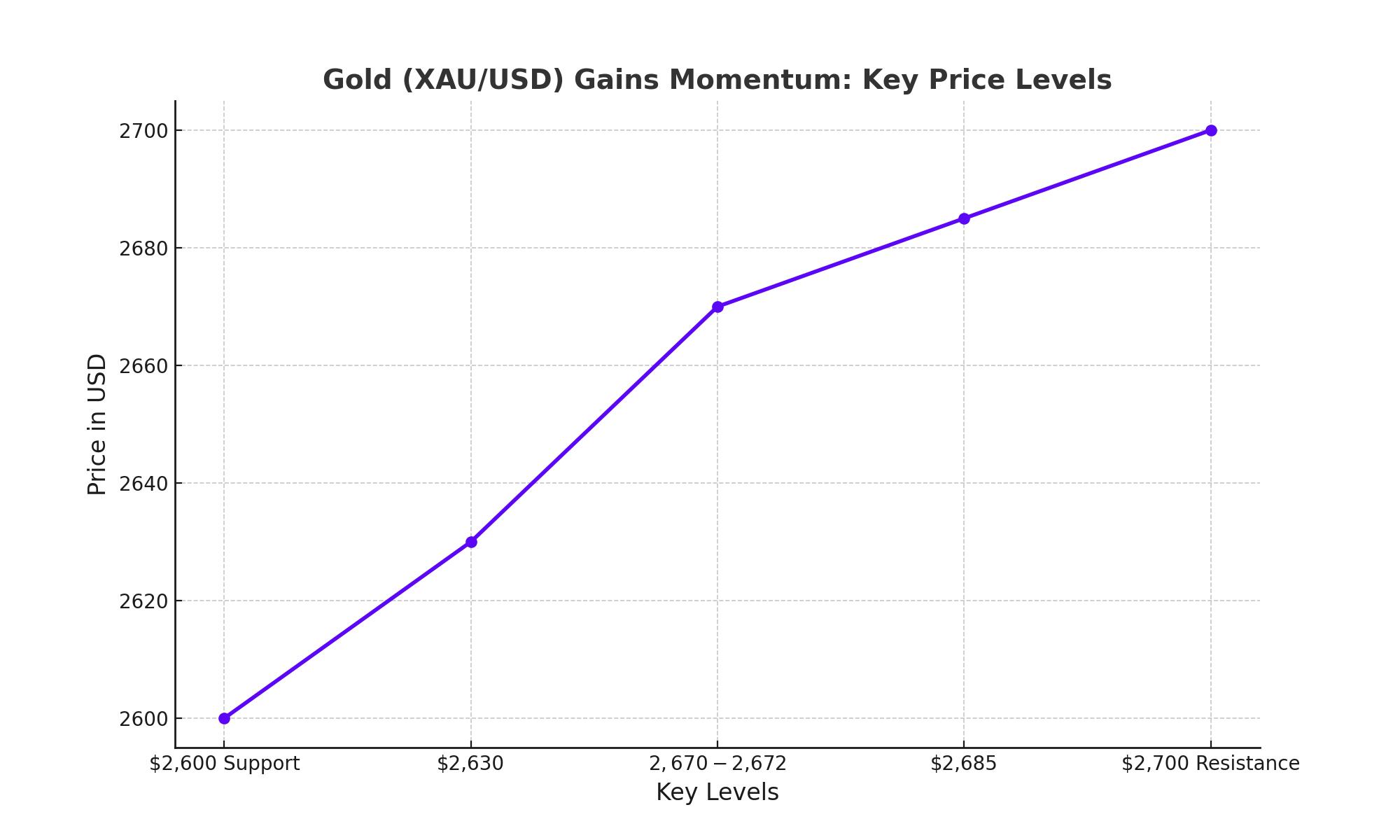

Technical Analysis: Gold's Key Levels to Watch

From a technical standpoint, gold’s ability to hold above the crucial $2,600 mark signals that further upward movement is likely. The $2,630 level, previously a point of resistance, now serves as support, underpinning the market's bullish sentiment. Oscillators remain in positive territory, suggesting that the path of least resistance for gold is upward. Traders are watching for a potential retest of the $2,670-$2,672 supply zone. A successful breach of this level would open the door for further gains, possibly testing all-time highs near $2,685. The $2,700 psychological barrier remains the next major target for bullish investors.

Conversely, a break below the $2,600 level could spark a deeper correction. In such a scenario, gold may target the $2,560 support zone, with further downside toward $2,535-$2,530 if selling pressure intensifies.

Global Geopolitical Risks Support Gold’s Bullish Outlook

Geopolitical uncertainty continues to be a driving force behind gold’s recent rally. The ongoing conflict between Israel and Iran, particularly the threats surrounding oil supply routes in the Middle East, has heightened demand for safe-haven assets. Investors remain cautious of a potential escalation in the region, which could disrupt global supply chains and fuel inflation. Central banks worldwide have also been increasing their gold reserves, reinforcing the metal's status as a hedge against economic instability and currency devaluation.

Gold’s Correlation with U.S. Dollar and Treasury Yields

Gold’s inverse relationship with the U.S. dollar has been a significant factor in its recent performance. As the dollar weakened following the labor market data and mixed inflation figures, gold prices have benefited from renewed buying interest. Additionally, a modest decline in U.S. Treasury bond yields has provided further support to non-yielding assets like gold. The 10-year U.S. Treasury yield remains above the 4% threshold, but any further weakness could bolster gold prices in the short term.

Fed’s Monetary Policy and Its Influence on Gold

The Federal Reserve’s monetary policy outlook remains a key driver of gold prices. Traders currently assign an 81% probability of a 25 basis point interest rate cut in November. While the Fed has indicated a slower pace of rate cuts, the broader trend of lower rates is positive for gold. Lower rates reduce the opportunity cost of holding non-yielding assets like gold and increase its attractiveness as an inflation hedge. Should the Fed adopt a more dovish tone, gold could continue its upward trajectory, especially if geopolitical tensions escalate.

Outlook: Gold Poised for Further Gains

In conclusion, gold remains well-positioned to capitalize on the current market dynamics. With the U.S. dollar retreating from recent highs and growing signs of labor market weakness, gold prices are likely to remain supported in the near term. The $2,600 level will continue to serve as a key pivot point for traders, with upside targets ranging from $2,670 to $2,700. As long as the Federal Reserve maintains its current monetary policy stance and geopolitical risks persist, gold will continue to attract safe-haven demand.

This backdrop sets the stage for continued gains in the precious metal, with the potential to break past the $2,700 mark in the coming weeks. For now, gold’s bullish trend appears firmly intact, bolstered by favorable technicals, weakening dollar strength, and an uncertain geopolitical environment.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex