Gold Prices Dip Below $2,500: Analyzing Market Pressures and Long-Term Outlook

Despite recent declines, gold maintains bullish momentum with expectations of a surge driven by geopolitical tensions, Federal Reserve policies, and sustained global demand | That's TradingNEWS

Gold Price Analysis: Impact of Macroeconomic Factors and Market Sentiment

Current Market Overview and Price Movements

Gold prices have been under notable pressure in recent trading sessions, with the price per ounce falling below the significant $2,500 mark to trade at $2,494 in the spot market. This marks the third consecutive day of decline, as the market anticipates critical U.S. economic data, particularly the PMI and Nonfarm Payrolls (NFP). Despite this recent dip, gold remains resilient with a year-to-date gain of 20.8%, reflecting its underlying bullish momentum in the broader economic context.

The U.S. Dollar and its Influence on Gold Prices

The U.S. dollar has regained strength following recent U.S. macroeconomic data, which has mitigated fears of a potential recession. This resurgence in the dollar has significantly dampened the safe-haven appeal of gold, contributing to the current downward trend in prices. As of now, the market is poised to react further based on the upcoming NFP report, which is expected to provide critical insights into the Fed's next move on interest rates.

The latest data from the Personal Consumption Expenditures (PCE) index suggests that inflation is under control, bolstering expectations that the Federal Reserve will cut interest rates after its mid-September meeting. However, the extent of these cuts remains uncertain and will likely hinge on the forthcoming NFP data, which could keep gold prices range-bound in the short term.

Technical Analysis and Price Levels

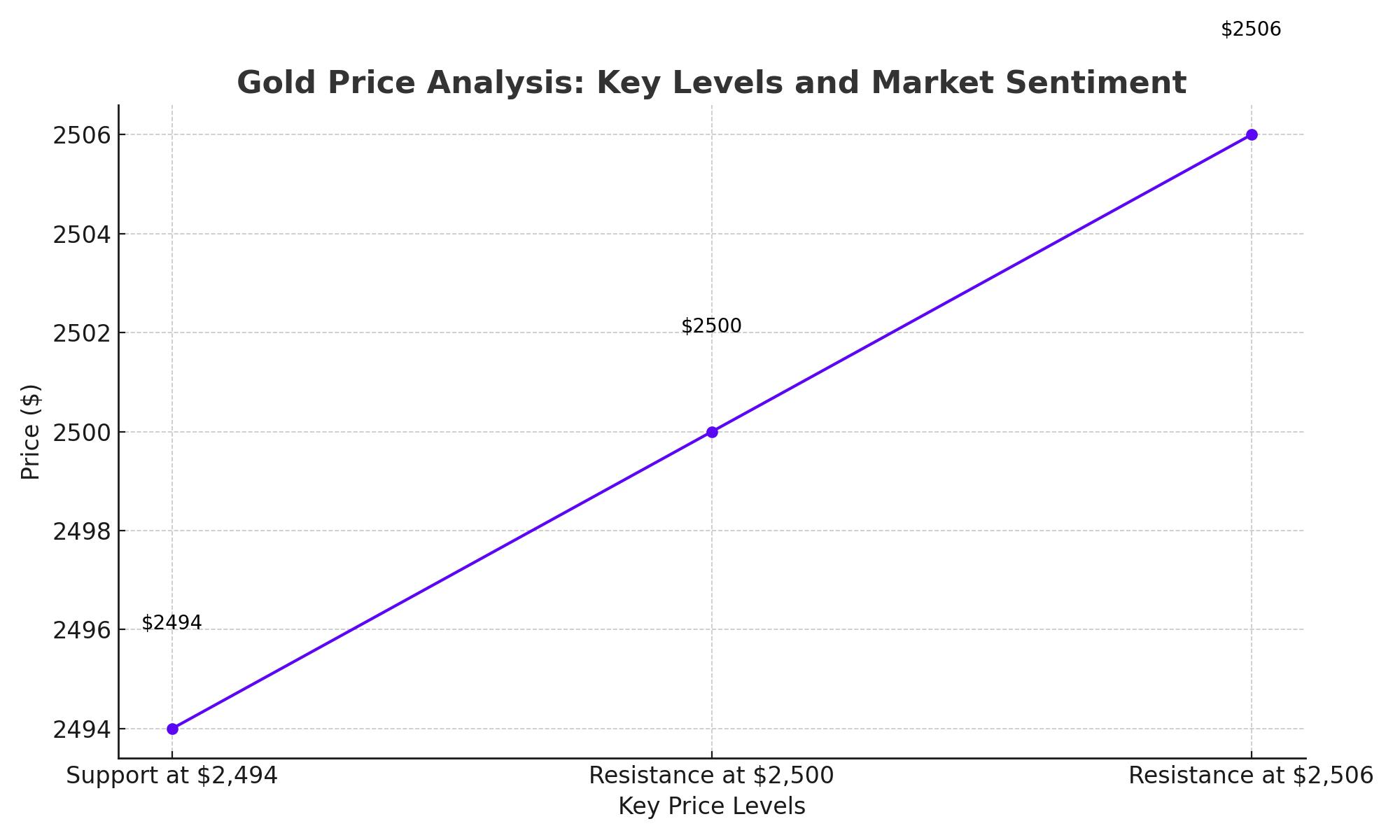

Gold’s price dynamics reveal a strengthening of the downside trajectory, as indicated by momentum indicators. The price has consistently traded below the Volume Weighted Moving Average (VWMA) on the 2-hour chart, with the VWMA currently positioned at $2,498. This level acts as a significant resistance point, suggesting that any movement above this could reignite bullish momentum.

On the 30-minute chart, the $2,500 level remains a critical resistance. Should prices fail to breach this threshold, gold could test the first support at $2,494, with the potential for further declines to $2,490 if bearish control persists. Conversely, a move above $2,500 could see gold testing the first resistance at $2,506, and potentially challenging the $2,511 mark, should buying momentum strengthen.

Geopolitical Factors and Their Role in Gold's Performance

Ongoing geopolitical tensions, particularly in the Middle East, continue to provide a backdrop of uncertainty that supports gold prices. The recent strength of the U.S. dollar, however, has prevented gold from reaching new all-time highs. This dynamic underscores the complex interplay between currency movements and geopolitical events in shaping gold’s market trajectory.

The upcoming U.S. elections add another layer of uncertainty. The potential re-election of Donald Trump could initially suppress gold prices due to the possibility of a stronger dollar driven by protectionist policies. However, these effects may be short-lived, with longer-term implications likely to reverse the initial trends depending on the broader economic and geopolitical landscape.

Global Economic Conditions and Gold Demand

The global economic climate, marked by high inflation, elevated interest rates, and political uncertainties, has driven significant interest in gold as a safe-haven asset. This environment has seen gold prices steadily climb, surpassing $2,500 per ounce in August. Analysts widely expect this trend to continue, with forecasts suggesting that gold could reach even higher levels by the end of the year.

Despite a recent cooling in inflation and expectations of a rate cut by the Fed, the demand for gold remains robust. The ongoing economic challenges, including geopolitical risks and currency weaknesses, particularly in major economies like China, are expected to keep gold in high demand as a protective asset.

Market Sentiment and Future Price Projections

Market sentiment remains bullish for gold, with many experts projecting further price increases. The ongoing weakness in paper currencies, particularly the U.S. dollar, is likely to continue driving investors towards gold as a hedge against currency debasement. This sentiment is echoed by market analysts who believe that we are still in the early stages of a significant gold bull market, with substantial upside potential remaining.

Edward Chandler, Director of Private Equity at Derwent Investments, expects gold to potentially reach $2,750 by the end of the year. This forecast is supported by the sustained demand from central banks and investors seeking refuge from the growing economic and geopolitical uncertainties.

Global Gold Market Dynamics

Gold prices have seen fluctuations in various global markets, with recent data from Saudi Arabia showing a slight decline in local prices. Despite these regional variations, the overall global outlook for gold remains positive. The London Bullion Market Association (LBMA) has noted that most analysts expect gold prices to exceed the record high of $2,480.25 achieved in July 2024, with average forecasts suggesting a rise to $2,547 in the second half of the year.

Conclusion: Navigating the Gold Market in 2024

The gold market is currently navigating a complex landscape of economic indicators, geopolitical tensions, and shifting market sentiment. While the recent decline below $2,500 suggests some short-term challenges, the long-term outlook for gold remains robust. With ongoing support from central bank purchases and continued demand driven by economic uncertainties, gold is well-positioned to maintain its status as a key asset in investor portfolios.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex