Gold Prices Tumble as U.S. Inflation Data Dashes Hopes for Aggressive Fed Rate Cuts

Market braces for volatility as geopolitical tensions and inflation data shape gold’s path forward, testing critical support levels in the face of uncertainty | That's TradingNEWS

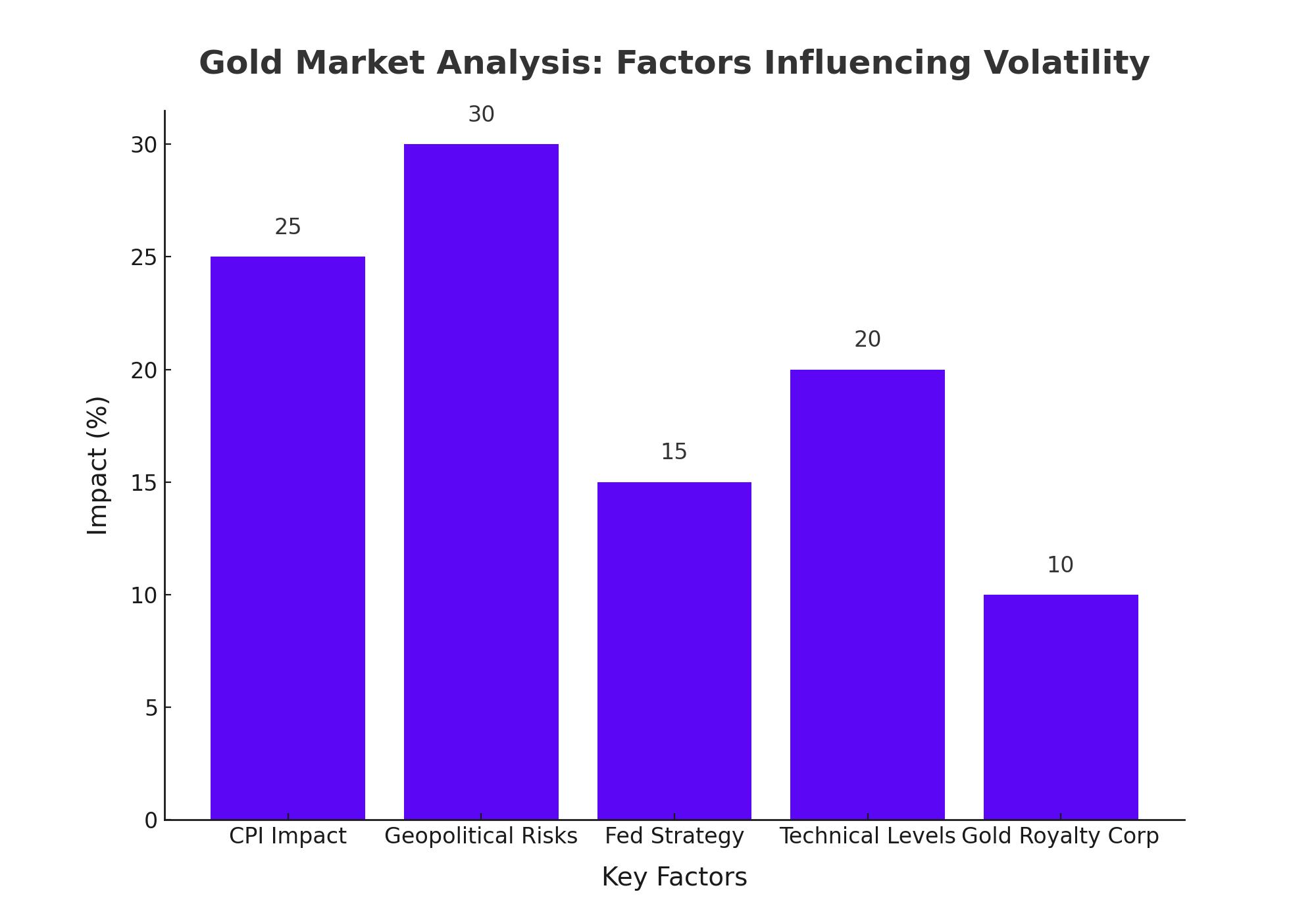

Gold Market Analysis: Volatile Trading, CPI Impact, and Strategic Insights

Gold Prices React to U.S. Inflation Data

Gold prices experienced a sharp decline on Wednesday, following the release of U.S. consumer price index (CPI) data for July. Spot gold slipped by 0.4% to $2,455.91 per ounce, while U.S. gold futures dropped by 0.5% to $2,494.50 per ounce. The data, which showed a 0.2% increase in CPI last month, dashed hopes for a significant rate cut from the Federal Reserve in the near term, shifting market expectations towards a smaller 25 basis point cut.

The market’s reaction to this data underscores the sensitivity of gold prices to changes in interest rate expectations. The slight rebound in CPI was enough to cool the momentum that had been driving gold prices toward their all-time highs, with traders adjusting their positions based on the reduced likelihood of aggressive monetary easing by the Fed.

Market Sentiment and Geopolitical Influences

Despite the immediate impact of the CPI data, gold's long-term outlook remains influenced by broader geopolitical tensions. The ongoing conflicts in the Middle East, coupled with the Russia-Ukraine war, continue to provide a backdrop of uncertainty that supports gold as a safe-haven asset.

Additionally, Fed officials, including Atlanta Fed President Raphael Bostic, have expressed a desire to see more economic data before committing to rate cuts, adding further complexity to the gold market's trajectory. This cautious stance by the Fed has contributed to the mixed sentiment in the gold market, where expectations of rate cuts are being balanced against the reality of persistent inflationary pressures.

Gold's Technical Outlook: Key Support and Resistance Levels

From a technical perspective, gold's price action has been volatile. The yellow metal recently tested its psychological resistance levels near $2,480 per ounce but failed to break through, leading to a retreat towards the $2,450 mark. This level now acts as a crucial support, with a potential break below it likely to trigger further downside momentum.

The Moving Average Convergence Divergence (MACD) indicator on the 4-hour chart has crossed below the signal line, signaling a bearish trend. Additionally, the price has dipped below the middle Bollinger Band, reinforcing the notion that sellers are gaining control. Should the downward pressure continue, the next support levels to watch are $2,440 and potentially $2,430.

On the upside, any recovery in gold prices would first need to clear the $2,470 resistance level. A successful breach could pave the way for a retest of $2,480, and if bullish momentum strengthens, prices could even approach the $2,490 mark.

Gold Royalty Corp's Strategic Moves and Financial Performance

Gold Royalty Corp. (NYSE: GROY) has reported a transformational second quarter for 2024, marked by strategic acquisitions and increased production. The company produced 947 gold equivalent ounces (GEOs), a significant increase from the 282 GEOs produced in the same period last year. This growth is largely attributed to the acquisition of the Vares Copper Stream for $50 million and the commencement of royalty payments from IAMGOLD’s Côté Gold Mine.

Financially, Gold Royalty reported a quarterly revenue of $1.8 million, up nearly 300% from the $468,000 reported in Q2 2023. Despite these gains, the company posted a net loss of $2.2 million for the quarter, down slightly from the previous year. However, the company’s focus on expanding its portfolio and optimizing costs has resulted in positive operating cash flow for the second consecutive quarter, a promising sign for future profitability.

Looking ahead, Gold Royalty expects to generate between 6,500 and 7,000 GEOs for the full year, translating to approximately $13 million to $14 million in revenue. This forecast is supported by the anticipated ramp-up of the Côté Gold Mine and the start of production at the Vares Project.

Gold Market Dynamics: Balancing Economic Indicators and Geopolitical Risks

The gold market remains in a state of flux, with prices reacting to a combination of economic indicators and geopolitical developments. While the latest U.S. inflation data has tempered expectations for aggressive Fed rate cuts, the ongoing geopolitical tensions and the safe-haven appeal of gold continue to underpin demand.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex