Gold’s Path to $3,000: Key Drivers Fueling a New Bull Market Surge

From central bank purchases to market volatility, explore the forces propelling gold to new heights and why demand shows no signs of slowing down | That's TradingNEWS

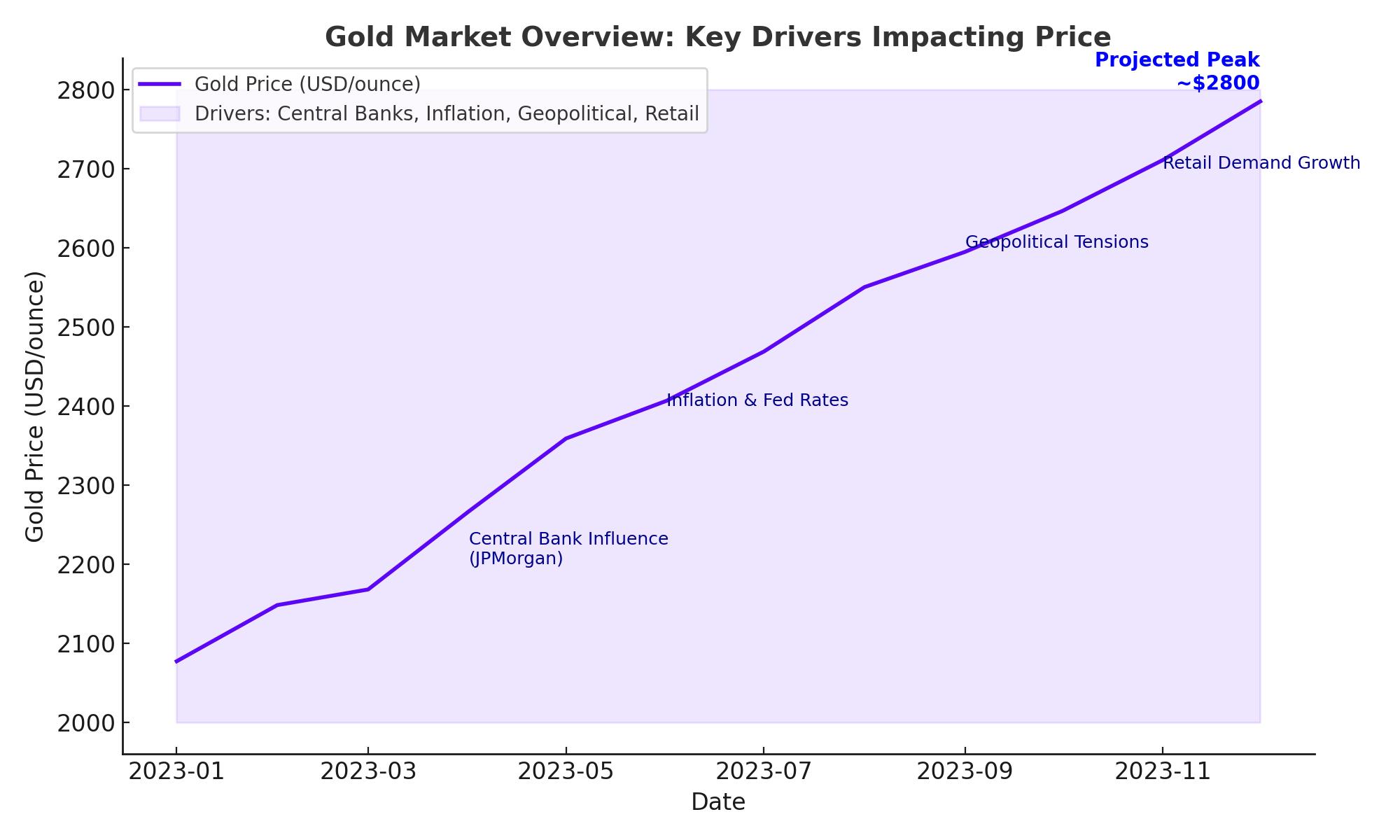

Gold Market Overview: Key Drivers, Trends, and Projections

Surging Demand and Accessibility Amid Economic Uncertainty

Gold's allure as a safe-haven asset has dramatically resurged since 2023, fueled by economic turmoil, inflationary pressures, and increased accessibility through retailers like Costco. Amid a backdrop of high inflation and Federal Reserve interest rate hikes, gold has become increasingly attractive to both institutional and retail investors. In September 2023, inflation was near a decade high, and interest rates reached their peak in over two decades, prompting many to seek refuge in gold's stability.

Gold's price performance over the year underscores this demand surge. Starting at $2,063.73 per ounce on January 1, 2023, gold prices have climbed nearly 33%, nearing $2,800 per ounce as the year concludes. This price rise suggests strong market fundamentals and continued investor interest, as economic uncertainty persists.

Analysis of Central Bank Influence and Macro-Economic Impacts on Gold

Gold has also seen robust demand from central banks, who view it as a safeguard against currency depreciation and global financial instability. JPMorgan's analysis highlights that large-scale purchases by central banks have significantly reshaped gold’s price relationship with interest rates, particularly since 2022. The report indicates that every 100 tonnes of central bank demand can elevate gold prices by approximately 2.4%. This increase has been notably impacted by emerging market economies, such as China, whose central bank gold holdings now represent roughly 5% of reserves.

These purchases also align with recent global trends, where the freezing of Russian central bank assets post-Ukraine invasion has driven other emerging markets to bolster gold reserves, as they seek to reduce dependency on Western assets and bolster financial security.

Geopolitical Tensions and Their Effect on Gold’s Price

Geopolitical instability, such as ongoing conflicts in the Middle East and the US election cycle, continues to support gold’s appeal. For instance, uncertainty surrounding the upcoming US presidential election and its implications for foreign policy have reinforced gold’s role as a stable asset. Traders are especially watchful of these developments, as surprising outcomes could spur market volatility, further driving gold demand.

Gold has historically responded positively to such instabilities, as investors often prefer hard assets over riskier financial instruments in turbulent times. Thus, any unexpected election outcome or escalation in global conflicts could reinforce gold's upward trajectory, potentially pushing it toward or even above the $2,850 mark in the short term.

The Role of Inflation and Federal Reserve Policies on Gold

Inflationary concerns remain a central factor for gold prices. Even with inflation cooling, the Federal Reserve’s anticipated rate cuts have sustained gold's attractiveness. Current market sentiment anticipates a 25 basis point rate cut from the Fed, a decision that could further buoy gold prices by reducing the dollar's relative strength and enhancing the appeal of non-yielding assets like gold.

Additionally, the latest US non-farm payrolls report shows minimal growth, with just 12,000 new jobs in October. This stagnation, the weakest since December 2020, has intensified expectations of rate cuts and driven demand for assets like gold. The unemployment rate remains stable at 4.1%, supporting the notion that the US economy is facing structural challenges that may keep rate cuts on the Fed’s agenda, which is beneficial for gold prices.

Technical Analysis: Key Support and Resistance Levels

Gold's technical indicators also reflect a favorable landscape for further growth. Currently trading around $2,740, gold's positive trajectory has been supported by the 100-day Exponential Moving Average (EMA), with the 14-day Relative Strength Index (RSI) holding strong near 60. Analysts are watching for gold to reclaim $2,746 on a daily closing basis, which would signal potential upward momentum toward the previous all-time high of $2,790.

However, if gold prices fall below $2,730, technical support at $2,718 and $2,700 could be tested. Sustained breaks below these levels could imply a short-term bearish trend, though the long-term outlook remains optimistic due to underlying market conditions.

The Retail Boom: Accessibility and Its Effect on Gold Prices

Gold’s availability through large retailers like Costco has democratized access to the asset, creating new demand streams. While traditionally held by governments and financial institutions, gold is now increasingly owned by individual investors who see it as a hedge against inflation and economic volatility. Retail gold purchases have added an unprecedented layer of demand, as Costco’s gold stocks frequently sell out upon restocking, signaling robust consumer interest.

This shift in distribution from institutional monopolies to everyday consumers marks a notable change in the gold market, as a larger percentage of stock now rests in the hands of private investors. This diffusion of gold ownership, combined with central bank acquisitions, could support gold prices even in the face of fluctuating institutional demand.

Economic Data from the Philippines: Reflecting Gold's Global Appeal

The rise in gold prices isn’t limited to Western markets. In the Philippines, gold reached PHP 5,133.22 per gram, and PHP 159,661.10 per troy ounce, marking a steady increase from previous days. This price strength in international markets reflects the universal appeal of gold, particularly as currency fluctuations drive investors worldwide to seek stable assets.

The Philippine market’s strong response mirrors similar patterns globally, where economic concerns and currency instability make gold an attractive investment. This widespread demand further solidifies gold's position as a globally recognized store of value, transcending individual economies and monetary systems.

Central Bank and Institutional Predictions: Projected Long-Term Growth

Major financial institutions continue to advocate for gold as a reliable long-term investment. JPMorgan's research points to a positive outlook for gold prices irrespective of the US election outcome, suggesting that even short-term volatility could create buying opportunities. If the Republican Party were to win, gold prices could see a boost of 7-10% over the next two quarters. Conversely, a win for Kamala Harris may cause a brief dip of 2-3%, but the overall trajectory remains upward.

In the context of ETFs, investment demand could stay elevated, supported by expected interest rate cuts and high fiscal deficits. Central bank buying is expected to remain strong, though perhaps not at the same intensity as previous years, with an estimated annual addition of 100 tonnes or more, enough to positively impact gold prices.

Short-Term Price Volatility and Expert Predictions

As the US heads into a decisive election week, gold traders are bracing for heightened price swings. PredictIt places Harris with a slight lead at 51%, while Trump follows closely at 49%. This tight race amplifies market uncertainty, increasing demand for safe-haven assets like gold. Analysts forecast gold's immediate support levels at $2,720-$2,705, with resistance at $2,754-$2,770. Should gold prices dip below these support zones, experts suggest waiting for corrective pullbacks before establishing new positions, as long-term fundamentals remain solidly bullish.

Key Events: US Election and Federal Reserve’s Decision

The upcoming US election and Federal Reserve’s policy announcement are pivotal for gold’s near-term performance. With the market fully pricing in a 25-basis point rate cut, gold stands to benefit if the Fed meets these expectations. Additionally, geopolitical tensions and central bank buying patterns remain vital influences that could sustain upward pressure on gold prices.

Investors should monitor these developments closely, as the outcome of the US election will set the tone for economic policies that could impact inflation, the US dollar, and bond yields—all crucial factors for gold’s price movements.

Global Defense Spending and Geopolitical Climate as Long-Term Gold Drivers

Gold has benefitted from increased military spending, particularly in Europe, where defense budgets are rising in response to geopolitical tensions. European Union defense spending increased 4.5% from 2022 to €280 billion, with a projected rise to €350 billion in 2024. This geopolitical landscape underscores gold's safe-haven appeal and may further elevate its demand in the coming years as defense expenditures continue to rise.

Gold’s role as a hedge against geopolitical instability is further solidified by long-term trends, including commitments by the European Union to increase domestic defense procurement. These factors reinforce the broader, sustained demand for gold, as nations and investors alike seek financial security in an uncertain world.

Conclusion: Strategic Outlook for Gold Investors

Gold’s current market dynamics indicate a strong bullish outlook for both short- and long-term investors. Central bank demand, geopolitical tensions, and economic uncertainties surrounding the US election and Federal Reserve policies are all factors bolstering gold's appeal. As long as these drivers remain active, gold is likely to retain its upward momentum, making it an appealing asset for those seeking a reliable hedge.

Investors should continue monitoring macroeconomic events and technical support levels to make informed decisions. Gold’s resilience through economic challenges and its adaptability to new market trends, such as retail accessibility, position it as a critical asset in today’s global financial landscape. With the potential for prices to surge above $2,800 in the near term and the support of strong institutional and retail demand, gold remains a compelling investment choice in the face of ongoing global uncertainty.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex