Gold’s Bullish Outlook for 2024: Key Drivers Fueling a Potential 3,000$ Breakout

As inflation persists and geopolitical tensions rise, gold’s safe-haven appeal strengthens. Discover why central banks are stockpiling gold and how supply constraints could push prices even higher | That's TradingNEWS

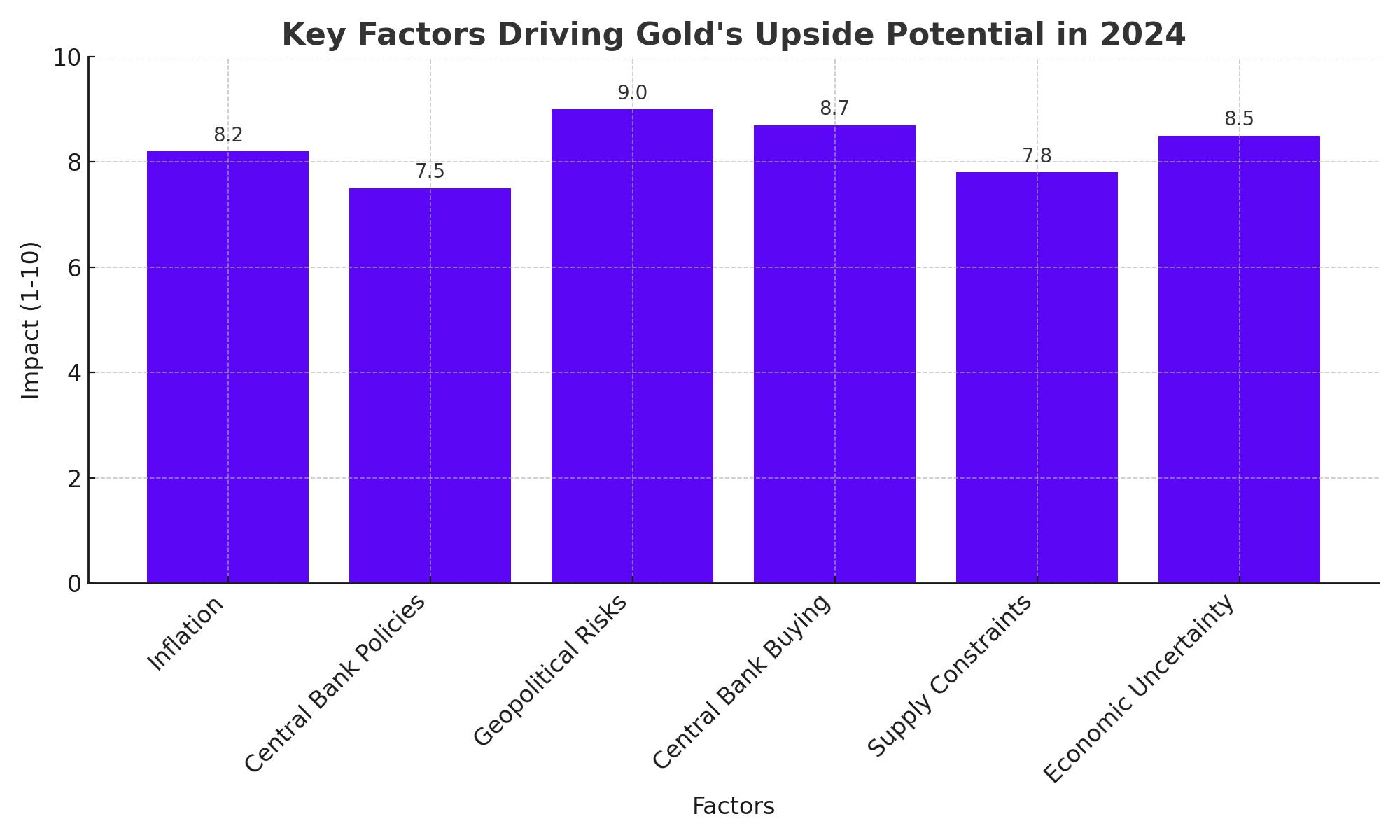

Long-Term Drivers of Gold’s Upside Potential

As we move deeper into 2024, several macroeconomic factors are shaping the gold market’s long-term trajectory. Gold’s performance is highly influenced by global interest rates, inflation expectations, central bank policies, and economic stability. With the world still navigating through uncertainties such as geopolitical conflicts, economic challenges from inflation, and potential recessions, the demand for gold as a safe-haven asset is expected to remain elevated. Here are some of the key factors that are likely to impact gold prices in the coming months.

Global Inflationary Pressures and Central Bank Policies

The primary driver of gold’s upward potential is its relationship with inflation. Historically, gold has served as an inflation hedge, particularly during periods of high inflation and currency devaluation. In the US, despite recent indications of easing inflation, price pressures remain. The US Consumer Price Index (CPI), which is set to be released later this week, could influence market sentiment towards gold. A higher-than-expected CPI would increase inflation fears, potentially sparking a rally in gold as investors seek refuge from eroding purchasing power.

Central banks around the world, particularly in developed economies, are recalibrating their monetary policies to tackle inflation. However, gold benefits from any perception that the Federal Reserve or other central banks are falling behind the curve. With the market already pricing in 94% odds of a 25 basis points rate cut in the next Fed meeting, a dovish tilt could enhance gold’s appeal. Conversely, any hawkish surprise from the Fed could cap some of gold’s upside, but it is unlikely to completely derail its safe-haven demand.

Globally, emerging markets are experiencing even more significant inflationary pressures, which continue to elevate gold's attractiveness. Countries like India and China, both major buyers of gold, are witnessing persistent inflation, which is further boosting gold demand. In particular, central banks in these nations have been accumulating gold reserves as part of a broader strategy to diversify away from the USD and shield against currency devaluation risks.

Geopolitical Instability and Its Impact on Gold

One of the major tailwinds for gold in 2024 has been escalating geopolitical tensions. The ongoing conflicts in the Middle East, including Israel's confrontations with Hezbollah and Iran, have heightened market uncertainties, prompting investors to seek safety in gold. Gold’s safe-haven status tends to gain prominence during such crises, as it is considered a store of value when political or economic stability is in jeopardy.

The conflict in the Middle East has the potential to spill over into other parts of the region, disrupting global supply chains, particularly for energy. Any disruptions in oil production or trade routes can lead to higher inflation and economic uncertainty, both of which are supportive of gold prices. Analysts believe that if the conflict escalates into a full-blown regional war, gold prices could surge beyond $3,000. Already, there is speculation that a retaliatory strike from Israel against Iran could drive gold prices sharply higher in the short term.

At the same time, the war in Ukraine continues to fuel geopolitical risk. Russia’s ongoing invasion has led to sanctions and market volatility that have kept gold demand high in Europe and beyond. As long as these conflicts persist, they will provide a strong floor under gold prices, limiting any significant downside.

Eastern Central Bank Gold Buying Spree

In addition to geopolitical instability, another major factor supporting gold prices is the continued accumulation of gold by central banks, particularly in the Asia-Pacific region. China’s People’s Bank has been a notable buyer, increasing its gold holdings consistently over the past 18 months. At the end of August, China’s gold reserves were valued at $182.98 billion, up from $176.64 billion the previous month.

Similarly, India has also increased its gold reserves, adding to the overall central bank demand that has supported the price floor for gold. Central banks in both China and India are seeking to diversify their foreign exchange reserves, reduce their reliance on the US dollar, and protect themselves from potential sanctions or economic restrictions.

The pattern of central bank buying aligns with the broader trend of de-dollarization, where nations are increasingly looking to alternative stores of value amid concerns about the long-term stability of the US dollar. As central banks continue to build their gold reserves, this will reduce the supply available to the broader market, exerting further upward pressure on prices.

Supply Constraints and Market Tightness

While demand for gold remains robust, the supply side has faced constraints, adding another dimension to the bullish case for gold. Gold mining production has struggled to keep pace with rising demand. Global gold production is projected to grow modestly in 2024, but increasing costs for exploration and mining, coupled with regulatory challenges in some regions, have constrained supply. Additionally, disruptions in some gold-producing nations due to political instability or labor strikes have further tightened supply.

Moreover, some investors and central banks have been reluctant to sell their gold holdings, exacerbating market tightness. This limited supply, combined with sustained demand from investors and institutions, has helped maintain high gold prices, even in the face of a stronger US dollar.

Gold as a Hedge Against Economic Uncertainty

Apart from inflation and geopolitical risks, gold is increasingly being viewed as a hedge against broader economic uncertainties. Concerns over a potential recession in 2025 have risen, with some economists predicting a slowdown in global economic growth as a result of high interest rates and tightening financial conditions. The global economy is also grappling with high levels of debt, and any signs of debt crises in emerging markets could send investors flocking to safe-haven assets like gold.

The US Federal Reserve has acknowledged the challenges facing the global economy, and while the Fed's priority remains controlling inflation, there are growing concerns that a policy misstep could trigger a recession. In such an environment, gold’s appeal as a non-correlated asset is likely to grow.

Investor Sentiment and Speculative Flows

Speculative flows in gold markets also play a significant role in price movements. Hedge funds and institutional investors have been increasing their positions in gold as they anticipate further gains driven by both economic and geopolitical uncertainties. With more investors positioning themselves for a weaker US dollar and higher inflation, gold has been a key beneficiary.

Gold exchange-traded funds (ETFs) have seen inflows over recent months, and the Gold Price Index shows continued growth in investor interest. Rising open interest in gold futures suggests that traders are bullish on the yellow metal, further driving up demand and limiting any potential downside.

Valuation and Forecast for Gold in 2024

The current price of gold, hovering near $2,650, is on the verge of breaking higher. While short-term corrections may occur, the broader macroeconomic and geopolitical backdrop supports a bullish outlook. Analysts forecast that gold could reach as high as $3,000 by the end of 2024, driven by a combination of strong demand from central banks, rising geopolitical risks, and sustained investor interest.

Gold’s price trajectory will also be influenced by US Federal Reserve policy. Should the Fed adopt a more dovish stance, gold prices could see additional tailwinds. On the other hand, any unexpected tightening could temporarily cap gains, although the long-term trend remains upward.

Final Considerations: Is Gold a Buy?

For investors considering gold as part of their portfolio, the current environment offers several compelling reasons to be bullish. With central bank demand at record levels, geopolitical risks escalating, and inflation concerns persisting, gold presents a solid hedge against volatility and uncertainty. The price outlook for gold remains robust, with potential gains of 10-15% within the next six to twelve months, making it a strong addition for those seeking stability in an uncertain market.

Investors should keep a close eye on key events such as the US CPI data, ongoing Fed policy decisions, and any significant geopolitical developments, as these will provide further direction for gold prices. Given the current macroeconomic conditions and rising demand for safe-haven assets, XAU/USD remains a solid investment for both long-term capital appreciation and portfolio diversification.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex