Goldman Sachs Outshines with Strategic Mastery and Robust Earnings

As GS pivots towards investment banking and wealth management, its latest earnings reveal a successful trajectory bolstered by strategic initiatives and market acumen | That's TradingNEWS

Goldman Sachs (NYSE:GS) Shows Strong Q2 Performance Amid Strategic Shift

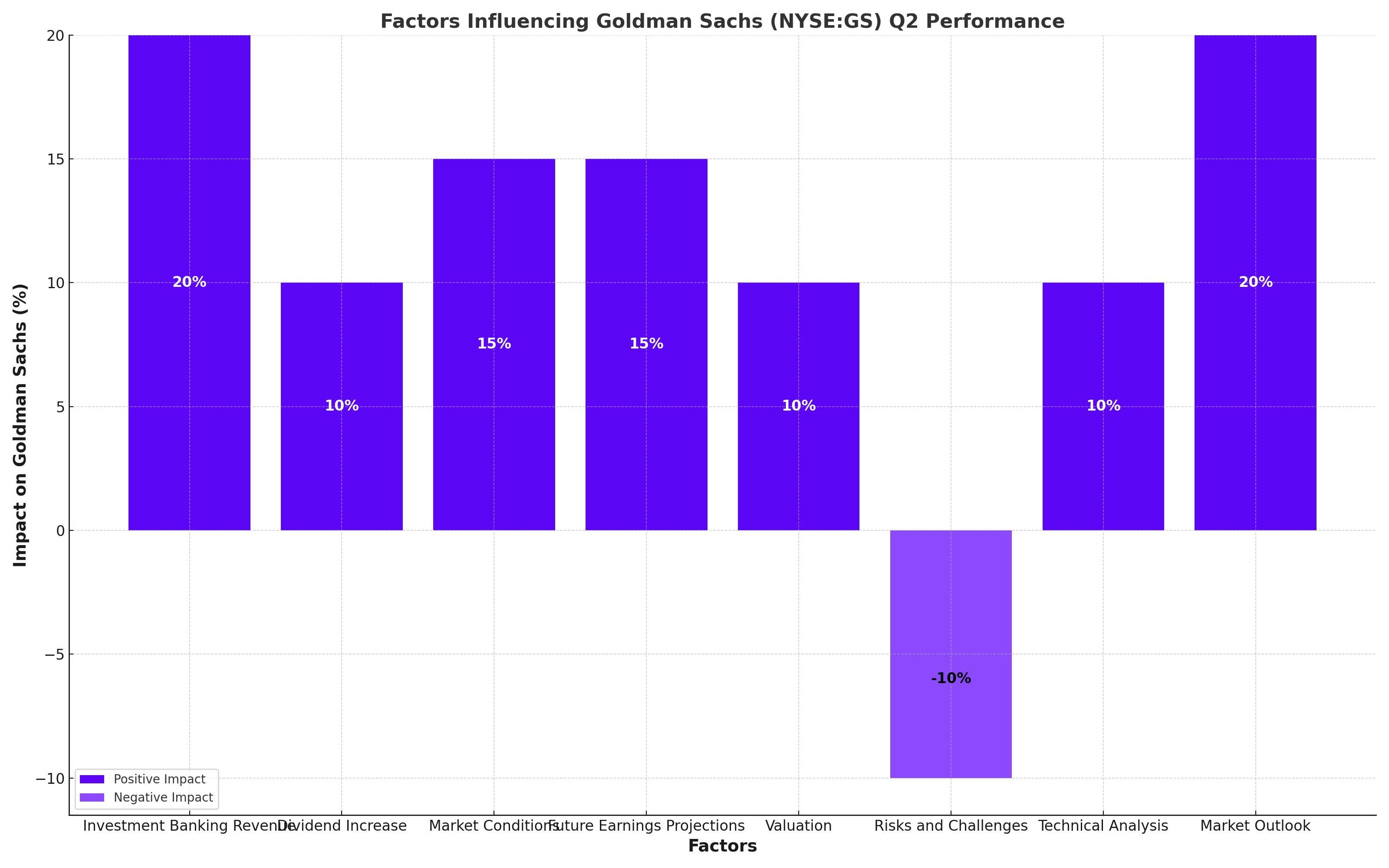

Goldman Sachs Group (NYSE:GS) reported impressive second-quarter results, demonstrating the effectiveness of its strategic shift back to core investment banking and trading activities. This move comes after the bank's costly foray into consumer banking, which culminated in the unsuccessful Marcus initiative. With a renewed focus on high-margin activities, Goldman Sachs has started to show significant positive results, bolstering its position as a leader in the financial sector.

Investment Banking Revenue Surge

Goldman Sachs reported second-quarter profits of $3.04 billion, marking a 150% increase year-over-year. This performance was driven by a 20% surge in investment banking revenue, which now stands as a testament to the bank’s successful refocus on Wall Street operations. Earnings per share (EPS) reached $8.62, surpassing the $8.42 consensus estimate. Net interest income (NII) rose by 33% to $2.24 billion, well above the expected $1.66 billion. Overall, total revenue increased by 17% to $12.73 billion, exceeding the $12.42 billion estimate.

This robust performance in investment banking can be attributed to the resurgence in deal-making activities. Goldman Sachs has capitalized on the increased demand for advisory services in mergers and acquisitions (M&A), debt issuance, and equity underwriting. The bank's strategic pivot to focus on these high-margin segments has paid off, driving substantial revenue growth and profitability.

Dividend Increase Reflects Confidence

The company also announced a 9% increase in its quarterly dividend, raising it to $3.00 per share from the previous $2.75. This decision reflects the management’s confidence in the bank's financial health and future growth prospects. Goldman Sachs shares saw a modest rise, trading at $483.80 following the announcement, contributing to a year-to-date increase of approximately 25%.

The dividend hike underscores Goldman Sachs' commitment to returning capital to shareholders while maintaining a strong balance sheet. This move is expected to attract income-focused investors and further solidify the bank's position in the market.

Strategic Refocus and Market Conditions

Goldman Sachs is capitalizing on current market conditions, with a rise in private equity deals and an increased need for debt market advisory and restructuring services. This strategic shift is well-timed, considering the Federal Reserve’s anticipated interest rate cuts. The bank’s strong deal flow in the first quarter of 2024, which saw net revenues of $14.2 billion and a 33% year-over-year increase in investment banking fees, is expected to continue. The rebound in global M&A activity, with deal volumes reaching $755 billion, highlights Goldman’s robust position in the market.

The bank's decision to step back from consumer lending and refocus on its core strengths has proven beneficial. By concentrating on investment banking and trading, Goldman Sachs can leverage its expertise and relationships to drive growth and profitability.

Future Earnings and Revenue Projections

Looking ahead, Goldman Sachs is projected to deliver strong earnings in upcoming quarters. For Q2 2024, the consensus estimates predict an EPS of $8.42, a 173.24% year-over-year growth. The expected revenue for the same quarter is $12.37 billion, marking a 13.58% increase from the previous year. This growth is largely attributed to the bank’s strong performance in the investment banking sector, particularly in M&A advisory and capital markets.

Adding to this optimism, Goldman Sachs’ Q3 2024 projections remain robust, with consensus estimates projecting an EPS of $8.49, a 55.17% increase from the previous year, and revenues of $12.53 billion. This continued strong performance is expected to be driven by a strong deal flow and a rise in transactions in the investment banking division.

Valuation and Market Position

Despite the strong performance, Goldman Sachs’ valuation appears to be attractive. The bank’s forward price-to-earnings (P/E) ratio is 13x, a premium compared to other major banks but justified by its robust growth prospects. The forward PEG ratio of 0.65 also suggests that the market might be undervaluing the bank’s future earnings potential. Additionally, Goldman’s strong focus on high-margin, asset-light revenue sources positions it well for sustainable growth.

Compared to its peers, Goldman Sachs' valuation metrics indicate a potential for significant upside. The bank's PEG ratio stands at 0.91x, versus a sector median of 1.13x, implying that the stock price is below the industry average. This undervaluation is further highlighted by the bank's forward P/E ratio, which remains attractive given its growth prospects.

Risks and Challenges

Rising credit defaults could impact the bank’s margins if consumer and commercial loan payments are missed. Economic stagnation could also pose challenges, although Goldman’s strategic shift towards wealth management and high-margin activities should mitigate some of these risks.

The potential for higher credit defaults is a significant concern. Recent data has shown that delinquency rates have increased across various loan types, posing a threat to the bank's profitability and stability. However, Goldman Sachs has implemented measures to mitigate these risks by reducing its exposure to consumer loans and focusing on more stable revenue sources.

Technical Analysis

Goldman Sachs' stock has been on a positive momentum since mid-April, trading above its 14-day moving average. The stock has formed a strong support level around $444 and a resistance level just under $470. The next earnings report, scheduled for July 15, will be crucial in determining the stock’s next move.

Technical indicators suggest that Goldman Sachs' stock is well-positioned for further gains. The Relative Strength Index (RSI) remains in neutral territory, indicating that the stock is neither overbought nor oversold. This suggests that there is room for the stock to move higher, supported by positive earnings momentum and strong market conditions.

Market Outlook and Analyst Sentiments

As Goldman Sachs approaches its next earnings report, market analysts remain optimistic about its prospects. The bank's stock has demonstrated resilience, consistently performing well against broader market trends. Analyst sentiment is buoyed by Goldman Sachs' strategic pivot towards higher-margin sectors such as investment banking and wealth management, which have historically yielded robust returns during times of economic recovery and market stability.

Furthermore, Goldman Sachs' adaptation to the evolving financial landscape—particularly its reduced reliance on consumer banking and increased focus on asset management and institutional client services—positions it favorably for future growth. This strategic realignment is reflected in the upgraded forecasts and target prices issued by several Wall Street analysts, who anticipate continued outperformance in the coming quarters.

Earnings Forecast and Potential Impact

For the upcoming quarterly earnings, the consensus among financial analysts suggests a strong performance, with expected earnings per share (EPS) significantly higher than the previous year. This anticipated increase is largely attributed to Goldman Sachs' aggressive engagement in high-profile mergers and acquisitions, as well as sustained revenue growth from its trading divisions.

Investors and market watchers will be keenly observing the bank’s performance in these areas, as well as any updates on its cost management strategies and capital allocation plans. Positive results could reinforce confidence in the stock, potentially driving further price appreciation. Conversely, any deviation from expected outcomes—particularly in core areas such as investment banking and asset management—might temper enthusiasm and impact stock valuation.

Long-term Strategic Initiatives and Risk Management

Goldman Sachs has also been proactive in deploying long-term strategic initiatives, which include enhancing digital platforms, expanding its global footprint, and entering into new market segments such as digital assets and sustainable finance. These initiatives are designed to diversify revenue streams and reduce dependency on traditional banking sectors that are susceptible to market downturns.

In terms of risk management, the bank continues to maintain stringent controls to mitigate risks associated with market volatility, credit exposure, and geopolitical uncertainties. The effectiveness of these risk management strategies is crucial for sustaining growth and protecting shareholder value, especially in an unpredictable economic environment.

Dividend Policy and Shareholder Returns

Goldman Sachs’ recent dividend increase is a testament to its strong financial health and commitment to returning value to shareholders. This policy not only enhances the stock's appeal to dividend-seeking investors but also signals the management's confidence in the bank’s stable cash flow and profitability.

Looking forward, the bank may continue to use dividends and share buybacks as tools to manage its capital efficiently and reward shareholders. The ability to sustain and possibly increase shareholder returns will depend largely on the bank's ongoing financial performance and market conditions.

Conclusion and Investment Recommendation

In conclusion, Goldman Sachs (NYSE:GS) presents a compelling investment case, backed by strong fundamentals, strategic growth initiatives, and a robust market position. The bank's focus on high-margin, asset-light business models, combined with its proactive management and innovative strategies, positions it well for continued success.

Given the current market dynamics and the bank's strategic positioning, Goldman Sachs is rated as a strong buy. Investors are advised to monitor upcoming earnings reports and strategic announcements closely, as these will provide further insights into the bank's trajectory and potential market movements.

That's TradingNEWS

Read More

-

Stock Market Today: Dow (^DJI) 48,404 And S&P 500 (^GSPC) 6,812 Slip As Jobs Hit +64K And AVGO Sells Off

16.12.2025 · TradingNEWS ArchiveStocks

-

Bitcoin Price Forecast - BTC-USD at $86K: BTC Squeezed Between $74K Panic Zone and $150K Upside

16.12.2025 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast - XAU/USD Pulls Back From Record Highs but Bulls Still Target $5,000

16.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen At 155: Yen Strength Builds As BoJ Hike And NFP Collide

15.12.2025 · TradingNEWS ArchiveForex