Gold Prices Climb on Fed Rate Cut Speculation and Political Uncertainties

Growing bets on a September Fed rate cut and geopolitical tensions drive gold prices higher, while China's pause in gold purchases introduces market volatility | That's TradingNEWS

Fed Rate Cut Speculation Fuels Gold Price Surge

Impact of Potential Federal Reserve Rate Cuts

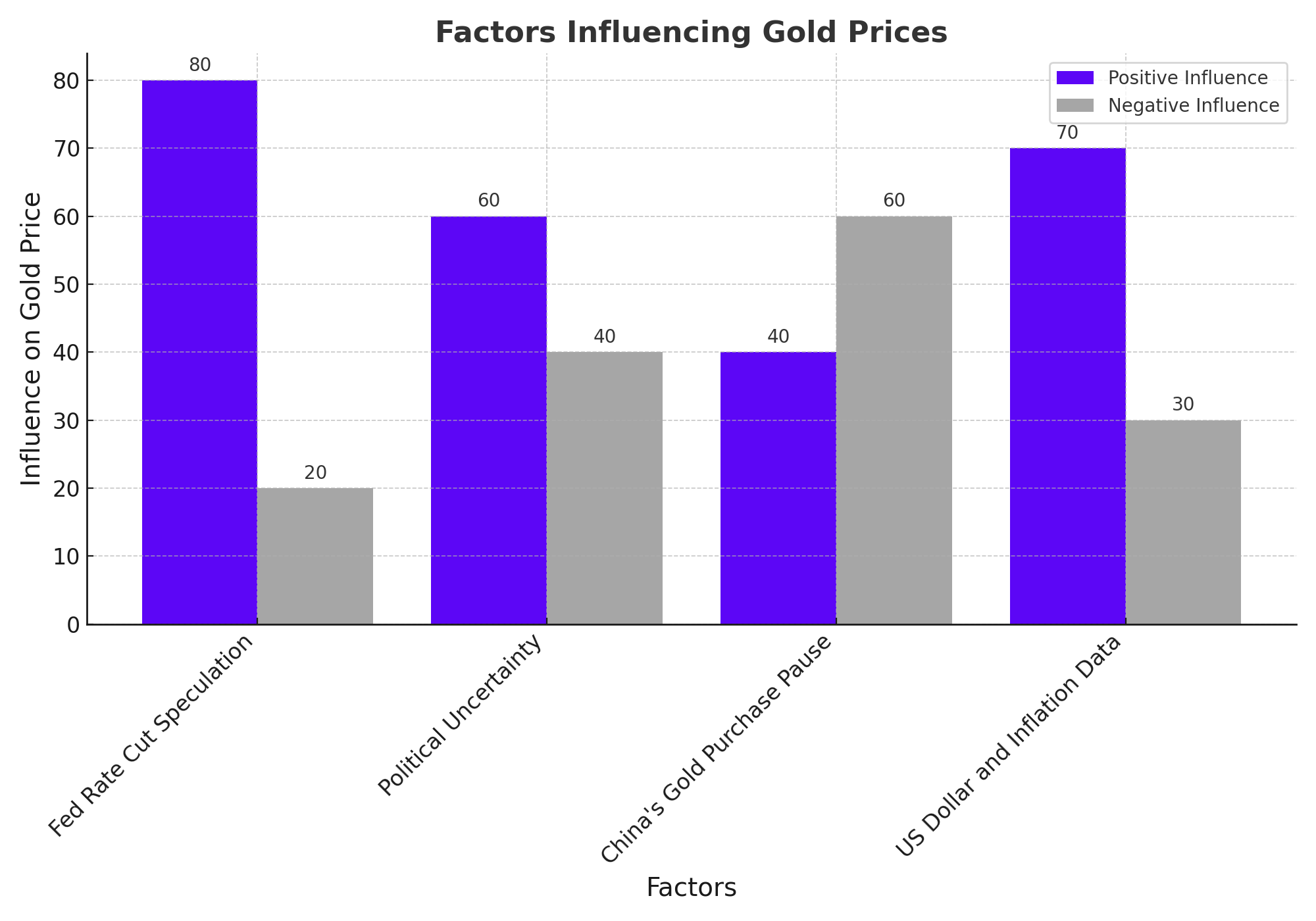

Gold (XAU/USD) prices gained momentum during the early European session on Wednesday, driven by increasing speculation that the US Federal Reserve (Fed) may start cutting rates as early as September. This potential policy shift supports the non-yielding metal, traditionally seen as a safe-haven asset. Market participants are pricing in a 74% chance of a Fed rate cut in September, up from 71% the previous Friday, according to the CME FedWatch tool.

Political Uncertainty and Its Influence on Gold

Political uncertainties within Europe and globally continue to bolster gold prices. Investors are particularly focused on the ongoing testimony by Fed Chair Jerome Powell, who emphasized the need for more substantial data to justify rate cuts. His remarks have been pivotal, highlighting that holding interest rates too high for too long could jeopardize economic growth.

China's Gold Purchase Pause and Market Implications

China's central bank has paused its gold purchases for the second consecutive month, maintaining its holdings at 2,264 tonnes. This development might prompt traders to reduce bullish bets on gold, considering China is the world's largest gold consumer. However, the anticipation of US CPI inflation data on Thursday could provide more clarity on the US interest rate path, potentially offsetting the impact of China's purchasing decisions.

Gold Price Technical Analysis

Current Trading Dynamics

Gold trades with a positive bias following a break above a descending channel, maintaining its uptrend above the 100-day Exponential Moving Average (EMA). The 14-day Relative Strength Index (RSI) stands in the bullish zone around 55.0, indicating continued upward momentum.

Key Resistance and Support Levels

The $2,400 psychological level acts as a crucial resistance for gold. Sustained trading above this level could set the stage for a retest of the all-time high at $2,450. On the downside, trading below $2,340, a former resistance level, could attract bearish demand, targeting $2,318 and further down to $2,274 (the 100-day EMA).

Market Reactions to Powell's Testimony

Gold and Silver Price Movements

During Fed Chair Jerome Powell's testimony before the US Senate Committee on Banking, Housing, and Urban Affairs, gold and silver prices experienced volatility. Gold was down $2.31 at $2,359 per ounce, while silver dipped $0.09 to $30.76 per ounce. Powell's cautionary stance on the timing of interest rate cuts influenced these price movements.

Investor Sentiment and Market Speculation

Investors closely monitored Powell's remarks for clues supporting an interest rate cut. Despite noting "considerable progress" in bringing inflation down, Powell emphasized the risks of adjusting policy too quickly, suggesting a balanced approach to future rate decisions. This cautious outlook has kept market speculation high, with traders looking towards upcoming CPI data for further insights.

Broader Market Impacts

US Dollar and Inflation Data

The US dollar index rose by 0.02% to 105.02, reflecting cautious optimism amid mixed signals from economic data. The upcoming CPI data is expected to show modest monthly gains, with headline prices projected to rise by 0.1% and core prices by 0.2%, translating to annual gains of 3.1% and 3.4%, respectively.

China's Economic Indicators

Recent data from China showed that small-business confidence increased to a six-month high in June, though inflation worries persist. Gold prices remained steady, hovering around $2,365.09 per ounce, as markets await clearer signals from both the Fed and China's economic performance.

Insider Transactions and Market Speculation

Strategic Moves by Key Players

Occidental Petroleum (NYSE: OXY) recently signed a significant deal with Microsoft for the sale of 500,000 tons of carbon removal credits from a new carbon capture facility. This strategic partnership highlights the growing importance of sustainable practices in the energy sector and its potential impact on related commodities, including gold.

Conclusion: The Path Forward for Gold

Despite the temporary setbacks and fluctuations driven by macroeconomic factors and geopolitical events, gold maintains a bullish outlook in the medium to long term. The interplay between Fed policies, global political uncertainties, and China's economic activities will continue to shape the precious metal's trajectory. Investors should closely monitor these developments, as well as technical indicators, to navigate the evolving market landscape effectively.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex