Hong Kong Bitcoin ETF: Bullish Trends and Future BTC Growth Prospects

Evaluating Bitcoin's (BTC) Q2 2024 Performance, Market Dynamics, and Strategic Outlook with New Bitcoin ETF in Hong Kong | That's TradingNEWS

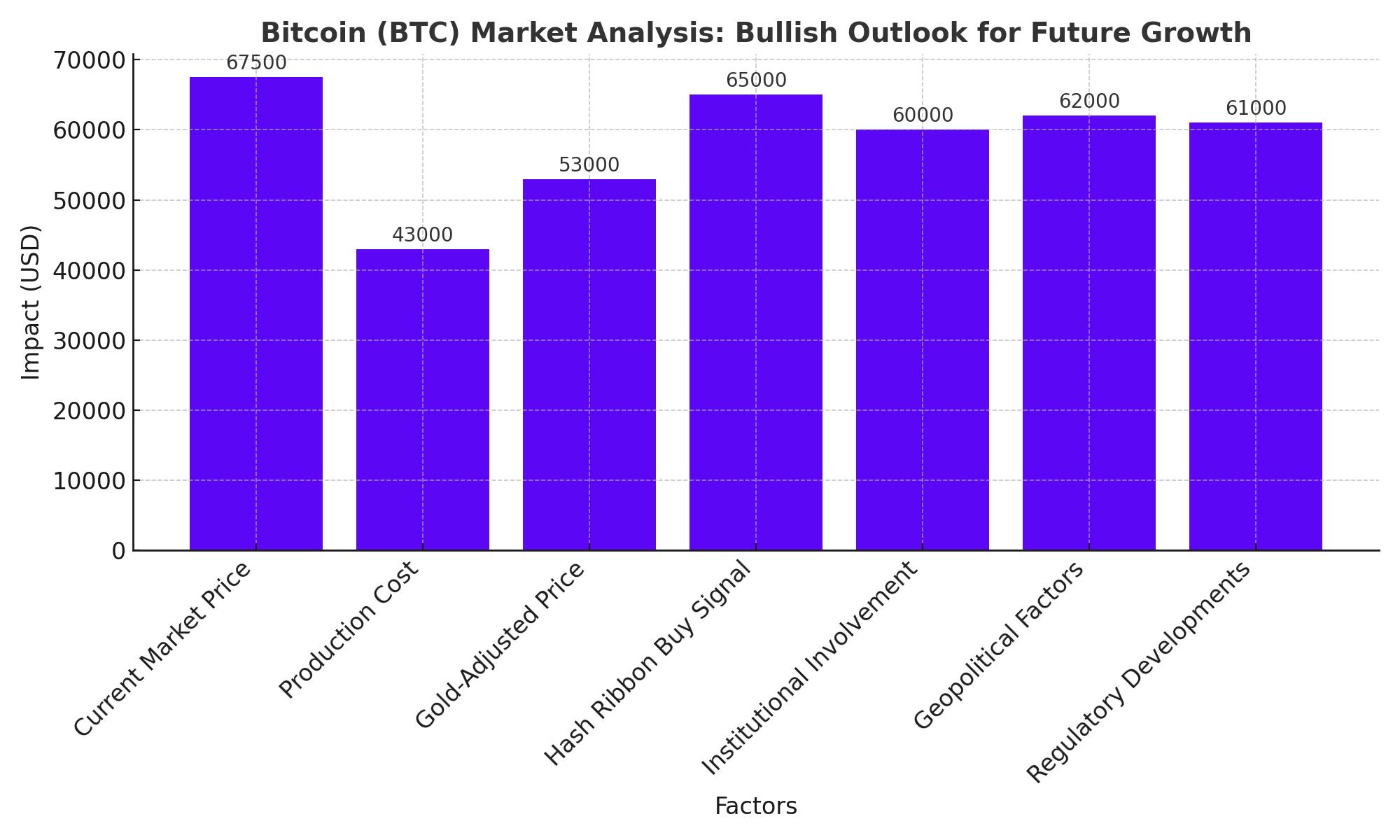

Bitcoin (BTC) Market Analysis: Bullish Outlook for Future Growth

Current Market Performance and Trends

Bitcoin (BTC) has recently experienced a significant surge, with its price exceeding $60,000. This bullish trend is attributed to a combination of factors, including sellers' exhaustion and market dynamics that favor a supply shock scenario. According to data analytics firm Glassnode, the reduction in daily active entities on the Bitcoin network and the declining number of coins on exchange platforms have created a supply shortage, driving prices upward.

The price of Bitcoin is currently trading around $67,500, significantly higher than the estimated production cost of $43,000. JPMorgan analysts have suggested that Bitcoin's current price is well above its volatility-adjusted price relative to gold, which they estimate to be around $53,000. This indicates that while Bitcoin is experiencing a strong rally, it may face some regression towards this average value in the long term.

Geopolitical and Economic Factors

The current geopolitical landscape, particularly the ongoing tensions in Europe and the Middle East, has influenced investor sentiment towards Bitcoin. Additionally, macroeconomic factors such as inflation and higher interest rates have played a role in shaping the market outlook. The potential for political changes, such as the impact of U.S. presidential elections on regulatory policies, also adds a layer of complexity to Bitcoin's market trajectory.

For instance, the potential return of Donald Trump to the presidency could favor crypto assets and gold. Trump's prospective trade policies might encourage central banks in emerging markets to diversify their reserves into gold, which could indirectly benefit Bitcoin. On the other hand, Biden's exit from the presidential race and the entry of Kamala Harris have created some turbulence related to concerns that Trump might encounter obstacles. The crypto market generally favors a Republican win due to their more favorable stance on cryptocurrencies.

Institutional Involvement and Regulatory Developments

Institutional interest in Bitcoin continues to grow, as evidenced by the launch of various cryptocurrency financial products. CSOP Asset Management, for instance, has introduced the first inverse Bitcoin ETF in Hong Kong, allowing investors to speculate on Bitcoin's decline. This product complements existing crypto ETFs in the region and highlights the increasing sophistication of crypto financial instruments globally.

Moreover, Ferrari's recent decision to expand its crypto payment options to its European dealer network further signifies the growing adoption of cryptocurrencies. This move follows the successful launch of crypto payments in the U.S., with payments accepted in Bitcoin, Ether, and USDC stablecoin, processed by BitPay.

Regulatory bodies like the Hong Kong Securities and Futures Commission (SFC) are actively monitoring the crypto market to ensure compliance and mitigate risks associated with unlicensed trading platforms. Such regulatory oversight is crucial for fostering a secure and transparent market environment. For instance, the SFC recently issued warnings about seven unlicensed crypto exchanges in the area, emphasizing the importance of adhering to industry standards to mitigate fraud risks.

Technical Analysis and Price Predictions

From a technical perspective, Bitcoin has shown resilience by maintaining higher lows and recovering from recent dips. The price target of $65,000 set by technical analysts is a key resistance point that, if surpassed, could pave the way for more bullish trends. The consolidation phase Bitcoin is currently undergoing is consistent with its historical four-year cycle, suggesting a potential for new highs in the near future.

Bitcoin hash ribbons, which track two moving averages of hashrate, indicate miner behavior. When the 30-day moving average drops below its 60-day equivalent, it suggests miners are struggling. Conversely, a buy signal is generated when the 30-day average rises above the 60-day average. Recently, Bitcoin exited a "capitulation" phase, signaling a buy opportunity.

Survey Insights and Expert Opinions

A recent survey by Finder involving 32 cryptocurrency experts revealed a generally bullish sentiment towards Bitcoin. The average price prediction for Bitcoin by the end of 2024 stands at $87,169, with some experts forecasting a peak as high as $200,000. This optimism is driven by historical price trends, market sentiment, and ongoing institutional interest.

Dr. Sathvik Vishwanath, CEO of Unocoin Technologies, predicts a strong increase in Bitcoin's value, reaching $120,000 by the end of the year. He attributes this to Bitcoin's role as a digital store of value and the macroeconomic factors supporting its adoption. Similarly, Ben Ritchie, CEO of Alpha Node, anticipates Bitcoin reaching $120,000, based on the current consolidation phase and its historical cycle.

Market Sentiment and Future Outlook

Despite the high volatility associated with cryptocurrencies, the current market conditions suggest a favorable outlook for Bitcoin. The influx of institutional investors, facilitated by products like Bitcoin ETFs, is expected to drive demand and support price increases. For instance, the launch of various Bitcoin ETFs by asset managers like CSOP in Hong Kong and similar products in the U.S. indicate growing institutional interest. These financial instruments make it easier for traditional investors to gain exposure to Bitcoin, thus broadening the market base and driving up prices.

Additionally, the potential for a reduction in U.S. interest rates could further stimulate market recovery and enhance Bitcoin's value. Historically, lower interest rates make traditional savings less attractive, pushing investors towards alternative assets like Bitcoin. The Federal Reserve's upcoming meetings are closely watched, with speculations that rates might be lowered to support economic recovery. This potential rate cut could act as a catalyst for Bitcoin's next price surge.

The potential for regulatory changes, such as the SEC's stance on Bitcoin ETFs and the influence of political shifts, will also play a crucial role in shaping the market. The SEC's approval or disapproval of Bitcoin ETFs significantly impacts market sentiment. Approval can lead to a surge in institutional investments, while disapproval might cause temporary setbacks. Moreover, the upcoming U.S. presidential elections add another layer of uncertainty. A government more favorable towards cryptocurrencies could implement policies that boost Bitcoin's adoption and regulatory clarity.

Investment Recommendations

Buy: Given Bitcoin's strong market performance, strategic institutional involvement, and positive price predictions, it presents a compelling buy opportunity for long-term investors. The current market dynamics and technical indicators support a bullish outlook, making Bitcoin a valuable addition to an investment portfolio. Institutional adoption, as evidenced by the significant inflows into Bitcoin ETFs and other crypto products, indicates a robust long-term demand for Bitcoin.

The adoption of Bitcoin by major corporations for transactions and investment portfolios further solidifies its position as a mainstream asset. For example, companies like Tesla and MicroStrategy have significant Bitcoin holdings, demonstrating confidence in its long-term value. This corporate adoption trend is likely to continue, contributing to Bitcoin's price stability and growth.

Investors should remain vigilant and informed about ongoing market developments and regulatory changes. Keeping up with regulatory news, especially from major economies like the U.S., EU, and China, is crucial. Changes in crypto regulations in these regions can have significant global impacts. Additionally, understanding technological advancements in the Bitcoin network, such as improvements in scalability and security, can provide insights into its future potential.

For real-time updates and detailed analysis on Bitcoin's performance, visit Bitcoin Real-Time Chart. Staying updated with real-time data helps in making timely investment decisions, especially in the highly volatile crypto market.

Conclusion

Bitcoin (BTC) is poised for continued growth, driven by favorable market conditions, strategic institutional participation, and positive expert predictions. Despite the inherent volatility of the crypto market, Bitcoin's robust performance and future potential make it an attractive investment option. Investors should leverage these insights and monitor market trends to make informed decisions and capitalize on Bitcoin's upward trajectory.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex