Gold Prices Rise to $2,385 on Fed Rate Cut Speculation

US Employment Data, Chinese Economic Indicators, and European Political Instability Influence Gold Market Dynamics | That's TradingNEWS

Market Dynamics Influencing Gold (XAU/USD) Prices

US Employment Data and Fed Rate Cut Expectations

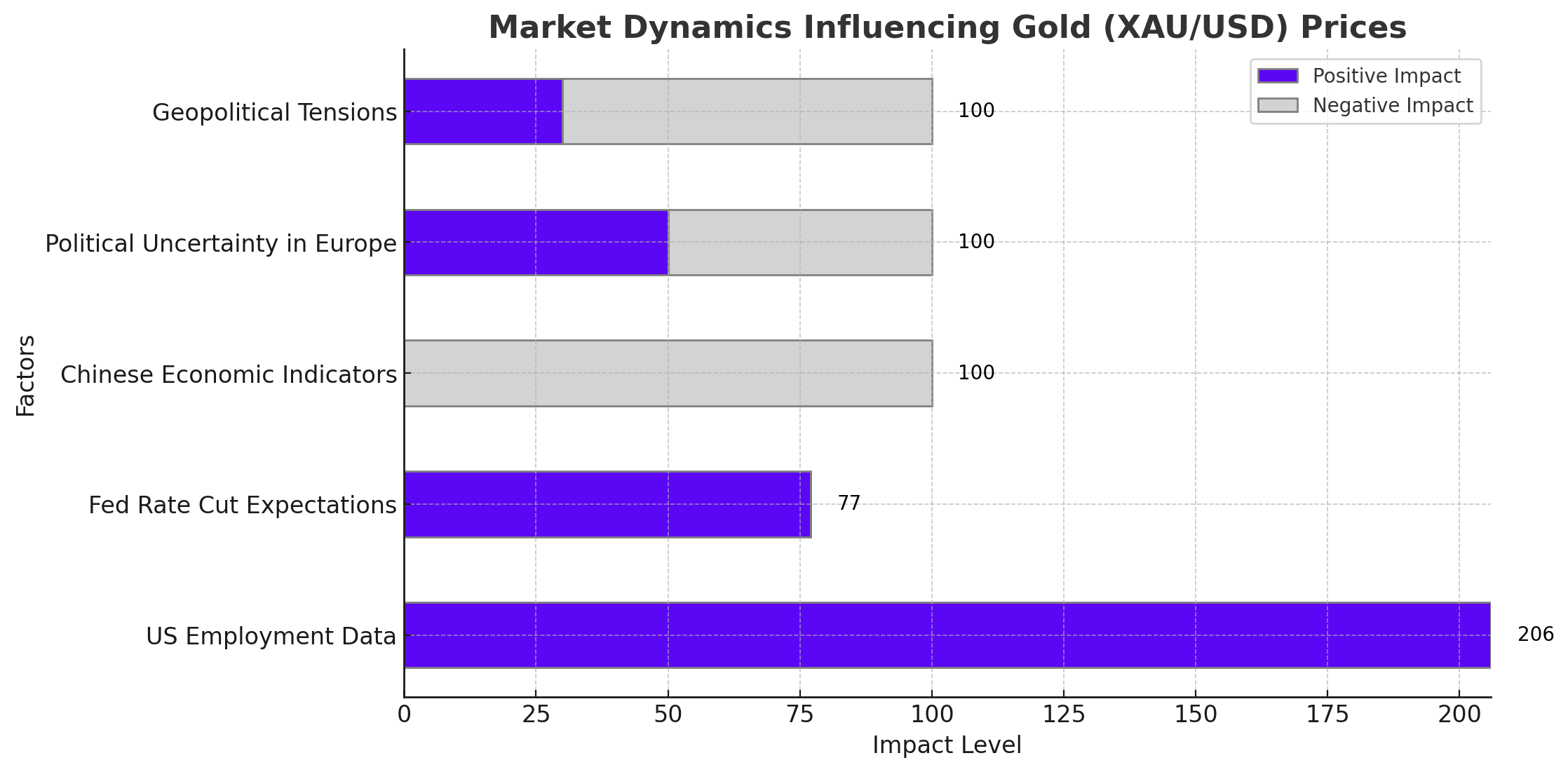

The recent uptick in the Gold price to $2,385 reflects a complex interplay of factors, particularly the mixed signals from US employment data. June's Nonfarm Payrolls showed an increase of 206K jobs, surpassing expectations of 190K but down from May’s 218K. Concurrently, the unemployment rate edged higher to 4.1% from 4.0%, indicating a slight softening in the labor market.

This data fuels market speculation of a September rate cut by the US Federal Reserve, now priced at a 77% probability, up from 70% previously. Lower interest rates typically weaken the US dollar, making gold, a non-yielding asset, more attractive to investors.

Chinese Economic Indicators

Adding to the bearish pressure on gold was the decision by the People's Bank of China (PBoC) to refrain from gold purchases for the second consecutive month. China, being the world’s largest bullion consumer, significantly impacts gold prices. According to Nitesh Shah, a commodity strategist at WisdomTree, this pause suggests that "gold prices remain a little too high and the PBoC is waiting for a further pullback before resuming its gold purchasing program."

Political Uncertainty in Europe and Geopolitical Tensions

Political dynamics in Europe, particularly in France, have added layers of uncertainty. The recent parliamentary elections resulted in a hung parliament, escalating concerns over political stability. This scenario often drives investors towards safe-haven assets like gold.

Moreover, geopolitical tensions in the Middle East continue to provide underlying support for gold prices. The possibility of increased conflicts can lead to a spike in demand for gold as a secure store of value.

Gold’s Technical Analysis and Short-term Projections

Technical Indicators and Support Levels

Gold’s price action indicates a bullish trend supported by several technical indicators. The 50-day and 200-day EMAs, currently at $2,359.76 and $2,339.76 respectively, provide strong support levels. As long as the price remains above the pivot point of $2,381.09, the bullish outlook holds. Immediate resistance is seen at $2,393.17, with potential targets at the May high of $2,450 and the psychological level of $2,500.

The Stochastic oscillator, currently in the overbought territory, suggests a possible short-term correction. A decisive move below $2,381.09 could lead to accelerated selling, targeting supports at $2,371.91 and further down at $2,360.

Influences from Broader Economic Indicators

Upcoming Economic Data

The near-term outlook for gold will be heavily influenced by upcoming economic data:

- Chinese Inflation Rate: Expected to tick up by 0.1% to 0.4% for June. A higher inflation rate could strengthen the yuan, potentially increasing demand for gold in China.

- British GDP Growth: Forecasted to rise by 0.2% month-over-month. While this may not have a direct impact on gold, it provides insight into the economic health of a major global economy.

- US Inflation Rate: Projected to decline by 0.2% to 3.1% for June. A lower inflation rate could support a dovish stance by the Fed, benefiting gold.

- US Producer Price Index (PPI): Expected to increase by 0.1%, potentially indicating higher consumer inflation in the coming months.

Conclusion

Gold’s current price dynamics are a reflection of mixed signals from global economic indicators, central bank policies, and geopolitical events. The interplay of these factors suggests that while the bullish trend remains intact, there are significant risks that could lead to short-term volatility. Investors should watch for key economic data releases and geopolitical developments, which will provide further direction for gold prices.