Gold's TradingNEWS - Analyzing the Impact of Economic Trends

A Deep Dive into the Rally in Precious Metals and the Broader Implications for Global Investors | That's TradingNEWS

Exploring Gold's Resurgence in Global Markets

Rally in Precious Metals

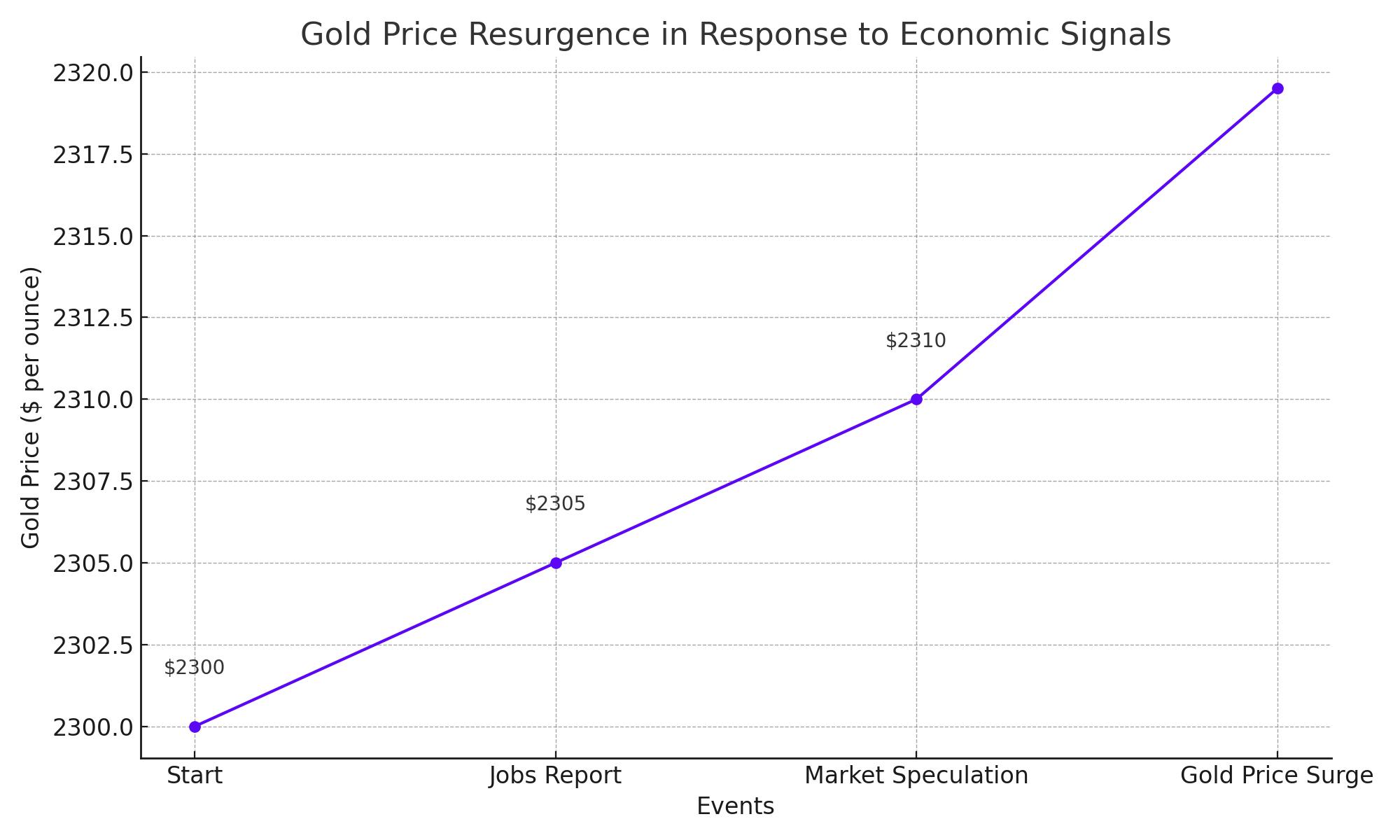

In the global financial landscape, gold has recently experienced a notable upturn, with spot gold rising by 0.7% to reach $2,319.50 per ounce. This increase is largely attributed to the softening of the U.S. dollar, sparked by a jobs report that underperformed relative to expectations. This economic indicator has revived market speculation that the Federal Reserve may be poised to cut interest rates within the year, enhancing gold's appeal as an investment.

Mining Stocks on the Rise

Reflecting the uptick in bullion prices, shares of major mining companies have shown significant premarket increases. Newmont and Barrick Gold, two of the heavyweight contenders in the industry, have seen their stock prices increase by 1.8% and 1.3%, respectively. This trend extends to other major players across the globe, with South African miners like Sibanye Stillwater and AngloGold Ashanti witnessing gains ranging from 1.5% to 3%. Canadian firms such as Kinross Gold and Agnico Eagle Mines have also benefited, experiencing rises of 0.5% and 1.5%.

Economic Data Influencing Market Dynamics

The weaker-than-expected U.S. employment data has had a twofold effect: lowering the U.S. dollar and boosting the attractiveness of gold. As the Federal Reserve contemplates rate cuts, the reduced opportunity cost of holding non-yielding assets like gold becomes more appealing. This dynamic is reflected in the activities of gold traders who are keenly awaiting further insights from upcoming Fed officials' speeches, expected to shed light on future monetary policy directions.

Technical and Market Outlook

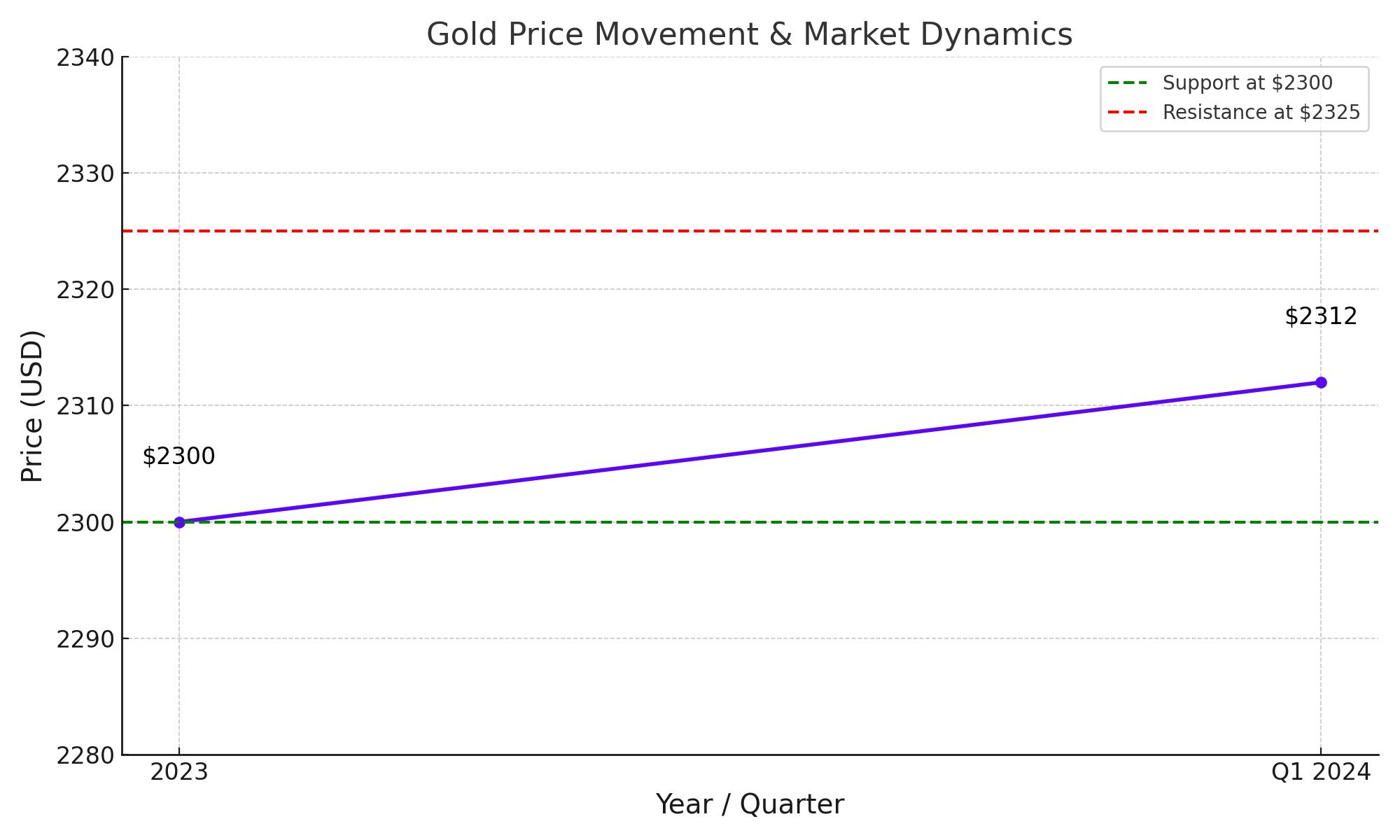

From a technical perspective, gold faces immediate resistance in the $2,350 to $2,365 range, with potential to push towards record highs if these thresholds are breached. The broader market sentiment is buoyed by these developments, alongside the persistent geopolitical tensions in the Middle East which continue to underpin the commodity's status as a safe haven.

Investment and Inflation Considerations

The scenario is further complicated by global inflation concerns, which are at multi-decade highs, prompting investors to flock towards commodities like gold as a hedge. Trading volumes in gold futures have surged by 20% year-over-year, underscoring the metal’s burgeoning role as both a hedge and a speculative asset in times of economic uncertainty.

Strategic Market Recommendations: Navigating Gold Investment Opportunities

Amidst the evolving economic landscape, investors in the gold market are presented with a mix of opportunities and complexities. Current market conditions are influenced by a range of bullish factors, notably the potential for U.S. Federal Reserve rate cuts. These anticipated adjustments are poised to soften the U.S. dollar further, which could catalyze an increase in gold prices, recently observed reaching up to $2,319.50 per ounce.

Investors are strongly encouraged to keep a vigilant watch on global geopolitical dynamics and the detailed communications issued by the Federal Reserve. These elements are crucial in understanding the broader market context that will likely dictate the price movements of gold in the short to medium term.

Specifically, the market's response to the Federal Reserve's monetary policy decisions—especially any indications of rate cuts—will be a decisive factor for gold's valuation. A softer dollar typically reduces the opportunity cost of investing in gold, enhancing its attractiveness as an investment during times of economic uncertainty and inflationary pressure.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex