Gold Surges to All-Time High Amid Fed Rate Cut Speculation and Global Unrest

As gold reaches $2,580, expectations of a Federal Reserve rate cut and growing geopolitical risks propel the metal higher—can it break through the $2,600 barrier? | That's TraidngNEWS

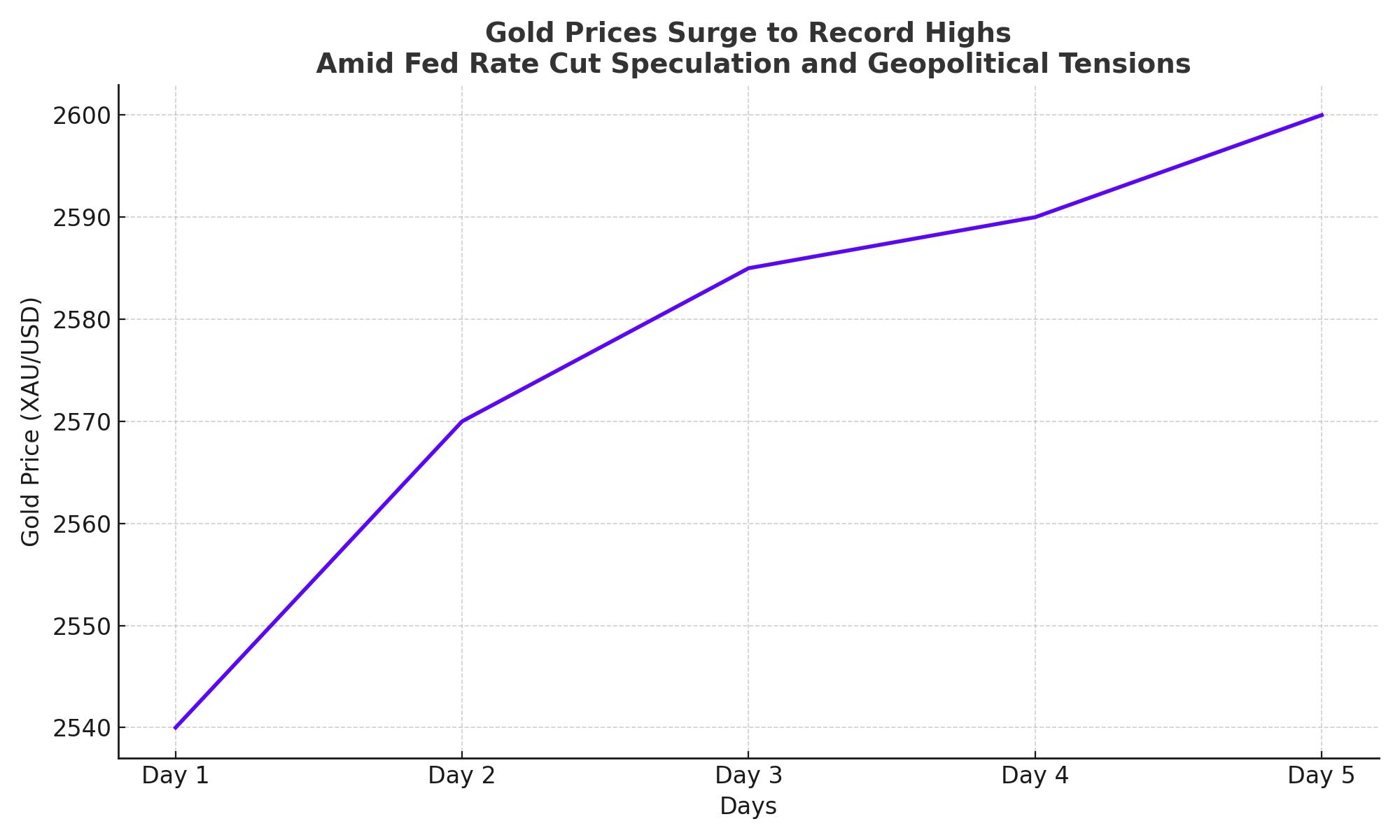

Gold Prices Surge to Record Highs Amid Fed Rate Cut Speculation and Geopolitical Tensions

Gold’s (XAU/USD) trajectory has reached unprecedented levels, with the precious metal now trading around $2,580 per troy ounce, inching closer to an all-time high of $2,586. The combination of looming Federal Reserve rate cuts, persistent geopolitical risks, and slowdowns in key global economies like China has positioned gold as the go-to safe-haven asset. This sharp rise reflects investor sentiment tied to upcoming Federal Open Market Committee (FOMC) decisions and external economic factors.

Rate Cut Expectations Drive Gold’s Ascent

A critical factor behind gold’s meteoric rise has been the increasing likelihood of aggressive Federal Reserve rate cuts. The US economic data, signaling a deceleration in activity, has heightened speculation that the Fed will act to reduce interest rates. According to the CME FedWatch tool, markets now price in a 48% chance of a 25 basis points (bps) cut, while the probability of a 50 bps cut stands at 52%. This environment is highly supportive for gold, as lower interest rates reduce the opportunity cost of holding non-yielding assets like gold.

The anticipation around this decision is further fueled by weak labor market data in August and easing inflation indicators, adding pressure on the Fed to adopt a more dovish stance. Additionally, Alex Ebkarian, Chief Operating Officer at Allegiance Gold, noted, "We are headed towards a lower interest rate environment, so gold is becoming a lot more attractive." The potential for more frequent and substantial cuts has further bolstered gold’s appeal.

Geopolitical Tensions Amplify Safe-Haven Demand

Gold’s rally isn’t only a story of economic expectations but also a reflection of mounting geopolitical tensions. Ongoing conflicts in the Middle East have injected further volatility into the global markets. Israeli Prime Minister Benjamin Netanyahu's warning to Yemen's Houthis following a missile attack on central Israel underscores the fragile geopolitical landscape. These tensions have continued to fuel demand for safe-haven assets, with gold being the primary beneficiary.

China’s Economic Slowdown: A Balancing Force

However, the upside for gold could be capped by concerns about China's economic slowdown. As the world’s largest producer and consumer of gold, any weakness in the Chinese economy has a direct impact on the metal’s demand. In August, Chinese industrial production grew at its slowest pace since March, while retail sales saw their second-slowest month of the year. This sluggish economic activity might weigh on gold prices, especially if China’s demand softens further in the coming months.

Gold’s Recent Record Highs and Silver’s Surge

Despite these challenges, gold prices have repeatedly broken record levels. Gold futures recently touched $2,617.40, a testament to the precious metal's strong upward momentum, especially as US Treasury yields and the dollar weakened. Not only did gold gain, but silver, often referred to as gold's sister commodity, also surged. Silver prices reached $31.10 per ounce, with a weekly gain of 10%, bringing its year-to-date rise to 30%.

Gold’s performance has been impressive, with a year-to-date rise of around 26%, and it’s expected to approach $2,700 before the year ends. The precious metals market is closely watching the upcoming FOMC meeting, where the Fed’s decision will play a pivotal role in gold’s future price movements.

Market Sentiment and Technical Analysis

Technically, gold is showing strong momentum across various timeframes. Short-term movements suggest gold is trading within an ascending channel, with bullish momentum supported by a 14-hour Relative Strength Index (RSI) in overbought conditions. Current support is seen at $2,518 per ounce, with resistance levels at $2,610 and $2,641 per ounce.

For long-term investors, gold remains in a bullish ascending channel. The 14-day RSI is also approaching overbought conditions, suggesting that prices could extend towards the $2,660 resistance level. Analysts believe the long-term target could surpass $2,735 per ounce if current momentum continues.

Fed and ECB Rate Decisions: Impact on Gold’s Trajectory

While the US Federal Reserve’s policy is the primary driver behind gold's rally, the European Central Bank (ECB) also plays a role. The ECB recently cut its interest rates for the second time this year, signaling that inflation in the eurozone is trending downwards. The weaker euro has further buoyed gold, as a cheaper dollar makes gold more attractive for foreign investors.

Market participants now debate whether the Fed will cut rates by 25 or 50 basis points at its upcoming meeting. A larger cut could push gold prices to new highs, while a smaller cut may lead to a short-term pullback. Nonetheless, the long-term outlook remains bullish as investors seek protection against potential economic downturns and geopolitical risks.

Gold’s Strength Amidst US Dollar Weakness

The US dollar has been on a downward trajectory, further supporting gold prices. A weaker dollar makes dollar-denominated assets like gold cheaper for foreign investors, driving up demand. This factor, combined with lower Treasury yields, creates a favorable environment for gold's continued ascent.

Conclusion: Buy, Hold, or Sell?

Given the current economic landscape, gold presents a compelling case as a bullish asset. With the likelihood of multiple rate cuts from the Federal Reserve and ongoing geopolitical uncertainties, gold’s safe-haven appeal remains strong. Technical indicators also suggest further upside potential, with key resistance levels near $2,700 in sight.

However, investors should keep an eye on economic data from China and any unexpected moves from central banks. For now, gold looks like a strong buy, especially for those seeking to hedge against inflation and global uncertainties.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex