Recent Pressure on Gold (XAU/USD) Amid US Dollar Strength

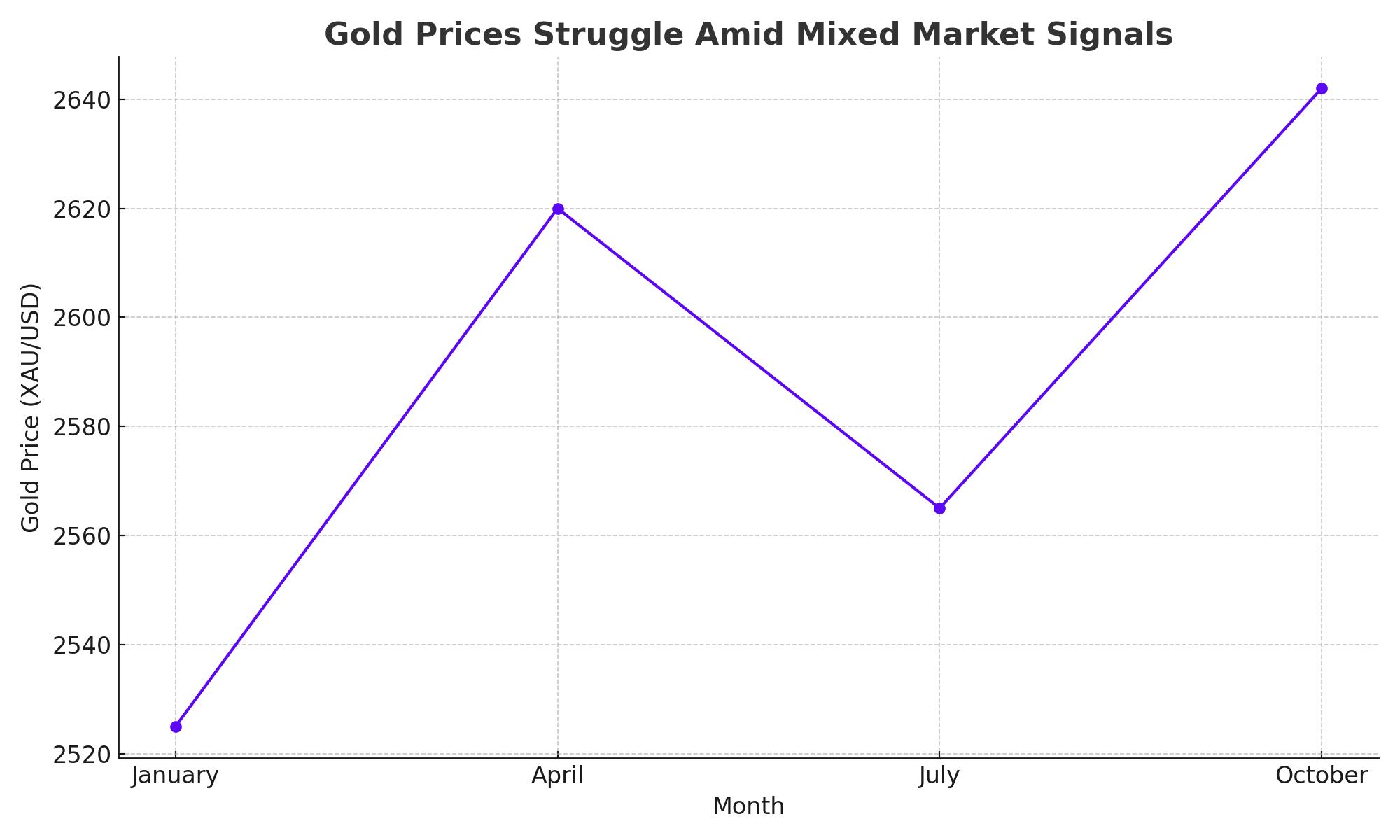

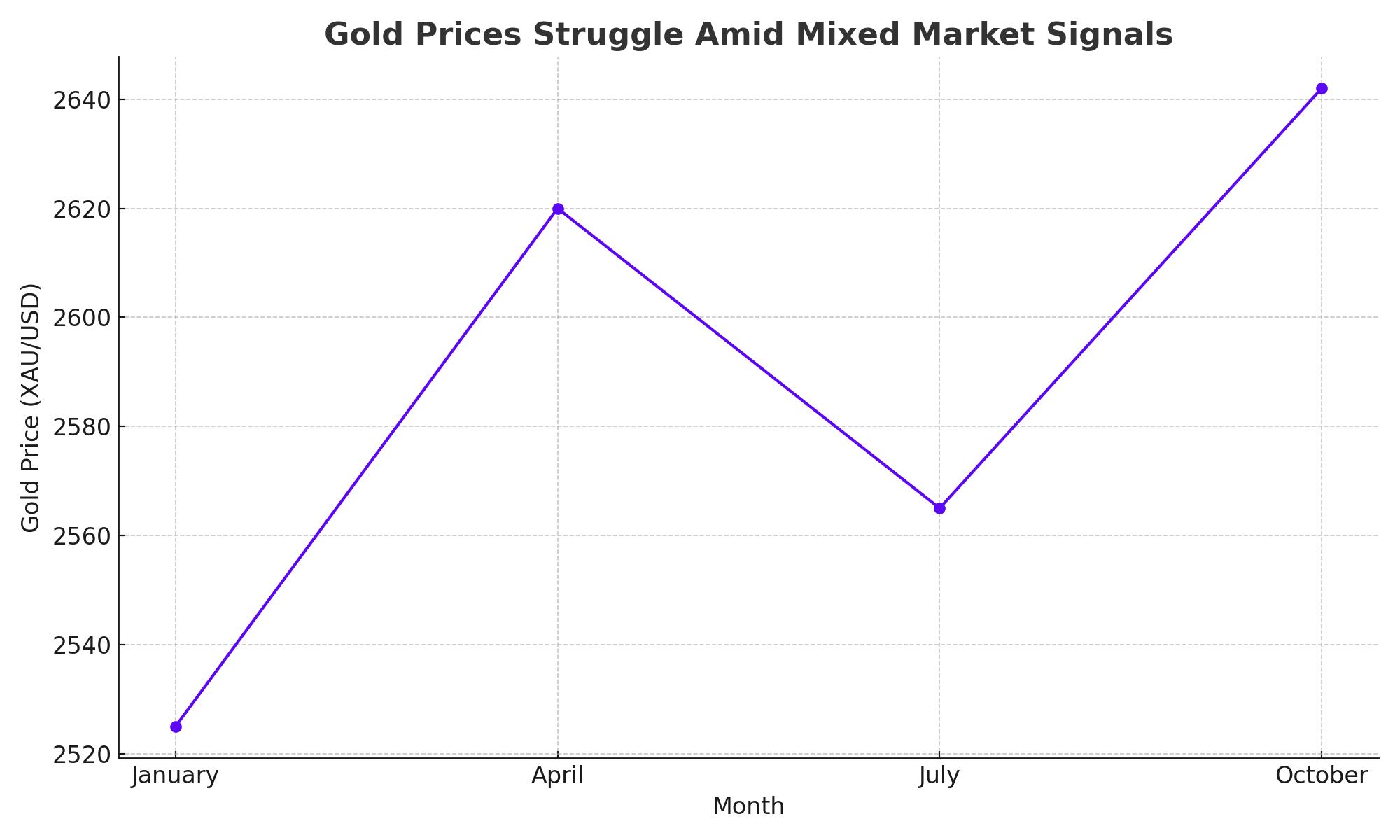

The price of gold has been under pressure recently, with XAU/USD trading near $2,650, unable to make significant gains. One of the main drivers of this has been the strength of the US Dollar (USD), which climbed following strong US Nonfarm Payrolls (NFP) data. In September, the US economy added 254,000 jobs, far exceeding market expectations of 140,000. This robust job growth has reduced hopes for aggressive interest rate cuts from the US Federal Reserve (Fed), putting pressure on non-yielding assets like gold.

Additionally, US unemployment dropped to 4.1% in September from 4.2% in August. The strong US labor market has bolstered the USD, which further challenges gold's upside potential. Market participants now see a 94% probability that the Fed will opt for a 25 basis points rate cut at its upcoming policy meeting. The likelihood of a more substantial rate cut has been diminished, which has capped gold’s momentum despite geopolitical risks.

Geopolitical Tensions Support Gold’s Safe-Haven Status

While US economic strength has weighed on gold, geopolitical risks, particularly in the Middle East, have been supportive of its price. Rising tensions between Israel and Hezbollah, including missile strikes in Gaza and Lebanon, continue to stoke fears of a broader regional conflict. Historically, gold has thrived during times of geopolitical uncertainty, and the current situation has limited any sharp declines in its price.

Additionally, Israel’s defense minister has hinted at possible retaliatory strikes against Iran, further increasing market volatility. These concerns have kept gold attractive as a safe-haven investment, even as economic data from the US leans toward a stronger USD and higher yields.

Gold’s Technical Picture: Key Levels to Watch

From a technical standpoint, gold is in a consolidation phase. It has struggled to break above key resistance levels near $2,670. Should gold break this level, it could target the next resistance zone around the $2,686-$2,700 area, potentially reaching new highs if the geopolitical situation worsens.

On the downside, $2,630 serves as a critical support level. A break below this threshold could lead to a deeper correction, with $2,600 and $2,560 acting as the next support levels. The 14-day Relative Strength Index (RSI) remains above 64, indicating that gold still has bullish potential, but it will need a clear catalyst to reignite the upward momentum.

The Influence of Central Banks and Investor Demand

Central bank buying continues to play a vital role in supporting gold prices. Notably, the People's Bank of China (PBOC) has been increasing its gold reserves, buying for 18 consecutive months, which now sit at 72.8 million ounces. China’s persistent buying, combined with increasing demand from other central banks, particularly in Asia, has provided a floor under gold prices. As central banks diversify away from the US dollar, gold has become a strategic reserve asset.

Investor demand has also seen a resurgence, with new entrants to the market attracted by gold’s ability to hedge against inflation and geopolitical risks. Recent estimates suggest that the price of gold could reach as high as $3,000 by the end of 2024, driven by continued conflict in the Middle East, rising inflation, and potential rate cuts from the Fed.

Impact of US Treasury Yields and Inflation Data

US Treasury yields, hovering near the 4.0% mark, have been another headwind for gold. Higher yields make gold less attractive as an investment since it does not pay interest. However, the upcoming US Consumer Price Index (CPI) data could provide more clues about the Fed's policy trajectory and its impact on gold prices. Softer inflation data could weaken the USD and lead to renewed buying interest in gold.

Outlook for Gold (XAU/USD)

Despite the pressure from the strong USD and rising yields, the outlook for gold remains cautiously bullish due to geopolitical risks and continued central bank buying. Gold prices have seen 45.93% growth over the past year, with a 6.58% increase in just the last 30 days. Currently trading at $2,642, the price could surpass $3,000 if conflicts in the Middle East escalate further.

In summary, while the immediate trajectory of gold depends on US economic data and Fed decisions, the longer-term outlook remains positive. Investors seeking a hedge against inflation, geopolitical risks, and market uncertainty continue to find gold an attractive option.

That's TradingNEWS