Gold Faces Key Resistance as Market Awaits Fed's Next Move

With gold prices nearing the $2,470 mark, investors weigh Federal Reserve policies, economic data, and global tensions in shaping the precious metal's future trajectory | That's TradingNEWS

Gold (XAU/USD) Eyes Key Resistance Amid Economic Uncertainty

The gold market is currently navigating a complex landscape as investors weigh the implications of potential Federal Reserve actions, ongoing geopolitical tensions, and economic indicators from major global economies. The spot price of gold, trading at approximately $2,436 per ounce, is testing critical resistance levels, with traders closely monitoring developments that could dictate the metal's next significant move.

Federal Reserve Policies and Inflation Dynamics

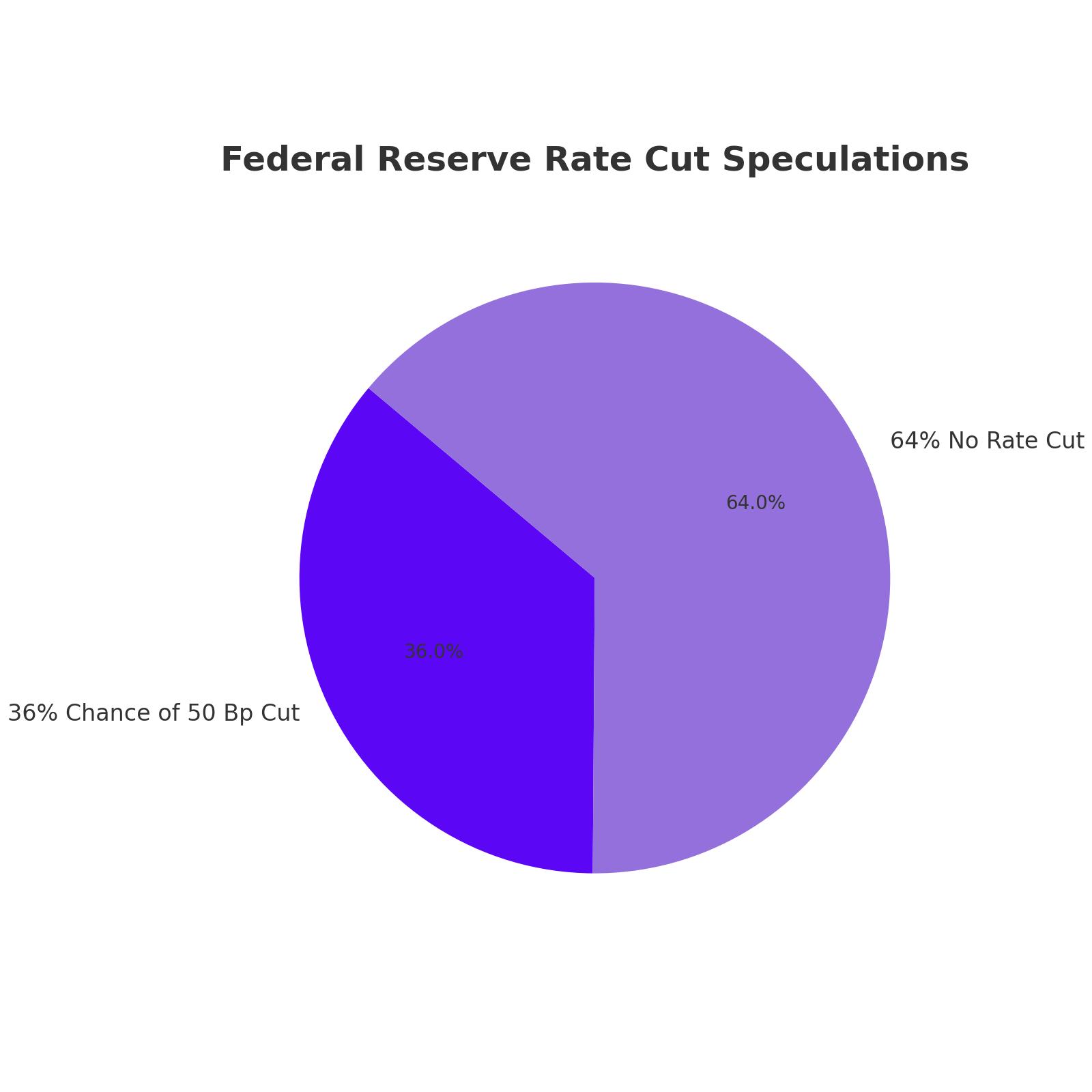

At the forefront of market sentiment is the Federal Reserve's stance on interest rates. The central bank's decisions have been a driving force behind gold's recent price movements. With the U.S. Consumer Price Index (CPI) showing a 2.9% year-over-year increase in July—slightly below market expectations—investors are speculating on the likelihood of a rate cut in the upcoming Federal Open Market Committee (FOMC) meeting. Current data suggests a 36% chance of a 50 basis point reduction, down from previous expectations of 50%. This uncertainty is keeping the market on edge, particularly as gold typically benefits from a low-interest-rate environment, which reduces the opportunity cost of holding non-yielding assets like gold.

Technical Analysis: Key Levels to Watch

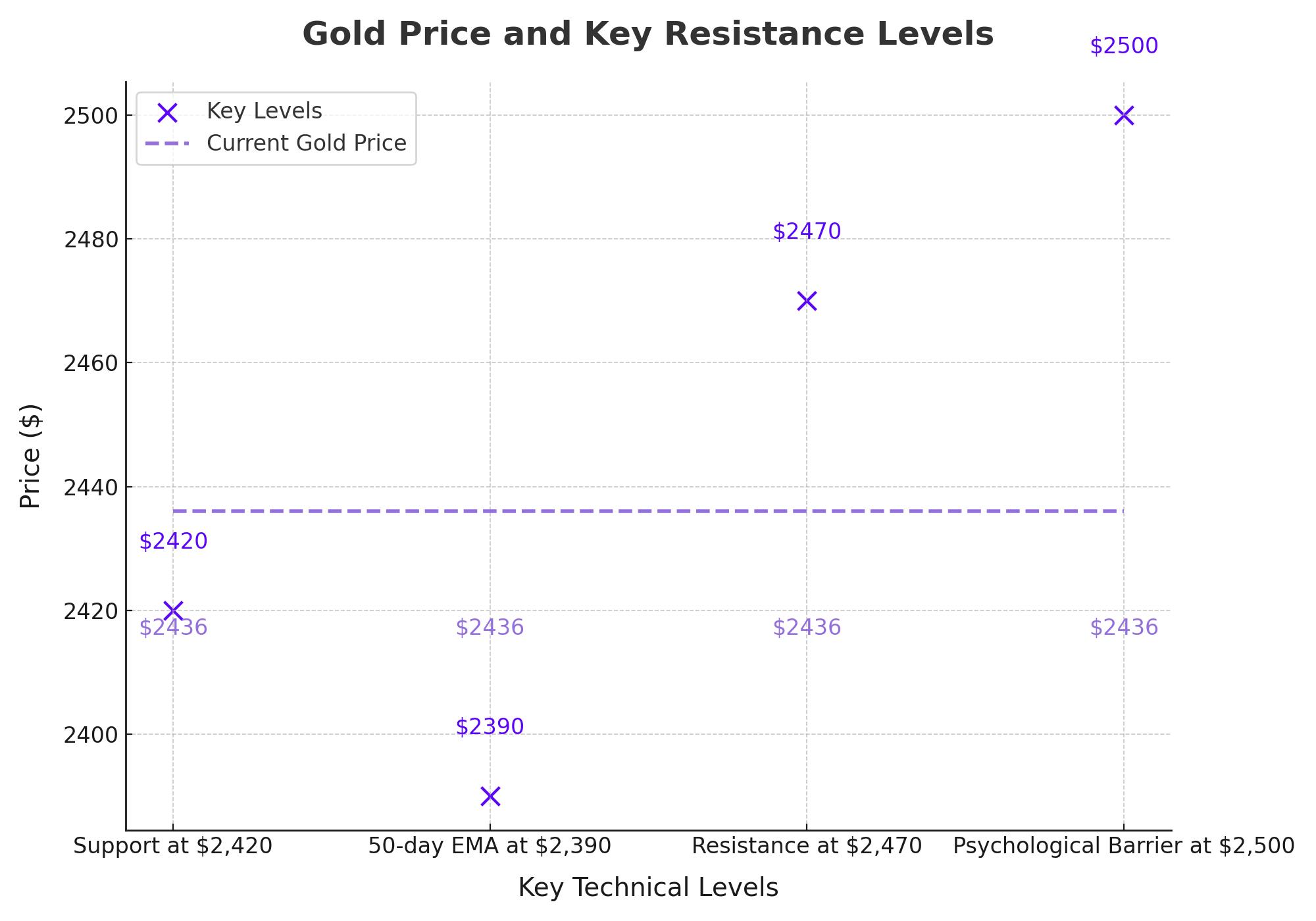

From a technical perspective, gold is battling to break through the $2,470 resistance, a level it has struggled to surpass in recent sessions. A successful breach could pave the way for a run toward the $2,500 psychological barrier, which, if overcome, might trigger a surge fueled by fear of missing out (FOMO) among investors. The 50-day Exponential Moving Average (EMA) near $2,390 continues to provide solid support, with the broader trend remaining bullish as long as prices hold above this level.

The Relative Strength Index (RSI) on the daily chart remains above 50, indicating that momentum is still on the side of the bulls. However, any failure to sustain gains above $2,470 could see prices retreat to test support at $2,420 or even $2,380, where the 50-day EMA and lower boundary of the current symmetrical triangle converge.

Global Economic Indicators and Geopolitical Risks

Gold's recent performance is also influenced by a mix of global economic data and geopolitical risks. China's mixed economic data for July—showing slightly higher-than-expected retail sales but lower industrial production—had a muted impact on gold prices, which remained focused on broader macroeconomic themes. Meanwhile, ongoing tensions in the Middle East, particularly involving Hamas and Iran, continue to provide a floor for gold prices, as investors seek safe-haven assets amidst geopolitical instability.

Retail Sales and Jobless Claims: Market Impact

The U.S. retail sales data for July, which showed a stronger-than-expected 1% increase, initially pressured gold prices as it raised doubts about the need for aggressive rate cuts by the Fed. This, coupled with a stronger U.S. dollar and rising Treasury yields, temporarily dampened gold's appeal. However, the metal's intrinsic value and its role as a hedge against inflation and currency debasement continue to attract buyers, especially as the Fed's restrictive monetary policy appears poised for potential easing in the near term.

Outlook: Buy, Sell, or Hold?

The outlook for gold remains bullish in the long term, particularly for investors who view it as a hedge against economic uncertainty and inflation. However, the short-term trajectory will likely depend on the Fed's actions, economic data, and global political developments. As gold hovers near crucial resistance levels, a decisive break above $2,470 could signal further gains, while a failure to do so might prompt a pullback to key support areas. Investors should stay vigilant, balancing their positions in line with evolving market dynamics and upcoming economic reports.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex