Gold's Price Volatility in Light of Current Economic Developments

Exploring the Impact of U.S. Economic Data and Global Market Trends on Gold Investment Strategies | That's TradingNEWS

Gold's Market Dynamics: A Comprehensive Financial Analysis

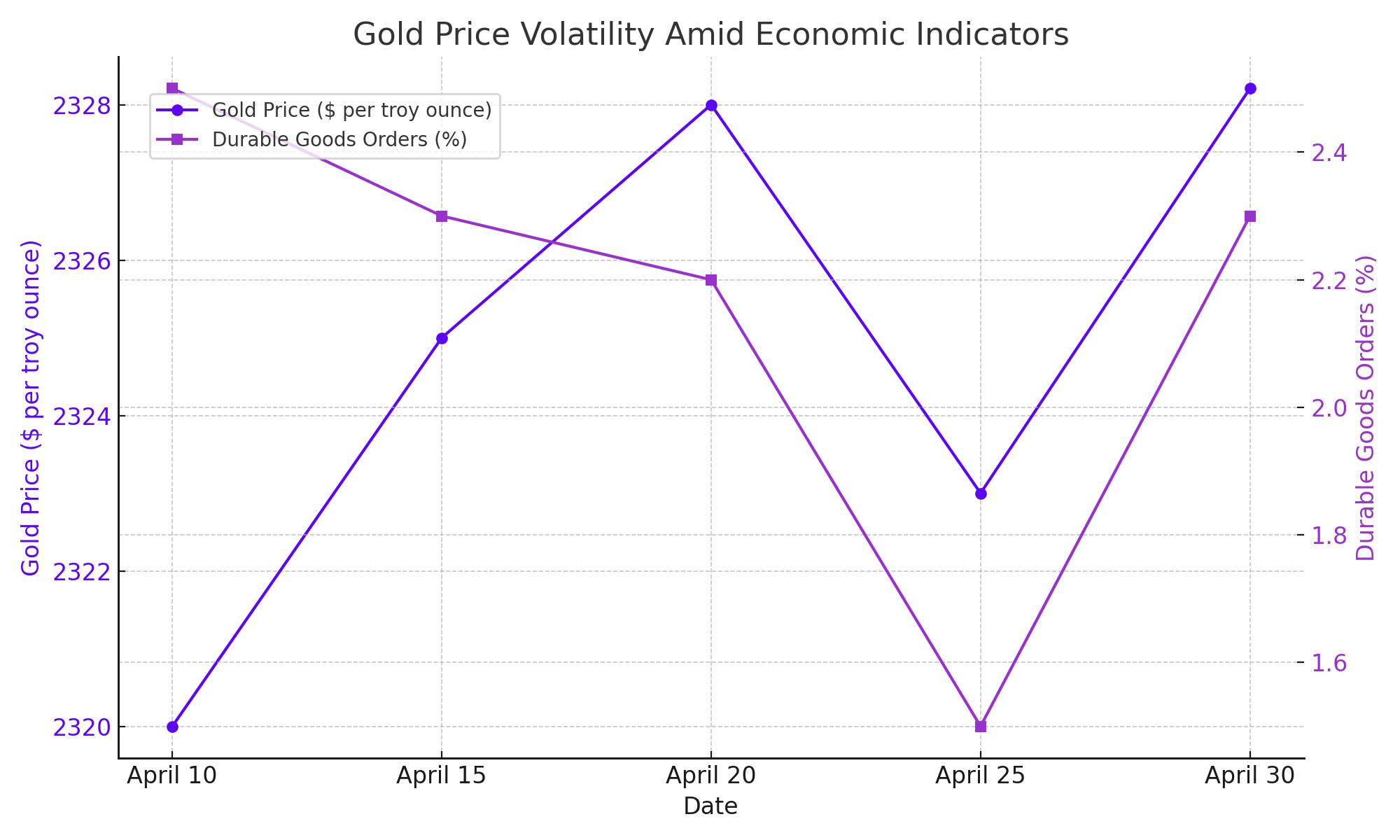

Gold Price Volatility Amid Economic Indicators

In the latest financial updates, the gold market (XAU/USD) has experienced a tumultuous period, characterized by significant price fluctuations. Currently priced at $2,328.21 per troy ounce, gold has shown resilience, despite recent dips and rebounds around the $2,325 mark. This price behavior is a direct reflection of the mixed economic signals from the United States, which continue to influence investor sentiment and monetary policy expectations.

Recent economic data, including a lower than expected rise in Durable Goods Orders at 2.3% against a forecast of 2.5%, has cast doubts on the robustness of the U.S. economy. Additionally, a downward revision of February's figures from 2.2% to 1.5% further complicates the outlook, suggesting potential hesitancy within the Federal Reserve to maintain current interest rate levels.

Upcoming Economic Forecasts and Their Implications

Looking ahead, the financial markets are poised for the upcoming release of the U.S. Q1 GDP, anticipated to show a growth rate of 2.5%. This data, coupled with the March PCE Price Index— the Fed’s preferred inflation measure—will be critical in shaping future rate decisions. These reports are expected to provide clearer insights into the economic trajectory and its impact on investment assets like gold.

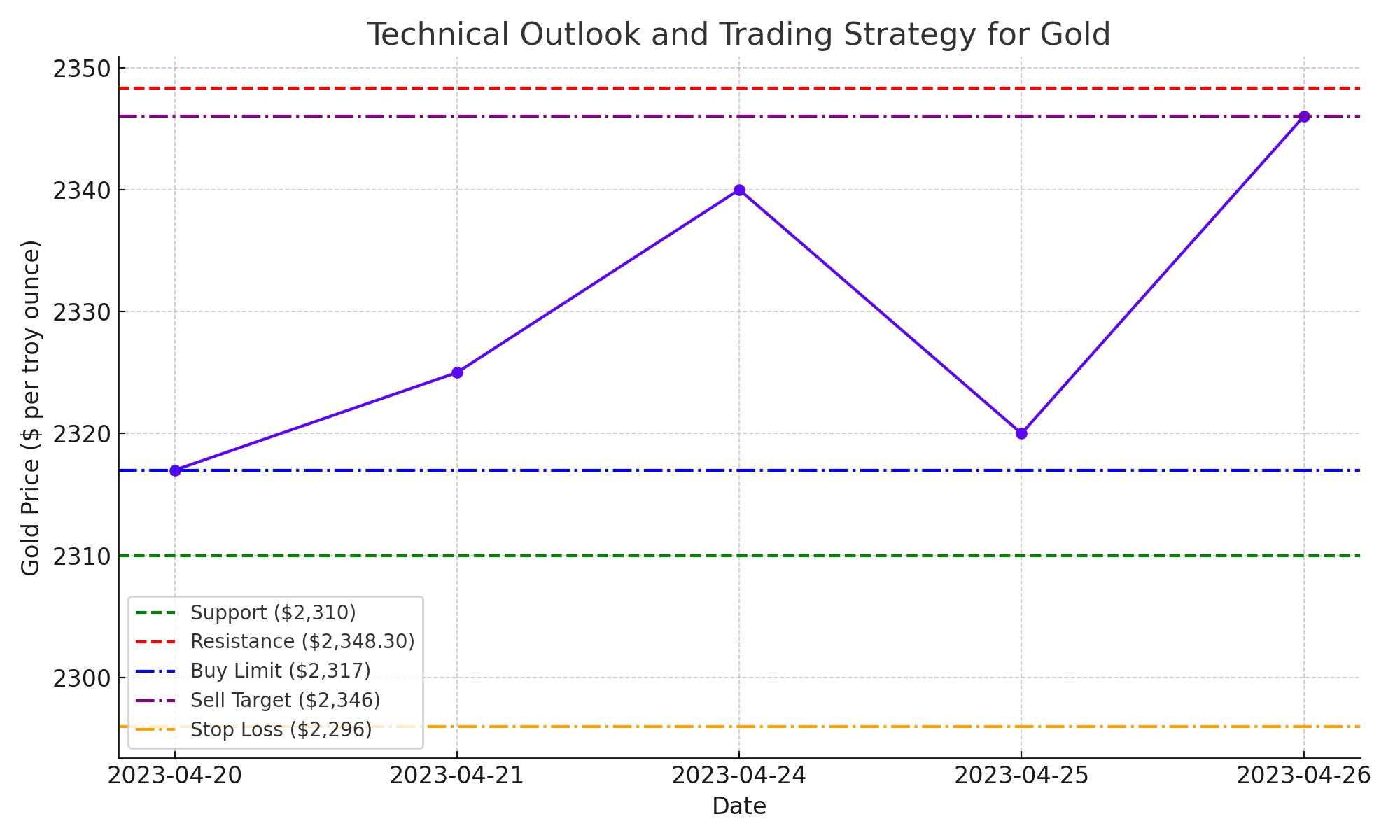

Technical Outlook and Trading Strategy for Gold

From a technical perspective, the gold market presents a mixed outlook. Currently trading around the 23.6% Fibonacci retracement level from its recent rally, gold struggles to maintain momentum above this critical threshold. The daily technical indicators suggest a lack of clear directional strength, with the 20 SMA presenting immediate resistance.

For traders, the key support and resistance levels to watch are $2,310 and $2,348.30, respectively. A strategic approach would involve setting a buy limit order at $2,317, aiming for a profit near $2,346, with a stop loss at $2,296 to mitigate potential declines. This strategy aligns with both the observed market patterns and the anticipated economic updates.

Global Influences and Market Sentiment

Internationally, easing geopolitical tensions, particularly between Israel and Iran, have somewhat reduced the demand for gold as a traditional safe haven. Despite ongoing regional conflicts, the current atmosphere suggests a possible de-escalation, diminishing the immediate rush to safe-haven assets.

Furthermore, the broader financial markets reflect a cautious optimism, as evidenced by modest losses on Wall Street, contrasting with gains in Asian and European markets. The U.S. dollar's weakness, particularly in light of disappointing PMI data, supports gold prices by making dollar-priced assets more attractive.

Investment Outlook

As investors navigate this complex landscape, the overarching strategy should focus on leveraging gold's intrinsic value as both a hedge against inflation and a diversifiable asset in a well-rounded investment portfolio. The upcoming U.S. economic reports will undoubtedly play a pivotal role in determining the short to medium-term price dynamics of gold.

In conclusion, while the current market conditions suggest a cautious approach to gold investment, the underlying factors provide a fertile ground for strategic investments that capitalize on both economic indicators and geopolitical developments. As always, investors are advised to stay attuned to global economic trends and adjust their strategies accordingly to harness the potential upsides while mitigating risks.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex