Gold Prices Near All-Time Highs: An In-Depth Analysis

Overview of Current Gold Market Trends (XAU/USD)

Gold prices have surged above the psychological $2,500 mark, reflecting a market that’s deeply influenced by macroeconomic factors, including Federal Reserve rate expectations, geopolitical risks, and the global economic landscape. The spot gold price recently touched an all-time high of $2,531, driven by expectations that the Federal Reserve (Fed) will soon begin its policy easing cycle, likely starting with a 25 basis point cut in September. This has kept pressure on U.S. Treasury yields and provided substantial support to gold as a non-yielding asset.

Fed Rate Cut Expectations and Their Impact on Gold

The gold market is heavily influenced by expectations surrounding U.S. monetary policy. As of the latest data, the CME Group’s FedWatch Tool shows that the market is pricing in over a 70% probability of a 25 basis point rate cut at the September FOMC meeting. This sentiment is bolstered by a Reuters poll indicating that a majority of economists anticipate three rate cuts by the end of 2024, compared to the two predicted in the previous month.

Fed Governor Michelle Bowman’s recent comments attempting to temper expectations of an imminent rate cut have done little to sway the bullish sentiment in the gold market. The persistent pressure on U.S. Treasury yields and the dollar's weakening have continued to make gold an attractive option for investors.

Geopolitical Tensions and Gold’s Safe-Haven Appeal

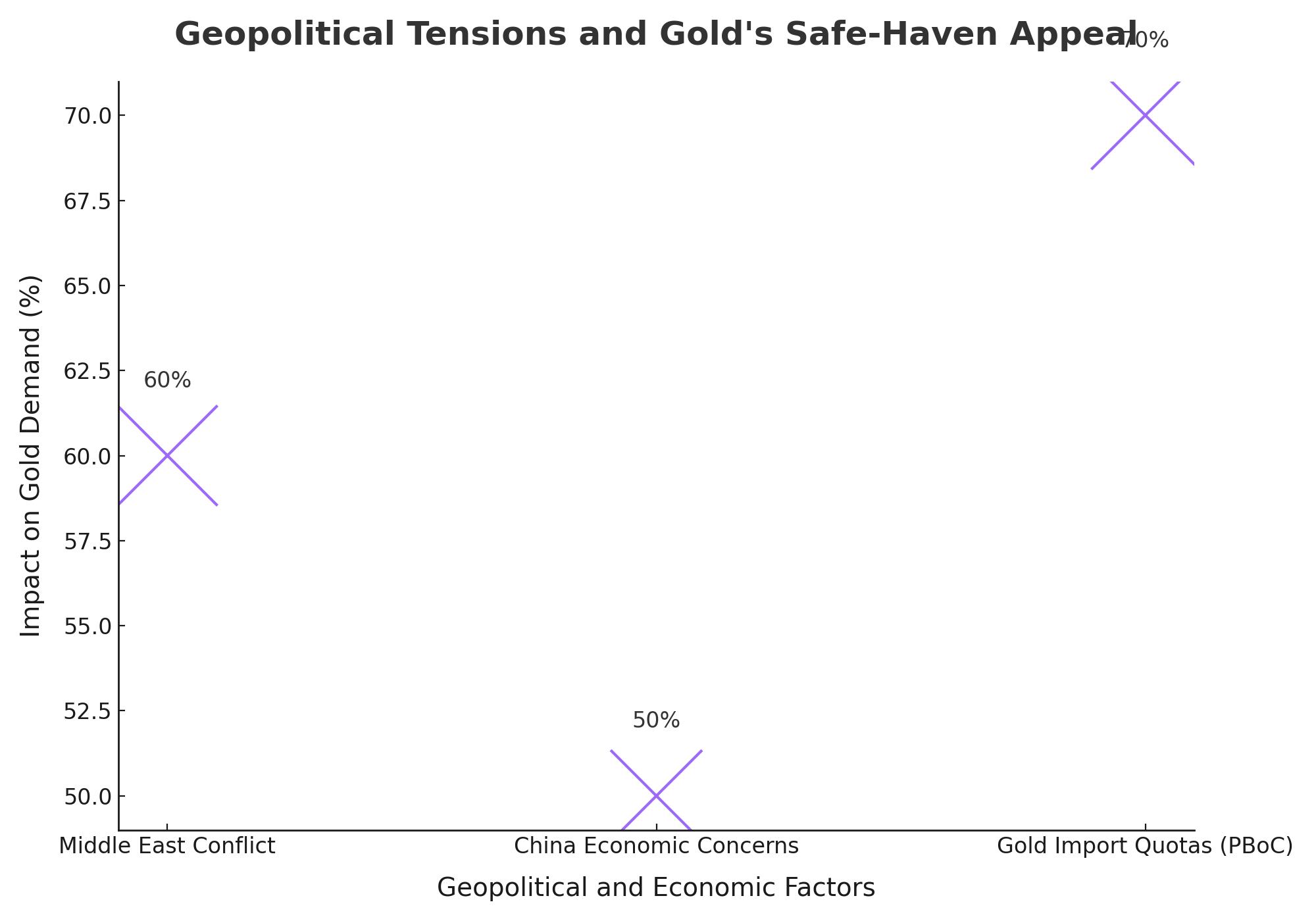

Geopolitical concerns, particularly in the Middle East, have also played a crucial role in gold's recent rally. The ongoing conflict between Israel and Hamas, coupled with fears of a broader regional escalation, has heightened investor demand for safe-haven assets like gold. Additionally, China’s economic struggles have added another layer of uncertainty, further enhancing gold’s appeal as a hedge against global instability.

The People’s Bank of China’s recent move to grant new gold import quotas suggests that a significant buying spree could be on the horizon, potentially adding further upward pressure on gold prices. Moreover, the holdings of the SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, have reached their highest levels in seven months, reflecting strong investment demand.

Technical Analysis: Support and Resistance Levels

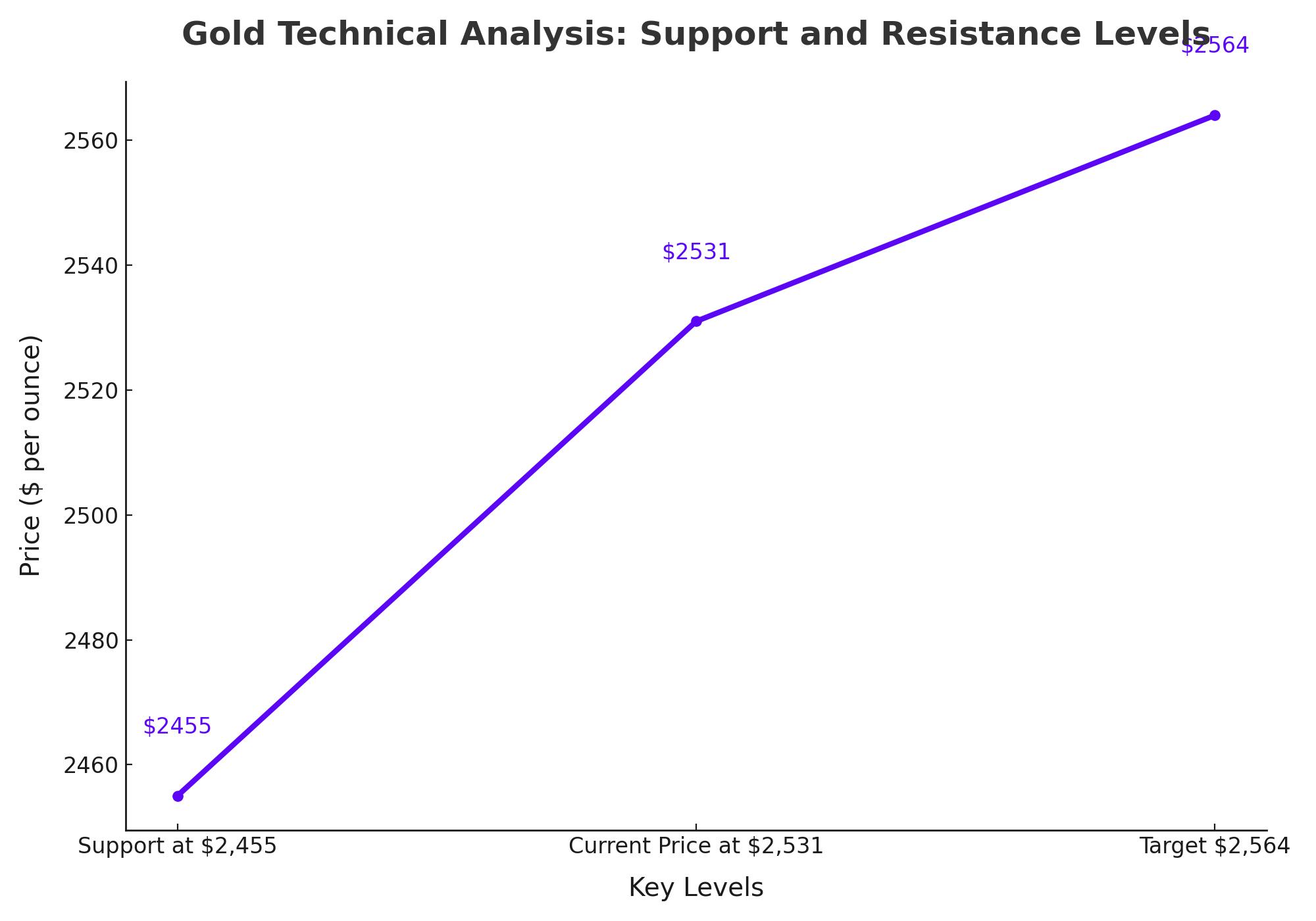

Technically, gold’s breakout above the $2,480 resistance level and its subsequent consolidation above $2,500 indicate strong bullish momentum. The current market sentiment suggests that any pullback towards $2,500 is likely to attract fresh buying interest. Key support levels to watch include the $2,480 region, with more significant support at the $2,455-$2,453 area. A break below these levels could lead to a decline towards the 50-day Simple Moving Average (SMA), currently around $2,400.

On the upside, a move above the recent high of $2,531 could see gold targeting $2,564 and potentially $2,600, given the ongoing macroeconomic backdrop.

Market Sentiment and Investor Behavior

Investor sentiment remains cautious but optimistic, with many market participants waiting for the release of the July FOMC meeting minutes and Fed Chair Jerome Powell’s upcoming speech at the Jackson Hole Symposium. These events are expected to provide crucial insights into the Fed’s future policy path, which will undoubtedly influence gold’s near-term trajectory.

Global Economic Indicators and Their Influence on Gold

Beyond the Fed, global economic indicators continue to play a significant role in shaping gold prices. The yield on the 10-year U.S. Treasury note recently stabilized around 3.88%, a level that does not pose a significant threat to non-yielding assets like gold. However, investors remain wary of any shifts in economic data that could alter the Fed’s policy course.

The U.S. dollar index (DXY) remains at its lowest levels in over seven months, further supporting gold prices. This weakness in the dollar is expected to persist as markets prepare for potential rate cuts, which reduces the opportunity cost of holding non-interest-bearing assets like gold.

Conclusion: A Bullish Outlook for Gold with Caution

The current market environment is overwhelmingly bullish for gold, with prices likely to remain well-supported above $2,500 in the near term. However, investors should remain vigilant, as any unexpected shifts in Fed policy or global geopolitical developments could introduce volatility. With central banks around the world, including the Fed, expected to ease monetary policy, the fundamental backdrop for gold remains strong, potentially driving prices higher in the coming months.

Investment Implications

Given the current dynamics, gold appears to be a strong buy, particularly on any dips below $2,500. Investors should consider maintaining a position in gold as part of a diversified portfolio, especially in light of ongoing geopolitical risks and the prospect of a more dovish Fed. However, it is crucial to stay informed and be prepared to adjust positions based on new economic data and policy announcements.