Growth Trajectory and Market Dynamics of NYSE:MGM Stock

An In-Depth Look at MGM's Financial Stability, Strategic Moves, and Investor Sentiment in the Evolving Gaming Landscape | That's TradingNEWS

MGM Resorts International (NYSE:MGM): A Strategic and Financial Deep Dive

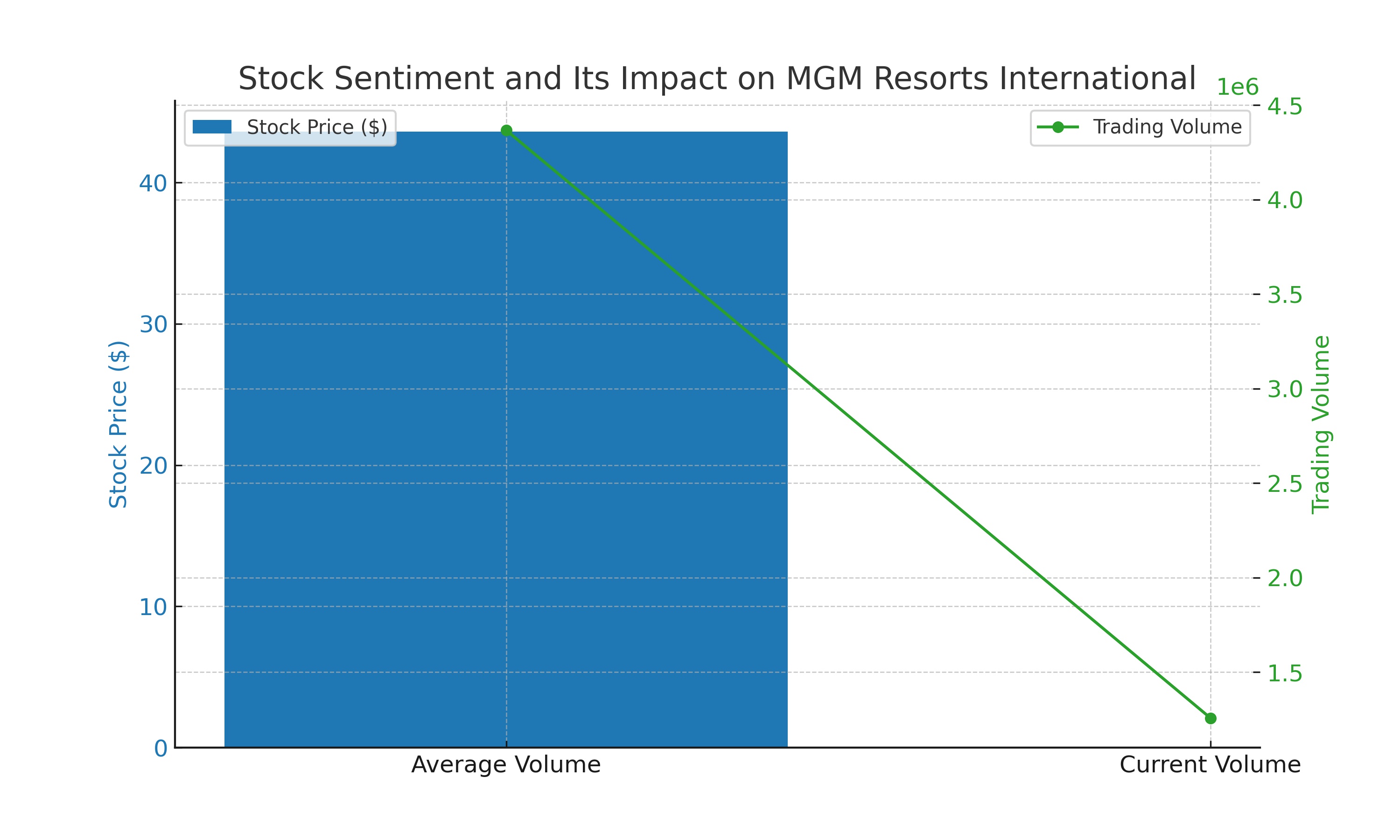

Understanding Stock Sentiment and Its Impact on MGM

Investor sentiment, a key driver of short-term market movements, doesn't typically reflect the fundamental health of a company like MGM Resorts International (NYSE:MGM). This sentiment, often gauged through stock price trends and trading volumes, can offer insights into how the market perceives MGM. As of this analysis, MGM's stock trades at $43.61, a marginal decrease from its previous closing. However, the average volume suggests less activity, indicating a potential shift in investor sentiment. This observation merits a deeper dive into MGM’s operational and financial health for a clearer investment picture.

MGM’s Current Market Performance

Today’s trading volume for MGM stands at 1,255,865 shares, significantly lower than the average of 4,367,306 shares. The stock fluctuated between $43.45 and $43.94 in the session, underlining a level of volatility in its market performance. The current price level, combined with trading patterns, reflects the investor sentiment surrounding the stock, which can be influenced by both internal company factors and external market conditions.

MGM's Core Business and Operational Footprint

MGM Resorts, a dominant force in the Las Vegas Strip, operates 35,000 guest rooms and suites, amounting to about a quarter of the market’s total capacity. Their properties, including MGM Grand, Mandalay Bay, and Mirage, among others, form a significant part of Las Vegas's hospitality and gaming landscape. In 2019, these properties contributed about 49% to the company's total EBITDAR. Moreover, MGM’s presence extends beyond Las Vegas, with regional assets in the U.S. and international ventures like the MGM Macau. The company is also expanding its footprint in digital gaming and sports betting, areas with growing revenue potential.

Institutional Ownership and Its Implications

Institutional investors hold a substantial 69% stake in MGM, reflecting strong professional confidence in the company’s potential. This level of institutional ownership suggests that analysts and large-scale investors recognize the value in MGM’s business model and growth prospects. However, it's important to consider that such a significant institutional presence can lead to volatility, as collective actions by these entities can greatly influence the stock’s market performance.

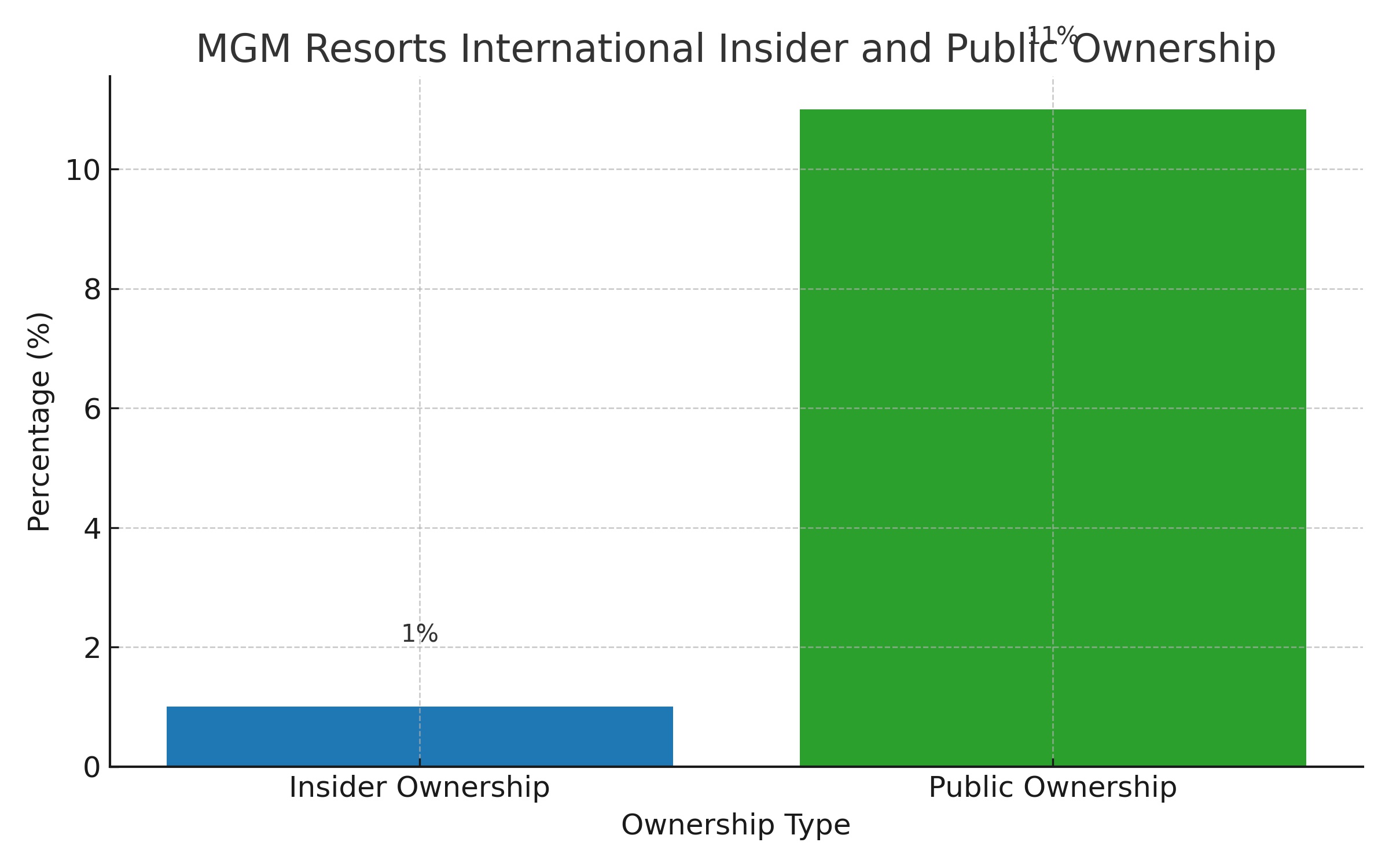

Analyzing MGM's Insider and Public Ownership

Insider ownership in MGM is less than 1%, a typical scenario for large corporations. While this implies limited direct control by company insiders, their collective share value of approximately $109 million ensures that the board’s interests are aligned with shareholder value creation. The general public, comprising individual investors, holds about 11% of MGM, contributing to the diversity of the shareholder base. This blend of ownership types creates a balanced dynamic, where various stakeholders have a vested interest in the company's success.

MGM’s Strategic Position in Major Events

MGM's strategic positioning for major events like the Super Bowl in Las Vegas and Chinese New Year in Macau highlights its significant role in the global hospitality and gaming market. The expected high occupancy rates during these events and the anticipated revenue boost could be pivotal for MGM's first-quarter performance in 2024. These events, coupled with MGM’s strong presence in sports betting through BetMGM, position the company for potential earnings surges, influenced by unique market opportunities.

Financial Performance and Growth Prospects

MGM's third-quarter results in 2023 showed a revenue of $2.1 billion in the Las Vegas segment, indicating a strong post-COVID recovery trajectory. The company’s continued stock repurchase program and its profitable turn in sports betting further enhance its financial stability. Additionally, MGM’s strategic positioning in the New York gaming market could serve as a future revenue catalyst, especially if it secures a full-service casino resort license.

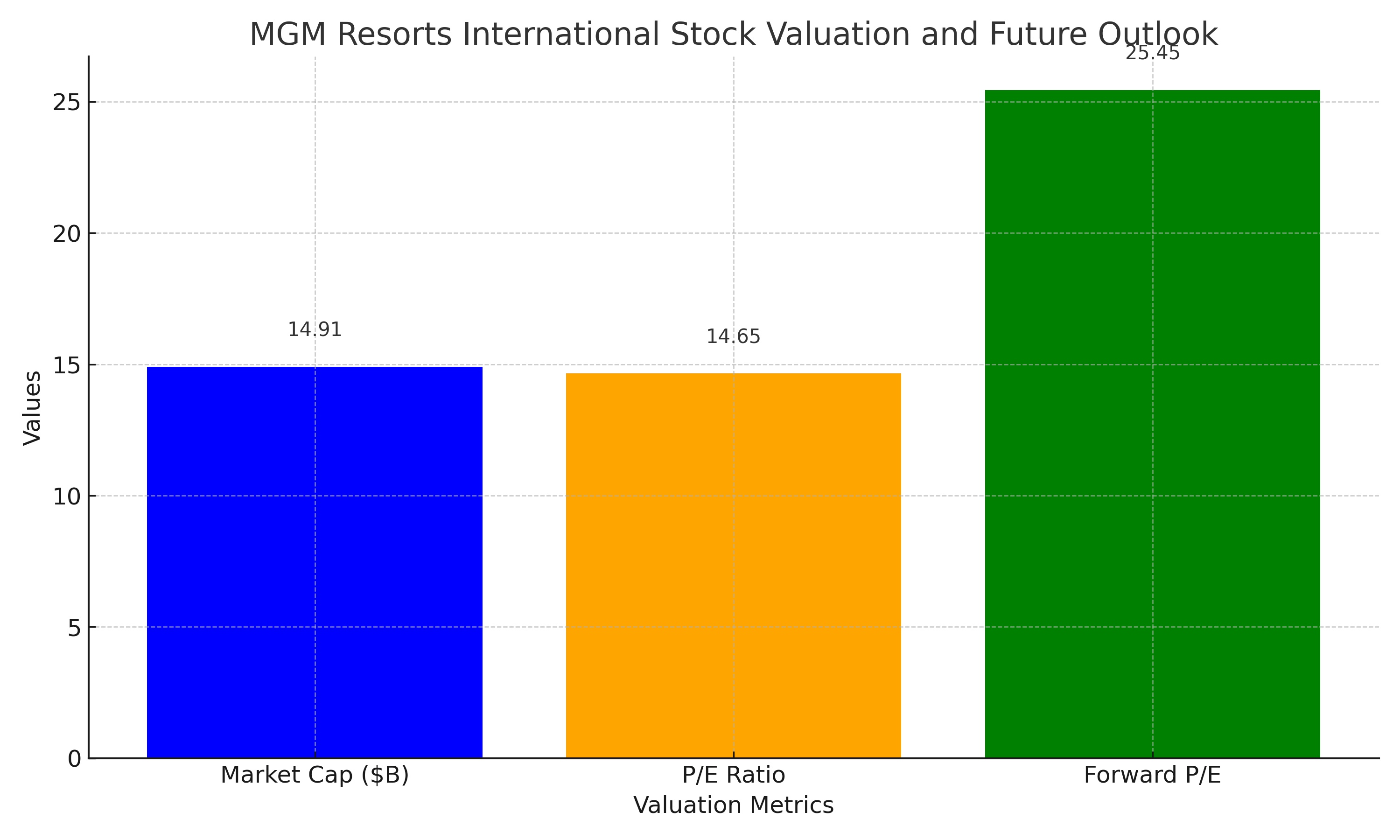

Stock Valuation and Future Outlook

With a market capitalization of $14.91 billion and a PE ratio of 14.65, MGM presents as an undervalued stock in its sector. The company's solid revenue growth, diversified business operations, and strategic expansions into digital gaming and sports betting, coupled with potential market catalysts, position MGM favorably for future growth. The company’s robust operational cash flow and significant cash reserves further reinforce its financial resilience.

Financial Health and Performance Indicators

MGM Resorts International's financial health is a critical aspect of its overall analysis. As of the latest data, MGM's total revenue stands at a robust $15.33 billion, with a notable quarterly revenue growth of 16.30% year-over-year. This growth is indicative of MGM's strong recovery and operational efficiency in a competitive market. The company’s profit margin is reported at 7.26%, and its operating margin at 9.08%, reflecting sound management and operational strategies.

MGM's total cash on hand is an impressive $3.32 billion, equating to $9.71 per share, providing the company with a substantial financial buffer for strategic initiatives and potential market downturns. However, it’s important to note MGM’s total debt, which is at a high $31.82 billion. Despite this, MGM’s current ratio of 1.78 suggests the company is well-positioned to meet its short-term liabilities.

Earnings Estimates and Growth Projections

Analysts have set various earnings estimates for MGM, indicating diverse expectations for the company's financial performance. For the current quarter (Dec 2023), the average earnings estimate is $0.70 per share, with a high estimate of $0.91 and a low of $0.54. For the next quarter (Mar 2024), the estimates are averaging at $0.56 per share. These figures suggest analysts are anticipating a strong performance from MGM, particularly considering the year-ago EPS figures.

The revenue estimates for the current and next quarters are $4.12 billion and $4.07 billion, respectively, reflecting continued growth expectations. This projected growth is underpinned by MGM's strategic operations in key markets and events that are likely to drive revenue increases.

Stock Performance and Market Cap Analysis

MGM's stock performance offers a window into the market's perception of the company's value and potential. The stock has a 52-week range of $34.12 to $51.35, indicating volatility and potential for growth. The current market cap of MGM stands at $14.91 billion, with an enterprise value of $43.34 billion. This market cap, combined with a beta of 2.22, suggests that the stock is more volatile than the market average, which could appeal to certain types of investors.

The stock's P/E ratio at 14.65 and a forward P/E of 25.45 provide a perspective on its valuation relative to earnings. Additionally, the company’s price-to-sales ratio of 1.05 and price-to-book ratio of 3.76 further inform its market valuation.

Institutional and Insider Ownership

Institutional ownership in MGM is significant, at 69.68%, indicating strong confidence from large-scale investors. This level of institutional investment can have a substantial impact on the stock’s performance. Insider ownership, although less than 1%, still represents a considerable value in dollar terms and reflects a vested interest in the company's success.

Upcoming Catalysts and Strategic Developments

MGM's strategic positioning for significant events like the Super Bowl and Chinese New Year in Macau, as well as its potential expansion in the New York gaming market, represent major catalysts for revenue growth. These events, coupled with the company’s advancements in digital gaming and sports betting, are likely to positively impact MGM's financial performance in the coming quarters.

Conclusion and Forward-Looking Perspective

In summary, MGM Resorts International presents a dynamic investment profile, characterized by strong revenue growth, substantial cash reserves, and a strategic presence in key gaming and hospitality markets. The company's high debt level is a point of consideration, but its current liquidity and revenue projections indicate a positive outlook. For real-time stock performance and insider transaction updates, investors are encouraged to visit Trading News for MGM and its stock profile for insider transactions. MGM's diverse revenue streams, robust market position, and strategic growth initiatives position it as a potentially valuable addition to an investment portfolio, especially for those looking at the gaming and hospitality sector.

That's TradingNEWS

Read More

-

UNG ETF At $12.25: Can Natural Gas, LNG Expansion And AI Power Demand Ignite A Rebound In 2026?

31.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI at $10.52 and XRPR at $14.90 End 2025 Red as Inflows Hit $1.15B

31.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Slides Toward $3.70 as Warm Forecasts Dominate but LNG Exports Support NG=F

31.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds Near 156.60 as Fed Easing and BoJ Tightening Collide at Year-End

31.12.2025 · TradingNEWS ArchiveForex