How the Fed's Rate Decisions Shape Bitcoin's Future

From Market Fluctuations to Strategic Corporate Moves in the Crypto Sphere | That's TradingNEWS

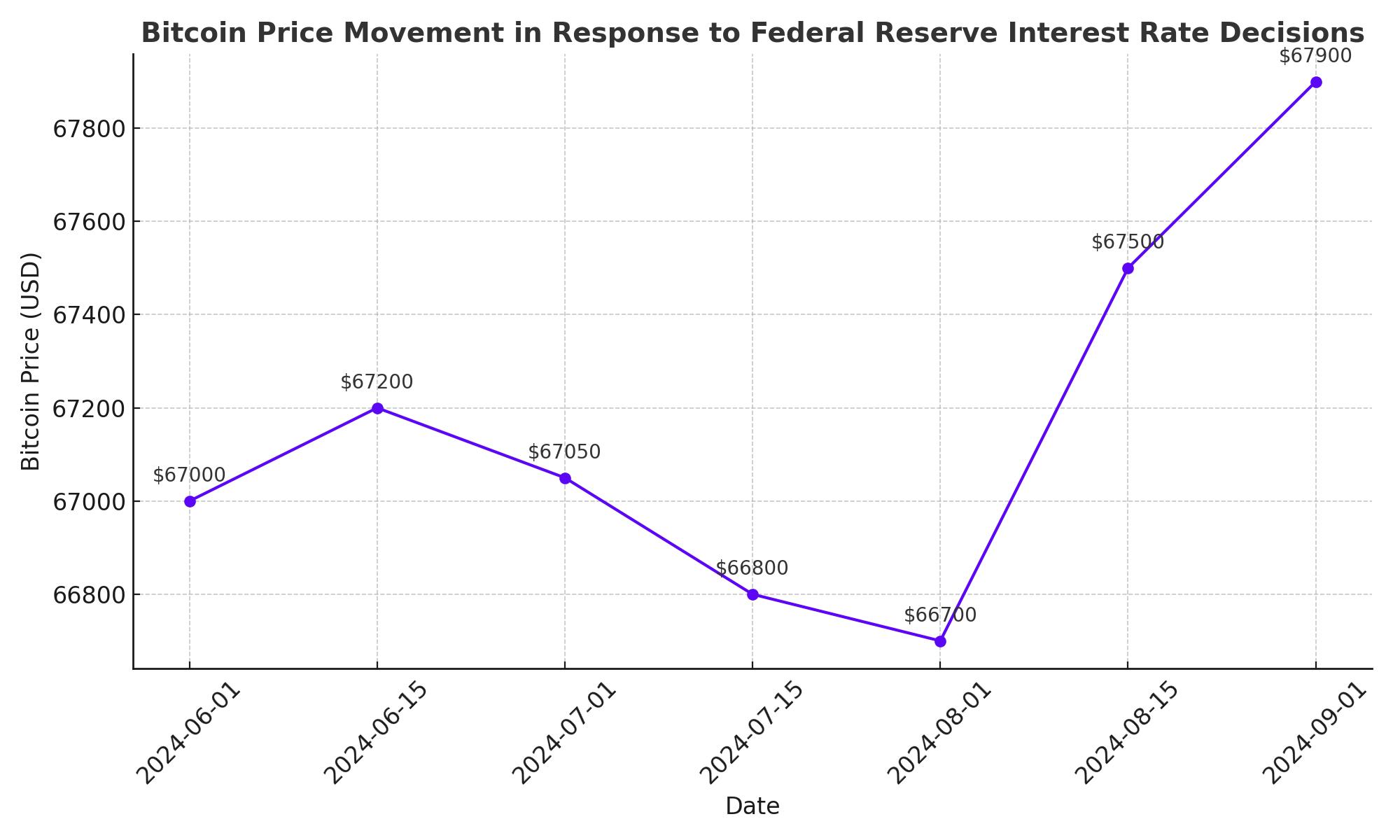

Market Response to Federal Reserve's Interest Rate Decisions

In the latest financial developments, the Federal Reserve has maintained a conservative stance regarding its monetary policy, opting to keep interest rates steady with a projection of only one potential rate cut within the current year. This decision has sent ripples through the financial markets, notably impacting Bitcoin, which saw a decrease following the announcement. Bitcoin's price dipped to approximately $67,000 during Asian trading hours but recovered swiftly, stabilizing between $67,200 and $67,800. As of the latest updates, Bitcoin has slightly risen to over $67,900, marking a modest 0.16% increase over the last 24 hours.

Strategic Shifts in the Cryptocurrency Industry

Paxos, a key player in the blockchain sector, recently reduced its workforce by 20%, eliminating 65 positions. This move is part of a broader strategy to pivot more decisively towards tokenization and stablecoins, as noted in a Bloomberg report. Despite these layoffs, Paxos asserts a strong financial posture, with a robust balance sheet of approximately $500 million. This shift in focus comes after regulatory challenges in 2023, notably with the cessation of Binance's BUSD minting, previously a significant asset with a market cap of $16 billion.

Volatility in the Cryptocurrency Tokens

Curve’s CRV token experienced a significant downturn, dropping 30% in early Asian market hours. This was primarily due to automated liquidation events linked to the founder's leveraged positions. The market tracked nearly $100 million in stablecoins loaned against $140 million in CRV collateral. Notably, after substantial repayments, total holdings in the associated wallets decreased by 50%.

Broader Implications of Fed's Policy on Bitcoin

MicroStrategy's Continued Investment in Bitcoin

In a significant development within the corporate sphere, MicroStrategy has announced plans to issue $500 million in convertible senior notes, specifically aimed at acquiring more Bitcoin. This move underscores the company's commitment to Bitcoin, with MicroStrategy currently holding approximately 214,400 BTC, valued at over $14 billion. This strategy highlights the growing acceptance of Bitcoin as a legitimate asset class among institutional investors.

2025 Outlook: Economic Shifts and Regulatory Developments

As we approach 2025, the interplay between economic factors and regulatory changes will critically determine Bitcoin's trajectory. With Bitcoin's next halving event slated for 2024, we anticipate a renewed speculative interest from long-term investors. Historically, halving events reduce the rate of new Bitcoin creation, thereby instigating a bullish cycle due to the resultant supply constraint.

Predictive Analysis for the Post-Halving Market

If past trends continue, the post-halving landscape could catapult Bitcoin to unprecedented highs. Analytical forecasts based on supply-demand dynamics suggest a potential ascent to the $90,000 to $100,000 range within 18 months following the halving. This prediction considers the expected supply shock against a backdrop of heightened demand, especially as global inflationary pressures push investors towards more deflationary assets like Bitcoin.

The Million-Dollar Prediction

Looking further ahead, the notion of Bitcoin reaching $1 million by 2025 has sparked considerable debate. Such a milestone would require significant global shifts, including widespread adoption by both institutional and retail investors, and a more favorable regulatory environment that supports cryptocurrency integrations into mainstream finance.

Regulatory Climate and Its Implications

The regulatory landscape remains highly unpredictable but is a crucial factor in Bitcoin’s growth strategy. Positive regulatory developments, such as the approval of Bitcoin ETFs and clear tax guidelines, could significantly boost investor confidence, thereby increasing market participation. Conversely, restrictive regulations may hinder growth and introduce greater volatility.

Navigating Uncertainty: Strategies for Bitcoin Investors

Investor Strategy in a Volatile Environment

Investors must remain exceptionally vigilant as we navigate towards and beyond 2025. The anticipation surrounding regulatory decisions and economic developments demands a proactive investment approach. Strategic adjustments to one's portfolio, emphasizing diversification and risk management, will be key in leveraging potential upswings in Bitcoin's value while cushioning against downturns.

Staying Ahead of Regulatory Changes

Investors should keep a close watch on regulatory announcements and shifts within the cryptocurrency landscape. Staying informed through reliable financial news sources and market analyses will enable investors to swiftly adjust their strategies in response to new information.

Conclusion: Preparing for Bitcoin's Next Big Leap

Long-Term Investment Perspectives

As Bitcoin continues to mature and potentially enters new phases of adoption and value, investors should prepare for a range of scenarios. The approach to 2025 should be marked by cautious optimism, with a readiness to capitalize on positive shifts in the market while guarding against potential downturns due to regulatory or economic adversities.

Empowering Decisions with Informed Insights

This analysis aims to equip investors with a deep understanding of the potential economic and regulatory factors that will shape Bitcoin’s future. By providing a nuanced view based on current data and projected trends, we offer a strategic framework for those looking to make informed decisions in a market as dynamic as that of Bitcoin.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex