Gold Prices Surge as Fed Rate Cut Speculations and Geopolitical Events

Gold Hits One-Week High, Eyeing 50-Day SMA Resistance Amid Easing Inflation and Global Uncertainty | That's TradingNEWS

Gold Price Dynamics Amid Economic and Geopolitical Uncertainty

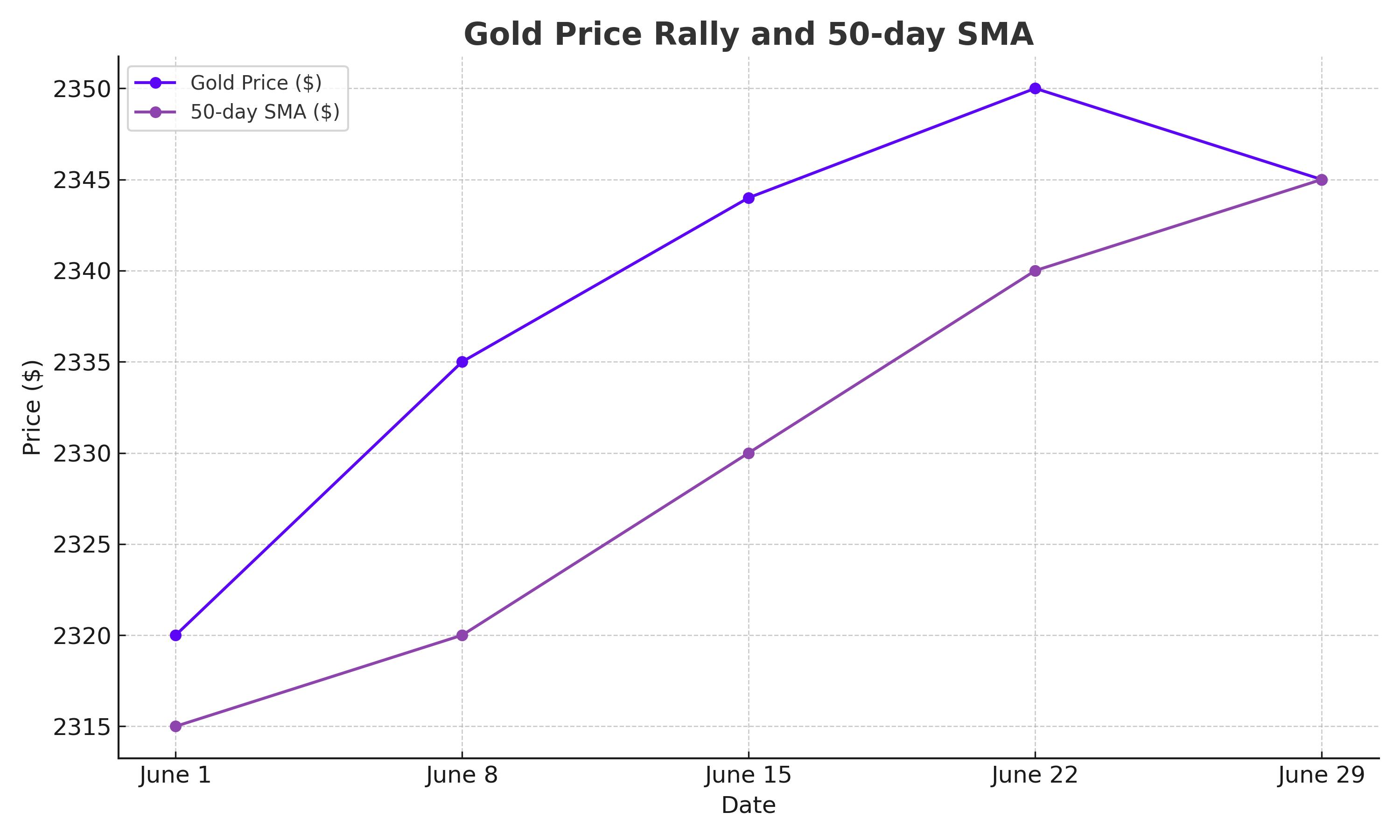

Gold Price Rally and Technical Analysis

Gold (XAU/USD) refreshed its one-week high in the early European session on Thursday, aiming to recapture the critical 50-day Simple Moving Average (SMA) resistance at approximately $2,344-$2,345. The recent U.S. macroeconomic data indicating easing inflationary pressures and a slowing economy has fueled speculation that the Federal Reserve (Fed) will cut interest rates twice this year. This expectation has driven flows towards the non-yielding yellow metal, pushing its price upwards.

Geopolitical Tensions and Safe-Haven Demand

Geopolitical tensions and renewed political uncertainty in Europe have further bolstered gold prices. The Fed's hawkish stance, projecting only one interest rate cut in 2024 compared to three projected in March, supports the U.S. Treasury bond yields, limiting the upside for gold. However, the safe-haven demand persists amid geopolitical risks, such as Ukrainian drone strikes on Russian energy infrastructure and Israel's potential conflict with Iran-backed Hezbollah.

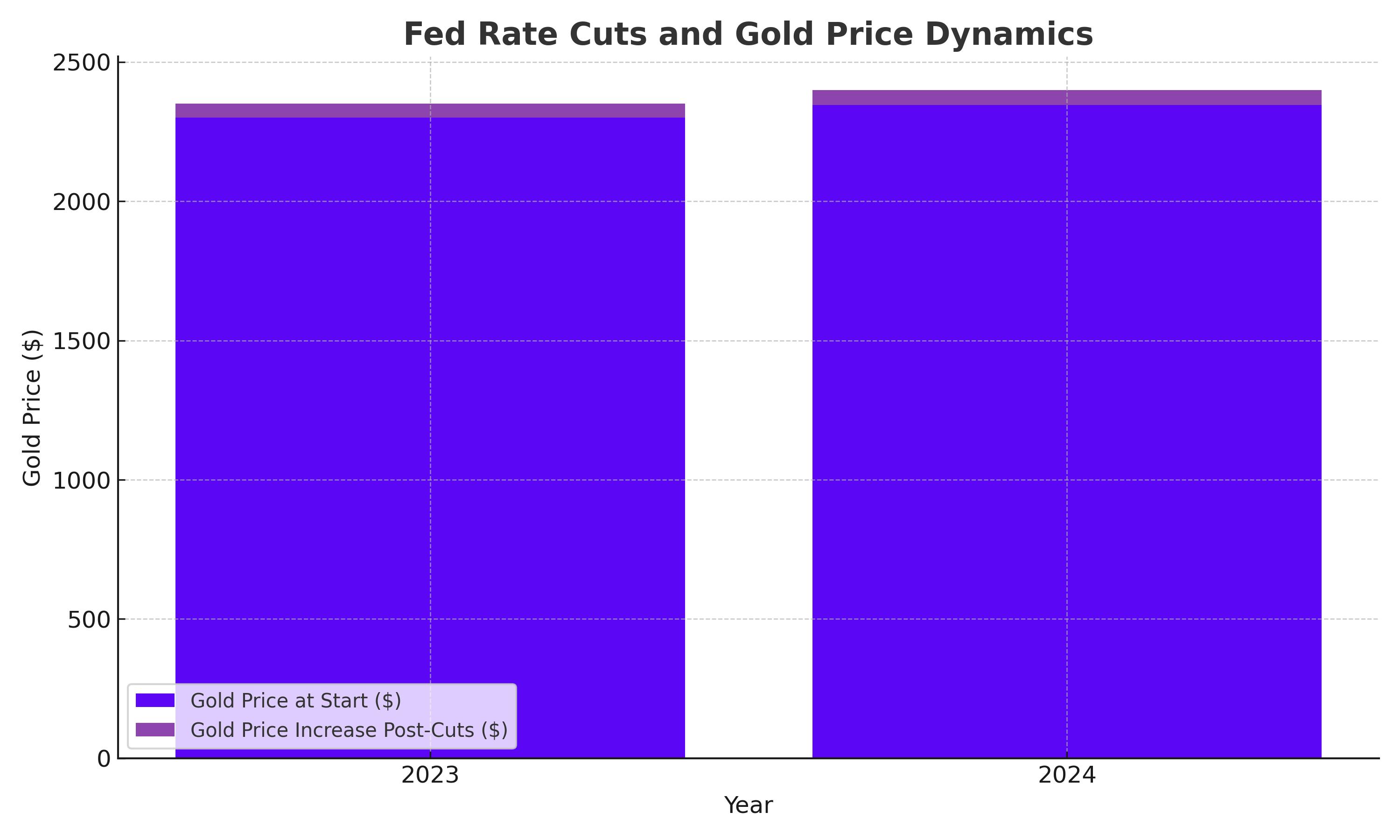

Economic Indicators and Federal Reserve Policies

The uncertainty surrounding the Fed's timing for interest rate cuts has kept traders cautious, resulting in range-bound price action for gold. Recent U.S. retail sales data indicated lackluster economic activity, coupled with weaker consumer and producer prices, suggesting that the Fed might ease monetary policy soon. Current market expectations indicate a high probability of the first rate cut in September, followed by another in November or December, providing support for gold prices.

Technical Levels and Market Sentiment

From a technical perspective, gold bulls await a sustained breakout above the 50-day SMA resistance near $2,344-$2,345 to place fresh bets. A successful move past this level could signal the end of the recent corrective decline, potentially lifting gold prices towards the $2,360-$2,362 zone, with an intermediate hurdle at $2,387-$2,388 en route to the $2,400 mark. The momentum might extend further towards the all-time peak around $2,450 touched in May.

On the downside, immediate support is found at the $2,320-$2,318 region, ahead of the $2,300 mark. A drop below the $2,285 horizontal support could trigger a fresh bearish trend, accelerating the decline towards $2,254-$2,253 and eventually to the $2,225-$2,220 support and the $2,200 round-figure mark.

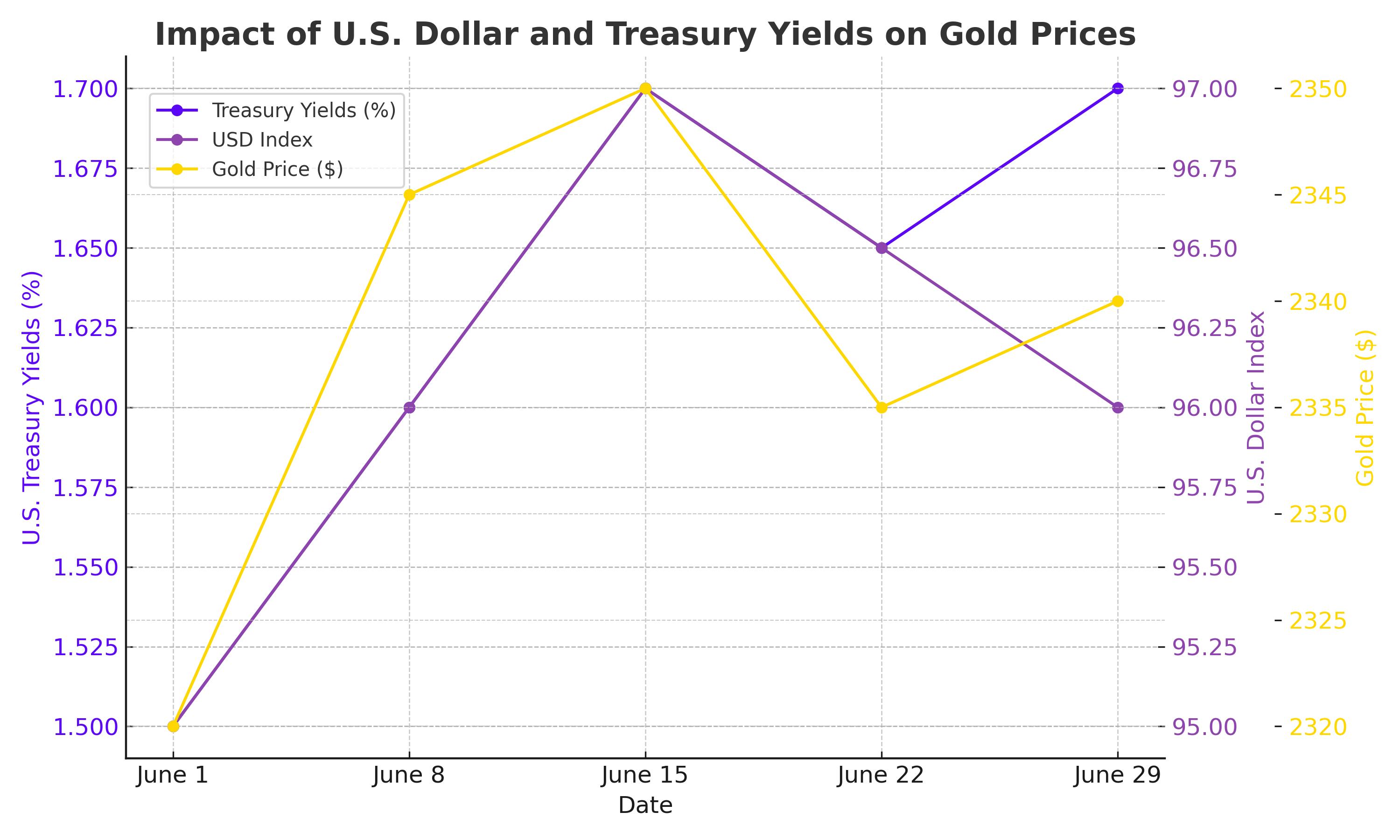

Impact of U.S. Dollar and Treasury Yields

A bounce in U.S. Treasury bond yields has revived demand for the U.S. Dollar (USD), capping further gains for gold. The Fed's projected interest rate cut this year acts as a tailwind for Treasury yields, impacting gold's performance as a non-yielding asset. Traders will closely monitor the upcoming U.S. economic docket, including Weekly Initial Jobless Claims, Philly Fed Manufacturing Index, Building Permits, and Housing Starts for further cues.

Global Market Movers and Central Bank Decisions

Investors are also focusing on decisions from the Swiss National Bank (SNB) and the Bank of England (BoE) policy meetings, which might introduce volatility and provide additional impetus to gold prices. The broader global market dynamics, including geopolitical risks and central bank policies, continue to play a significant role in shaping investor strategies and influencing gold prices.

Conclusion: Navigating Gold's Market Dynamics

The gold market's recent performance reflects a complex interplay of economic indicators, geopolitical tensions, and central bank policies. While the immediate technical outlook suggests potential for further gains if key resistance levels are breached, underlying economic and geopolitical uncertainties continue to drive investor sentiment. As such, gold remains a pivotal asset for navigating the current market landscape, offering a hedge against inflation and geopolitical risks.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex