Gold Shatters Records: Why $2,500 Might Just Be the Beginning

With the Fed Eyeing Rate Cuts and Global Tensions Rising, Is Gold Set for Even Greater Heights? | That's TradingNEWS

Gold Reaches New Heights: What's Driving the Surge?

Gold Prices Surge to Record Highs Amid Economic Uncertainty

Gold (XAU/USD) has recently seen its price surge past $2,500, setting new all-time highs as global economic conditions and geopolitical tensions create the perfect storm for the precious metal. As of Monday's early Asian trading session, gold reached $2,505, reflecting a strong momentum driven by multiple factors. This article delves into the key elements fueling this historic rally and what investors should watch moving forward.

Interest Rate Expectations and Economic Data Boost Gold

One of the primary drivers behind gold's recent surge is the growing expectation of interest rate cuts by the U.S. Federal Reserve. Economic indicators, such as the recent U.S. Housing Starts, which fell by 6.8% in July, have raised concerns about the strength of the economy. This decline, coupled with softer inflation data, has led markets to price in a nearly 76% chance of a 25-basis-point rate cut in September. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it a more attractive investment.

The U.S. economic data released last week further supports this outlook. Retail Sales exceeded expectations, but the Producer Price Index (PPI) and Consumer Price Index (CPI) indicated that inflation is moderating, increasing the likelihood of a dovish shift by the Fed. This environment is highly favorable for gold, which has historically thrived in low-interest-rate settings.

Geopolitical Tensions: A Catalyst for Safe-Haven Demand

Geopolitical instability continues to be a significant factor in gold's upward trajectory. The ongoing conflicts in the Middle East, particularly the escalating tensions between Hezbollah and Israel, have heightened demand for safe-haven assets. The potential for further conflict in the region, combined with the ongoing war in Ukraine, has investors flocking to gold as a hedge against uncertainty.

These geopolitical risks are not just regional concerns; they have global implications that affect investor sentiment worldwide. The market's nervousness is palpable, with every escalation in tension translating to higher gold prices.

Central Bank Buying and Global Demand Trends

Central banks around the world have been significant players in the gold market, adding to their reserves as a safeguard against economic instability. Recent reports indicate that China's central bank has issued new gold-import quotas to its banks, sparking speculation of a renewed wave of buying. This move is seen as a response to the record low yields on Chinese bonds and concerns over the country's slowing economic growth.

The increased central bank buying has added another layer of support to gold prices, which have already been boosted by investor demand amid fears of a global recession. As more countries look to diversify their reserves away from the U.S. dollar, gold stands out as a reliable store of value.

Technical Analysis: A Bullish Outlook for Gold

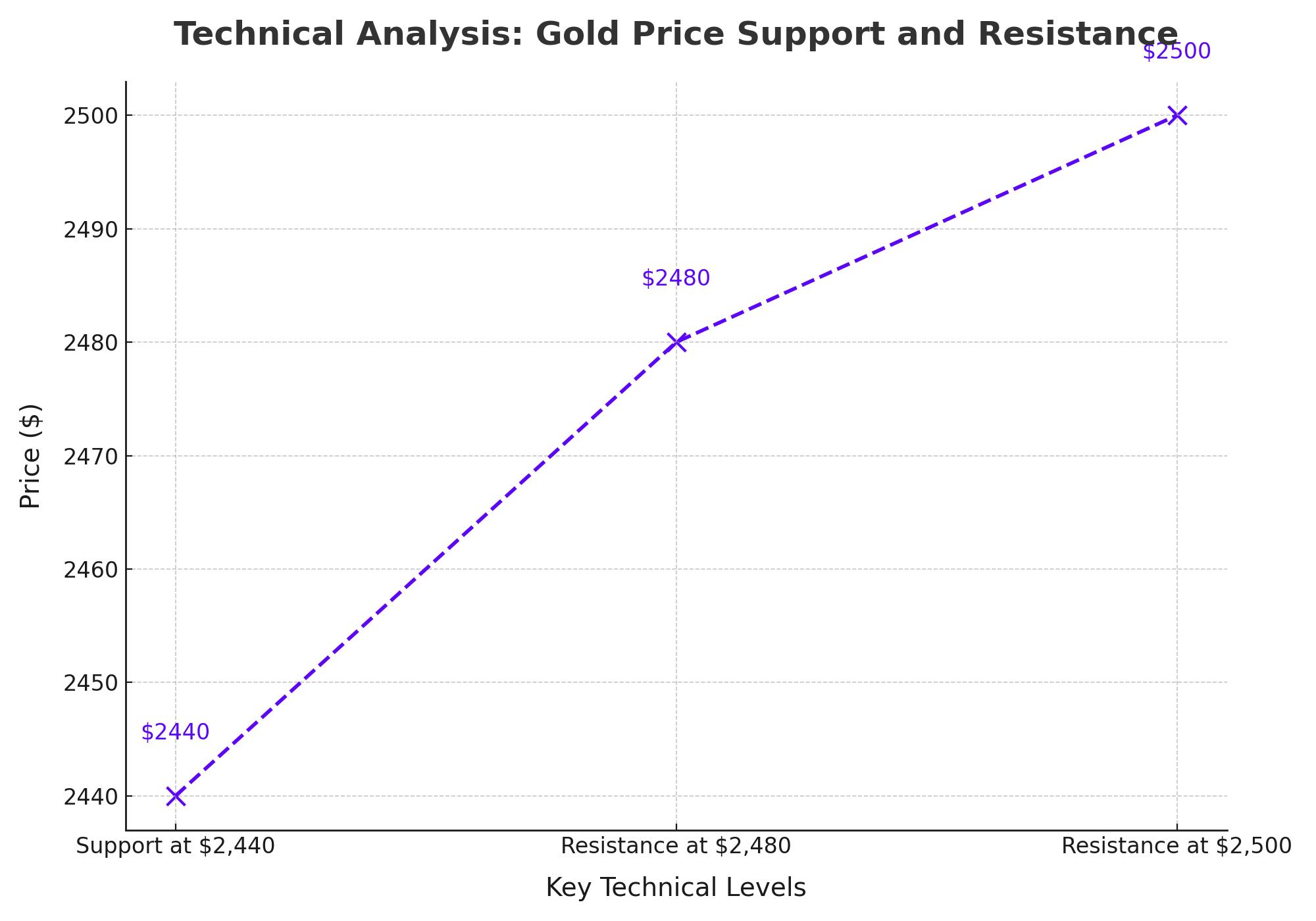

From a technical perspective, gold's price action is showing strong bullish signals. The price has found solid support around the $2,440 level and has continued to climb, trading well above the upper band of the Bollinger bands, indicating increased volatility. The 50-day moving average is trading above the 100-day moving average, further validating the bullish trend.

However, traders should note that the Stochastic oscillator is in overbought territory, which could signal a potential short-term correction. If a pullback occurs, the first area of support might be around the $2,480 level, a psychologically significant price point.

Long-Term Outlook: Is Gold Still a Buy?

With gold prices hovering near record highs, the question on every investor's mind is whether now is the time to buy, hold, or sell. The long-term outlook for gold remains bullish, driven by expectations of continued central bank buying, lower interest rates, and persistent geopolitical risks. However, the potential for short-term corrections should not be ignored, especially as markets react to upcoming data releases and speeches from key figures like Fed Chair Jerome Powell.

As gold continues its upward march, it remains an essential asset for those seeking to hedge against economic uncertainty. While the road ahead may have its bumps, the overall trajectory for gold looks promising, especially if the Fed confirms market expectations with rate cuts in the near future.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex