Gold Hits $2,722 New Record Amid Geopolitical Tensions and Rate Cut Expectations

Surging to $2,722, gold shines as central bank easing and Middle East conflict drive safe-haven demand—could $3,000 be next? | That's TradingNEWS

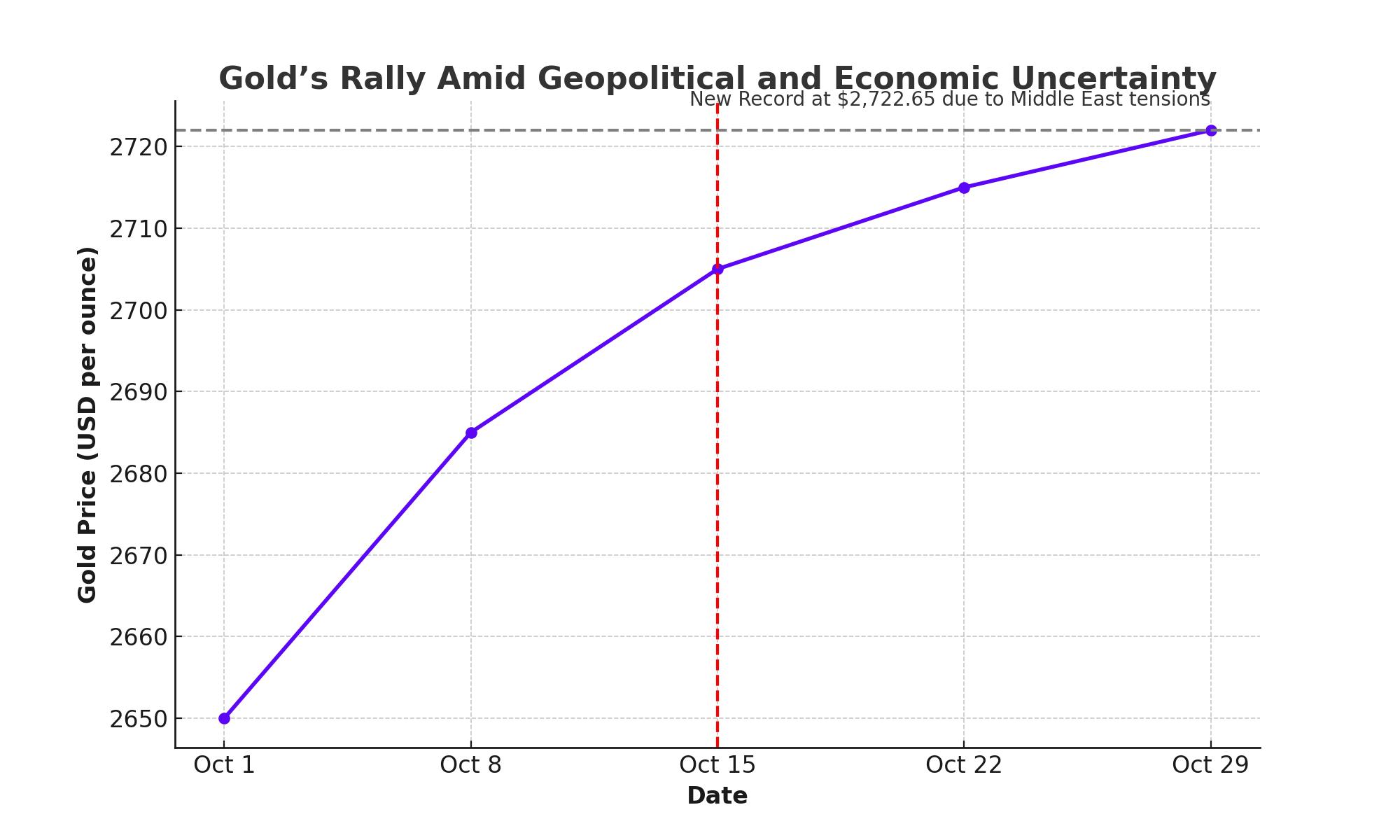

Gold’s Rally Amid Geopolitical and Economic Uncertainty

Middle East Conflict Fuels Safe-Haven Demand

Gold (XAU/USD) has seen a sharp rise, driven largely by geopolitical tensions in the Middle East, particularly the ongoing conflict between Israel and Hezbollah. As Hezbollah escalates military activity, the instability across the region has prompted investors to flock to safe-haven assets like gold. On Friday, gold prices surged to a new record of $2,722.65 per ounce, highlighting the heightened geopolitical risk that continues to drive gold’s bullish momentum.

Monetary Easing Boosts Gold Demand

Another major catalyst for the gold rally is the expectation of continued monetary easing by central banks. The Federal Reserve is widely anticipated to cut interest rates by 25 basis points in November, with a 92% probability of such a move, according to market projections. Historically, lower interest rates enhance the appeal of non-yielding assets like gold by reducing the opportunity cost of holding bullion.

The European Central Bank (ECB) has also contributed to the momentum, delivering its third rate cut of the year. With further easing likely, the demand for gold as a hedge against uncertain economic conditions continues to rise.

Mixed U.S. Economic Data

Despite the bullish sentiment in gold, U.S. economic data has presented mixed signals. Retail sales exceeded expectations with a 0.4% increase in September, indicating resilience in consumer spending. However, the housing market weakened, with both housing starts and building permits showing declines. This combination of strong consumption and a softer housing market has led to speculation that the Federal Reserve will maintain its dovish stance, further supporting gold prices.

Geopolitical Risks and U.S. Elections

Gold continues to attract safe-haven demand as investors weigh geopolitical risks and uncertainty surrounding the upcoming U.S. presidential election. With Donald Trump and Kamala Harris in a closely contested race, the outcome of the election could have significant implications for trade, taxes, and monetary policy. This uncertainty is driving further demand for gold, as investors seek stability amid political and economic volatility.

Outlook for Gold Prices

Gold's momentum remains strong, with prices expected to test new highs in the coming weeks. Analysts project that gold could surpass $3,000 per ounce within the next 6 to 12 months, driven by geopolitical risks and continued monetary easing. Key factors to monitor include developments in the Middle East, U.S. economic data, and central bank policies.

Central Bank Activity and U.S. Debt Concerns

A critical factor supporting gold’s bullish outlook is central bank activity, particularly in relation to U.S. debt concerns. The U.S. debt as a percentage of GDP is set to break record highs, prompting the Treasury Department to sell more bonds. However, with rising yields, bond prices fall, weakening their appeal. As a result, central banks are diversifying their reserves away from U.S. debt and toward gold, driving demand for the precious metal.

The ballooning U.S. deficit, which reached $1.8 trillion in the fiscal year ending September 30, has added to concerns over the sustainability of U.S. fiscal policy. The interest expense on U.S. debt alone was $950 billion, more than defense spending, and up 35% from the prior year. Analysts suggest that rising debt and fiscal uncertainty will continue to boost gold prices, as investors seek alternatives to U.S. Treasuries.

Technical Outlook for Gold (XAU/USD)

Gold is trading around $2,721, showing strong bullish momentum. The price is currently holding above key technical support levels, with immediate support at $2,666 and resistance at $2,685. A break above the $2,685 level could lead to further gains toward $2,710 and $2,750. On the downside, strong support exists around $2,653 and $2,637, which could prevent a deeper correction.

Technical indicators, including the 50-day Exponential Moving Average (EMA) at $2,660 and the 200-day EMA at $2,637, reinforce the bullish trend. As long as gold stays above $2,666, the upward trend is likely to continue.

Impact of U.S. Election and Geopolitical Tensions

The upcoming U.S. election is another factor that is likely to influence gold prices. With the race between Trump and Harris remaining close, uncertainty around trade policies, taxation, and foreign relations is fueling demand for gold as a safe-haven asset. Geopolitical tensions, particularly in the Middle East, are adding to gold’s strength. Recent Israeli airstrikes and escalating conflicts in Lebanon have driven risk-averse investors toward gold.

Forecast: Gold Could Reach $3,000

The outlook for gold remains solidly bullish, with analysts predicting significant price increases in the months ahead. Gold has already surged past $2,722 per ounce amid expectations that the Federal Reserve and other central banks will continue to cut interest rates to stimulate economic growth. These rate cuts reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors. As the global economic environment becomes increasingly unstable due to geopolitical tensions, such as the ongoing conflict in the Middle East, and financial uncertainty, the demand for gold as a safe-haven asset is expected to rise.

According to the London Bullion Market Association (LBMA), gold is forecast to reach $2,941 per ounce over the next 12 months. However, many experts believe this could be a conservative estimate. With central banks ramping up their gold reserves and inflationary pressures persisting, some projections suggest that gold could break through the $3,000 per ounce mark sooner than anticipated. This would represent a new all-time high for the precious metal, highlighting its enduring role as a hedge against both economic and geopolitical uncertainty.

Key Economic Data to Watch

Investors are closely monitoring key U.S. economic indicators that could influence the direction of gold prices in the coming months. Among the most important data points are retail sales, industrial production figures, and weekly jobless claims. A weaker-than-expected performance in any of these areas could prompt the Federal Reserve to accelerate its plans for additional rate cuts. This would likely provide further support for gold, as lower interest rates tend to weaken the U.S. dollar and boost demand for gold.For instance, if retail sales come in below forecasts, it would suggest that consumer spending is slowing, a red flag for economic growth. Similarly, a decline in industrial production could signal broader economic weakness. Both scenarios would increase the likelihood of the Federal Reserve adopting a more dovish monetary policy stance, which typically benefits gold.

Treasury Yields and the Strong U.S. Dollar

Despite the strong support for gold, rising U.S. Treasury yields and a strengthening U.S. dollar could pose challenges for gold's upward trajectory. Treasury yields have been climbing as investors anticipate future rate cuts, which can increase the appeal of interest-bearing assets relative to gold. Additionally, the U.S. Dollar Index has reached its highest level since August, making gold more expensive for holders of other currencies and potentially dampening demand.

However, the impact of a strong dollar on gold prices could be offset if central banks globally continue their dovish monetary policies. If the Federal Reserve proceeds with rate cuts, it could put downward pressure on the dollar, creating a more favorable environment for gold. This balancing act between a rising dollar and dovish monetary policy will be crucial in determining gold’s short-term price movements.

Conclusion: Gold’s Future Outlook

In the context of ongoing geopolitical risks, expectations of further monetary easing, and persistent fiscal uncertainty, gold is well-positioned for continued gains. While fluctuations in the short term are inevitable—particularly due to factors like rising Treasury yields and the strong U.S. dollar—the long-term outlook remains strongly positive. If the Federal Reserve and other central banks continue cutting rates, and geopolitical tensions remain high, gold could very well test the $3,000 per ounce level within the next year.

For investors, monitoring upcoming U.S. economic data, central bank policies, and global political developments will be key to navigating the market. With so many factors aligning in gold’s favor, the precious metal continues to stand out as a crucial hedge against economic instability and global uncertainty.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex