Gold Prices Surge Amid Weak Dollar and Rate Cut Speculations

Bullish Momentum Pushes Gold Towards Record Highs as Investors Eye Key Economic Data | That's TradingNEWS

Gold Prices Maintain Strong Bullish Momentum Amid Market Uncertainty (GOLD)

Gold's Recent Performance and Market Dynamics

Gold prices have continued their strong rally, recently nearing a one-week high, driven by a weakening U.S. dollar. A weaker dollar typically makes gold more attractive to international investors, and this correlation has been evident as the yellow metal benefits from mixed economic signals in the U.S.

The U.S. private sector reported the addition of 99,000 jobs, falling short of the 144,000 expectations, signaling potential weakness in the labor market. This shortfall has raised concerns over the nonfarm payroll report, expected to be a critical factor for the Federal Reserve’s decision on a possible rate cut. A rate cut, especially one of 50 basis points, could further fuel gold's upward trajectory.

Economic Reports and Rate Cut Expectations

While employment data indicated softness, other economic indicators presented a more robust picture. Unemployment claims dropped more than expected, and the services sector showed resilience, suggesting that parts of the economy remain strong. Nevertheless, with labor market data becoming a primary focus for the Federal Reserve, the anticipation of lower interest rates is heightening gold's appeal as a safe-haven asset.

Gold prices have consolidated between key technical levels—$2,480.38 on the downside and $2,520.09 on the upside. The bullish sentiment is supported by technical indicators like the 30-day simple moving average (SMA) and a relative strength index (RSI) above 50. However, gold bulls may need additional momentum to push beyond resistance levels and set new highs.

Key Technical Levels for Gold (XAU/USD)

Investors are eyeing the critical resistance level of $2,524–$2,525, a key hurdle for further gains. Breaking through this level could trigger a rally toward all-time highs around $2,531–$2,532. Conversely, the $2,500 psychological level remains a vital support area. A fall below $2,471–$2,470 could expose gold to deeper declines, potentially pushing prices toward the 50-day SMA at $2,440 and even the 100-day SMA at $2,388.

Long-Term Outlook: Gold Price Predictions (2024–2030)

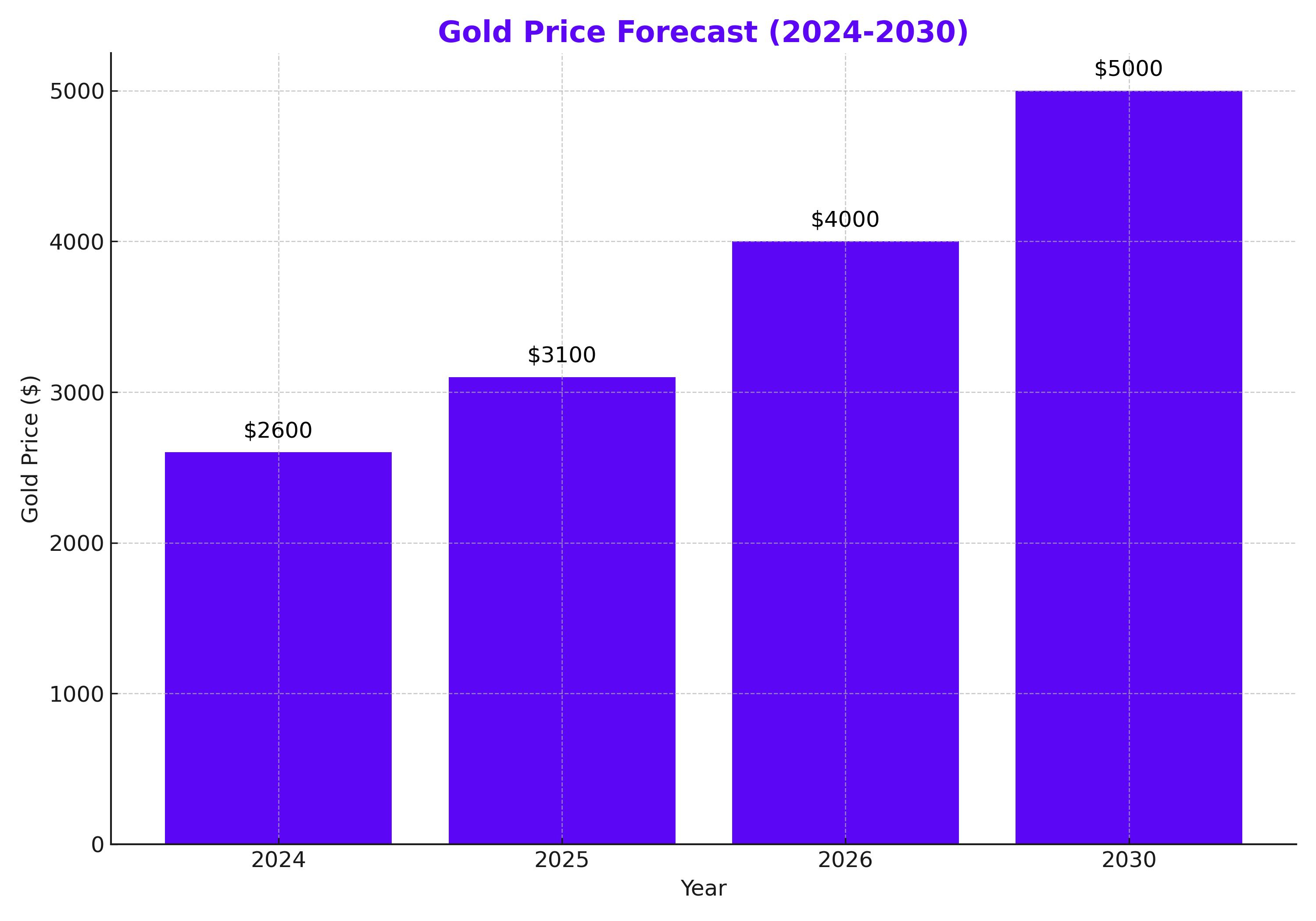

Looking ahead, market forecasts for gold remain bullish. Analysts project gold prices to reach around $2,600 in 2024, with further growth leading to $3,100 in 2025 and potentially $4,000 by 2026. By 2030, some estimates place gold as high as $5,000 per ounce, driven by factors like inflation expectations, central bank demand, and geopolitical tensions.

Gold Prices and Central Bank Activity

One of the driving forces behind gold's recent surge is the increased demand from central banks. According to a survey by the World Gold Council, 29% of central banks plan to increase their gold reserves over the next 12 months. This trend underscores the role of gold as a hedge against economic and geopolitical instability.

In fact, gold prices have set new all-time highs across various global currencies since early 2024. This global demand surge confirms the strength of the gold bull market.

Gold's Historic Performance and Future Trends

Gold’s price has surged by over 20% in 2024, peaking at a record $2,531.75 per ounce. The Fed's dovish tone, paired with strong demand from over-the-counter markets, geopolitical concerns, and inflationary fears, has bolstered gold’s performance this year.

Historically, gold has performed exceptionally well during periods of economic turbulence. Events like 9/11, the COVID-19 pandemic, and the ongoing Russia-Ukraine conflict have all contributed to significant price rallies. This trend looks set to continue, with central banks increasingly using gold as a hedge against potential financial crises.

Geopolitical Uncertainty and Gold's Safe-Haven Status

Geopolitical tensions continue to play a pivotal role in supporting gold prices. The ongoing conflicts in the Middle East and Ukraine have triggered safe-haven buying, with gold being viewed as a protective asset during times of uncertainty. As such, any escalation in these conflicts could push gold prices even higher.

Investor Sentiment and Market Outlook

Investor sentiment remains cautiously optimistic, with many expecting the Federal Reserve to cut rates in response to deteriorating labor market conditions. Market participants are pricing in a 40% chance of a 50-basis-point rate cut at the Fed's upcoming September meeting, which would likely spur further gold buying.

However, much depends on the upcoming U.S. nonfarm payroll report. A weaker-than-expected reading could be the catalyst for another leg higher in gold prices, while a stronger report could temper bullish momentum.

Final Thoughts: Gold’s Potential to Break New Highs

Gold's ability to maintain its bullish momentum largely hinges on economic data, particularly labor market performance and Fed rate cut decisions. While caution is warranted ahead of key reports, the overall outlook remains bullish. With technical indicators showing room for further gains, gold could soon surpass its all-time highs, paving the way for a potential move towards $3,000 by the end of 2024.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex