Gold's Shaky Ground: Will Fed Decisions Spark a Rally or Deepen the Decline?

As global demand falters and the Federal Reserve mulls over rate cuts, gold investors brace for a turbulent ride. What’s next for the precious metal? | That's TradingNEWS

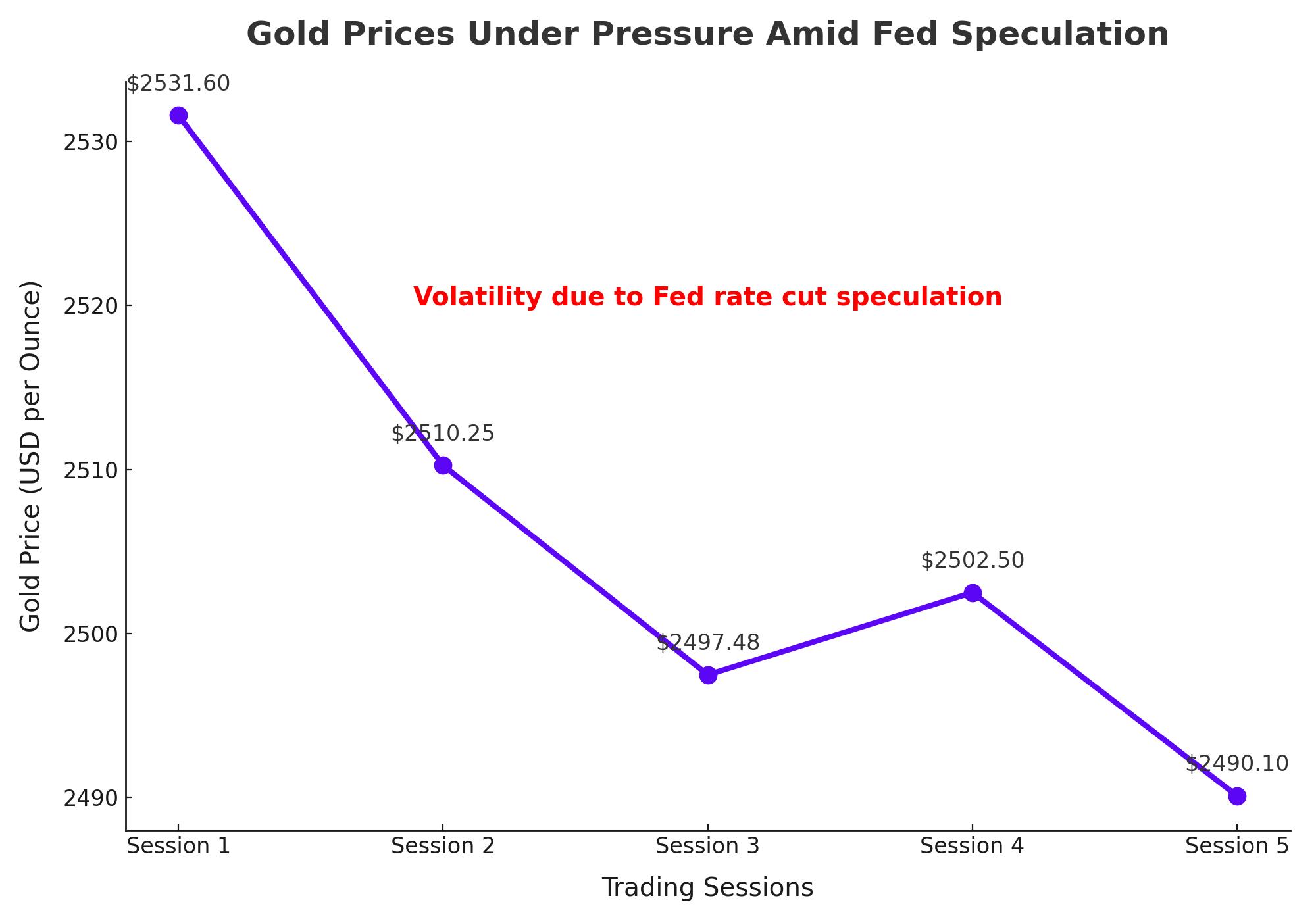

Gold Prices Under Pressure Amid Fed Speculation

Gold has been on a volatile ride recently, with prices fluctuating as traders brace for potential interest rate cuts by the Federal Reserve. The yellow metal reached an all-time high of $2,531.60 earlier in the week, only to pull back below the $2,500 mark due to profit-taking and a strengthening U.S. dollar. Spot gold was last trading at $2,497.48 per ounce, reflecting a 0.51% increase from the previous session, yet still nursing a weekly decline of nearly 1%.

Rate Cut Anticipation and Its Impact on Gold

The market is widely expecting the Fed to announce a 25-basis-point rate cut in September, with a 74% probability according to recent data. Some traders are even betting on a more aggressive 50-basis-point cut, which could have profound implications for gold prices. Lower interest rates generally enhance gold's appeal as a non-yielding asset, as the opportunity cost of holding bullion diminishes. However, this expectation has created a precarious environment where any deviation from the anticipated rate cut could trigger significant volatility.

Global Demand Concerns Weigh on Gold Prices

Despite the optimism around potential rate cuts, global demand concerns continue to cast a shadow over gold's rally. Economic data from key markets such as the U.S., Europe, and China have shown signs of slowing demand, which could dampen the outlook for gold. For instance, the Purchasing Managers' Index (PMI) in July fell to an eight-month low in the U.S., extended a two-year contraction trend in the eurozone, and dropped below the growth threshold in China. These indicators suggest that even with supportive monetary policies, gold may face headwinds from weakening global demand.

Market Sentiment and Investor Positioning

Investor sentiment has been cautious ahead of Federal Reserve Chair Jerome Powell's speech at the Jackson Hole Symposium, scheduled for 14:00 GMT today. Powell's remarks are expected to provide crucial insights into the Fed's monetary policy trajectory. While the market has largely priced in a rate cut, there is a palpable sense of uncertainty, with traders positioning themselves for possible surprises.

Gold's recent price movements suggest a "buy the rumor, sell the fact" scenario may be unfolding. If Powell's speech aligns with market expectations without offering any new dovish signals, gold could experience further selling pressure. Conversely, any indication of more substantial rate cuts or economic concerns could reignite bullish momentum for the metal.

Technical Analysis: Key Levels to Watch

On the technical front, XAU/USD is currently hovering just above a crucial short-term pivot at $2,482.00. A failure to hold this level could lead to a steep decline towards the next pivot at $2,442.48, with a break below $2,432.22 potentially changing the trend to bearish. If this bearish scenario unfolds, gold could test the 50-day moving average at $2,402.80, which would be a critical support level. Conversely, a rally above $2,500 could set the stage for a retest of the recent highs, particularly if Powell signals a more dovish outlook.

Global Gold Market Dynamics

The broader global gold market has also seen some interesting developments. In the Philippines, for example, gold prices fell slightly, with the price per gram dropping to PHP 4,516.73 from PHP 4,566.82. Similarly, the price per tola decreased to PHP 52,682.19 from PHP 53,266.53. These movements reflect the global nature of gold pricing, influenced by both local economic conditions and broader international trends.

In contrast, India's silver imports are on track to nearly double this year, driven by rising demand from solar panel manufacturers and electronics makers, as well as investors seeking better returns than those offered by gold. This surge in demand for silver highlights the dynamic nature of precious metals markets and the potential for shifts in investor preferences.

Geopolitical and Economic Factors

Geopolitical tensions and economic uncertainty continue to influence gold prices. The ongoing ceasefire negotiations in the Middle East, particularly the complex situation in Gaza, have maintained a "war premium" on oil prices, which in turn impacts gold as a safe-haven asset. Meanwhile, economic data from the U.S. Labor Department revealed a significant downward revision in job growth figures, further complicating the outlook for the U.S. economy and adding another layer of uncertainty for gold traders.

Conclusion: What Lies Ahead for Gold?

As we move into the final quarter of the year, gold's path will likely be shaped by a combination of monetary policy decisions, global economic conditions, and investor sentiment. The upcoming Fed rate decision, along with Powell's guidance at Jackson Hole, will be pivotal in determining whether gold can sustain its recent highs or if it will face further downside pressure.

Investors should remain vigilant, as the potential for significant price swings remains high. Whether gold continues its upward trajectory or faces a deeper correction will depend largely on the interplay between these various factors, making it a critical period for those invested in the precious metal.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex