Gold Price Outlook: Strength Amid Uncertainty as XAU/USD Targets $2,700

Inflation, Safe-Haven Demand, and USD Impact on Gold (XAU/USD)

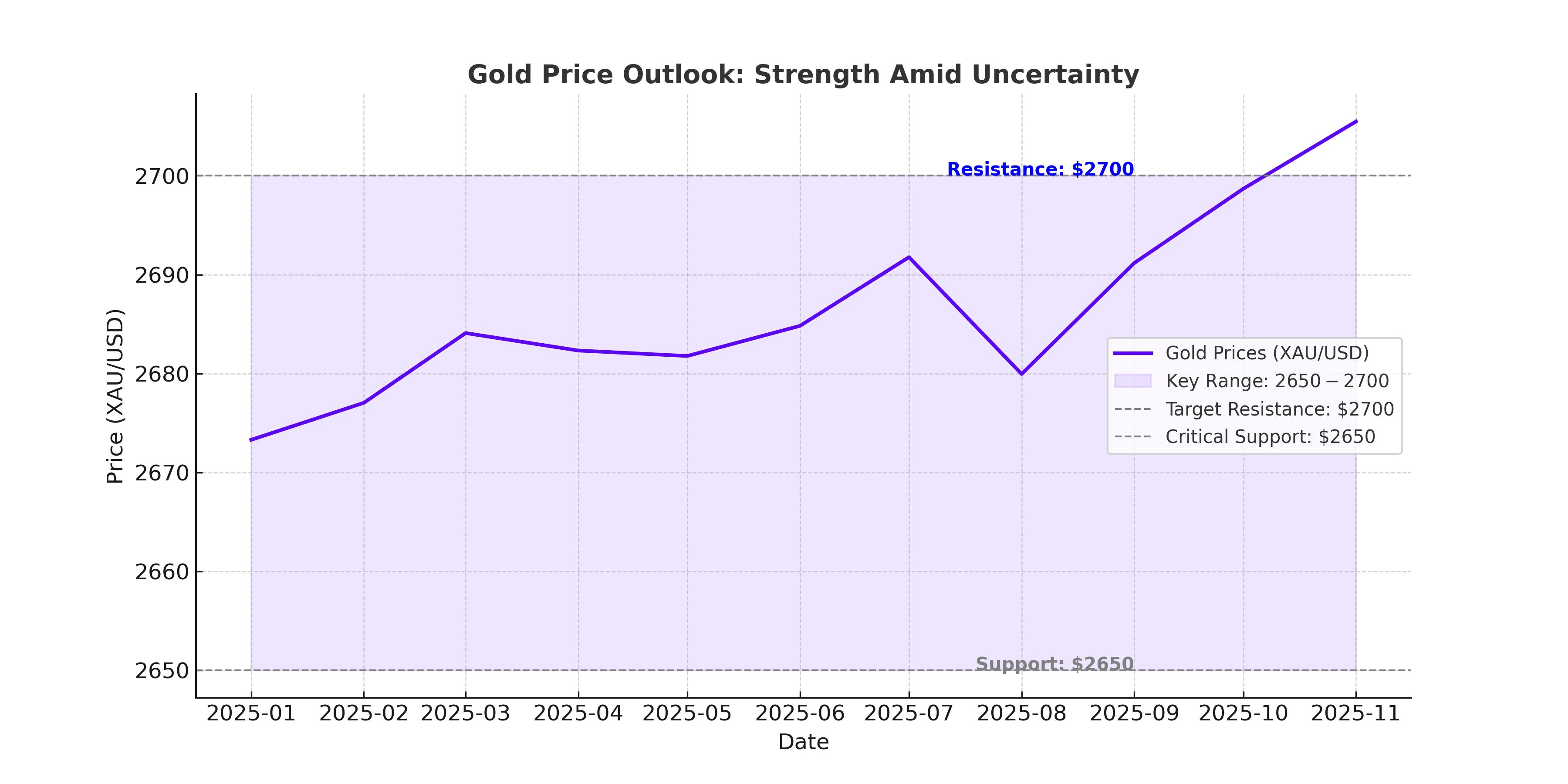

The price of gold (XAU/USD) continues to show remarkable resilience, trading near $2,670 per ounce as of January 2025. This upward momentum comes amid a stronger dollar, high Treasury yields, and inflation concerns spurred by global economic uncertainty and U.S. fiscal policies. Investors are closely monitoring whether gold will sustain its bullish trajectory in the face of rising yields and a strengthening USD.

Despite the U.S. Dollar Index hovering around a two-year high of 109.06, gold prices have remained firm, signaling strong relative strength. The benchmark 10-year Treasury yield touched 4.673%, its highest in months, but gold's steady climb indicates safe-haven demand remains a dominant driver.

Gold's Technical Landscape: Support and Resistance Levels in Focus

Gold futures surged past $2,654, breaking the 55-day Simple Moving Average (SMA) and marking a pivotal moment for traders. The next significant resistance level stands at $2,680, followed by $2,700, which, if breached, could signal a move toward $2,720. On the downside, critical support levels are set at $2,654, $2,632, and $2,612. The Relative Strength Index and MACD also reflect bullish momentum, reinforcing expectations for further gains.

Gold prices are underpinned by their alignment within a rising channel, maintaining support above $2,650—a critical threshold for confirming long-term bullish trends. Analysts emphasize that gold must stay above $2,650 through March 2025 to sustain its secular bull market.

Inflation and Fed Policies: Key Drivers of Gold's Performance

Inflationary fears, amplified by President-elect Donald Trump’s aggressive fiscal reforms and proposed tariffs, are expected to boost gold’s appeal as a hedge against rising prices. The Federal Reserve’s cautious approach to rate cuts, highlighted in the minutes from the December FOMC meeting, further supports gold prices. Officials noted increasing inflation risks due to proposed economic policies, leading to speculation of prolonged higher interest rates.

While high rates typically dampen gold's attractiveness by increasing the opportunity cost of holding the non-yielding asset, the metal’s recent performance defies this norm. The Fed’s emphasis on stabilizing the economy without aggressive rate cuts has inadvertently bolstered gold’s appeal as a safe-haven asset.

Global Demand Trends and ETF Flows

Gold-backed ETFs recorded their first inflow in four years, reflecting renewed investor confidence in the metal. As geopolitical tensions and economic uncertainties persist, institutional and retail investors are turning to gold as a reliable store of value.

Demand from Asian markets remains robust, with China and India—the world's largest gold consumers—maintaining strong purchase volumes. Additionally, the World Gold Council reports an uptick in demand for physical gold, further supporting prices.

Will Gold Reach $3,000 by 2026?

Goldman Sachs recently revised its forecast, predicting gold to reach $3,000 by mid-2026 instead of 2025, citing slower-than-expected Federal Reserve rate cuts. Hedge fund positions on gold have declined to six-month lows, reflecting caution among institutional investors. However, the long-term outlook remains optimistic, driven by inflationary pressures and safe-haven demand.

Short-Term Expectations: Non-Farm Payroll Data and Technical Indicators

Friday’s U.S. Non-Farm Payroll report, expected to show a gain of 160,000 jobs, could influence market sentiment. A stronger labor market might pressure gold prices, while weaker-than-expected data could provide further upside momentum.

Technical analysis indicates that breaking the $2,680 resistance could propel gold toward $2,700 and beyond. However, failure to maintain support above $2,650 could trigger a retracement to $2,600 or lower.

Gold Price Outlook: Buy, Hold, or Sell?

Given current market dynamics, gold appears poised for further gains, making it a strong buy for both short-term traders and long-term investors. The metal's resilience amid high yields and a robust dollar underscores its safe-haven appeal. Investors should monitor inflation trends, central bank policies, and global economic developments to capitalize on gold’s upward momentum.

Key Question: Will Gold Sustain Its Bullish Momentum Amid Rising Yields and a Strong Dollar?

The analysis points to continued strength for gold (XAU/USD) as it navigates challenges posed by rising yields and USD strength. Technical and fundamental indicators suggest the metal is well-positioned to maintain its upward trajectory, with $2,700 remaining a critical level to watch.