Gold Holds Steady at $2,675 Amid Geopolitical Chaos and Dollar Strength

As tensions rise between Israel and Iran, gold prices surge, but strong US Dollar caps further gains | That's TradingNEWS

Geopolitical Risks and Dollar Strength Keep Gold (XAU/USD) on a Bullish Trajectory

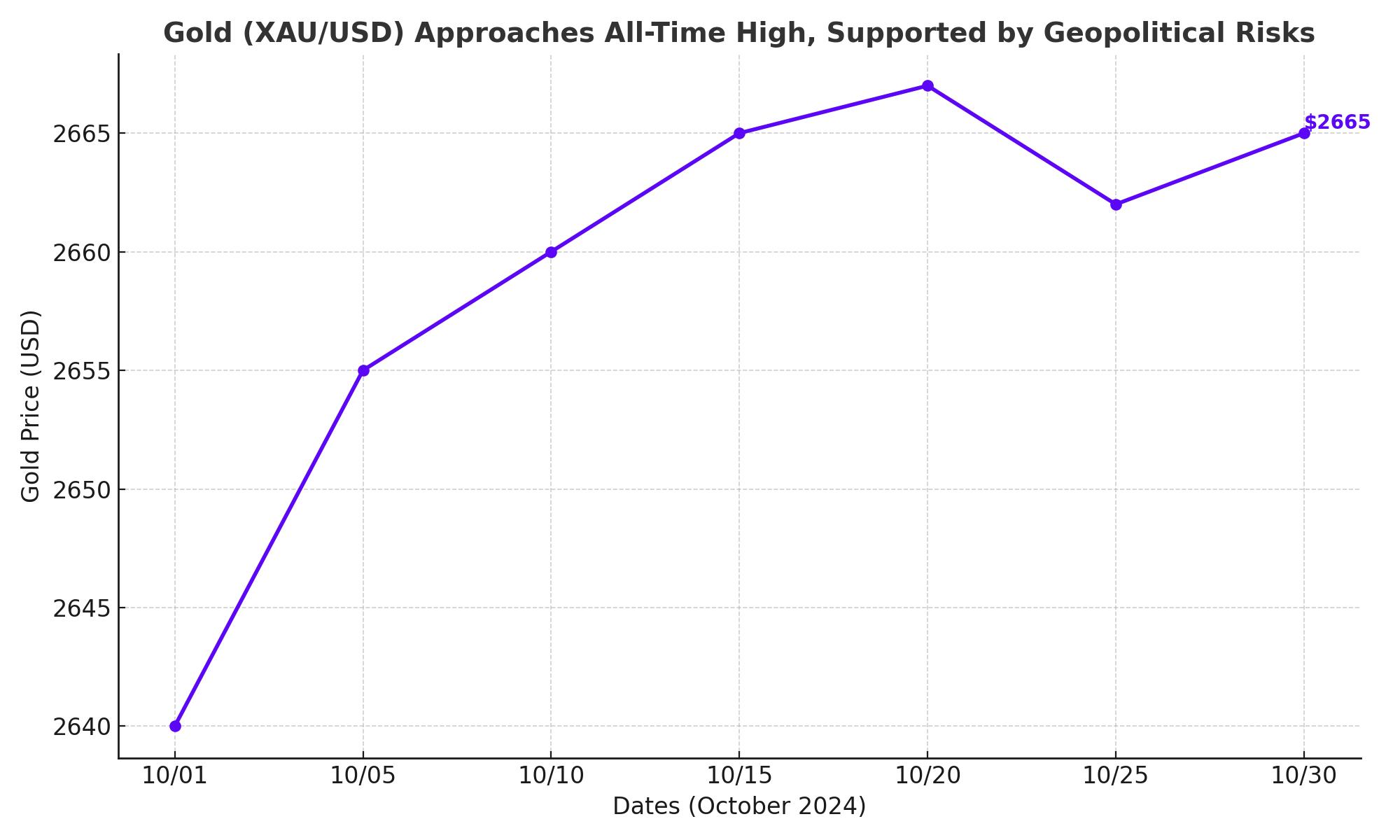

Gold prices (XAU/USD) continue their upward momentum, maintaining a positive bias near the $2,675 level. The ongoing geopolitical uncertainty, particularly the heightened tension between Israel and Iran, has investors seeking the safe haven of gold. Despite fluctuations in the equity markets and weaker-than-expected fiscal measures from China, gold is holding steady, thanks to its status as a non-yielding asset that thrives in times of crisis.

Geopolitical Tensions Drive Demand for Gold

The conflict in the Middle East, particularly Israel's potential military actions against Iran, has reignited fears of further escalation. Earlier, reports suggested that Israel would avoid targeting Iran’s oil infrastructure, temporarily easing pressure on the markets. However, uncertainty returned when Israeli officials signaled that they would act independently, renewing concerns about potential supply disruptions in the region. These developments have fueled demand for safe-haven assets like gold, pushing it close to its recent peak of $2,685.

US Bond Yields and Dollar Strength Counterbalance Gold Gains

While geopolitical risks are supporting gold prices, the rise in US Treasury bond yields is acting as a counterweight. The 10-year Treasury note yield dipped to 4.03%, making gold more attractive as a non-yielding asset. However, expectations of a less aggressive policy easing from the Federal Reserve, with markets pricing in a potential 25-basis-point rate cut, have lifted the US Dollar. The stronger dollar makes gold more expensive for foreign investors, capping some of the metal's gains.

China’s Economic Struggles Weigh on Global Demand

China's sluggish economic performance has also played a critical role in influencing gold prices. The world's largest consumer of gold saw disappointing inflation data and weak fiscal measures, further dampening global demand. The International Energy Agency (IEA) has revised down its global demand forecasts for 2024 for the third consecutive month, predicting an increase of only 1.93 million barrels per day. As a result, weaker Chinese demand, coupled with fears of oversupply in the global market, has placed downward pressure on the commodity markets, including gold.

Technical Outlook: Gold Approaching Key Resistance

From a technical standpoint, gold is eyeing a critical resistance zone near the $2,685 level, just shy of its all-time high. A break above this mark could set the stage for a further rally toward the $2,700 psychological barrier. Conversely, any pullback could find support at $2,650, with more substantial support at the $2,600 level. A breach below these levels could trigger a sell-off, though the broader market sentiment remains bullish.

The Road Ahead: Key Data to Watch

As the market awaits key US economic data, including retail sales and industrial production numbers, traders will be closely watching for signals on the Federal Reserve's next moves. Should the data surprise to the upside, it could bolster the case for additional rate cuts, providing further support for gold prices. However, any indication of economic resilience could temper expectations of aggressive easing, keeping the dollar strong and limiting gold’s upside potential.

In summary, while geopolitical tensions and risk-off sentiment are driving gold prices higher, the strength of the US Dollar and bond yields remain crucial factors that could limit further gains. Nevertheless, gold continues to be an attractive asset amid global uncertainty, with potential to breach the $2,700 mark in the near future.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex