Gold Rallies Near Record Highs—Is $3,000 Next?

With gold prices close to their all-time high, geopolitical risks and market volatility fuel investor demand. What’s driving this surge and where could gold go next? | That's TradingNEWS

Gold (XAU/USD) Approaches All-Time High, Backed by Safe-Haven Demand and Persistent Dollar Strength

Geopolitical Risks Propel Gold Price Toward $2,700

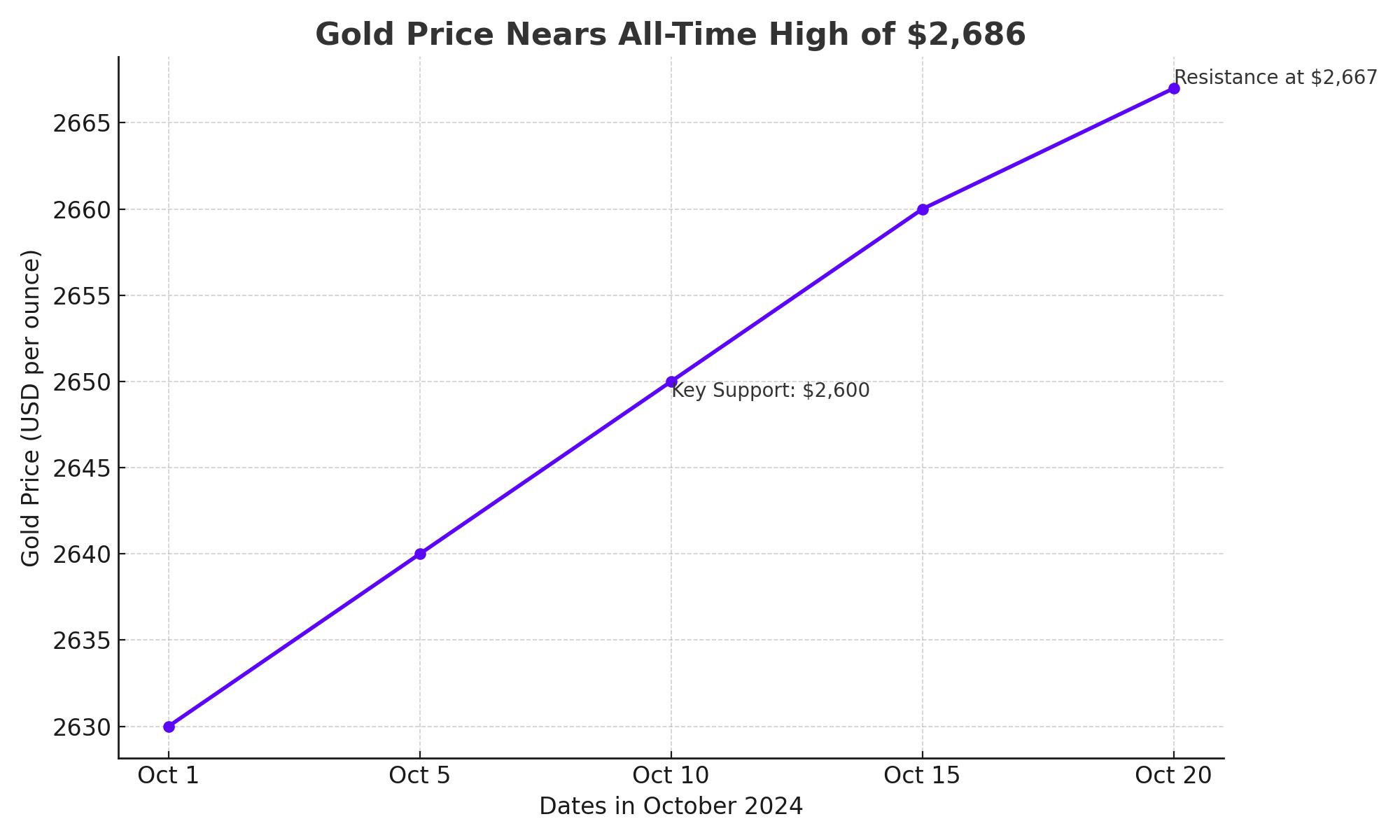

Gold prices surged to $2,667 per ounce this week, just shy of its all-time high of $2,686, as tensions in the Middle East intensified, reinforcing its safe-haven status. Investors turned to gold as a hedge against mounting geopolitical risks, primarily driven by Israel’s ongoing military actions and fears of a broader conflict involving Iran. The metal’s ability to weather this volatile environment underscores its position as a reliable store of value during periods of global uncertainty.

Despite easing expectations for substantial rate cuts by the Federal Reserve, gold continues to rise, illustrating its resilience. Market analysts are now predicting that any potential de-escalation in the Middle East could temper these gains, but as long as geopolitical tensions persist, gold’s support near $2,600 remains solid.

Interest Rate Outlook and the Dollar’s Impact

The market's focus on Federal Reserve rate cuts continues to weigh on gold’s near-term trajectory. Earlier in October, markets anticipated up to 75 basis points in rate cuts by year-end, but this has now been revised to just 50 basis points. Despite this shift, gold remains elevated, bolstered by its safe-haven appeal in the face of political and economic uncertainty.

The strength of the U.S. dollar also factors into gold's performance. A stronger dollar traditionally makes gold more expensive for holders of other currencies, yet the metal has held its ground near $2,650, indicating solid demand even in the face of a rising dollar index (DXY). Traders are currently eyeing U.S. retail sales and industrial production data for further clues on the Fed's next moves, which could influence gold’s direction in the near term.

Technical Analysis: Gold’s Battle at $2,650

From a technical perspective, gold has maintained its position around the $2,650 mark, with short-term pullbacks providing buying opportunities for value-seeking investors. The $2,600 level remains critical, acting as a psychological and technical floor. The 50-day EMA is quickly approaching this zone, adding further support.

If gold breaks through resistance at $2,667, a test of the all-time high at $2,686 is likely. Should the geopolitical situation worsen, the metal could make a run for $2,700 and beyond, with some analysts suggesting a potential surge toward $3,000. On the downside, a breach of $2,600 could open the door to deeper corrections, with $2,560 and $2,530 offering further support levels.

China’s Economic Data Adds to Gold’s Safe-Haven Demand

Weak economic data from China, the world’s largest gold consumer, has introduced another layer of complexity for the precious metal. Chinese exports have fallen significantly, raising concerns about global demand, while China’s stimulus measures have so far failed to boost investor confidence. This economic softness has kept risk-averse investors leaning toward gold as a hedge against potential economic downturns.

The latest data showed a decline in Chinese oil imports, which could signal weaker industrial demand and a slowing global economy. However, gold continues to benefit from this risk-off sentiment, as investors flock to the metal to preserve capital in uncertain times.

Outlook for Gold Amid Global Volatility

Looking ahead, gold’s performance will hinge on several factors, including the evolving geopolitical landscape, the Federal Reserve’s monetary policy, and economic signals from key global markets like China. The metal’s ability to hold above $2,600 despite easing rate cut expectations is a testament to its enduring appeal in turbulent times.

For now, the $2,667-$2,686 range represents a key resistance zone for gold. If this level is broken, $2,700 could be within reach. Conversely, any de-escalation in the Middle East or stronger-than-expected economic data from the U.S. could trigger a pullback toward $2,600 or lower. However, gold's longer-term outlook remains bullish, with a likely floor around $2,600 and potential to break new highs if geopolitical risks persist.

Investor Sentiment and Strategy

Investor sentiment remains cautiously bullish, with many positioning for continued volatility in gold prices. For those seeking long-term protection against inflation and geopolitical risks, gold remains an attractive option, especially as markets digest the Fed's next moves. Investors looking for shorter-term gains may find opportunities in the near-term volatility, with pullbacks below $2,600 offering potential entry points.

In the current environment, gold continues to be a key asset for portfolio diversification, providing a hedge against both inflationary pressures and geopolitical uncertainties. With potential for further upside, gold remains a strong buy for long-term investors. However, traders should remain vigilant to shifts in global sentiment, particularly around Fed policy and Middle East developments, which could quickly alter the metal’s trajectory.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex