Gold Market Outlook 2024: Economic Indicators and Federal Policies

Assessing the Future of Gold Prices: Technical Analysis, US Treasury Yields Impact, and Fed's Policy Directions | That's TradingNEWS

Analyzing Gold's Market Dynamics as 2024 Approaches

Current State of Gold Prices

As we edge into 2024, gold prices are exhibiting a resilient uptrend, hovering around $2035 per ounce after a recent surge that overcame the critical $2000 resistance level. This week's modest rise of 0.2% adds to a commendable year-to-date increase of 12%. The sister commodity, silver, mirrors this upward trend, with futures cresting at $24.485 per ounce, marking a 1.5% weekly and 1.3% annual rise. These movements in the precious metals market are intricately linked to the fluctuations in US Treasury yields and the US dollar's strength.

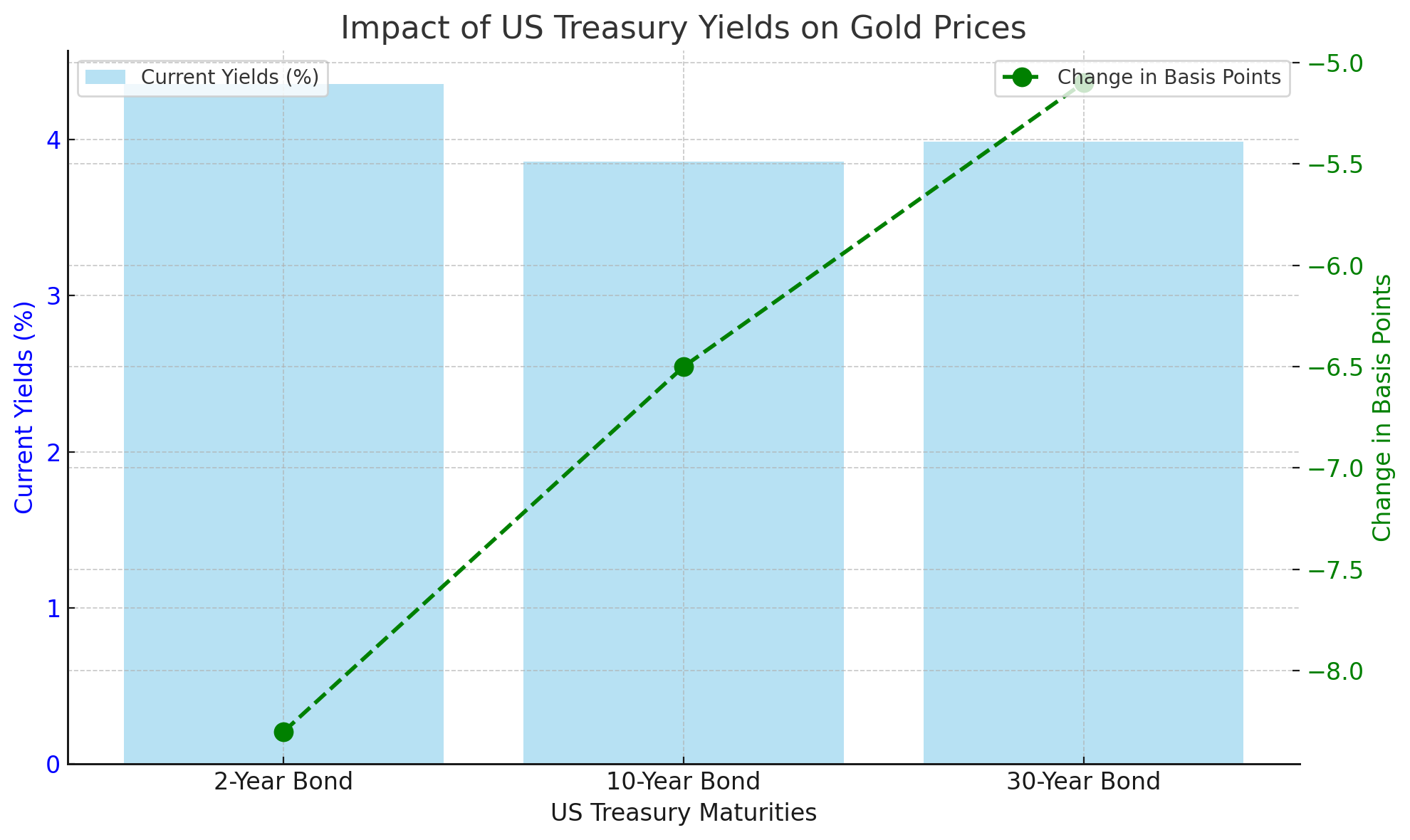

Influence of US Treasury Yields and the Dollar

The decline in US Treasury yields has been a notable factor bolstering gold's appeal. Specifically, we observed a dip in yields across various maturities - the 10-year bonds fell by 6.5 basis points to 3.857%, two-year bonds by 8.3 basis points to 4.354%, and 30-year bonds by 5.1 basis points to 3.985%. This decline in yields reduces the opportunity cost of holding non-yielding bullion, thus enhancing gold's attractiveness. Simultaneously, the US dollar index (DXY) experienced a slight uptick to 102.42, though it remains down by 0.45% this week and over 1% for the year. A weaker dollar generally benefits dollar-denominated commodities like gold, making them more affordable for foreign investors.

Short-Term Gold Price Projections

Amidst global economic uncertainties, gold could find support from potential stock selloffs. However, the Federal Reserve's tone in the December FOMC meeting suggests a more cautious stance, leading to a predicted short-term trading range for gold between $1950 and $2150.

Upcoming Economic Indicators

The market eagerly anticipates the release of the US Personal Consumption Expenditures (PCE) price index, a critical inflation gauge for the Federal Reserve. This data will likely influence short-term price dynamics for gold and other metals. For instance, copper and platinum futures are currently positioned at $3.88 and $966.90 per ounce, respectively, while palladium has dropped to $1212.50 per ounce.

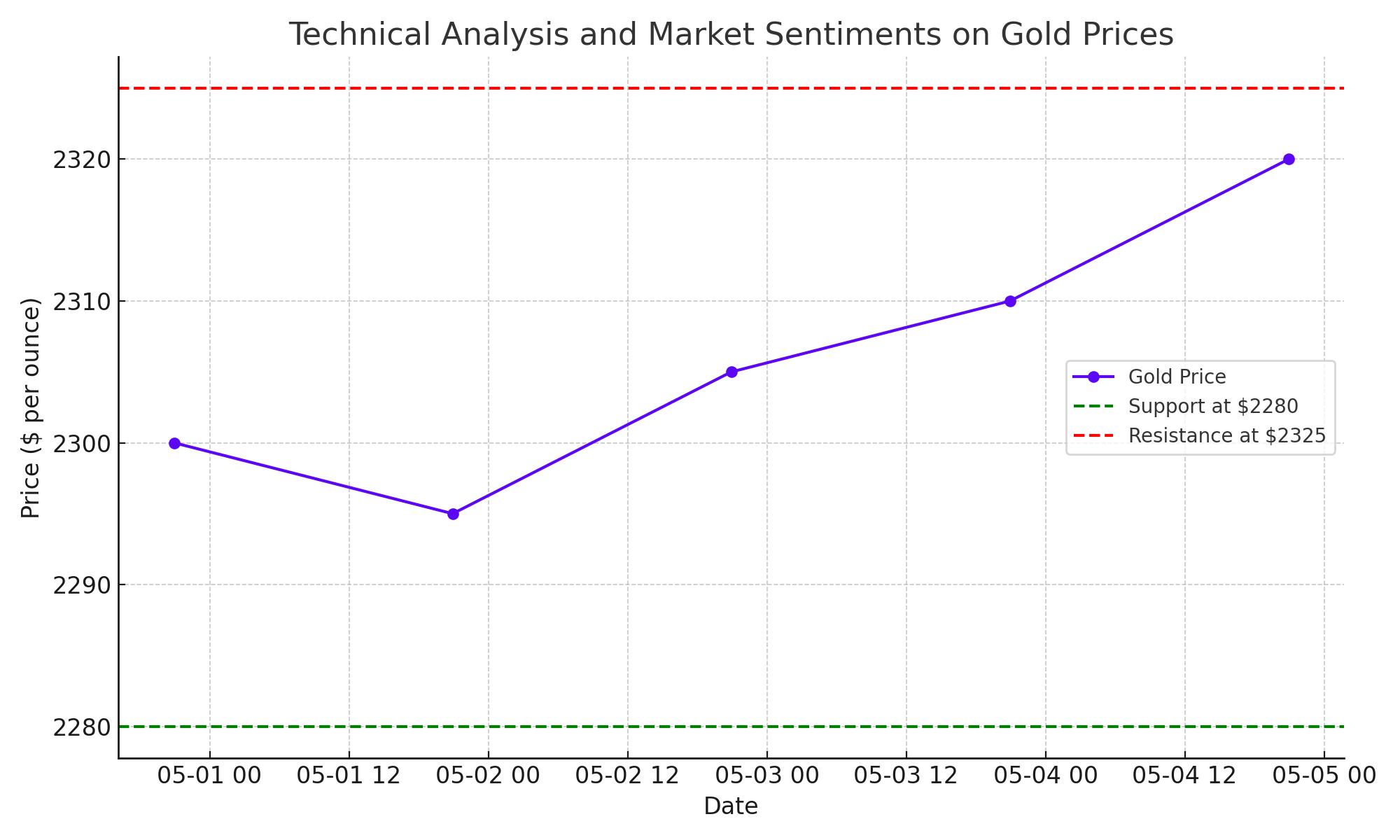

Technical Analysis of Gold Prices

From a technical standpoint, gold's trajectory (XAU/USD) remains bullish, with its steadfast position above the $2000 mark reinforcing this sentiment. Potential catalysts for further price escalation include a weaker US dollar, heightened global geopolitical tensions, and increased central bank purchases of gold. Conversely, a downward shift could be triggered if gold approaches the support level of $1985 per ounce.

Market Sentiment and Technical Indicators

The daily Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) histogram suggest an underlying buying pressure, though a pause in momentum is indicated by their flat trajectory. Gold maintains a bullish stance across larger timeframes, as evidenced by its position above the 20, 100, and 200-day Simple Moving Averages (SMAs).

Support and Resistance Levels

For traders and investors, key levels to watch include support at the $2020 (20-day SMA), $2000, and $1980 marks, and resistance at $2040, $2050, and $2070.

Looking Ahead: The Fed’s Core PCE and Gold's Outlook

The impending release of the Fed’s Core PCE Price Index is crucial. A forecasted decline in the November Core PCE to 3.3% from October's 3.5% will challenge the Fed's stance on maintaining current interest rates. Gold, trading around $2036/oz, seeks strong drivers for further movement. Friday’s PCE release could be pivotal, potentially steering gold towards $2070/oz and beyond. Conversely, support levels at $2023/oz (20-day SMA) and $2009/oz may come into play if the market does not receive the expected stimulus.

Fed's Influence and Gold's Prospects

Despite Fed officials pushing back against rate cut expectations for 2024, market sentiment remains unfazed, with the probability of rate reductions looming. A dovish Fed pivot continues to suppress US Treasury bond yields and the dollar, favoring gold prices. Any indications from the upcoming PCE data supporting softer inflation could escalate March rate cut prospects, further boosting gold.

Conclusion: Gold's Path Forward

Gold’s future trajectory hinges on key economic indicators and market perceptions of the Fed's policy direction. The technical analysis suggests an upward path, but the metal needs significant catalysts to break through current resistance levels and target new highs. Investors and market watchers should closely monitor the upcoming PCE data and broader economic trends to gauge gold’s direction in the evolving financial landscape.

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex