Gold Poised for Further Gains: Central Banks, Geopolitics, and Industrial Demand Fuel Rally

Why savvy investors are turning to gold as a safe haven amidst global instability and increasing demand from both institutions and industries | That's TradingNEWS

Gold Prices Amid Global Market Volatility

The gold market has been experiencing significant fluctuations recently, influenced by various economic and geopolitical factors. As of the latest data, gold prices in the Philippines dropped slightly, with the price per gram standing at PHP 4,548.67, down from PHP 4,555.94 the previous day. Similarly, the price per tola decreased to PHP 53,054.75 from PHP 53,139.59. These changes reflect broader trends in the global gold market, where the metal has recently seen a mix of bullish momentum and cautious trading.

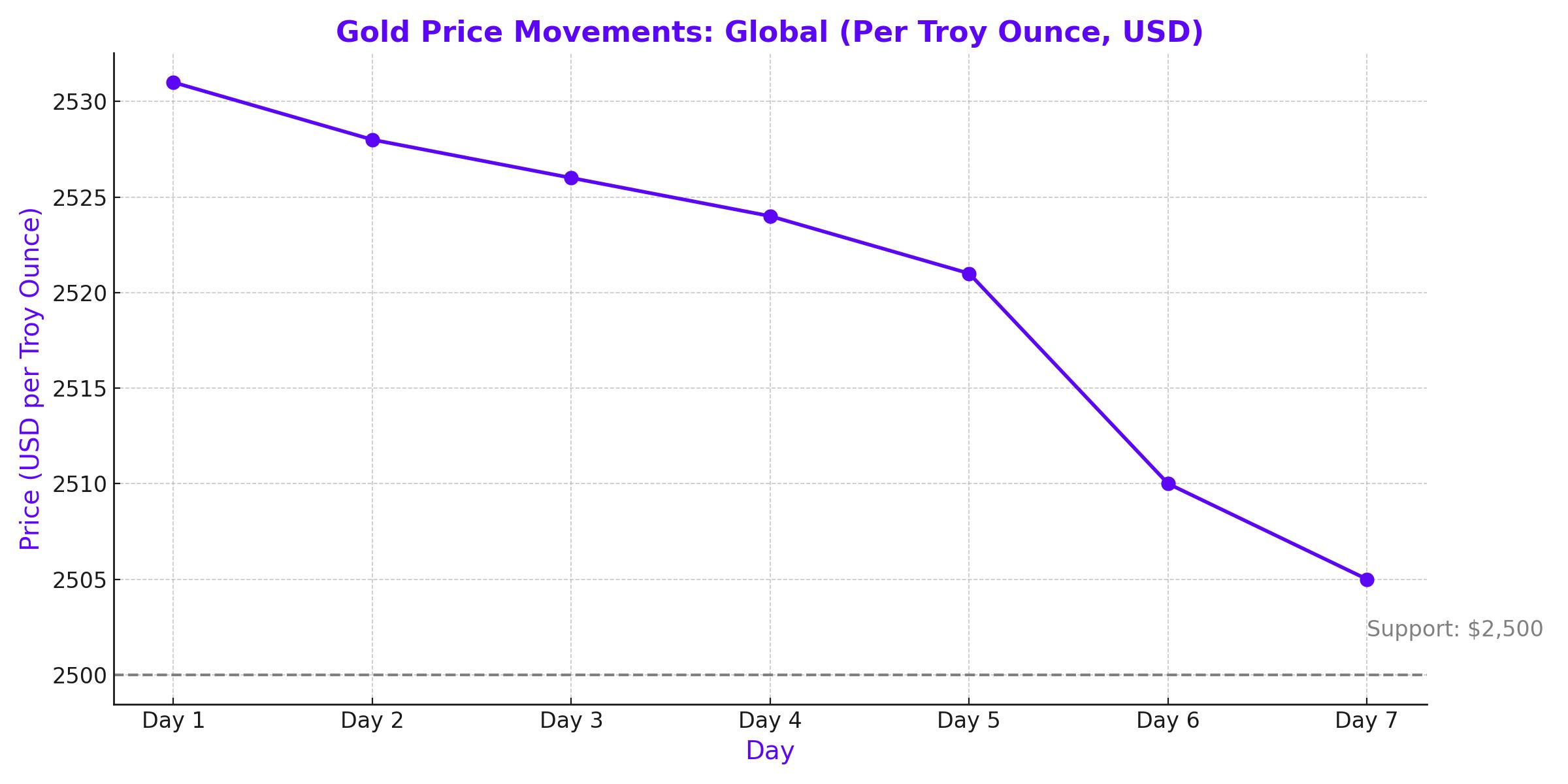

In the global arena, gold peaked at $2,531 per Troy ounce last week before edging back to $2,505. This slight decline was partly due to reduced expectations for a sharp interest rate cut by the U.S. Federal Reserve at its upcoming September meeting. The market's anticipation for a half-point rate cut dropped to 28%, down significantly from the 85% odds seen earlier this month.

Impact of U.S. Economic Indicators on Gold

The U.S. economy plays a critical role in shaping gold prices worldwide. The Commerce Department's report on durable goods orders showed a robust increase of 9.9% in July, surpassing expectations of a 4.0% rise. However, when stripping out volatile transportation items, core durable goods orders fell by 0.2%, indicating some underlying weaknesses in the economy.

This mixed economic data has kept the gold market in a state of flux. The Federal Reserve's focus on the labor market and inflation rates, as indicated by Fed Chair Jerome Powell, suggests that monetary policy could continue to influence gold prices significantly. With the upcoming PCE inflation data and revised Q2 GDP growth figures, market participants are keenly watching how these indicators will affect the Fed's decisions and, by extension, gold prices.

Geopolitical Tensions and Gold as a Safe Haven

Geopolitical instability remains a key driver of gold prices. Recent escalations in the Middle East, particularly the conflict between Israel and Hezbollah, have heightened gold's appeal as a safe-haven asset. Additionally, ongoing tensions between the U.S. and China, including issues around airspace violations and naval blockades in Southeast Asia, further contribute to the demand for gold during uncertain times.

The situation in Ukraine also continues to influence market dynamics. With Moscow intensifying its attacks on Ukrainian cities and Ukraine claiming control of territories in western Russia, the geopolitical landscape remains volatile. Such conditions often lead investors to flock to gold, seeking stability amid global chaos.

Central Bank Buying and Its Influence on Gold Prices

One of the most significant factors supporting gold prices is the continued purchasing by central banks. Countries around the world are increasingly diversifying their reserves away from traditional currencies, favoring gold as a stable store of value. This sustained demand from institutional buyers provides a strong foundation for gold's price trajectory, particularly as we move into the latter part of 2024.

This trend aligns with historical patterns where central bank activities have had a profound impact on gold prices. As central banks continue to accumulate gold, it adds upward pressure on prices, making gold a more attractive investment for both retail and institutional investors.

Technical Analysis: Short-Term Fluctuations and Long-Term Potential

From a technical perspective, gold has shown some short-term weaknesses but retains strong long-term potential. After reaching a peak of $2,531, gold experienced a correction but remained above the critical support level of $2,500. The MACD indicator, with its signal line positioned above zero but trending downward, suggests a potential bearish scenario in the short term. However, the Stochastic oscillator, which is nearing 50 and expected to rise to 80, indicates potential short-term gains before any further decline.

Analysts predict that if gold breaks through the $2,515 resistance level, it could trigger a new wave of buying, pushing prices higher. On the downside, if gold falls below the $2,494 support level, it could lead to a sell-off, targeting lower support zones around $2,480 and $2,435.

Industrial Demand and Supply Constraints

Beyond its role as a financial asset, gold's industrial demand continues to grow. The metal's unique properties make it valuable in various high-tech applications, from electronics to medical devices. As industries innovate, the demand for gold in these sectors is likely to increase, providing additional support for gold prices.

Moreover, supply constraints could play a crucial role in sustaining high gold prices. With limited new gold discoveries and increasing challenges in extraction, the cost of production is rising, potentially setting a higher floor for gold prices in the long term.

Market Outlook: What Lies Ahead for Gold Investors

As we approach the end of 2024, several factors suggest that gold prices could remain strong or even increase. Central bank buying, geopolitical uncertainties, and industrial demand all point to a favorable environment for gold. However, the market remains subject to volatility, influenced by a complex interplay of economic indicators, monetary policies, and global events.

For investors, gold continues to offer a hedge against inflation and currency devaluation, making it a valuable addition to diversified portfolios. As always, it's crucial to stay informed and consider both the risks and rewards when making investment decisions in the gold market.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex