Impact of U.S. Inflation Data on Gold Prices

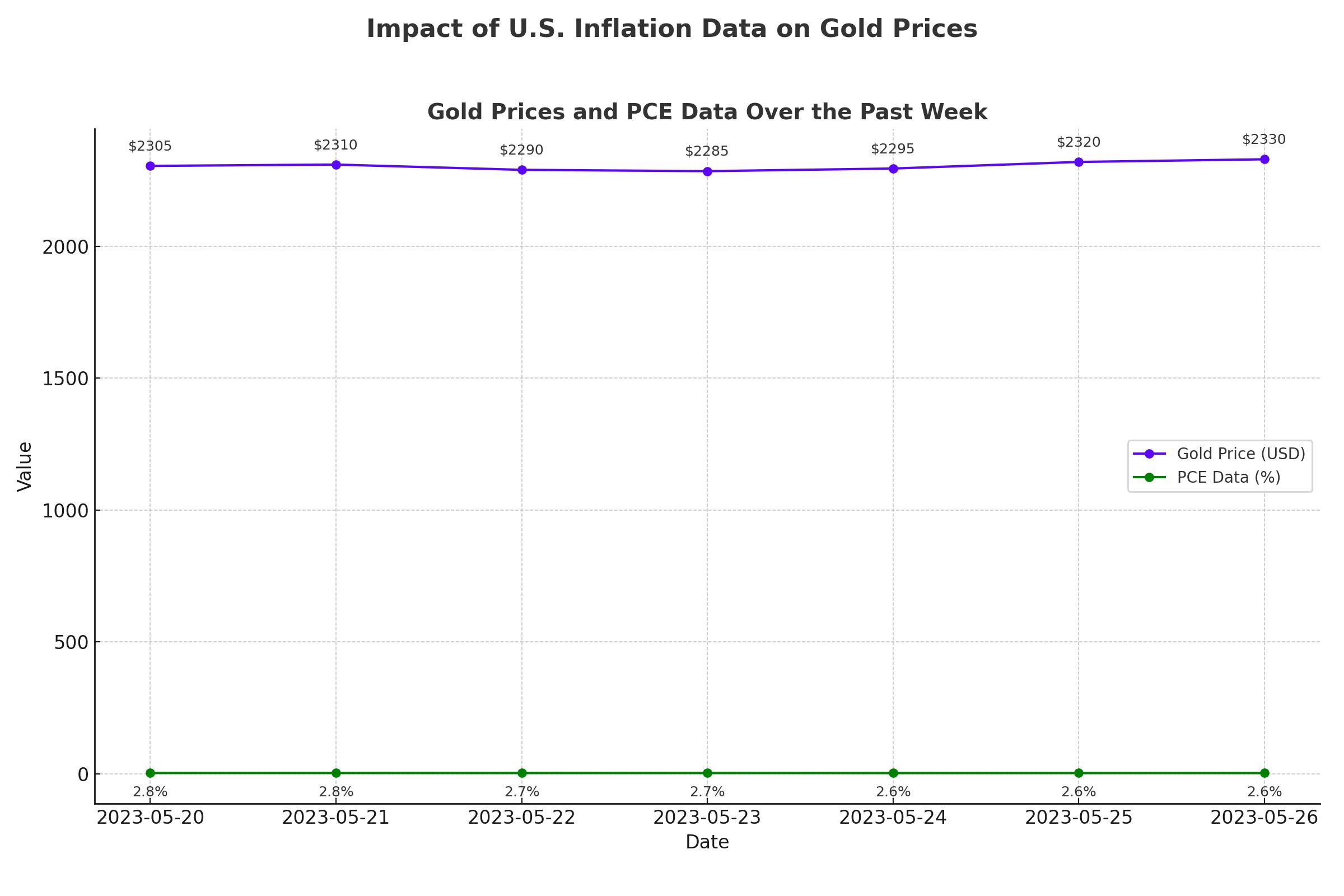

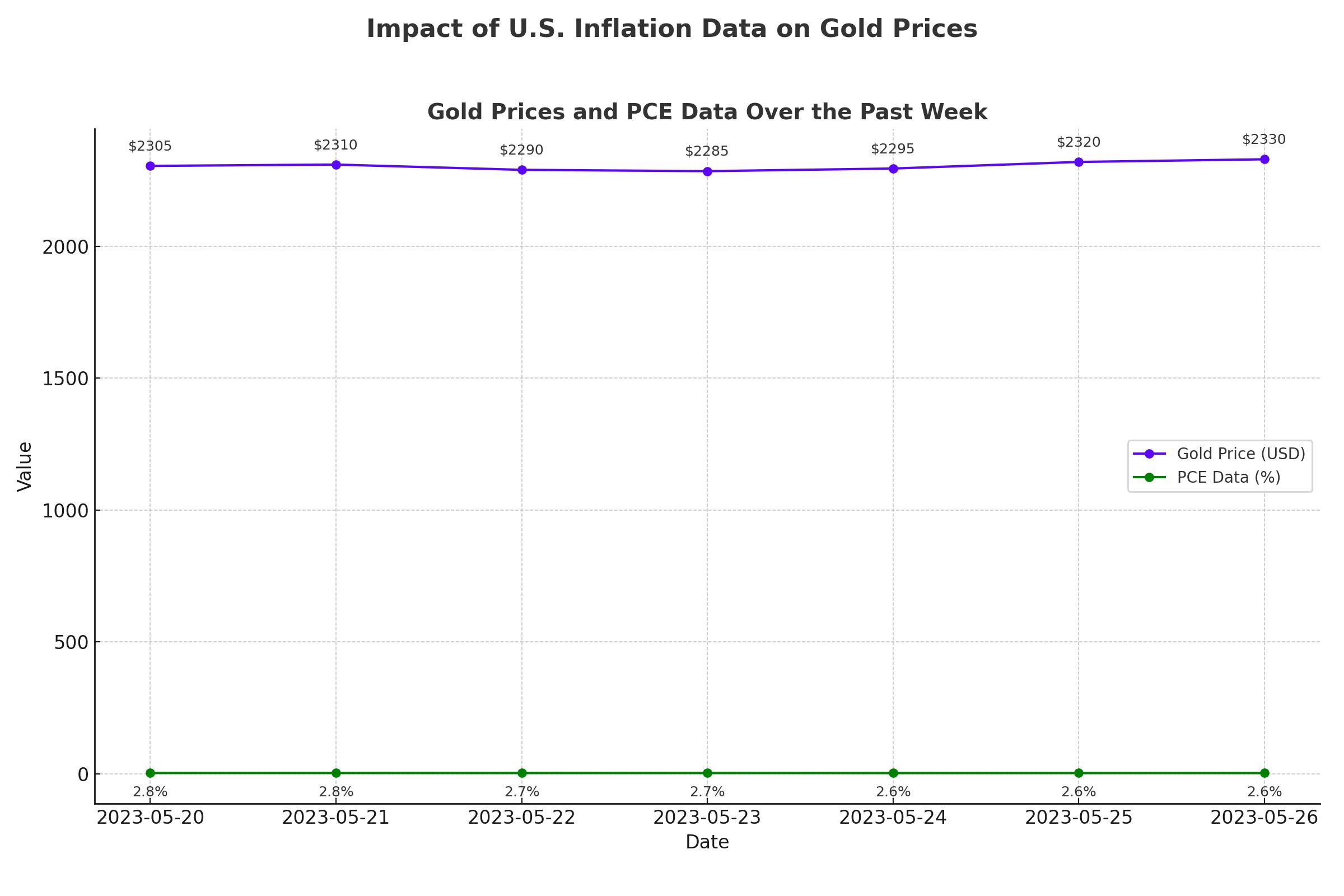

Gold (XAU/USD) surged to trade in the $2,330s on Friday after the release of the U.S. Personal Consumption Expenditures (PCE) Price Index for May. The PCE, the Federal Reserve's preferred inflation gauge, showed a cooling in price rises to 2.6% year-over-year in May from 2.7% previously, aligning with expectations. Core PCE also slowed to 2.6% from 2.8%, indicating that inflation is steadily approaching the Fed's 2.0% target.

Personal spending data rose 0.2% in May, slightly below the forecasted 0.3% increase but up from April's 0.1% rise. The data suggests that the Fed might cut interest rates sooner than expected, which is bullish for gold prices given its status as a non-interest-bearing asset.

Commentary from Fed Officials

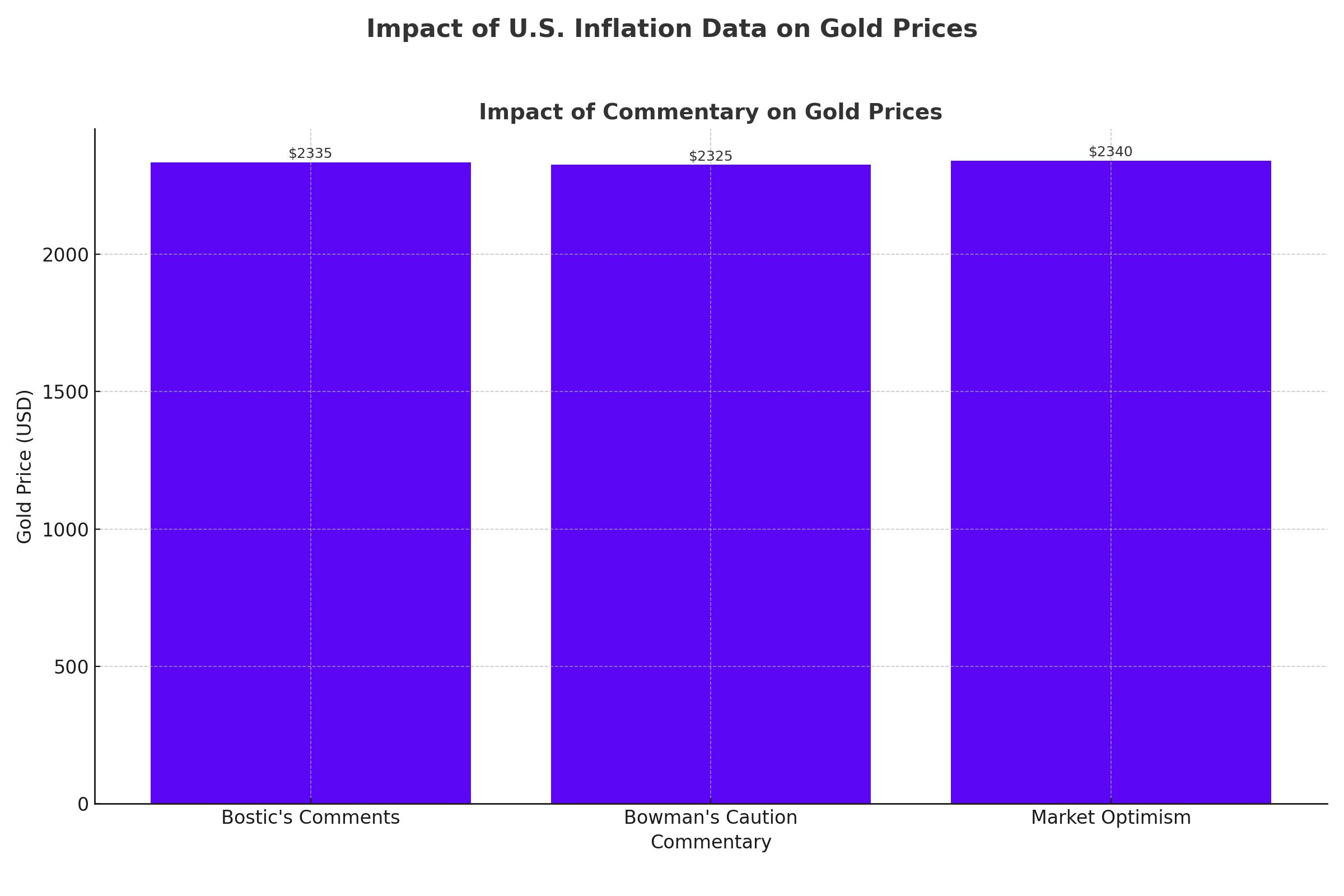

Commentary from Federal Reserve officials has also influenced gold prices. Atlanta Fed President Raphael Bostic mentioned that the Fed has started considering future rate cuts, suggesting a more concrete plan than previous data-dependent statements. Bostic expects an interest rate cut in the fourth quarter, likely followed by four quarter-point cuts in 2025. He downplayed concerns about a weakening labor market and noted signs of cooling in the services sector.

On the other hand, Fed Board of Governors member Michelle Bowman was more cautious, indicating that the Fed is not yet ready to consider rate cuts. Market-based gauges, such as the CME FedWatch tool, indicate a 66% probability of a rate cut at or before the Fed's September meeting, reflecting optimism after the PCE data release.

Long-Term Prospects for Gold

Gold's long-term prospects remain positive, supported by geopolitical uncertainty in the Middle East and Ukraine, climate change, and tech-driven economic challenges. These factors enhance gold's appeal as a safe haven. Despite the complex relationship with the U.S. Dollar (USD), gold demand has been buoyed by Asian central banks hedging against their currencies' devaluation and the BRICS trade confederation using gold as a replacement for the USD in global trade.

Joy Yang, Head of Index Product Management & Marketing at MarketVector Indexes, suggested that these global trends could push gold prices back up to $2,400, especially if the Fed begins cutting interest rates.

Technical Analysis: Gold's Trendline Break and Potential Targets

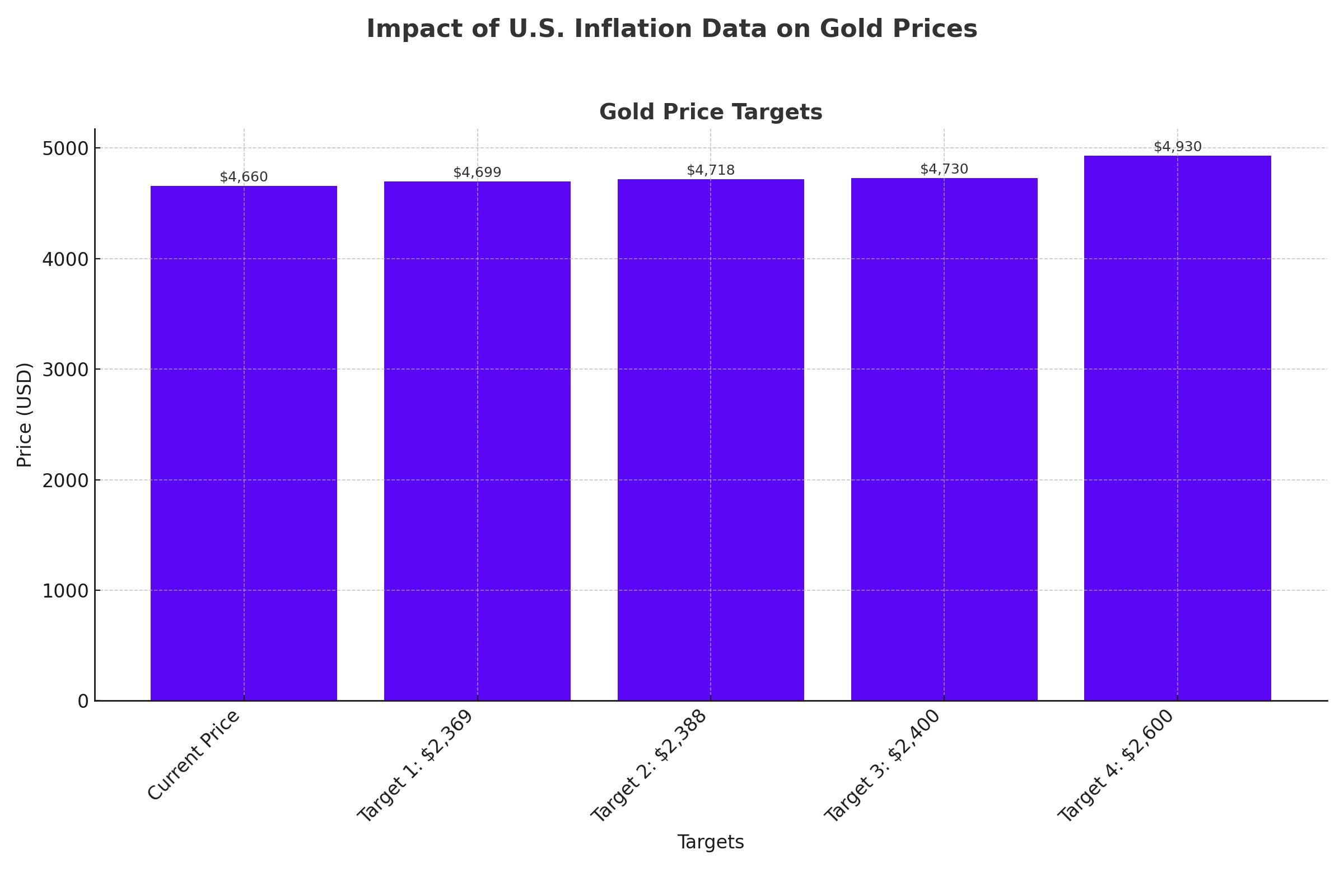

Gold recently broke above a downsloping trendline, invalidating a bearish Head and Shoulders (H&S) pattern that formed during April, May, and June. This break suggests a potential rise to the $2,369 level (the high of June 21), with further bullish targets at $2,388 (the high of June 7). Alternatively, a reversal below the compromised topping pattern’s neckline at $2,279 could target $2,171 and $2,105.

Gold's Steady Performance Amid Market Uncertainty

Gold has maintained solid gains, but prices have not seen new momentum due to the latest inflation data. The U.S. Department of Commerce reported that core PCE increased by 0.1% last month, aligning with expectations. This data supports the case for potential Fed rate cuts, boosting gold's appeal.

Spot gold was steady at $2,328.85 per ounce, with U.S. gold futures rising 0.1% to $2,339.60. Despite benign inflation pressures, the report showed that personal consumption increased by 0.2%, indicating slowing economic activity heading into the second half of the year.

ABN Amro's Cautious Gold Price Outlook

ABN Amro has published a cautious outlook for gold, maintaining a year-end forecast of $2,000 per ounce. Currently, gold costs $2,327.28 per ounce. Georgette Boele, Senior Economist in Sustainability at the bank, highlighted several influencing factors, including central bank policies, U.S. real interest rates, and the strength of the USD.

Boele noted that central bank easing measures and the unusual correlation between rising U.S. real interest rates and higher gold prices are contributing to a complex market environment. She predicted that gold should remain stable against the USD and slightly higher against the euro.

Market Sentiment and Analyst Views

Market sentiment towards gold remains positive, driven by geopolitical tensions, economic uncertainty, and central bank policies. Analysts forecast that gold prices could reach $2,600 by year-end, supported by demand and favorable economic conditions. Traders should monitor economic indicators and Fed policy signals to adjust their positions effectively.

That's TradingNEWS